Buod ng kumpanya

| Huajin International Buod ng Pagsusuri | |

| Itinatag | 2013 |

| Nakarehistrong Bansa/Rehiyon | Hong Kong |

| Regulasyon | SFC |

| Mga Produkto sa Kalakalan | Mga Securities, Futures |

| Platform ng Kalakalan | ET Trade Online Trading Platform, TradeGo Online Trading Platform |

| Suporta sa Customer | Oras ng Opisina: Lunes hanggang Biyernes (09:00 ng umaga hanggang 06:00 ng gabi), Sabado, Linggo at mga Public Holidays (Sarado) |

| Telepono: (852) 31 033 030 | |

| Email: csdept@hjfi.com.hk | |

| Address: Suite 1101, 11/F, Champion Tower, 3 Garden Road, Central, H.K. | |

Huajin International, itinatag noong 2013 at naka-rehistro sa Hong Kong, China, ay isang pinamamahalaang kumpanya sa pinansyal na binabantayan ng Securities and Futures Commission (SFC) na may lisensyang BFJ369. Nag-aalok ito ng iba't ibang mga securities at futures trading. Ang kumpanya ay nagbibigay ng tatlong pangunahing uri ng account: Securities Cash Account, Securities Margin Account, at Futures Account, na tumutugon sa mga kliyenteng individual, joint, at korporasyon. Bukod dito, nag-aalok ito ng dalawang online trading platform: ET Trade at TradeGo.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Regulated by SFC | Komplikadong istraktura ng bayad |

| Iba't ibang uri ng account |

Tunay ba ang Huajin International?

Oo, ang Huajin International ay kasalukuyang pinamamahalaan ng SFC, na may hawak na Dealing in futures contracts.

| Pinamamahalaang Bansa | Pinamamahalaang Awtoridad | Kasalukuyang Kalagayan | Lisensyadong Entidad | Uri ng Lisensya | Numero ng Lisensya |

| Securities and Futures Commission (SFC) | Pinamamahalaan | Huajin Futures (International) Limited | Dealing in futures contracts | BFJ369 |

Ano ang Maaari Kong Kalakalan sa Huajin International?

Huajin International ay nagbibigay ng serbisyo sa mga kliyente sa securities at futures trading.

| Mga Produkto sa Trading | Supported |

| Securities | ✔ |

| Futures | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptos | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

