회사 소개

| Point72 리뷰 요약 | |

| 등록 연도 | 2010 |

| 등록 국가/지역 | 미국 |

| 규제 | SFC |

| 투자항목 | 주식, 글로벌 매크로 투자, 체계적 투자, 벤처 캐피탈 |

| 거래 플랫폼 | / |

| 최소 입금액 | / |

| 고객 지원 | LinkadIn, Twitter, Facebook, Instagram, YouTube, Glassdoor |

Point72 정보

Point72는 Steven A. Cohen이 설립한 글로벌 대체 투자 회사입니다. 이 회사는 재량적 롱/숏 주식, 체계적 및 매크로 투자 전략을 채택하고 성장하는 사설 시장 포트폴리오를 보완합니다. 제공되는 투자 전략에는 재량적 롱/숏 주식, 체계적 투자, 글로벌 매크로, 벤처 캐피탈 및 사설 투자가 포함됩니다.

장단점

| 장점 | 단점 |

| SFC에 의해 규제됨 | 수수료 정보 없음 |

| 직접 연락 채널 없음 |

Point72가 합법인가요?

Point72는 합법적이고 규정을 준수하는 글로벌 투자 회사로, 홍콩 증권 및 선물 위원회 (SFC)의 라이센스 번호 AOB349에 따라 엄격한 규제를 받습니다. 그러나 규정 요건을 충족하는 전문 투자자에게만 서비스를 제공합니다.

