مقدمة عن الشركة

| Huajin International ملخص المراجعة | |

| تأسست | 2013 |

| البلد/المنطقة المسجلة | هونغ كونغ |

| التنظيم | SFC |

| منتجات التداول | الأوراق المالية، العقود الآجلة |

| منصة التداول | منصة التداول عبر الإنترنت ET Trade، منصة التداول عبر الإنترنت TradeGo |

| دعم العملاء | ساعات العمل: من الاثنين إلى الجمعة (09:00 صباحًا إلى 06:00 مساءً)، السبت والأحد والعطلات الرسمية (مغلق) |

| الهاتف: (852) 31 033 030 | |

| البريد الإلكتروني: csdept@hjfi.com.hk | |

| العنوان: جناح 1101، الطابق 11، برج تشامبيون، 3 غاردن رود، سنترال، هونغ كونغ | |

Huajin International، التي تأسست في عام 2013 ومسجلة في هونغ كونغ، الصين، هي شركة مالية منظمة تخضع لرقابة هيئة الأوراق المالية والعقود الآجلة (SFC) برقم ترخيص BFJ369. تقدم مجموعة من الأوراق المالية و العقود الآجلة للتداول. توفر الشركة ثلاثة أنواع رئيسية من الحسابات: حساب النقدية للأوراق المالية، حساب الهامش للأوراق المالية، وحساب العقود الآجلة، مستهدفة العملاء الفرديين والمشتركين والشركات. علاوة على ذلك، تقدم منصتي تداول عبر الإنترنت: ET Trade و TradeGo.

الإيجابيات والسلبيات

| الإيجابيات | السلبيات |

| تنظيمها من قبل SFC | هيكل رسوم معقد |

| أنواع حسابات متنوعة |

هل Huajin International شرعية؟

نعم، Huajin International تخضع حاليًا للرقابة من قبل SFC، وتحمل التعامل في عقود الآجلة.

| البلد المنظم | السلطة المنظمة | الحالة الحالية | الكيان المرخص | نوع الترخيص | رقم الترخيص |

| هيئة الأوراق المالية والعقود الآجلة (SFC) | منظم | هواجين فتشرز (إنترناشيونال) ليمتد | التعامل في عقود الآجلة | BFJ369 |

ما الذي يمكنني التداول به على Huajin International؟

Huajin International يوفر للعملاء تداول الأوراق المالية والعقود الآجلة.

