Profil perusahaan

| Point72 Ringkasan Ulasan | |

| Teregistrasi | 2010 |

| Negara/Daerah Terdaftar | Amerika Serikat |

| Regulasi | SFC |

| Investasi-an | Ekuitas, investasi global makro, investasi sistematis, modal ventura |

| Platform Perdagangan | / |

| Dukungan Pelanggan | LinkadIn, Twitter, Facebook, Instagram, YouTube, Glassdoor |

Informasi Point72

Point72 adalah perusahaan investasi alternatif global yang didirikan oleh Steven A. Cohen. Perusahaan ini menggunakan strategi investasi ekuitas long/short diskresioner, sistematis, dan makro, dilengkapi dengan portofolio pasar swasta yang berkembang. Strategi investasi yang ditawarkan meliputi Ekuitas Long/Short Diskresioner, Investasi Sistematis, Makro Global, dan Modal Ventura & Investasi Swasta.

Pro dan Kontra

| Pro | Kontra |

| Diatur oleh SFC | Tidak ada informasi biaya yang tersedia |

| Tidak ada saluran kontak langsung |

Apakah Point72 Legal?

Point72 adalah perusahaan investasi global yang sah dan patuh, diaturoleh Komisi Sekuritas dan Berjangka Hong Kong (SFC) dengan nomor lisensi AOB349, dan tunduk pada regulasi ketat. Namun, perusahaan ini hanya melayani investor profesional yang memenuhi persyaratan regulasi.

