회사 소개

| Huajin International 리뷰 요약 | |

| 설립 연도 | 2013 |

| 등록 국가/지역 | 홍콩 |

| 규제 | SFC |

| 거래 상품 | 증권, 선물 |

| 거래 플랫폼 | ET Trade 온라인 거래 플랫폼, TradeGo 온라인 거래 플랫폼 |

| 고객 지원 | 영업 시간: 월요일부터 금요일 (오전 09:00부터 오후 06:00), 토요일, 일요일 공휴일 (휴무) |

| 전화: (852) 31 033 030 | |

| 이메일: csdept@hjfi.com.hk | |

| 주소: Suite 1101, 11/F, Champion Tower, 3 Garden Road, Central, H.K. | |

Huajin International은 2013년에 설립되어 중국 홍콩에 등록된 규제된 금융 기관으로, 라이센스 번호 BFJ369으로 증권 및 선물 거래를 제공합니다. 회사는 증권 현금 계정, 증권 마진 계정, 선물 계정 등 세 가지 주요 계정 유형을 제공하며, 개인, 공동 및 기업 고객을 대상으로 합니다. 또한, ET Trade와 TradeGo 두 개의 온라인 거래 플랫폼을 제공합니다.

장단점

| 장점 | 단점 |

| SFC 규제 | 복잡한 수수료 구조 |

| 다양한 계정 유형 |

Huajin International은 신뢰할 만한가요?

네, Huajin International은 현재 SFC에 의해 규제되어 있으며, 선물 계약 거래를 보유하고 있습니다.

| 규제 국가 | 규제 기관 | 현재 상태 | 라이센스 보유 기관 | 라이센스 유형 | 라이센스 번호 |

| 증권 및 선물 위원회 (SFC) | 규제됨 | Huajin Futures (International) Limited | 선물 계약 거래 | BFJ369 |

Huajin International에서 무엇을 거래할 수 있나요?

Huajin International은 고객들에게 증권 및 선물 거래를 제공합니다.

