Présentation de l'entreprise

| Fulbright Financial Group Résumé de l'examen | |

| Fondé | 1999 |

| Région Enregistrée | Hong Kong |

| Régulation | SFC |

| Instruments de Marché | Titres, Contrats à terme, Options (HK, US, Global) |

| Compte de Démo | ❌ |

| Plateformes de Trading | Fulbright App (Mobile), Fulbright Terminal (PC), Fulbright Web Platform, Fulbright Pro Terminal, Fulbright Speed Trader |

| Support Client | Téléphone : +852 3108 3333, 4001-200-899 (Continent) |

| Email : cis@fulbright.com.hk | |

| Wechat : hkfuchang | |

Informations sur Fulbright Financial Group

Fulbright Financial Group, fondé en 1999 et basé à Hong Kong, est une institution financière agréée réglementée par la Commission des valeurs mobilières et des contrats à terme de Hong Kong, seule sa société de trading de contrats à terme est actuellement autorisée. Elle propose des transactions de titres, de contrats à terme et d'options à Hong Kong, aux États-Unis et sur d'autres marchés mondiaux, ainsi que différentes plateformes de trading, cependant il n'y a pas de compte de démo ni de divulgation claire du dépôt minimum.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Réglementé par la SFC de Hong Kong | Pas de comptes de démo disponibles |

| Offre un accès multi-marchés | Dépôt minimum non clairement divulgué |

| Plusieurs plateformes de trading | Informations limitées sur les types de comptes |

Fulbright Financial Group est-il Légitime ?

Oui, Fulbright Financial Group est une organisation agréée. Cependant, seule Fulbright Futures Limited détient actuellement une licence active (réglementée) pour le trading de contrats à terme de la SFC de Hong Kong. Les licences des deux autres entités ont expiré, elles ne sont donc plus valides.

| Entité Agréée | Type de Licence | Numéro de Licence | Date d'Effet | Statut Actuel | Réglementé par |

| Fulbright Futures Limited | Transactions de contrats à terme | AME963 | 2005/12/5 | Réglementé | SFC Hong Kong |

| Fulbright Securities Limited | Transactions de titres | AFB820 | 2004/11/30 | Expirée | SFC Hong Kong |

| Fulbright Asset Management Limited | Gestion d'actifs | AYQ254 | 2012/3/22 | Expirée | SFC Hong Kong |

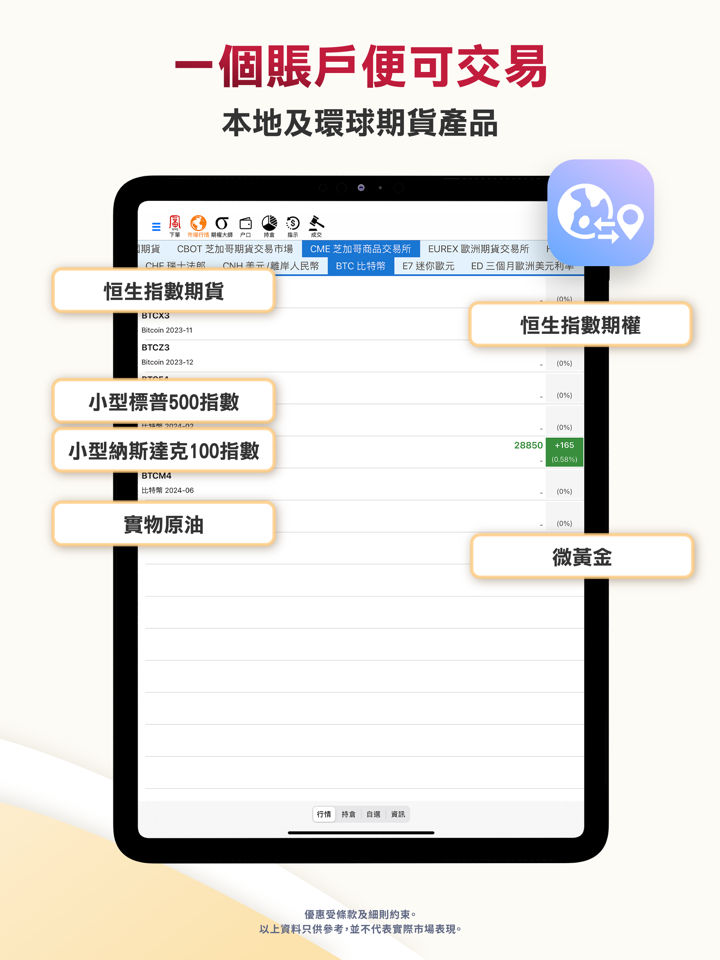

Que Puis-je Trader sur Fulbright Financial Group ?