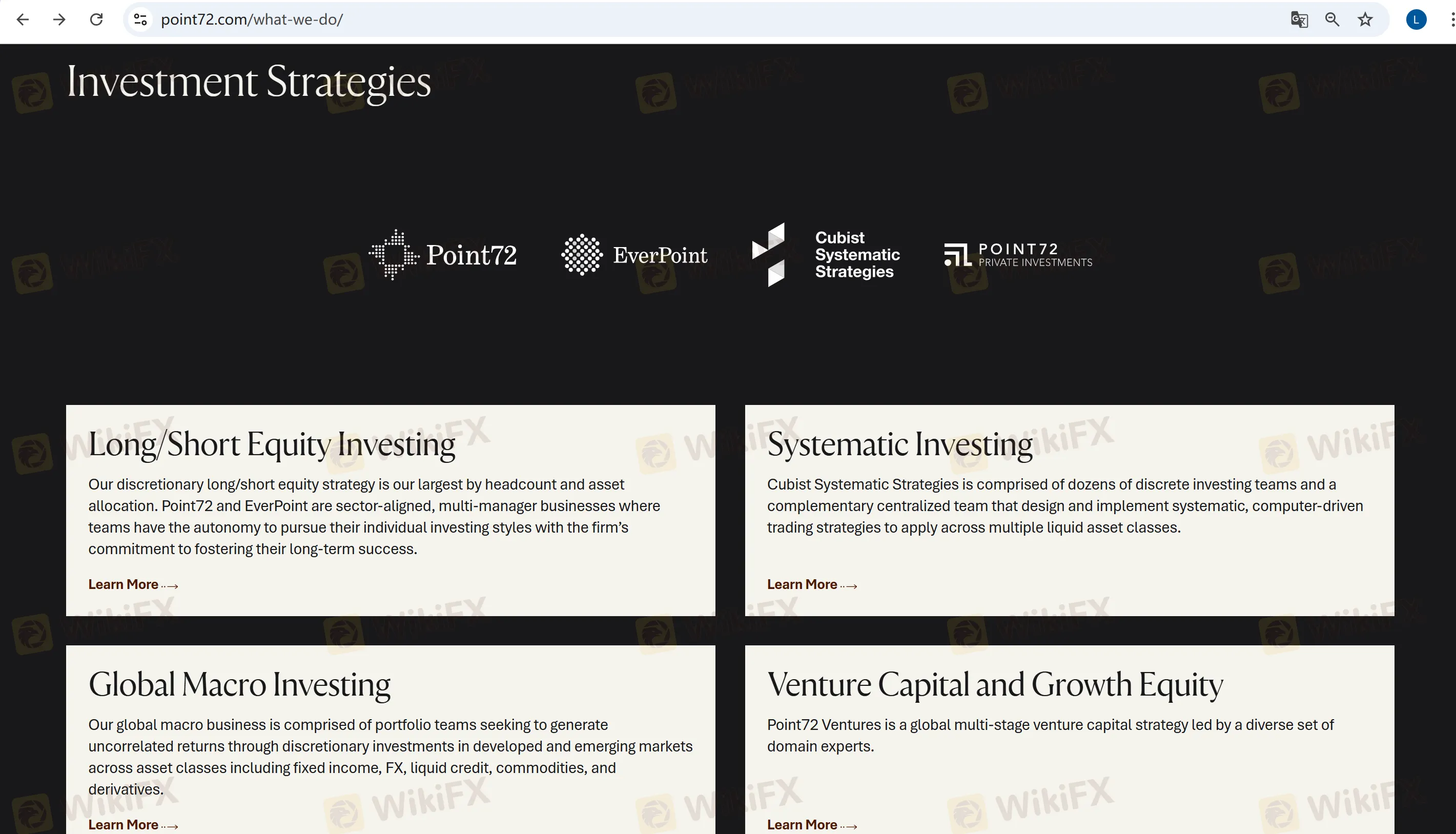

Point72에서 무엇을 거래할 수 있나요?

Point72의 투자 전략 서비스에는 롱/숏 주식 투자가 포함됩니다. 글로벌 매크로 투자는 고정 소득, 외환, 유동성 신용, 상품, 파생상품 등을 포함합니다. 또한 Cubist Systematic Strategies는 체계적 투자를 제공하며, Point72 Ventures는 벤처 캐피탈 및 성장 투자를 제공합니다.