| 거래 상품 | 지원 |

| 증권 | ✔ |

| 선물 | ✔ |

| 외환 | ❌ |

| 상품 | ❌ |

| 지수 | ❌ |

| 암호화폐 | ❌ |

| 채권 | ❌ |

| 옵션 | ❌ |

| ETFs | ❌ |

계좌 유형

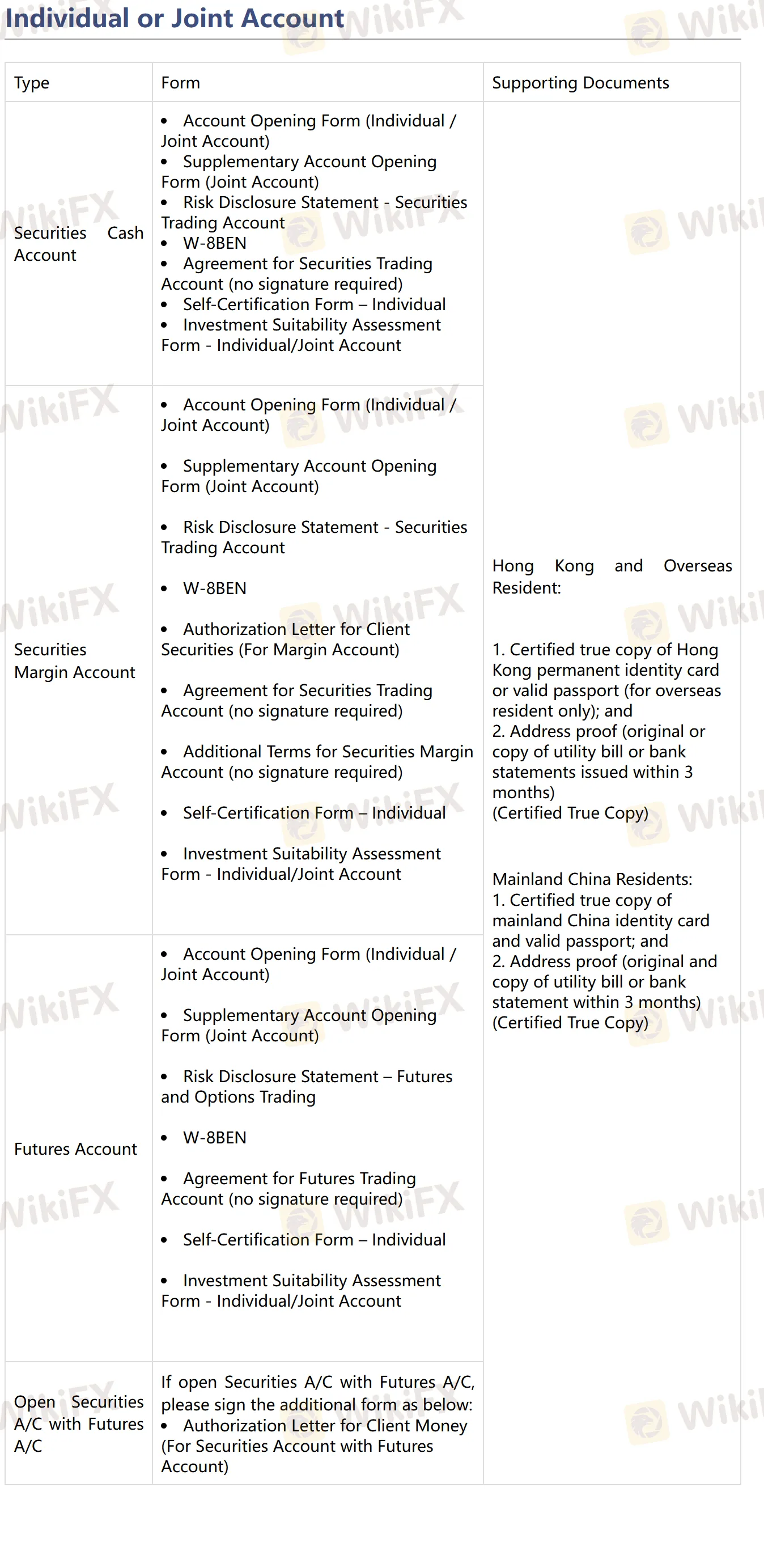

Huajin International은 증권 현금 계좌, 증권 마진 계좌 및 선물 계좌를 포함하여 개인, 공동 및 기업 계좌를 개설할 수 있습니다.

