Présentation de l'entreprise

| Point72 Résumé de l'examen | |

| Inscrit | 2010 |

| Pays/Région d'inscription | États-Unis |

| Régulation | SFC |

| Investissements | Actions, investissements macro mondiaux, investissements systématiques, capital-risque |

| Plateforme de trading | / |

| Dépôt minimum | / |

| Support client | LinkadIn, Twitter, Facebook, Instagram, YouTube, Glassdoor |

Informations sur Point72

Point72 est une société d'investissement alternative mondiale fondée par Steven A. Cohen. Elle utilise des stratégies d'investissement discrétionnaires long/court, systématiques et macro, complétées par un portefeuille croissant sur le marché privé. Les stratégies d'investissement proposées incluent les investissements discrétionnaires long/court, l'investissement systématique, le macro mondial et le capital-risque et les investissements privés.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Réglementé par SFC | Aucune information sur les frais disponible |

| Aucun canal de contact direct |

Point72 est-il légitime ?

Point72 est une société d'investissement mondiale légitime et conforme, réglementéepar la Commission des valeurs mobilières et des contrats à terme de Hong Kong (SFC) sous le numéro de licence AOB349, et soumise à une réglementation stricte. Cependant, elle ne sert que les investisseurs professionnels qui répondent aux exigences réglementaires.

Que puis-je échanger sur Point72 ?

Les services de stratégie d'investissement de Point72 incluent des investissements en actions long/court. Les investissements macro mondiaux couvrent les revenus fixes, le forex, le crédit liquide, les matières premières, les dérivés, etc. De plus, Cubist Systematic Strategies propose des investissements systématiques, et Point72 Ventures offre du capital-risque et des actions de croissance.

