公司簡介

| 華金國際 評論摘要 | |

| 成立年份 | 2013 |

| 註冊地區/國家 | 香港 |

| 監管機構 | SFC |

| 交易產品 | 證券、期貨 |

| 交易平台 | ET Trade 在線交易平台、TradeGo 在線交易平台 |

| 客戶支援 | 辦公時間:星期一至星期五(上午09:00至下午06:00),星期六、星期日及公眾假期(休息) |

| 電話:(852) 31 033 030 | |

| 電郵:csdept@hjfi.com.hk | |

| 地址:香港中環花園道3號冠君大廈11樓1101室 | |

華金國際 成立於2013年,註冊於中國香港,是一家由證券及期貨事務監察委員會(SFC)監管的金融公司,牌照編號為BFJ369。公司提供一系列的證券和期貨交易。公司提供三種主要帳戶類型:證券現金帳戶、證券保證金帳戶和期貨帳戶,滿足個人、聯名和企業客戶的需求。此外,公司提供兩個在線交易平台:ET Trade 和 TradeGo。

優點與缺點

| 優點 | 缺點 |

| 受SFC監管 | 複雜的費用結構 |

| 多樣化的帳戶類型 |

華金國際 是否合法?

是的,華金國際 目前受SFC監管,持有期貨合約交易牌照。

| 監管國家 | 監管機構 | 當前狀態 | 持牌實體 | 牌照類型 | 牌照號碼 |

| 證券及期貨事務監察委員會(SFC) | 受監管 | 華金期貨(國際)有限公司 | 持有期貨合約交易牌照 | BFJ369 |

我可以在 華金國際 上交易什麼?