| 투자 전략 | 지원 |

| 롱/숏 주식 투자 | ✔ |

| 글로벌 매크로 투자 | ✔ |

| 체계적 투자 | ✔ |

| 벤처 캐피탈 및 성장 투자 | ✔ |

FX1123820651

페루

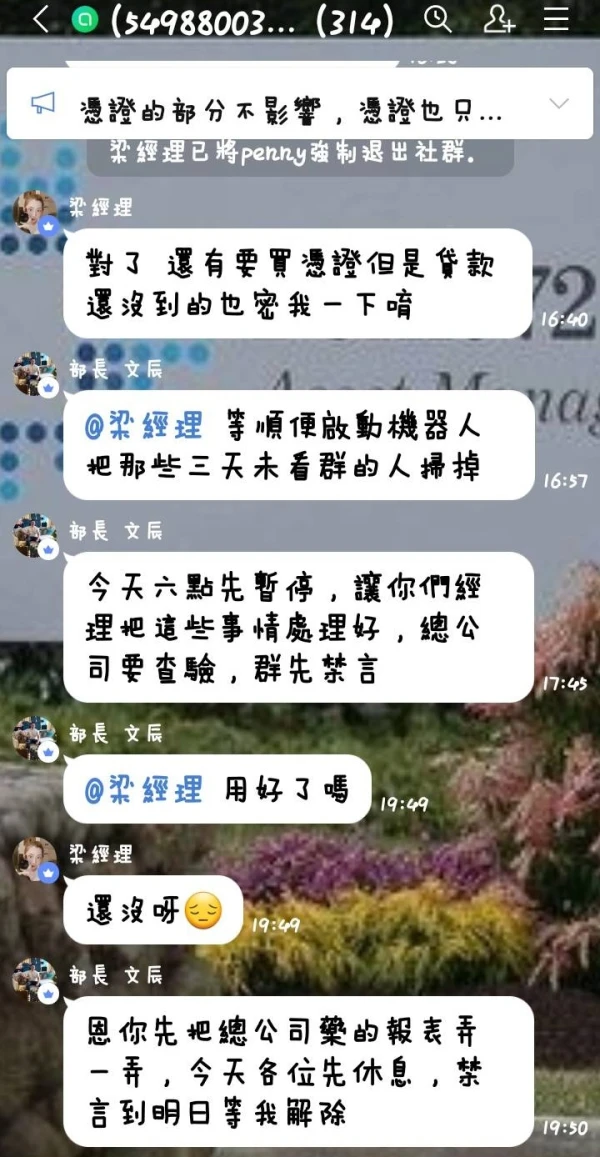

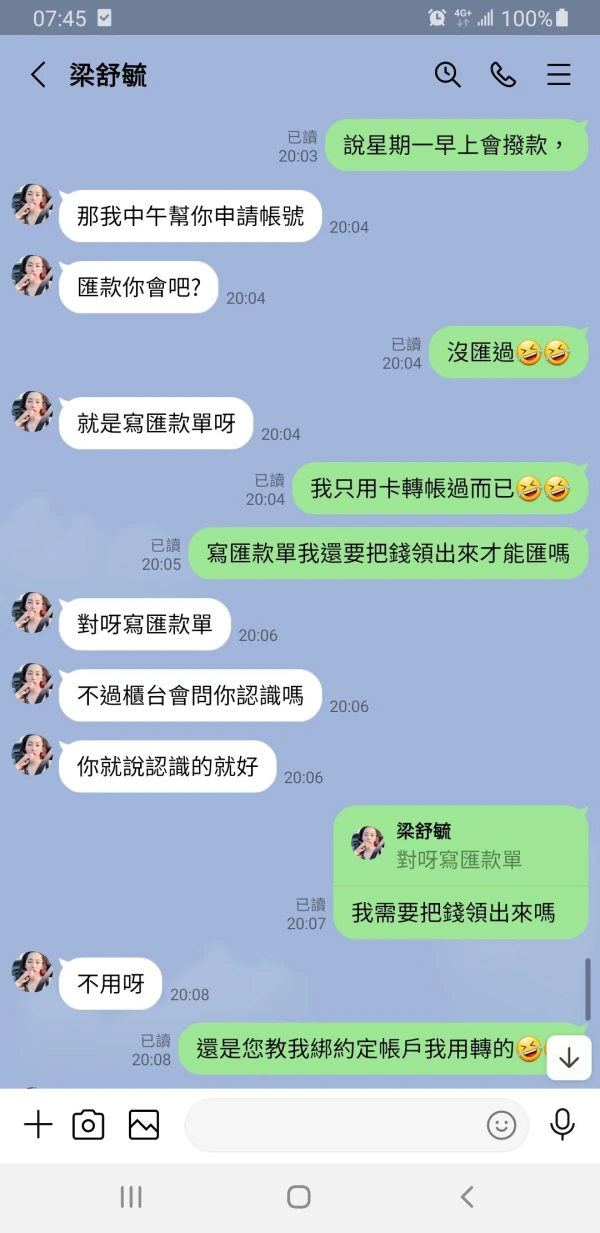

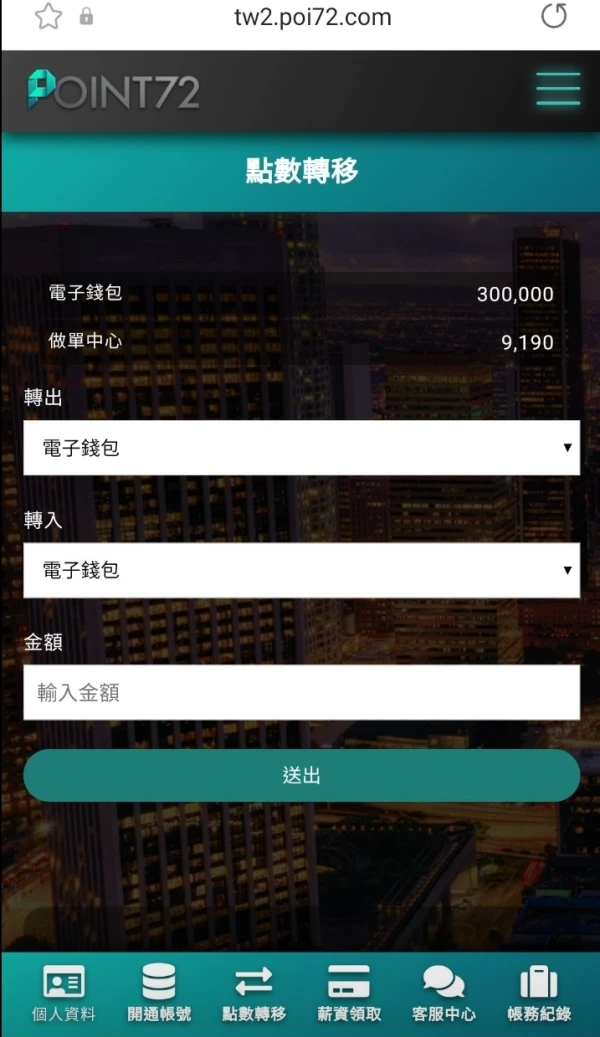

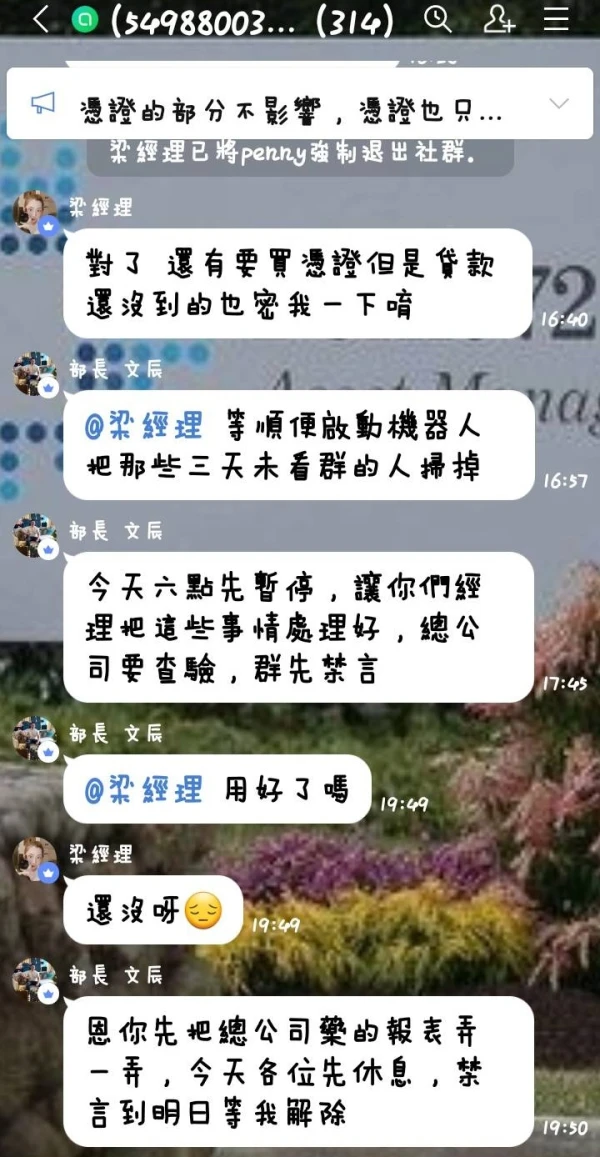

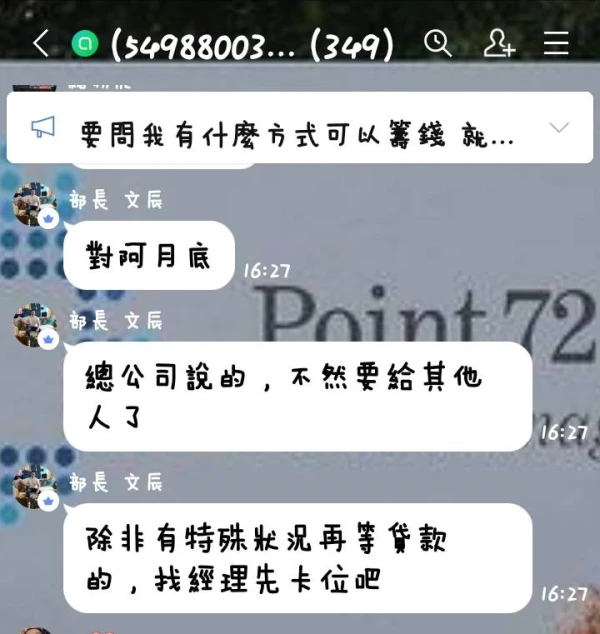