| Stratégies d'investissement | Pris en charge |

| Investissements en actions long/court | ✔ |

| Investissements macro mondiaux | ✔ |

| Investissements systématiques | ✔ |

| Capital-risque et actions de croissance | ✔ |

FX1123820651

Le pérou

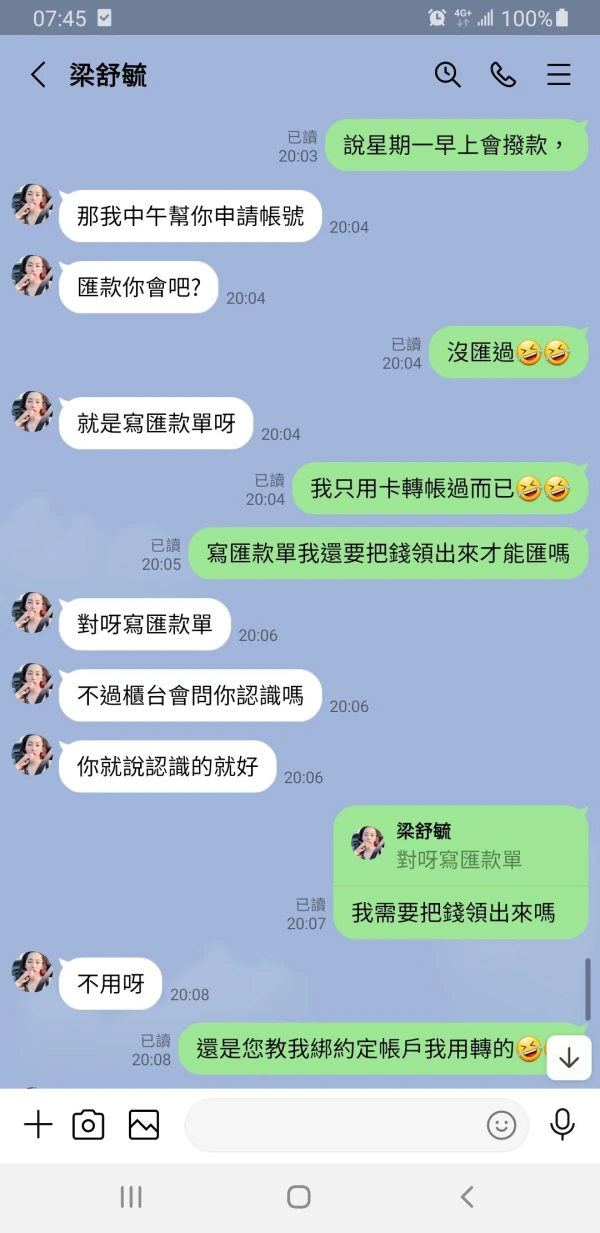

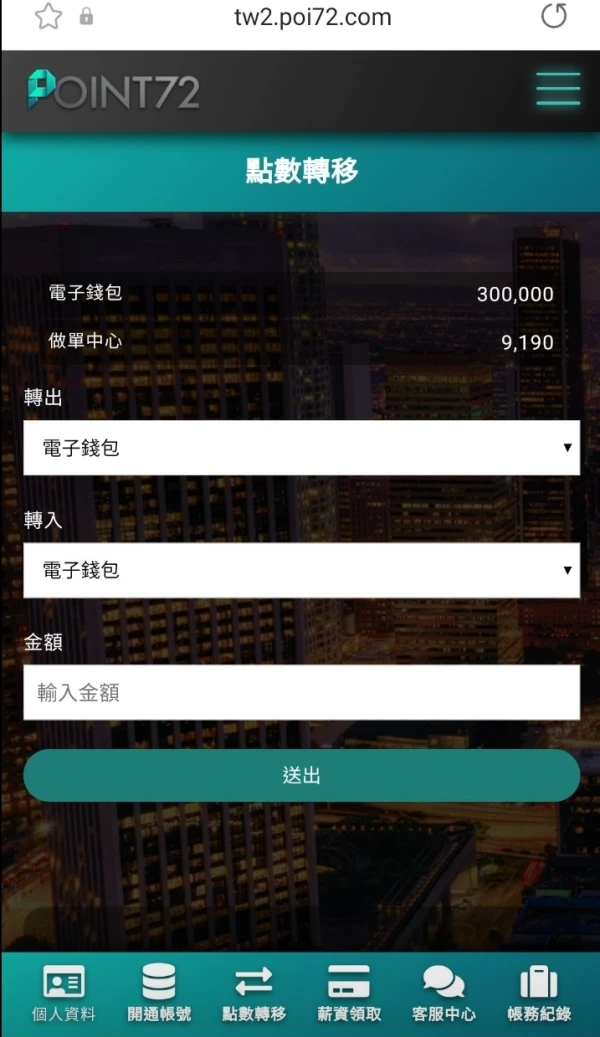

La société soi-disant POINT 72, qui opère via la plateforme GDCK, se livre à des opérations frauduleuses de la manière suivante : Ils vous offrent un bonus minimum de 10 $ pour vous apprendre à trader. Comme ils manipulent la plateforme, ils vous font gagner en vous envoyant des signaux d'entrée et de sortie pour les cryptomonnaies à suivre. Tout en vous faisant réaliser des profits, ils vous incitent ensuite à augmenter votre capital. La conseillère ou gestionnaire, Anna Bansley, est celle qui m'a harcelé par messages pour que je dépose plus de fonds. Il est à noter que cette personne utilise de nombreux numéros de téléphone différents, que je joindrai comme preuve. Le capital que vous investissez semble croître très rapidement. Cependant, une fois que vous avez investi une somme substantielle, même en suivant leurs instructions, vous perdez tout votre argent en quelques secondes. J'ai été retiré du groupe où ils émettaient des signaux pour exposer leur mode opératoire et ont été bloqués de tous leurs numéros enregistrés. Le capital total investi était d'environ 15 000 USD entre mai et août de cette année (2025). Je joins l'un des nombreux reçus de dépôt comme preuve.

Divulgation

FX3845532432

Le pérou

Le courtier Point72 via la plateforme pro GDCK n'autorise pas le transfert de cryptomonnaies vers Binance.