| منتجات التداول | مدعوم |

| الأوراق المالية | ✔ |

| العقود الآجلة | ✔ |

| الفوركس | ❌ |

| السلع | ❌ |

| المؤشرات | ❌ |

| العملات الرقمية | ❌ |

| السندات | ❌ |

| الخيارات | ❌ |

| صناديق الاستثمار المتداولة | ❌ |

نوع الحساب

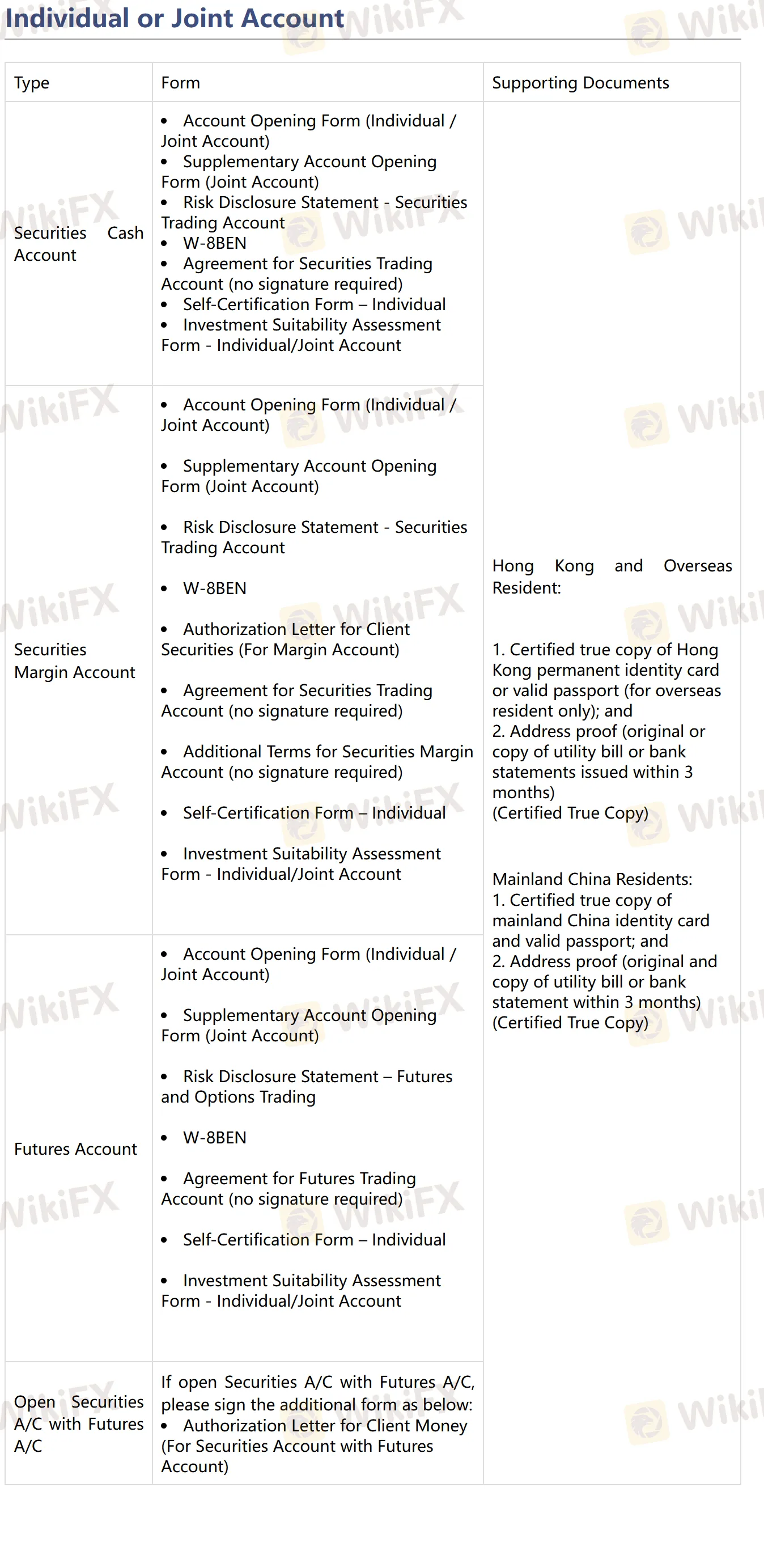

Huajin International يقدم ثلاثة أنواع رئيسية من الحسابات: حساب نقدي للأوراق المالية، حساب هامش للأوراق المالية وحساب للعقود الآجلة، بالإضافة إلى فتح حسابات فردية ومشتركة وشركات.