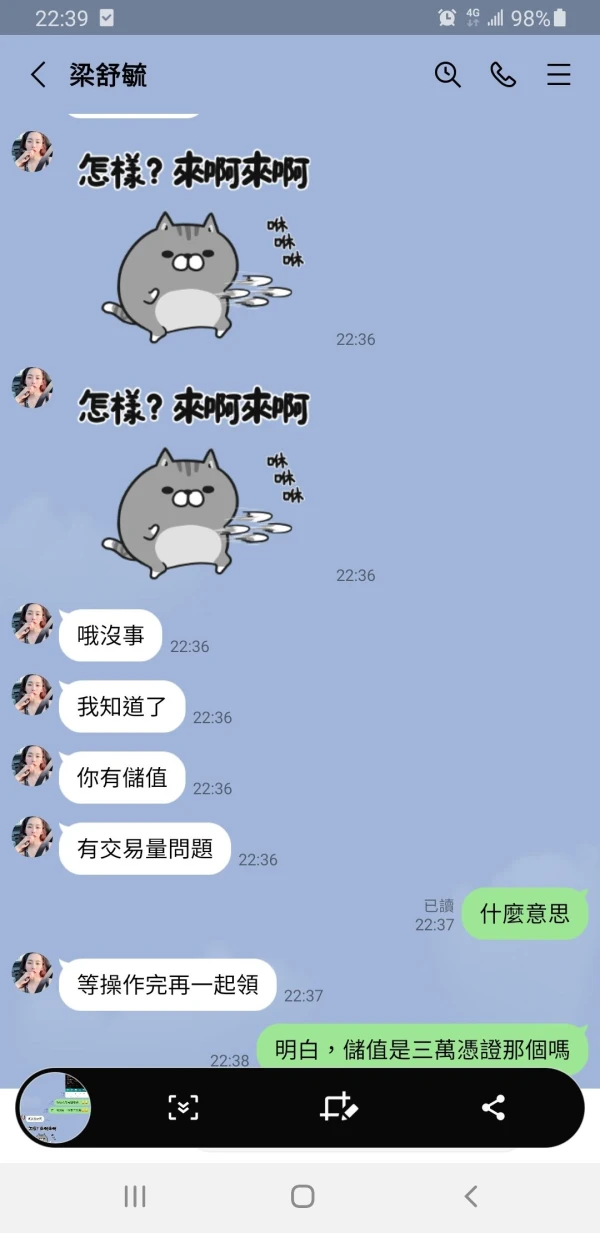

GDCK 플랫폼을 통해 운영되는 소위 회사 POINT 72는 다음과 같은 사기 행위를 합니다: 그들은 최소 $10의 보너스를 주며 거래 방법을 가르친다고 합니다. 그들이 플랫폼을 조작하기 때문에, 그들이 보내는 암호화폐의 진입 및 청산 신호를 따라가면 승리하게 됩니다. 당신이 수익을 내자, 그들은 자본을 늘리도록 유도합니다. 어드바이저이자 매니저인 Anna Bansley는 더 많은 자금을 입금하라고 메시지로 괴롭힌 사람입니다. 이 사람은 여러 다른 전화번호를 사용한다는 점을 주목할 필요가 있으며, 이를 증거로 첨부하겠습니다. 투자한 자본은 매우 빠르게 증가하는 것처럼 보입니다. 그러나 상당한 금액을 투자하면, 그들의 지시를 따르더라도 몇 초 만에 모든 돈을 잃게 됩니다. 저는 제거되었습니다. 그룹에서 그들의 작전 방식을 폭로하기 위한 신호를 보냈고 등록된 모든 번호에서 차단되었습니다. 투자된 총 자본은 올해(2025년) 5월부터 8월 사이에 약 15,000달러였습니다. 증거로 여러 입금 영수증 중 하나를 첨부합니다.

신고

FX3845532432

페루

브로커 Point72는 GDCK pro 플랫폼을 통해 바이낸스로의 암호화폐 이체를 허용하지 않습니다.