Divulgation

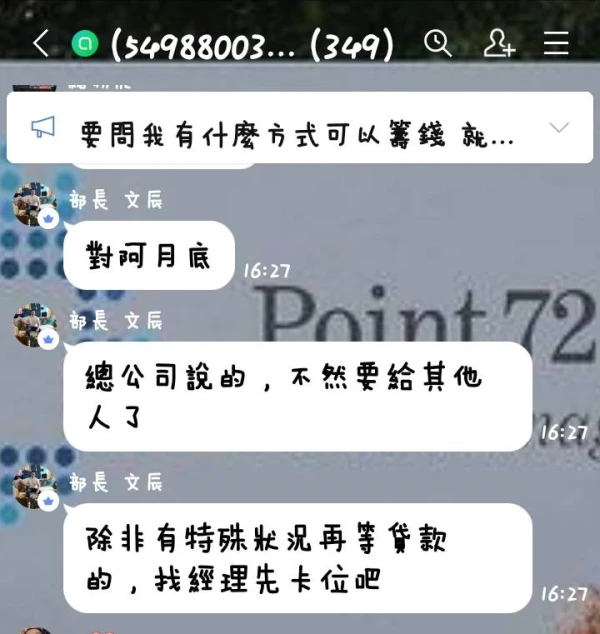

王兆雲

Taïwan

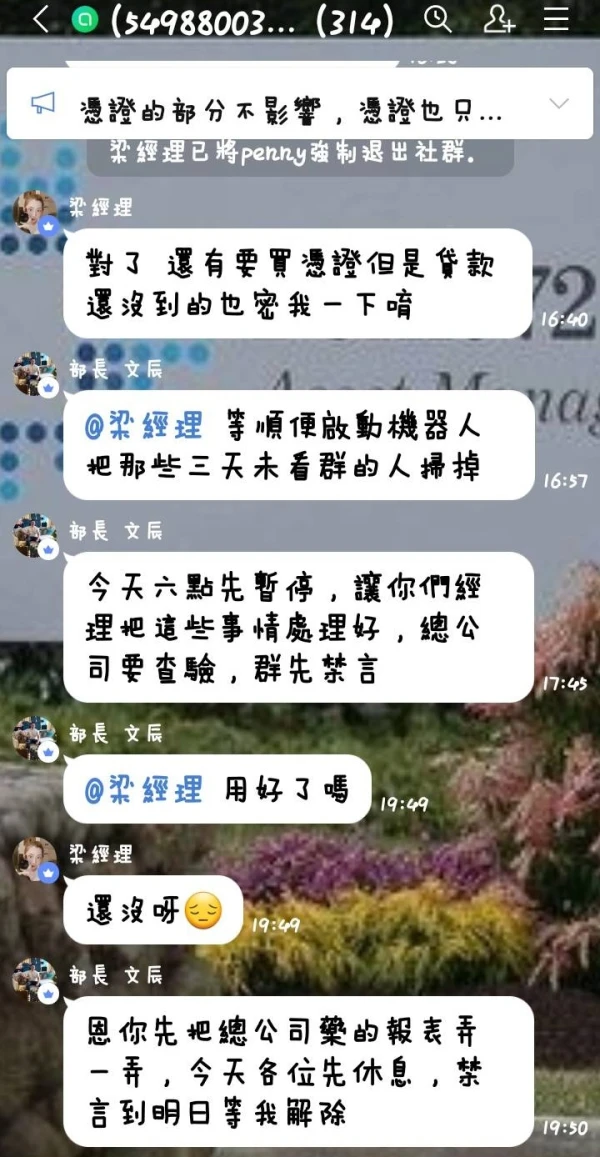

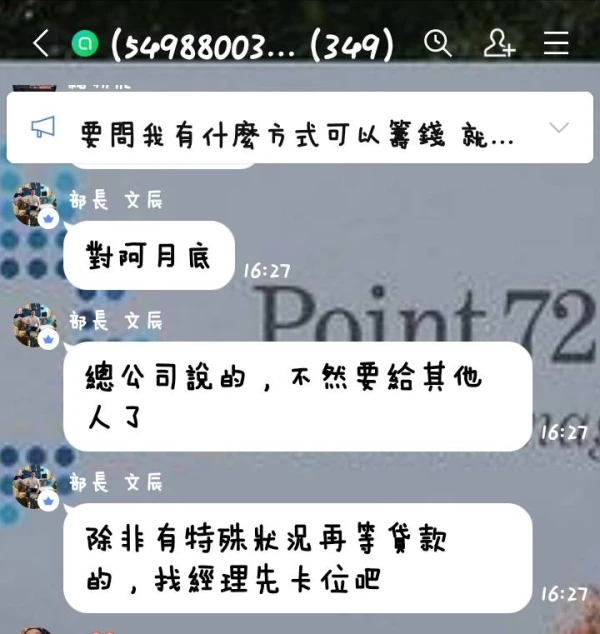

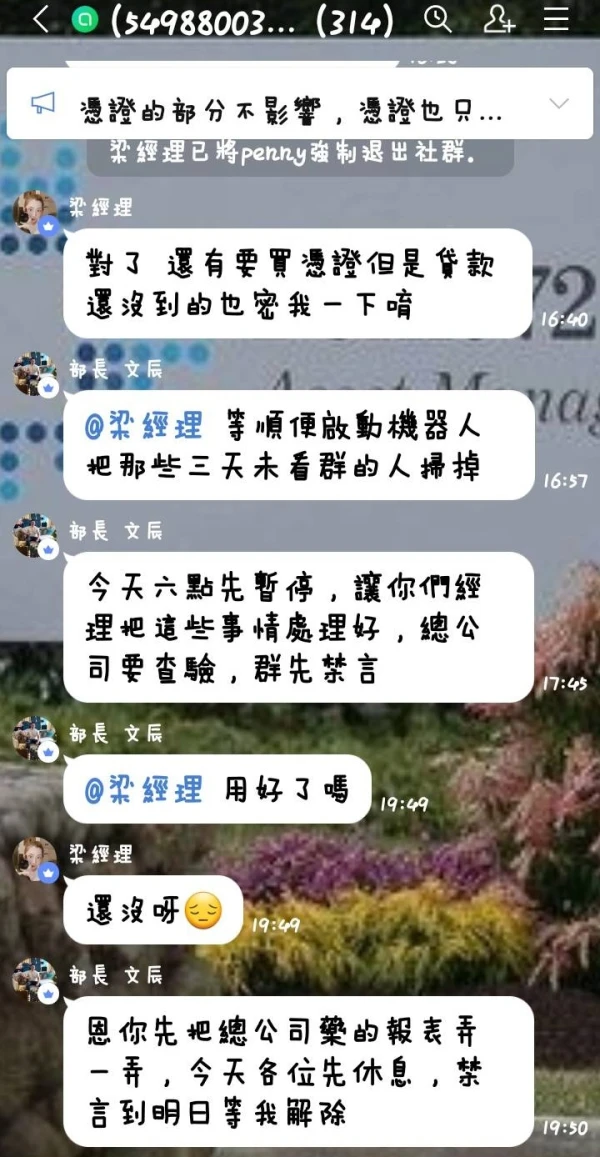

Ils vous ont ajouté sur Facebook et ont prétendu être une entreprise à Taïwan. Ils ont bavardé dans le groupe et vous ont persuadé qu'ils étaient une vraie compagnie. Attention à cette arnaque.

Divulgation

健乐

La tunisie

Point72 est une société de gestion de fonds spéculatifs bien connue avec une riche expérience en investissement et une solide équipe professionnelle. Leur site Web fournit une mine d'informations et de ressources sur les investissements, y compris les dernières nouvelles du marché, des données et des rapports de recherche. En outre, ils fournissent des ressources pédagogiques pour aider les investisseurs novices à mieux comprendre et maîtriser les connaissances et les compétences en matière d'investissement. En conclusion, Point72 est une institution d'investissement très fiable et remarquable.

Positifs

陳王馬杰

Hong Kong

Le contenu du site Web de cette société est assez mince, sans aucune information réglementaire, et j'ai vu plusieurs personnes se faire arnaquer. Danger! La seule chose qui pourrait m'intéresser, c'est qu'il existe depuis plus de 15 ans, mais ce n'est rien comparé à la sécurité.