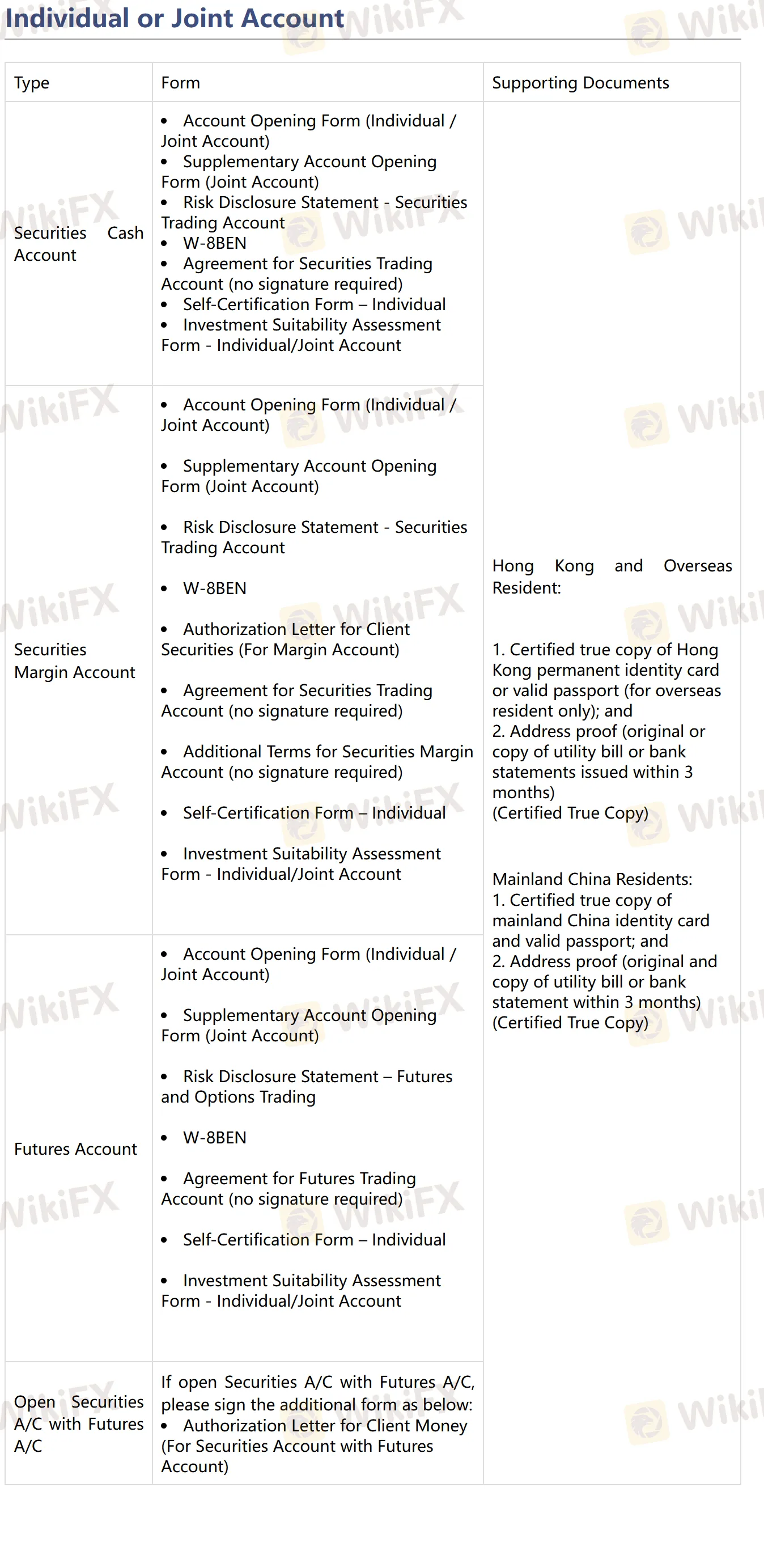

Uri ng Account

Huajin International ay nag-aalok ng tatlong pangunahing uri ng account: Securities Cash Account, Securities Margin Account at Futures Account, pati na rin ang pagbubukas ng indibidwal, joint at korporasyon na mga account.