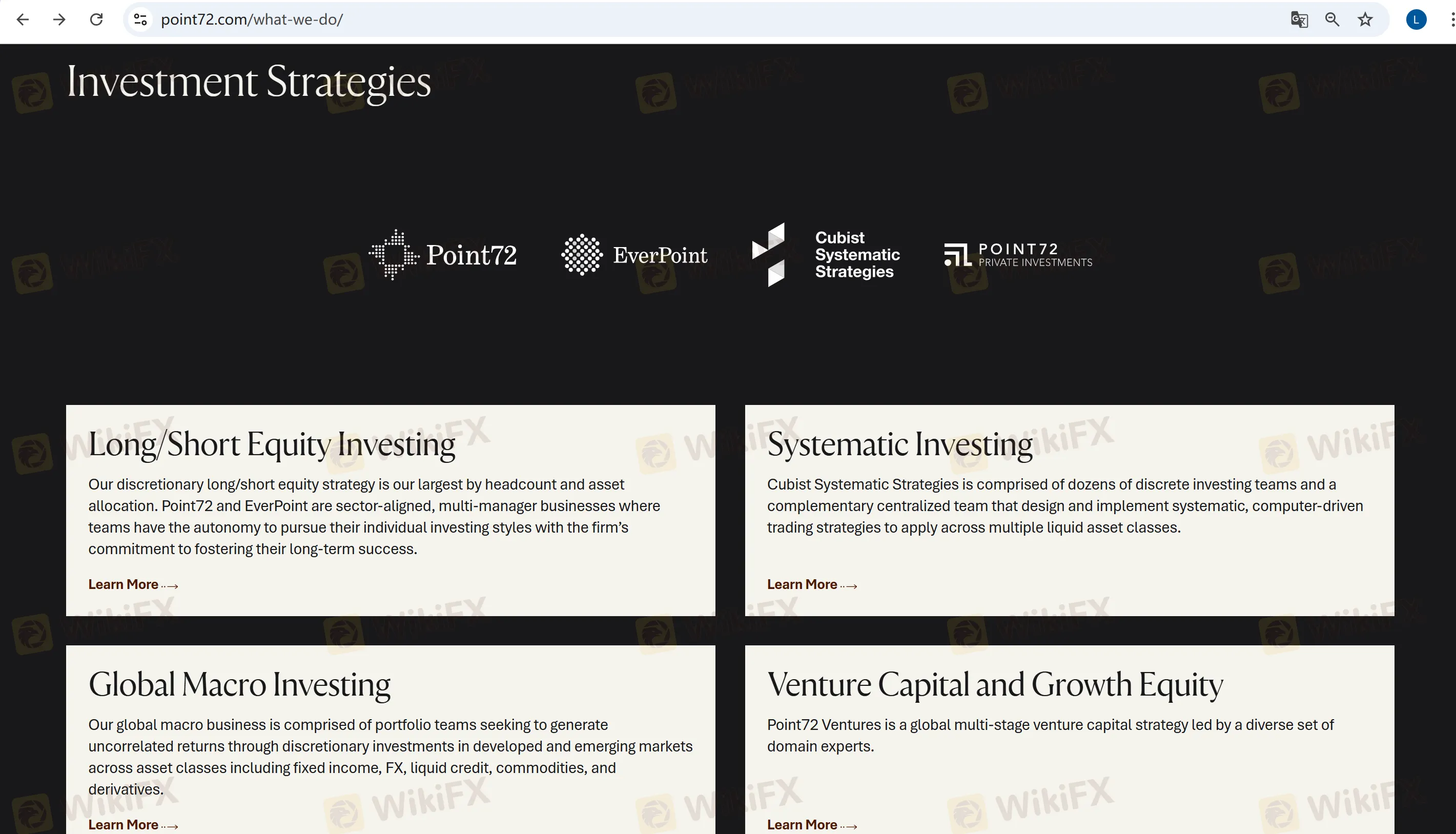

Apa yang Bisa Saya Perdagangkan di Point72?

Layanan strategi investasi Point72 meliputi investasi ekuitas long/short. Investasi makro global mencakup pendapatan tetap, forex, kredit likuid, komoditas, derivatif, dll. Selain itu, Cubist Systematic Strategies menyediakan investasi sistematis, dan Point72 Ventures menawarkan modal ventura dan ekuitas pertumbuhan.