Positifs

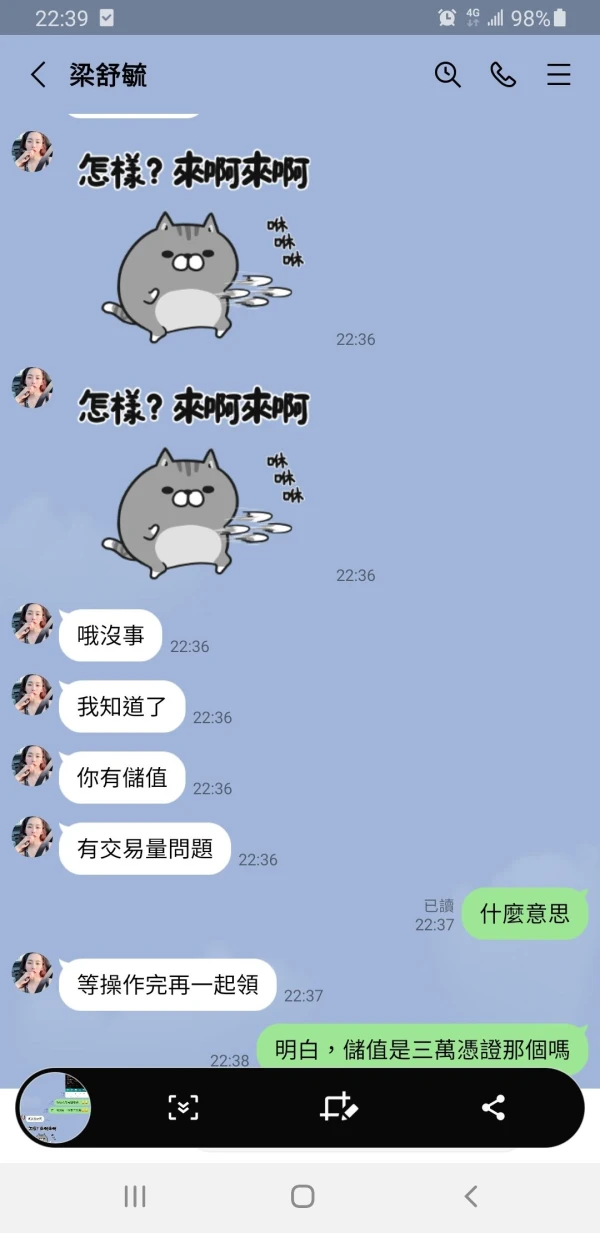

李惟

Taïwan

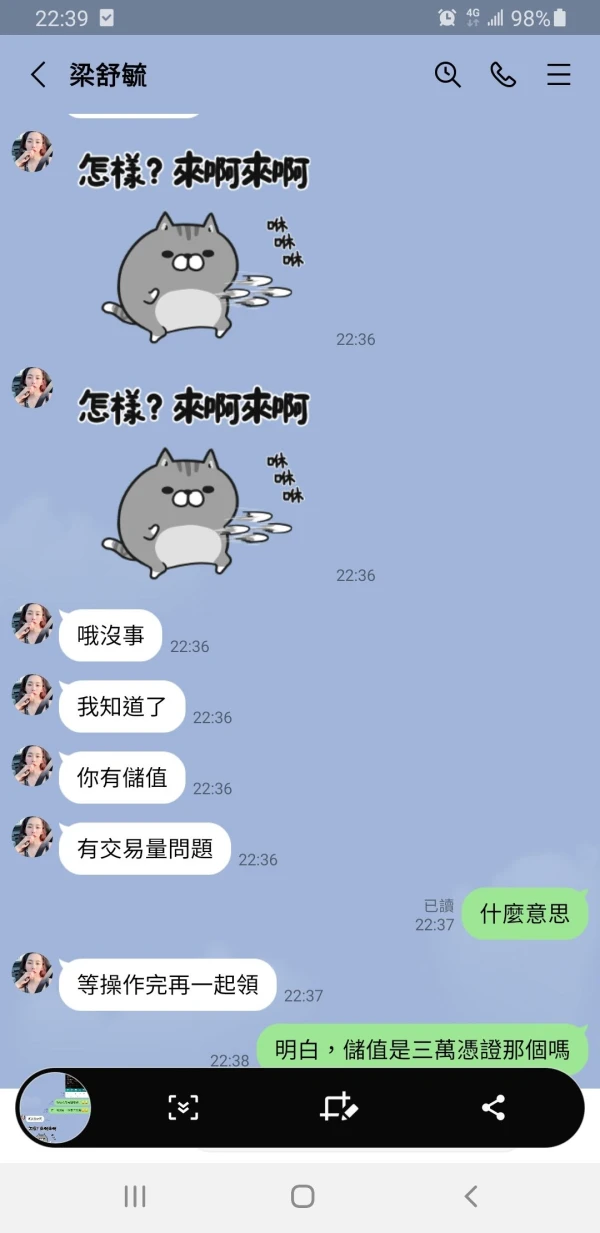

Quelqu'un a trompé des gens au nom de la société de recherche américaine Bohao. Ils m'ont trompé 100 000 yuans.

Divulgation

王兆雲

Taïwan

J'ai déposé 1 000 $ et je voulais retirer lorsqu'il est passé à 2 000 $. Mais le retrait a été annulé. Il a changé plusieurs fois de site Web. Il faut se méfier.

Divulgation