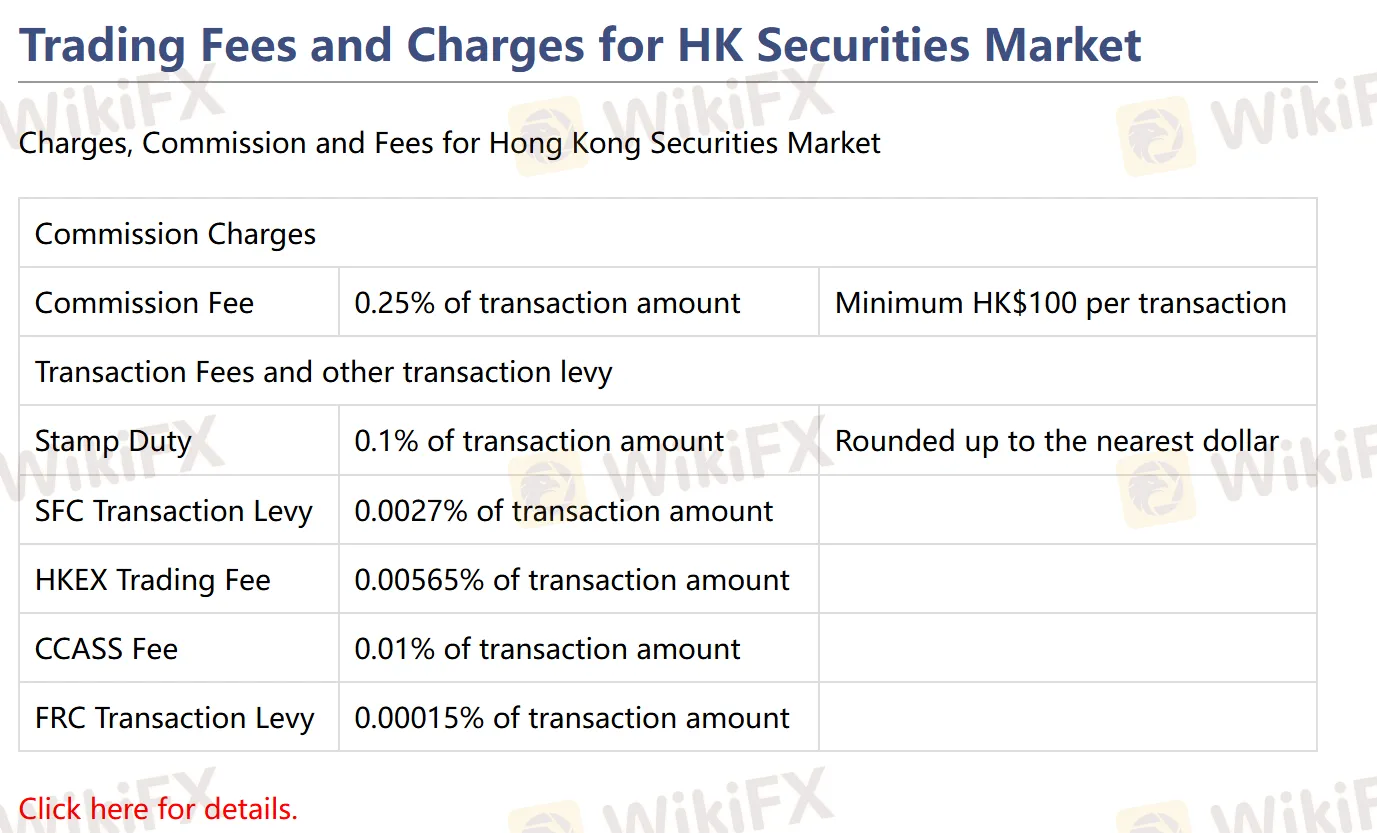

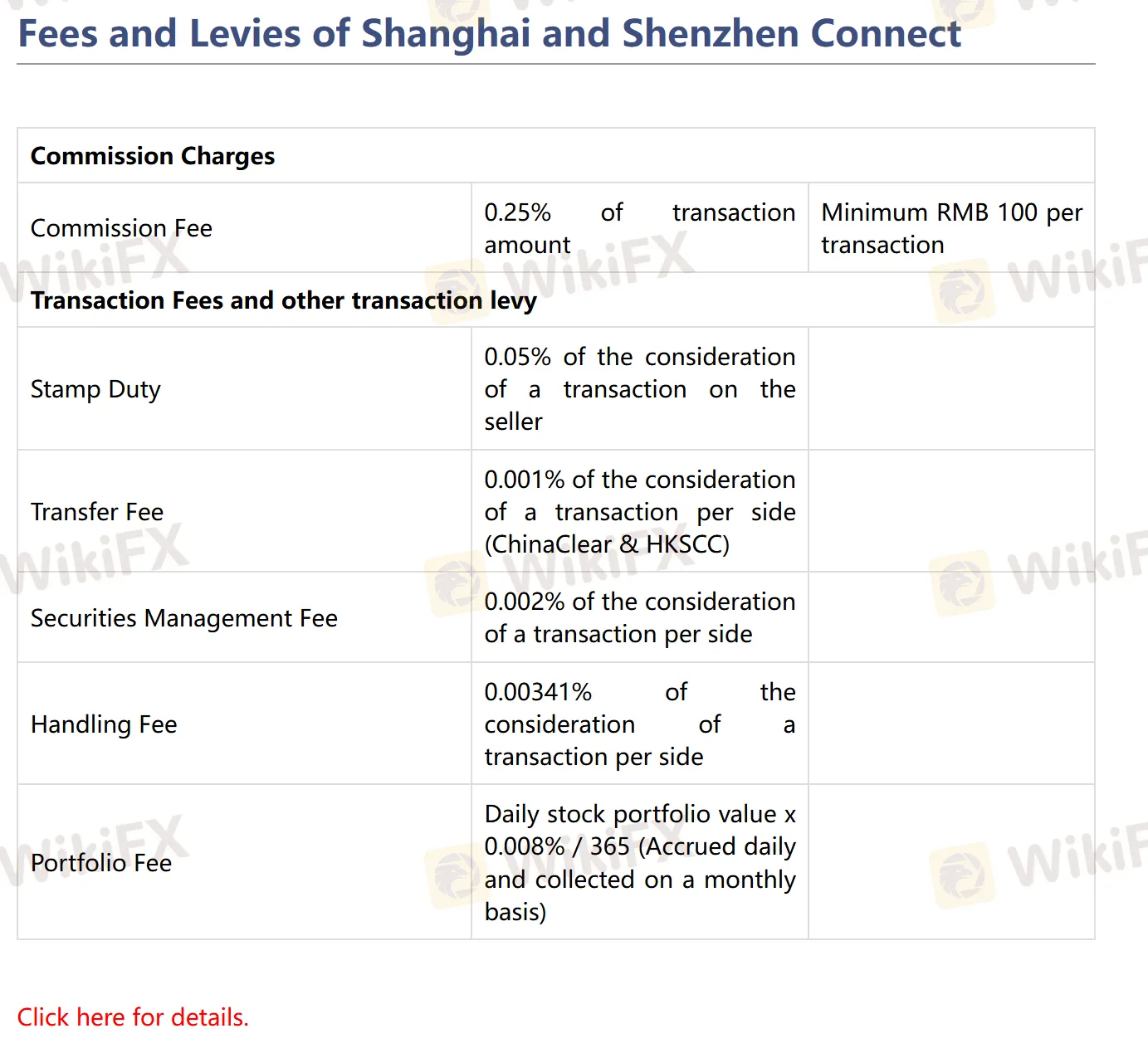

Mga Bayarin

Komisyon: Depende sa merkado at produkto, ang rate ng komisyon ay nasa pagitan ng 0.15% hanggang 0.25%, may minimum na bayad na HK$100 / RMB 100 / US$15.

Iba pang bayarin: kabilang ang stamp duty, SFC levy, exchange fees, clearing fees, at iba pa, ang mga tiyak na rate at minimum ay nag-iiba depende sa merkado at produkto.

Para sa karagdagang detalye, maaari mong bisitahin ang kanilang opisyal na website: https://www.hjfi.hk/EN/ffssc.php

Plataforma ng Trading

| Plataforma ng Trading | Supported | Available Devices |

| ET Trade Online Trading Platform | ✔ | iPhone/iPad, Android |

| TradeGo Online Trading Platform | ✔ | iPhone/iPad, Android |

Pagdedeposito at Pagwiwithdraw

| Uri ng Account | Mga Paraan ng Pagdedeposito | Mga Paraan ng Pagwiwithdraw |

| Securities Account | Faster Payment System (FPS) | Online trading system |

| Bank Transfer | Makipag-ugnayan sa Customer Service Department sa pamamagitan ng email: csdept@hjfi.com.hk | |

| Cheque Deposit | ||

| Futures Account | Bank Transfer | Makipag-ugnayan sa Customer Service Department sa pamamagitan ng email: csdept@hjfi.com.hk |

| Cheque Deposit |