| Strategi Investasi | Didukung |

| Investasi ekuitas long/short | ✔ |

| Investasi makro global | ✔ |

| Investasi sistematis | ✔ |

| Modal ventura dan ekuitas pertumbuhan | ✔ |

FX1123820651

Peru

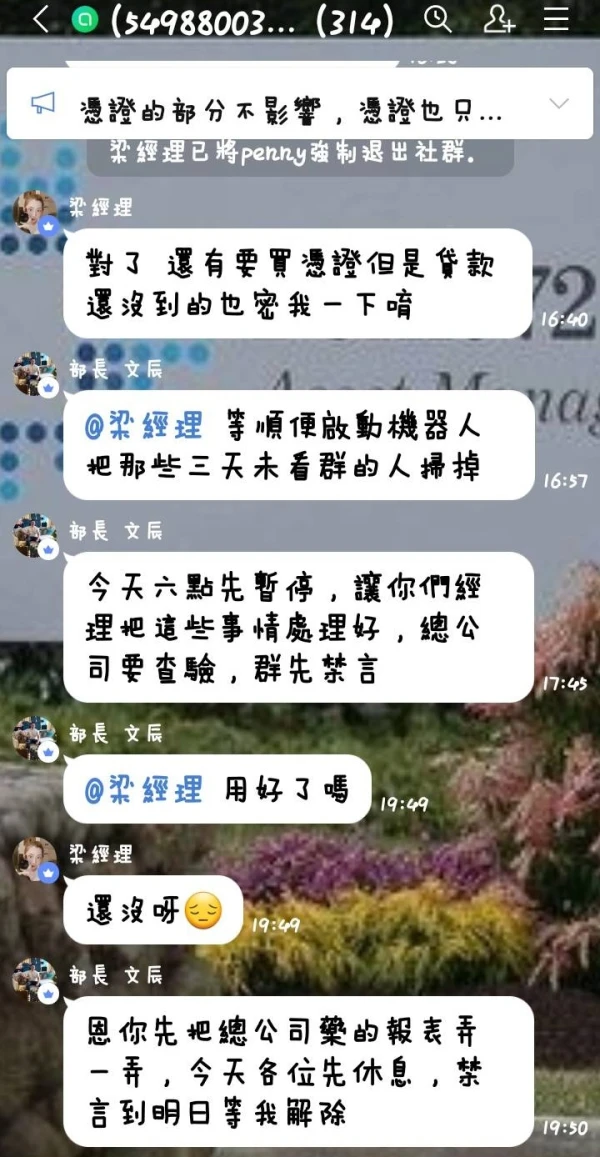

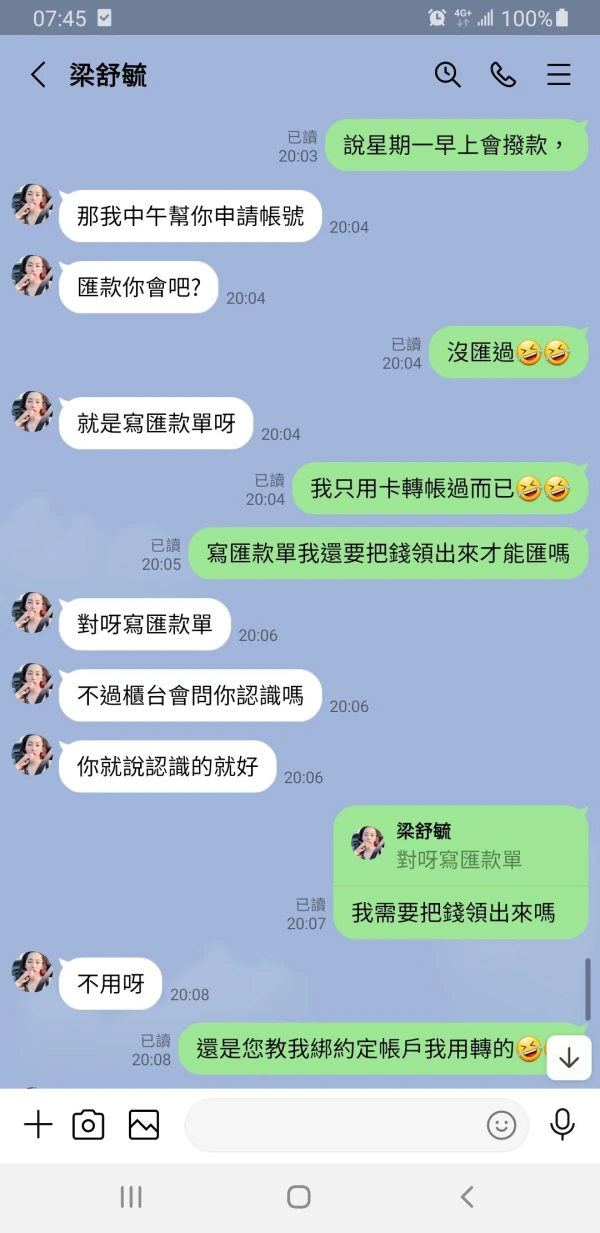

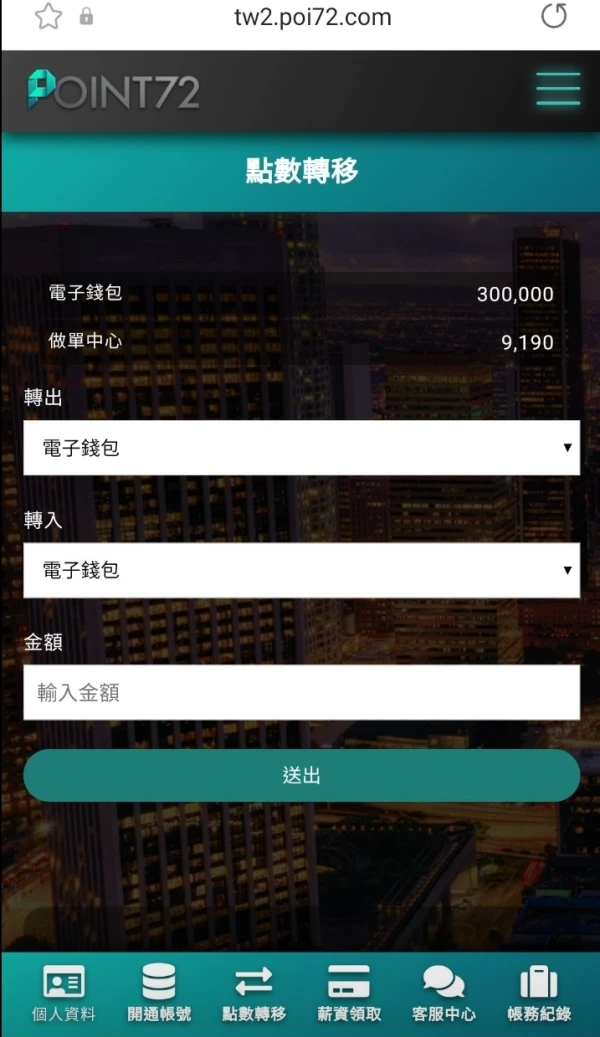

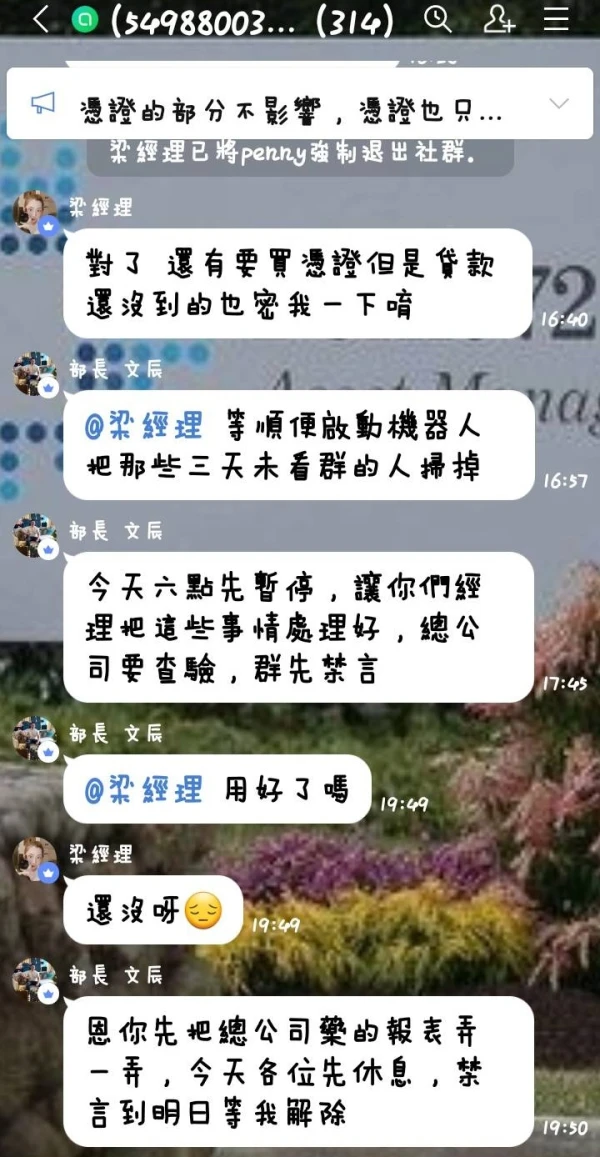

Perusahaan yang disebut POINT 72, yang beroperasi melalui platform GDCK, melakukan operasi penipuan sebagai berikut: Mereka memberi Anda bonus minimal $10 untuk mengajari Anda cara berdagang. Karena mereka memanipulasi platform, mereka membuat Anda menang dengan mengirimkan sinyal masuk dan keluar untuk cryptocurrency agar Anda ikuti. Saat mereka membuat Anda untung, mereka kemudian membujuk Anda untuk menambah modal. Penasihat atau manajer, Anna Bansley, adalah orang yang mengganggu saya dengan pesan untuk menyetor lebih banyak dana. Perlu dicatat bahwa orang ini menggunakan banyak nomor telepon berbeda, yang akan saya lampirkan sebagai bukti. Modal yang Anda investasikan tampaknya tumbuh sangat cepat. Namun, begitu Anda memiliki jumlah investasi yang besar, bahkan saat mengikuti instruksi mereka, Anda kehilangan semua uang Anda dalam hitungan detik. Saya dihapus dari grup tempat mereka mengirim sinyal untuk mengungkap modus operandi mereka dan telah diblokir dari semua nomor terdaftar mereka. Total modal yang diinvestasikan adalah sekitar $15.000 USD antara Mei dan Agustus tahun ini (2025). Saya melampirkan salah satu dari banyak tanda terima setoran sebagai bukti.

Paparan

FX3845532432

Peru

Pialang Point72 melalui platform pro GDCK tidak mengizinkan transfer kripto ke Binance.