수수료

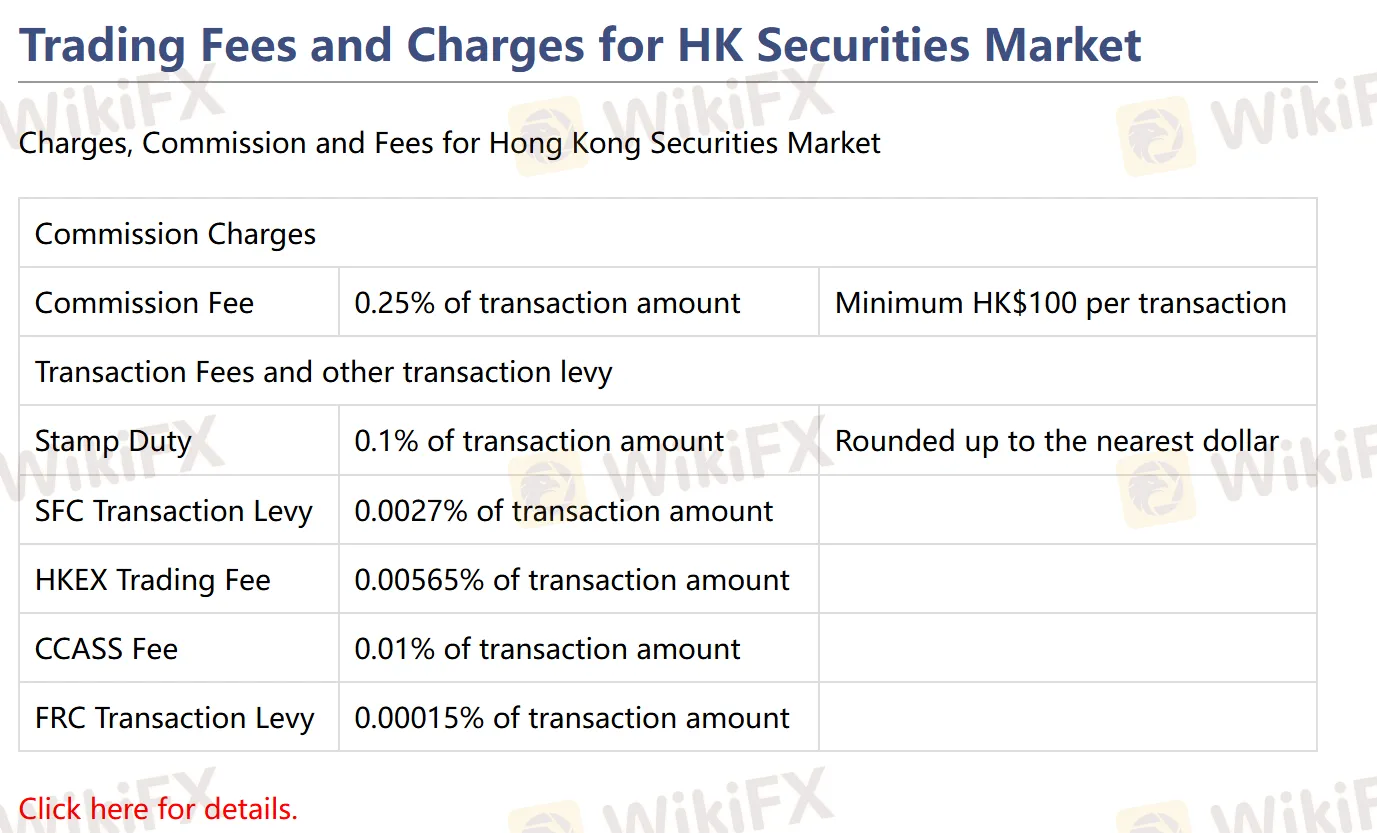

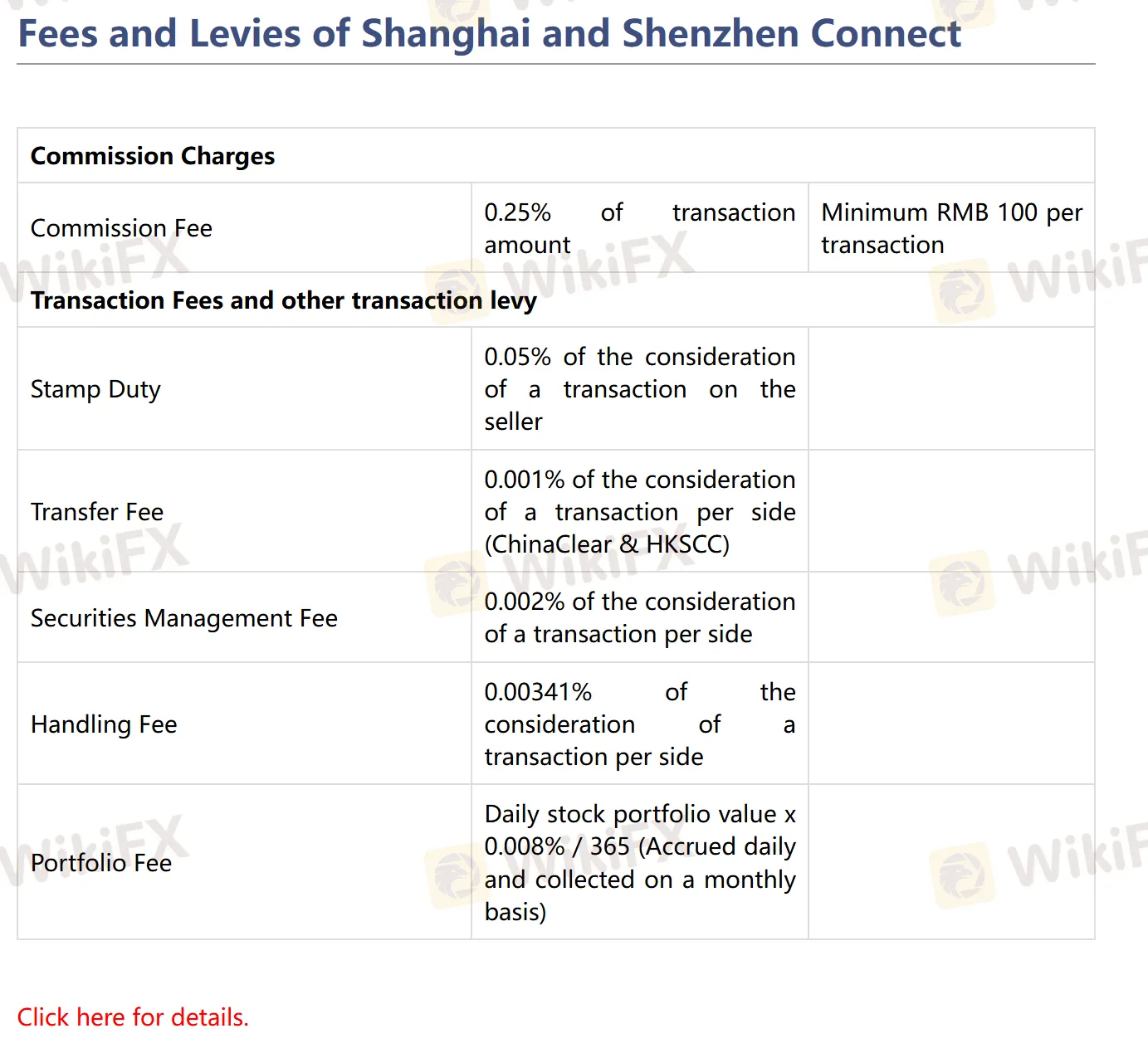

수수료: 시장 및 제품에 따라 수수료율은 0.15%에서 0.25% 범위 내에 있으며, 최소 수수료는 HK$100 / RMB 100 / US$15입니다.

기타 수수료: 인쇄세, SFC 부과금, 교환 수수료, 청산 수수료 등이 포함되며, 구체적인 요율 및 최소 요율은 시장 및 제품에 따라 다릅니다.

자세한 내용은 공식 웹사이트를 방문하십시오: https://www.hjfi.hk/EN/ffssc.php

거래 플랫폼

| 거래 플랫폼 | 지원 | 사용 가능한 장치 |

| ET Trade 온라인 거래 플랫폼 | ✔ | iPhone/iPad, Android |

| TradeGo 온라인 거래 플랫폼 | ✔ | iPhone/iPad, Android |

입출금

| 계좌 유형 | 입금 방법 | 출금 방법 |

| 증권 계좌 | Faster Payment System (FPS) | 온라인 거래 시스템 |

| 은행 송금 | 이메일을 통해 고객 서비스 부서에 문의: csdept@hjfi.com.hk | |

| 수표 입금 | ||

| 선물 계좌 | 은행 송금 | 이메일을 통해 고객 서비스 부서에 문의: csdept@hjfi.com.hk |

| 수표 입금 |