Unternehmensprofil

| Huajin International Überprüfungszusammenfassung | |

| Gegründet | 2013 |

| Registriertes Land/Region | Hongkong |

| Regulierung | SFC |

| Handelsprodukte | Wertpapiere, Futures |

| Handelsplattform | ET Trade Online-Handelsplattform, TradeGo Online-Handelsplattform |

| Kundensupport | Bürozeiten: Montag bis Freitag (09:00 bis 18:00 Uhr), Samstag, Sonntag Feiertage (geschlossen) |

| Telefon: (852) 31 033 030 | |

| E-Mail: csdept@hjfi.com.hk | |

| Adresse: Suite 1101, 11/F, Champion Tower, 3 Garden Road, Central, H.K. | |

Huajin International, gegründet im Jahr 2013 und in Hongkong, China, registriert, ist ein reguliertes Finanzunternehmen, das von der Securities and Futures Commission (SFC) mit der Lizenznummer BFJ369 überwacht wird. Es bietet eine Reihe von Wertpapier- und Futures-Handel an. Das Unternehmen bietet drei Hauptkontotypen: Wertpapier-Cash-Konto, Wertpapier-Margin-Konto und Futures-Konto, die auf individuelle, gemeinsame und Unternehmens Kunden zugeschnitten sind. Darüber hinaus bietet es zwei Online-Handelsplattformen: ET Trade und TradeGo.

Vor- und Nachteile

| Vorteile | Nachteile |

| Reguliert durch SFC | Komplexes Gebührenmodell |

| Vielfältige Kontotypen |

Ist Huajin International legitim?

Ja, Huajin International wird derzeit von der SFC reguliert und hält ein Handeln mit Futures-Kontrakten.

| Reguliertes Land | Regulierungsbehörde | Aktueller Status | Lizenzierte Einheit | Lizenztyp | Lizenznummer |

| Securities and Futures Commission (SFC) | Reguliert | Huajin Futures (International) Limited | Handel mit Futures-Kontrakten | BFJ369 |

Was kann ich bei Huajin International handeln?

Huajin International bietet Kunden Wertpapier- und Futures-Handel an.

| Handelsprodukte | Unterstützt |

| Wertpapiere | ✔ |

| Futures | ✔ |

| Forex | ❌ |

| Waren | ❌ |

| Indizes | ❌ |

| Kryptowährungen | ❌ |

| Anleihen | ❌ |

| Optionen | ❌ |

| ETFs | ❌ |

Kontotyp

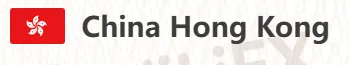

Huajin International bietet drei Hauptkontotypen an: Wertpapier-Barkonto, Wertpapier-Margin-Konto und Futures-Konto, sowie die Möglichkeit, individuelle, gemeinsame und Unternehmenskonten zu eröffnen.