الرسوم

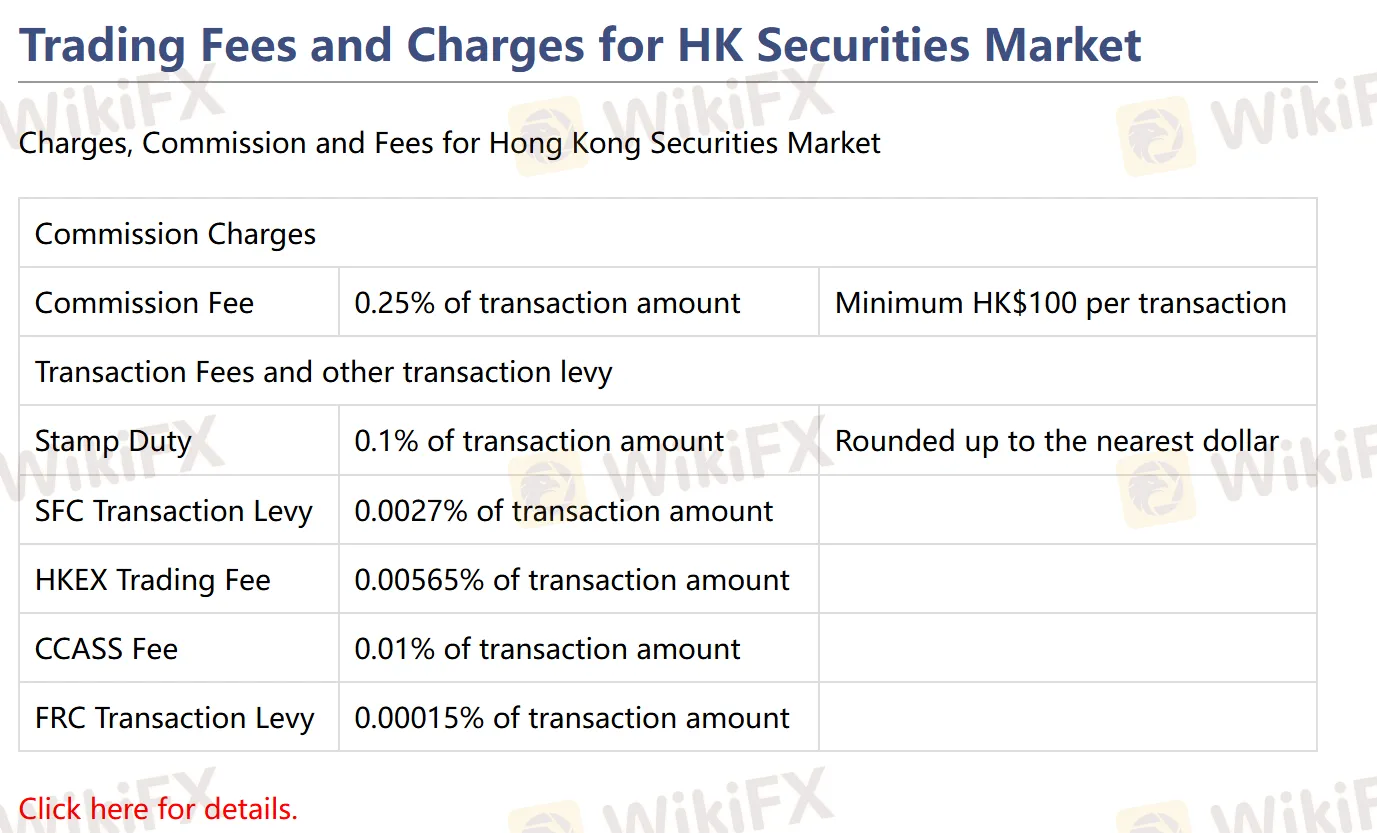

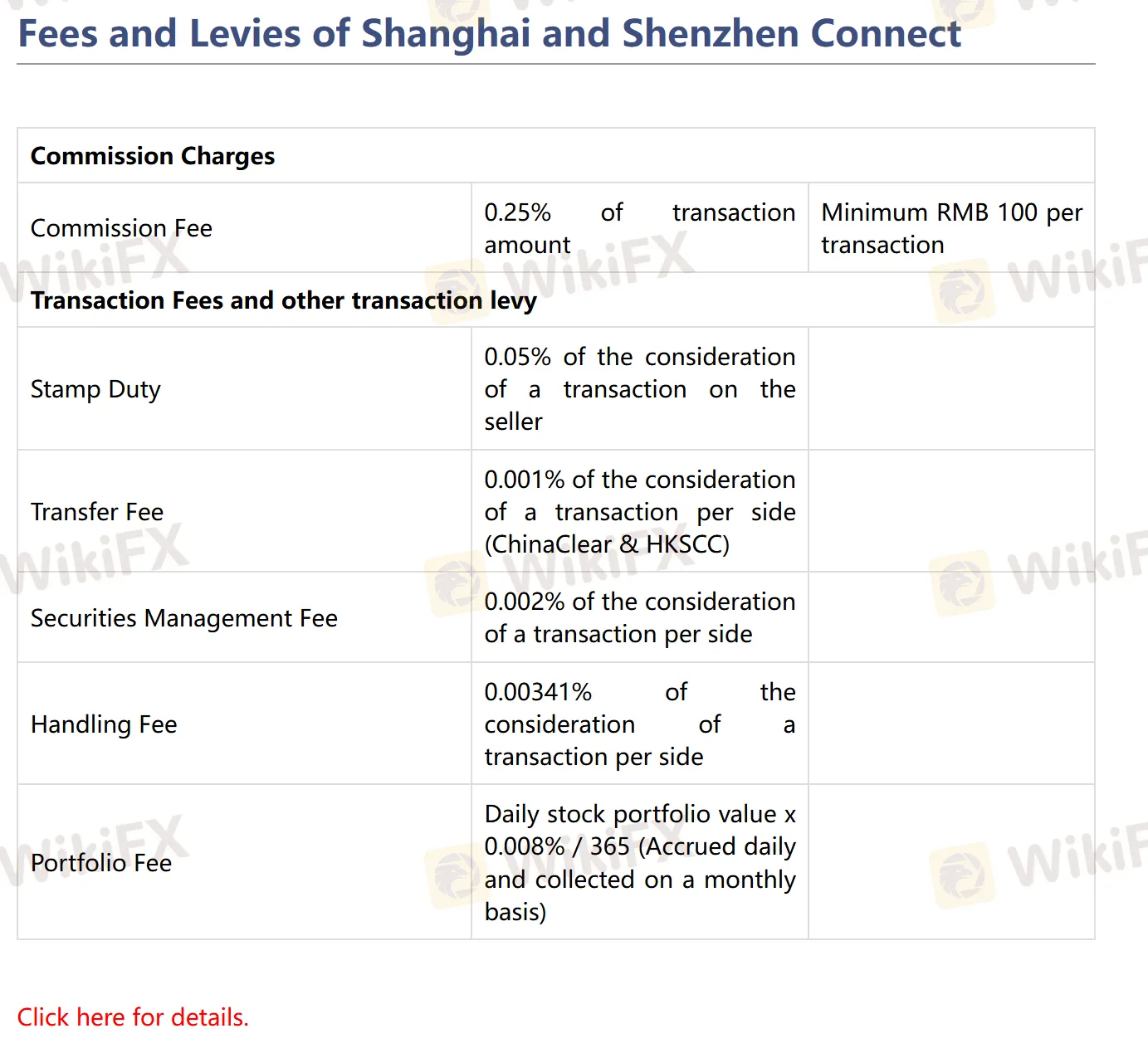

العمولة: تتراوح نسبة العمولة بين 0.15% إلى 0.25%، مع رسوم دنيا تبلغ HK$100 / RMB 100 / US$15.

رسوم أخرى: تشمل ضريبة الطوابع، رسوم SFC، رسوم التبادل، رسوم التصفية، وما إلى ذلك، تختلف الأسعار والحد الأدنى بحسب السوق والمنتج.

لمزيد من التفاصيل، يمكنك زيارة موقعهم الرسمي: https://www.hjfi.hk/EN/ffssc.php

منصة التداول

| منصة التداول | مدعومة | الأجهزة المتاحة |

| ET Trade منصة التداول الإلكترونية عبر الإنترنت | ✔ | iPhone/iPad, Android |

| TradeGo منصة التداول الإلكترونية عبر الإنترنت | ✔ | iPhone/iPad, Android |

الإيداع والسحب

| نوع الحساب | طرق الإيداع | طرق السحب |

| حساب الأوراق المالية | نظام الدفع السريع (FPS) | نظام التداول عبر الإنترنت |

| تحويل بنكي | الاتصال بقسم خدمة العملاء عبر البريد الإلكتروني: csdept@hjfi.com.hk | |

| إيداع شيكات | ||

| حساب العقود الآجلة | تحويل بنكي | الاتصال بقسم خدمة العملاء عبر البريد الإلكتروني: csdept@hjfi.com.hk |

| إيداع شيكات |