Présentation de l'entreprise

| MGM Résumé de l'examen | |

| Fondé | 2003 |

| Pays/Région enregistré(e) | Pakistan |

| Réglementation | Non réglementé |

| Instruments de marché | Courtage en actions, Services de garde d'actions, Finance d'entreprise, Trading d'actions en ligne |

| Compte de démonstration | / |

| Effet de levier | / |

| Spread | / |

| Plateforme de trading | KITS, Terminaux de trading à distance, Trading basé sur le Web |

| Dépôt minimum | / |

| Assistance clientèle | Adresse: Salle n° G-10, Rez-de-chaussée, LSE Plaza, 19-Khyaban-e-Aiwan-e-Iqbal, Lahore |

| Email: mgmsecurities@mgm-lse.com / mgmsecurities@yahoo.com / info@mgm-lse.com | |

| Téléphone: 042-36279181-2 / 042-36280761 / 042-36310753 | |

| Portable: 0333-4296005 | |

MGM Information

Fondée en 2003 et enregistrée au Pakistan, MGM propose des services de finance d'entreprise, de trading d'actions sur Internet, de courtage en actions et de garde d'actions. Malgré sa large gamme de services, elle n'est pas soumise à un contrôle réglementaire, ce qui pourrait mettre les investisseurs en danger.

Avantages et inconvénients

| Avantages | Inconvénients |

| Offre une variété de services de trading | Non réglementé |

| Propose plusieurs plateformes de trading en ligne | Pas de compte de démonstration |

| Aucune information sur les frais |

Est-ce que MGM est légitime ?

MGM n'est pas réglementé dans son pays d'enregistrement, le Pakistan, et ne détient aucune licence des organismes de réglementation reconnus tels que la FCA (Royaume-Uni) ou l'ASIC (Australie). Veuillez être conscient du risque potentiel.

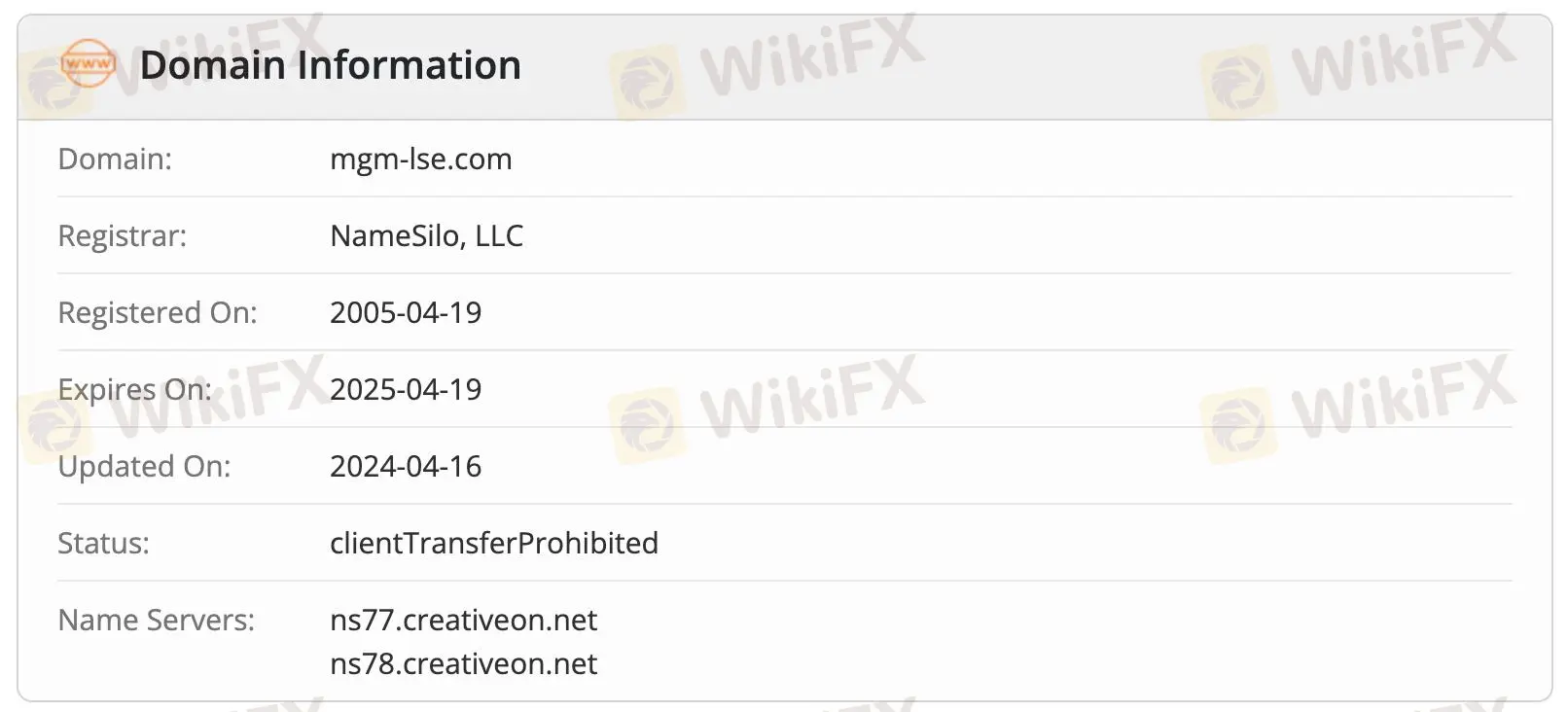

Ayant été enregistré le 19 avril 2005, mgm-lse.com est actuellement utilisé avec un statut de clientTransferProhibited, ce qui indique un contrôle administratif limité.

Services de MGM

MGM propose des services de trading d'actions, de services de conservation d'actions, de finance d'entreprise et de trading d'actions en ligne via différentes plateformes.

| Services | Pris en charge |

| Courtage en actions | ✔ |

| Services de conservation d'actions | ✔ |

| Finance d'entreprise | ✔ |

| Trading d'actions en ligne | ✔ |

| Terminaux de trading à distance | ✔ |

| Trading basé sur le Web | ✔ |

Plateforme de trading

| Plateforme de trading | Pris en charge | Appareils disponibles | Convient à quel type de traders |

| KITS | ✔ | Ordinateur de bureau | Traders actifs nécessitant des outils avancés |

| Terminaux de trading à distance | ✔ | Ordinateur de bureau | Traders institutionnels et professionnels |

| Trading basé sur le Web | ✔ | Web (Navigateur) | Traders particuliers recherchant la commodité et la flexibilité |