Paparan

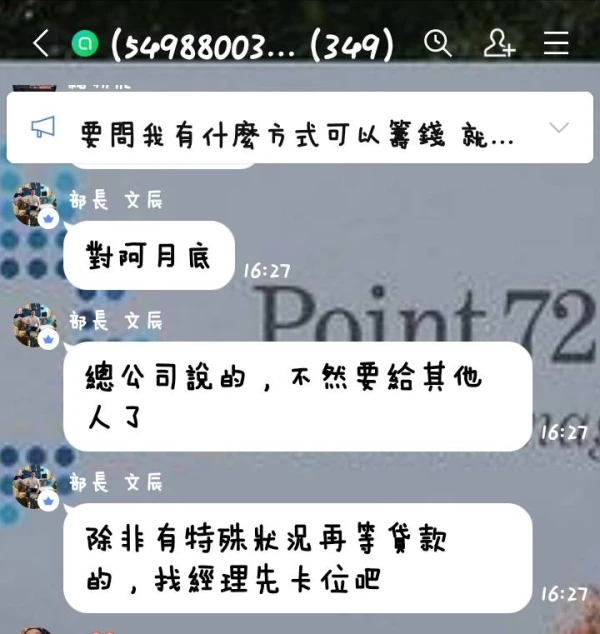

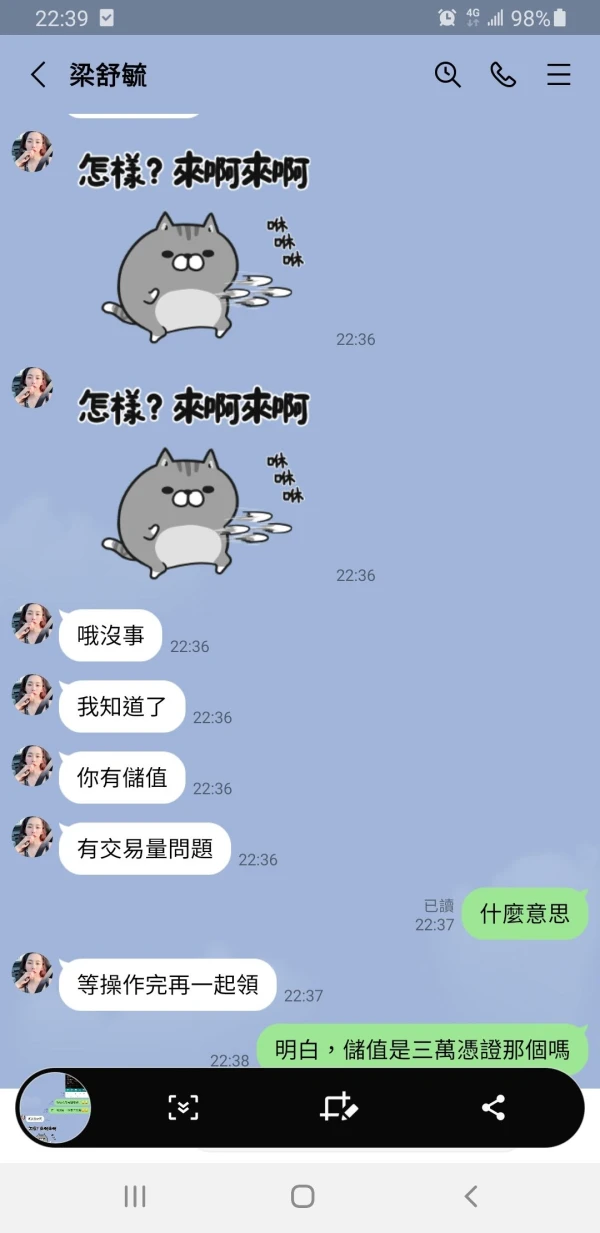

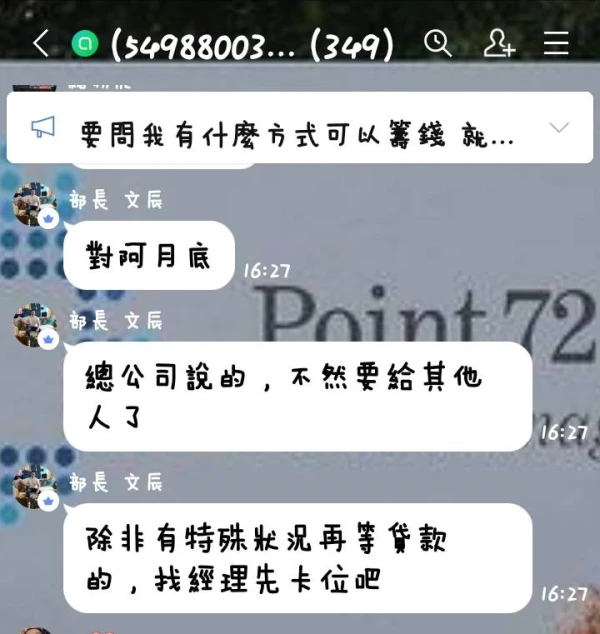

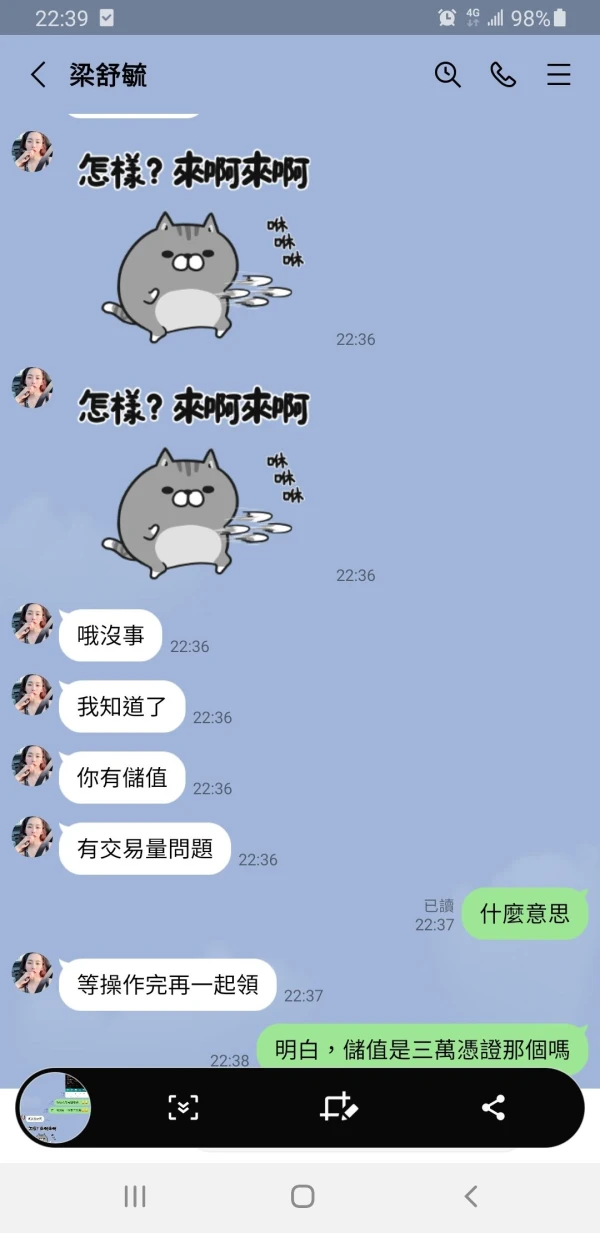

王兆雲

Taiwan

Mereka menambahkan Anda di Facebook dan berpura-pura menjadi perusahaan di Taiwan. Mereka mengobrol di grup dan meyakinkan Anda bahwa mereka adalah teman yang nyata. Waspadalah terhadap penipuan ini.

Paparan

健乐

Tunisia

Point72 adalah perusahaan pengelola dana lindung nilai terkenal dengan pengalaman investasi yang kaya dan tim profesional yang kuat. Situs web mereka menyediakan banyak informasi dan sumber daya investasi, termasuk berita pasar terbaru, data, dan laporan penelitian. Selain itu, mereka menyediakan beberapa sumber pendidikan untuk membantu investor pemula lebih memahami dan menguasai pengetahuan dan keterampilan investasi. Kesimpulannya, Point72 adalah lembaga investasi yang sangat terpercaya dan patut diperhatikan.

Baik

陳王馬杰

Hong Kong

Konten situs web perusahaan ini cukup tipis, tanpa informasi peraturan apa pun, dan saya telah melihat beberapa orang telah ditipu. Bahaya! Satu-satunya hal yang mungkin menarik bagi saya adalah bahwa itu sudah ada selama lebih dari 15 tahun, tapi itu tidak seberapa dibandingkan dengan keamanan.

Baik

李惟

Taiwan

Seseorang menipu orang atas nama perusahaan riset American Bohao. Mereka menipu saya 100.000 yuan.

Paparan

王兆雲

Taiwan

Saya menyetor $1000 dan ingin menarik ketika meningkat menjadi $2000. Tapi penarikan itu dibatalkan. Itu mengubah situs web beberapa kali. Awas.

Paparan