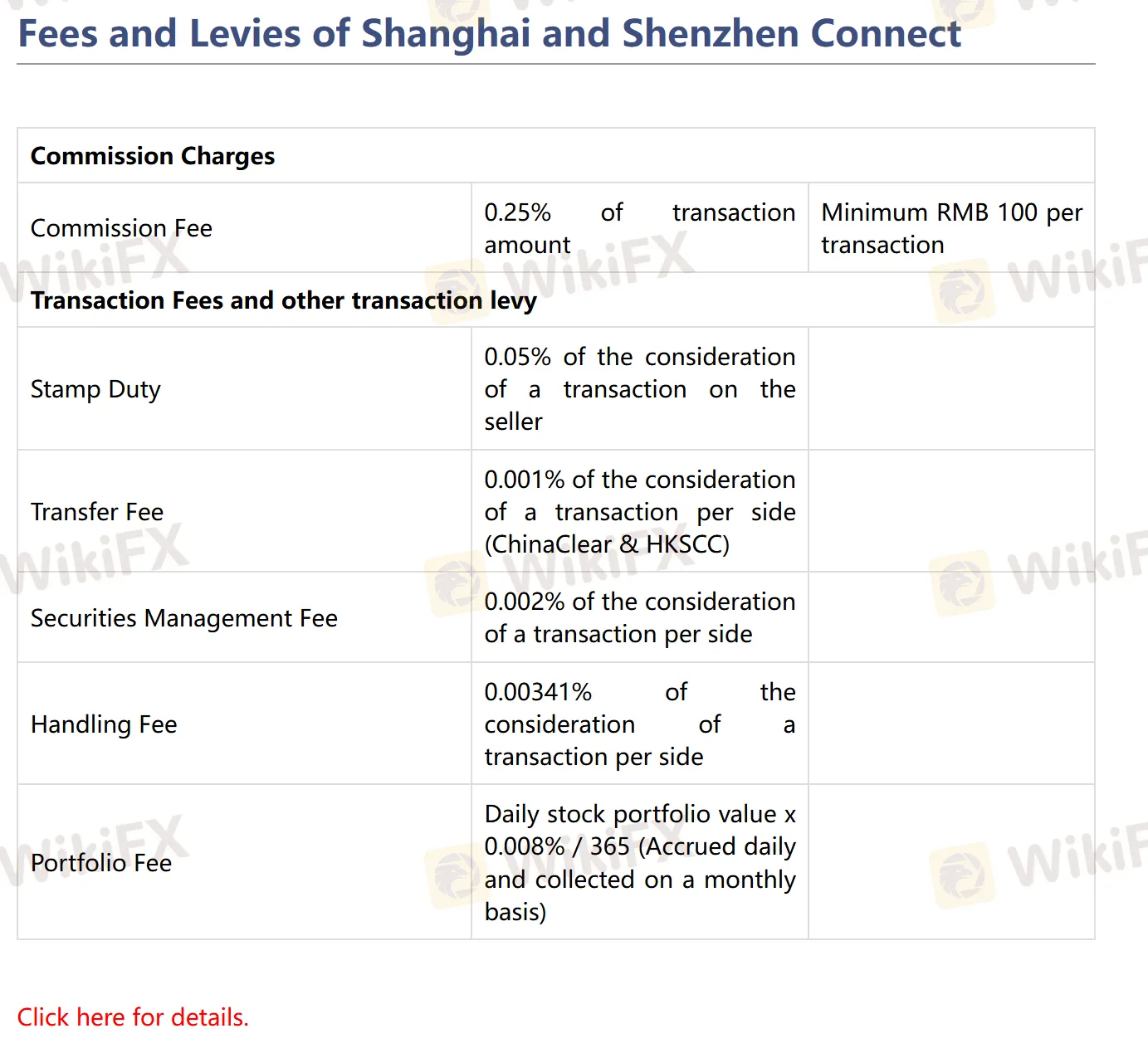

Gebühren

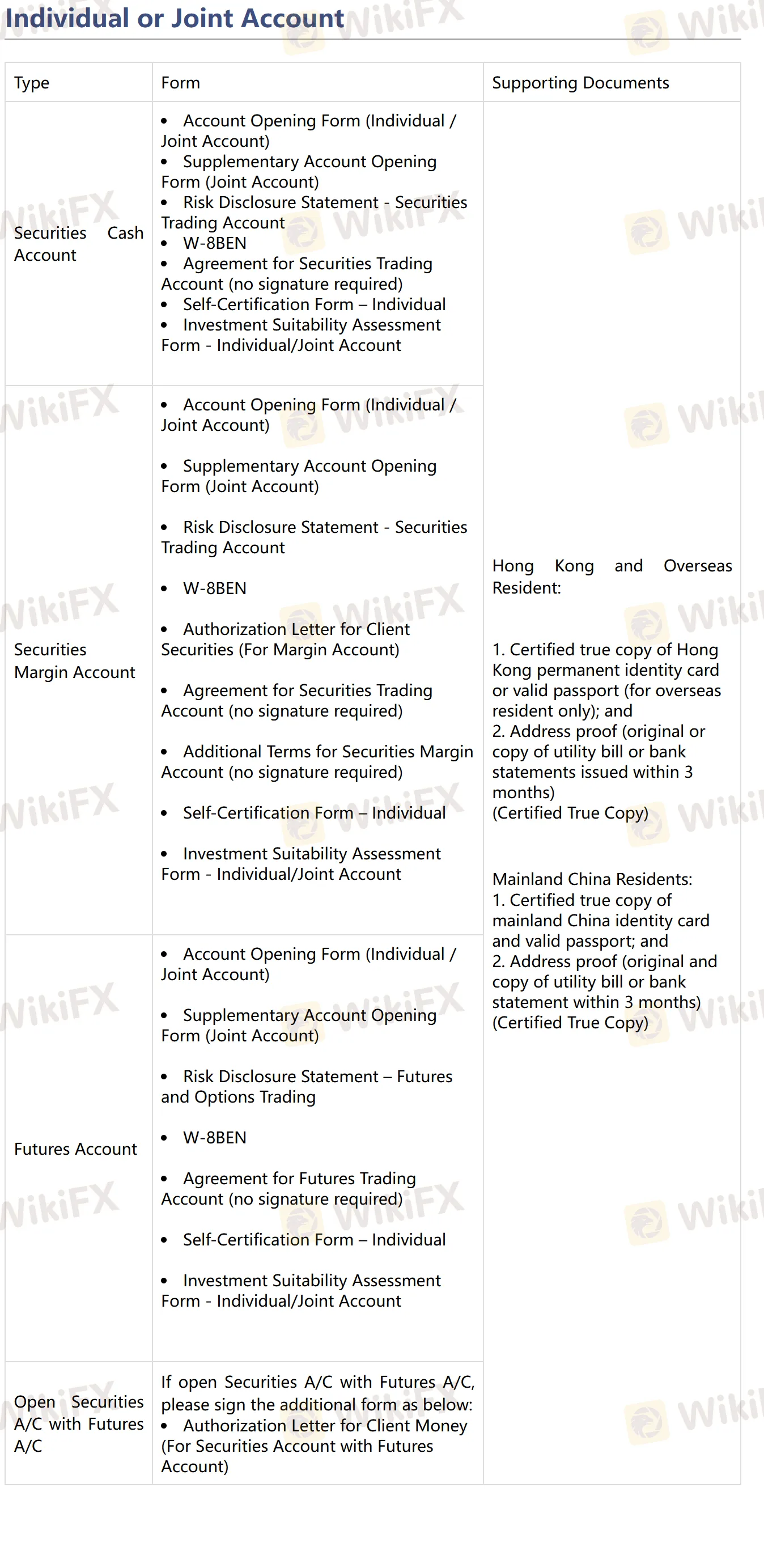

Provision: Abhängig vom Markt und Produkt liegt der Provisionssatz zwischen 0,15% und 0,25%, mit einer Mindestgebühr von HK$100 / RMB 100 / US$15.

Weitere Gebühren: einschließlich Stempelsteuer, SFC-Abgabe, Börsengebühren, Clearing-Gebühren usw., die spezifischen Sätze und Mindestbeträge variieren je nach Markt und Produkt.

Für weitere Details besuchen Sie bitte die offizielle Website: https://www.hjfi.hk/EN/ffssc.php

Handelsplattform

| Handelsplattform | Unterstützt | Verfügbare Geräte |

| ET Trade Online-Handelsplattform | ✔ | iPhone/iPad, Android |

| TradeGo Online-Handelsplattform | ✔ | iPhone/iPad, Android |

Ein- und Auszahlung

| Kontotyp | Einzahlungsmethoden | Auszahlungsmethoden |

| Wertpapierkonto | Faster Payment System (FPS) | Online-Handelssystem |

| Banküberweisung | Kontaktieren Sie den Kundendienst per E-Mail: csdept@hjfi.com.hk | |

| Scheckeinreichung | ||

| Futures-Konto | Banküberweisung | Kontaktieren Sie den Kundendienst per E-Mail: csdept@hjfi.com.hk |

| Scheckeinreichung |