신고

王兆雲

대만

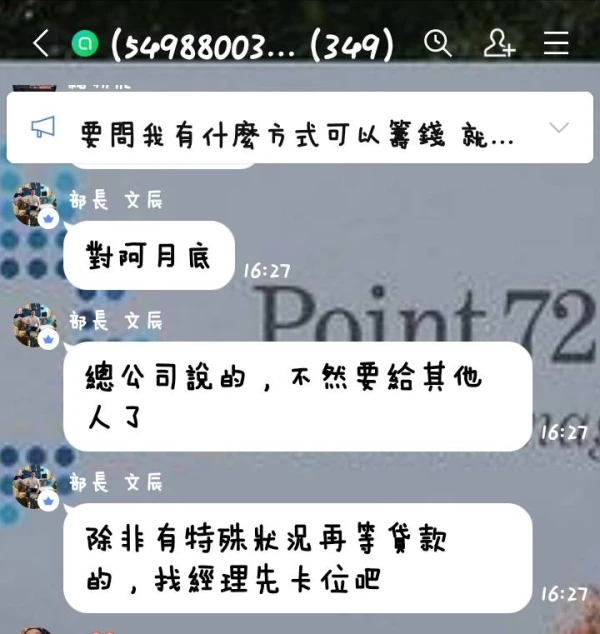

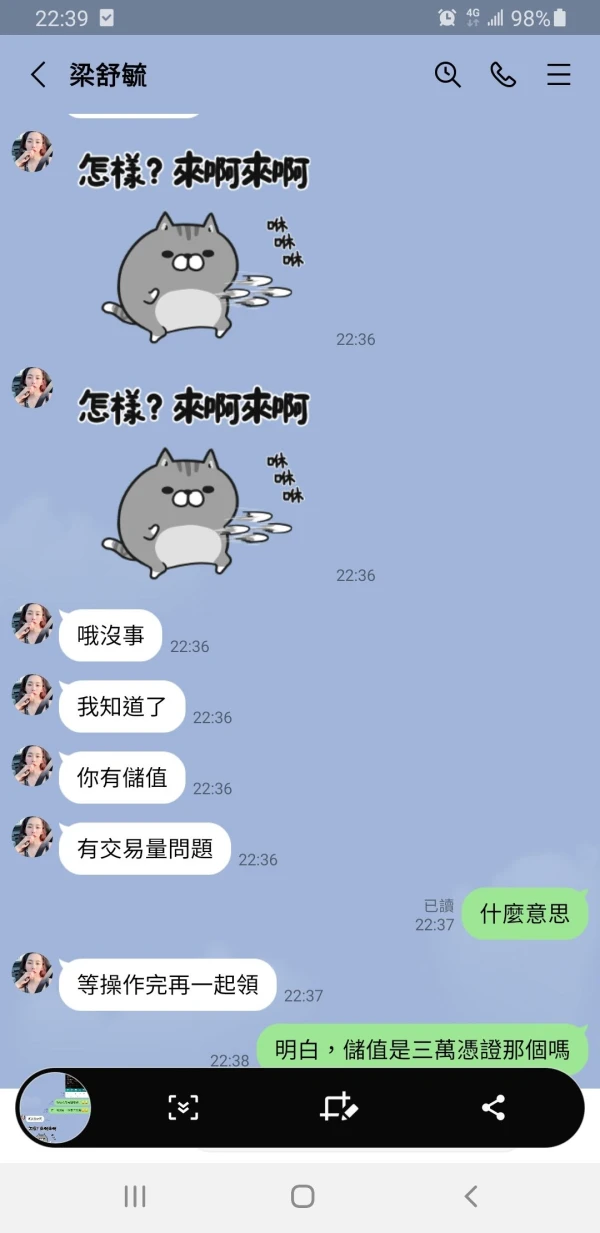

그들은 당신을 Facebook에 추가하고 대만에 있는 회사인 척했습니다. 그들은 그룹에서 채팅을하고 그들이 실제 회사라고 설득했습니다. 이 사기를 조심하십시오.

신고

健乐

튀니지

Point72는 풍부한 투자 경험과 강력한 전문 팀을 보유한 잘 알려진 헤지 펀드 관리 회사입니다. 그들의 웹 사이트는 최신 시장 뉴스, 데이터 및 연구 보고서를 포함하여 풍부한 투자 정보 및 리소스를 제공합니다. 또한 초보 투자자가 투자 지식과 기술을 더 잘 이해하고 마스터할 수 있도록 교육 리소스를 제공합니다. 결론적으로 Point72는 매우 신뢰할 수 있고 주목할만한 투자 기관입니다.

좋은 평가

陳王馬杰

홍콩

이 회사 웹사이트의 내용은 규제 정보가 전혀 없이 매우 빈약하며 여러 사람이 사기를 당하는 것을 보았습니다. 위험! 나에게 매력적일 수 있는 유일한 점은 그것이 15년 넘게 주변에 있었다는 것입니다. 그러나 그것은 보안에 비하면 아무것도 아닙니다.

좋은 평가

李惟

대만

누군가가 미국 Bohao 연구 회사의 이름으로 사람들을 속였습니다. 그들은 나에게 100000위안을 속였다.

신고

王兆雲

대만

1000달러를 입금했는데 2000달러가 되었을 때 출금하고 싶었습니다. 그러나 철수는 취소되었다. 웹사이트를 여러 번 변경했습니다. 조심해.

신고