華金國際為客戶提供證券和期貨交易。

| 交易產品 | 支援 |

| 證券 | ✔ |

| 期貨 | ✔ |

| 外匯 | ❌ |

| 大宗商品 | ❌ |

| 指數 | ❌ |

| 加密貨幣 | ❌ |

| 債券 | ❌ |

| 期權 | ❌ |

| 交易所買賣基金 | ❌ |

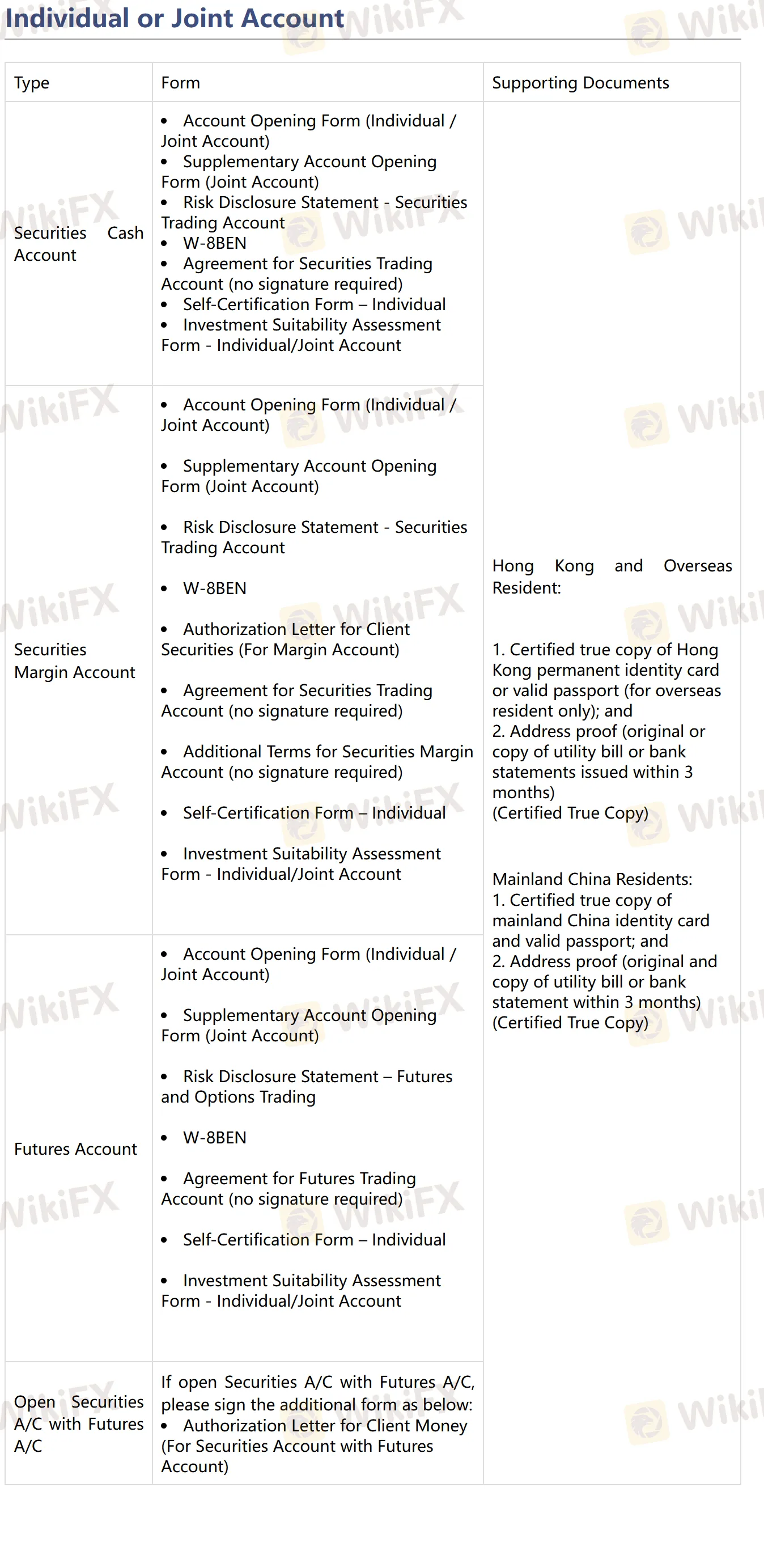

帳戶類型

華金國際提供三種主要帳戶類型:證券現金帳戶、證券保證金帳戶和期貨帳戶,以及開立個人、聯名和公司帳戶。

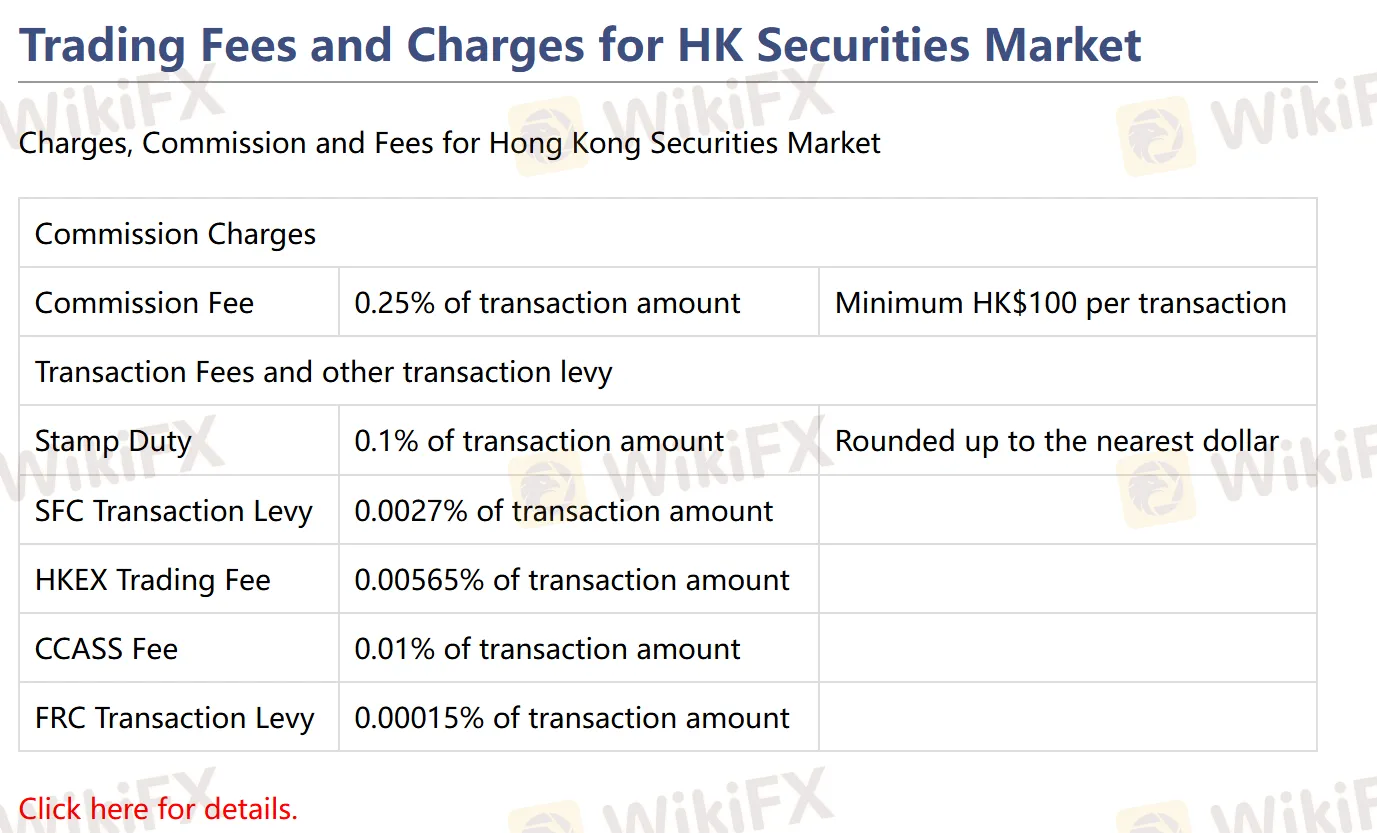

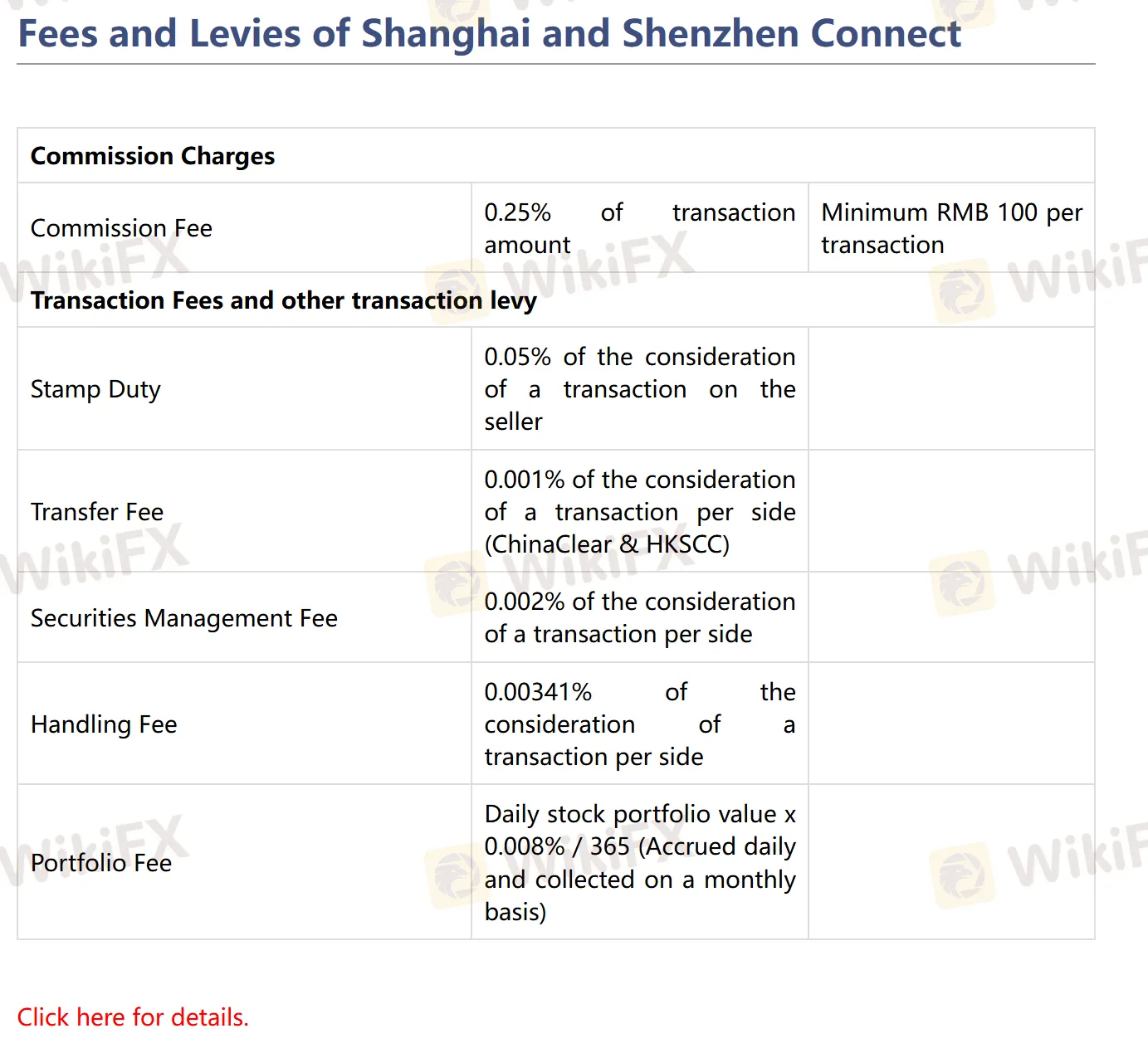

費用

佣金:根據市場和產品不同,佣金率從0.15%至0.25%不等,最低費用為HK$100 / RMB 100 / US$15。

其他費用:包括印花稅、證監會徵費、交易所費用、結算費用等,具體費率和最低金額因市場和產品而異。

欲了解更多詳情,請瀏覽官方網站:https://www.hjfi.hk/EN/ffssc.php

交易平台

| 交易平台 | 支援 | 可用設備 |

| ET Trade 在線交易平台 | ✔ | iPhone/iPad, Android |

| TradeGo 在線交易平台 | ✔ | iPhone/iPad, Android |

存款和提款

| 帳戶類型 | 存款方式 | 提款方式 |

| 證券帳戶 | 更快支付系統 (FPS) | 網上交易系統 |

| 銀行轉帳 | 通過電子郵件聯絡客戶服務部:csdept@hjfi.com.hk | |

| 支票存款 | ||

| 期貨帳戶 | 銀行轉帳 | 通過電子郵件聯絡客戶服務部:csdept@hjfi.com.hk |

| 支票存款 |