Fulbright Financial Group propose une large gamme de services financiers, y compris le trading de titres, de contrats à terme et d'options à Hong Kong et dans le monde entier.

| Instruments de trading | Pris en charge |

| Titres | ✔ |

| Contrats à terme | ✔ |

| Options | ✔ |

| Forex | ❌ |

| Matières premières | ❌ |

| Indices | ❌ |

| Actions | ❌ |

| Cryptomonnaies | ❌ |

| Obligations | ❌ |

| ETFs | ❌ |

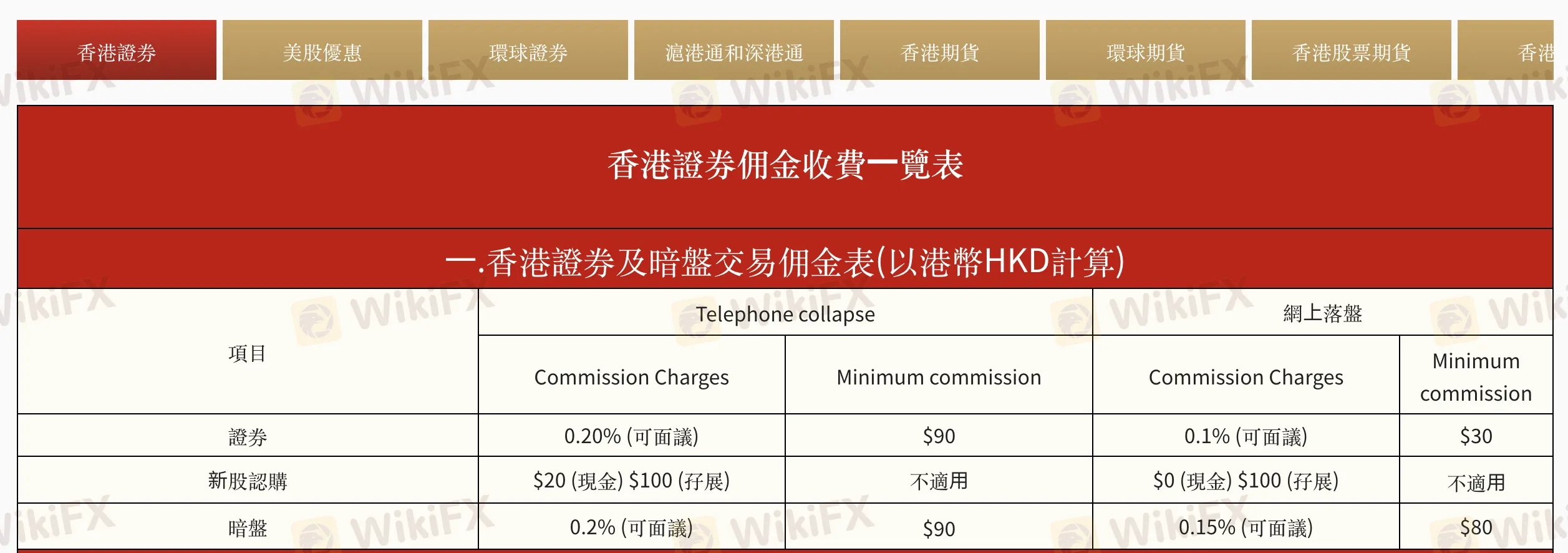

Frais de Fulbright Financial Group

Fulbright Financial Group facture des coûts légèrement inférieurs à la norme de l'industrie, notamment pour le trading en ligne. Certains frais, tels que les frais de traitement et les intérêts de financement, varient en fonction du profil du client et sont négociables, comme c'est la pratique commerciale courante.

| Catégorie | Service/Article | Frais (HKD) | Remarques |

| Commissions de Trading | Valeurs Mobilières de Hong Kong (Téléphone) | 0,20% (min 90 $) | Négociable |

| Valeurs Mobilières de Hong Kong (En ligne) | 0,10% (min 30 $) | Négociable | |

| Souscription à une IPO (Espèces/Marge) | 20 $ / 100 $ | En ligne en espèces : Gratuit | |

| Marché Gris (Téléphone/En ligne) | 0,20% / 0,15% (min 90 $ / 80 $) | ||

| Frais Réglementaires | Droit de Timbre | 0,10% | Min 1 $ |

| Prélèvement sur les Transactions de la SFC | 0,00% | ||

| Frais de Bourse (HKEx) | 0,01% | ||

| Frais de Compensation (HKSCC) | 0,005% (min 5 $, max 200 $) | ||

| Prélèvement sur les Transactions de la FRC | 0,00% | ||

| Intérêts | Compte sur Marge / Intérêt Compte Espèces | P+1,8% ou ~7,05% | Basé sur le Taux Privilégié de la HSBC |

| Services de Garde et d'Agent | Transfert d'Actions (SI/ISI) | Gratuit (dépôt), 5 $/lot (retrait, min 500 $) | Frais HKSCC applicables |

| Retrait d'Actions (Physique) | 5 $/lot | Incl. frais HKSCC de 3,5 $ | |

| Collecte de Dividendes | 0,5% (min 20 $, max 10 000 $) | Incl. frais HKSCC de 0,12% | |

| Actions Bonus / Souscription de Droits | Gratuit / 100 $ + 0,80 $/lot | Max 10 000 $ | |

| Gestion d'IPO (Espèces/Marge) | 20 $ / 100 $ | ||

| Autres Frais | Réédition / Envoi Mensuel de Relevé | 50 $/mois chacun | Frais d'envoi en vigueur depuis Sep 2023 |

| Demande de l'Article 329 de la SFO | 4 000 $ par cas |

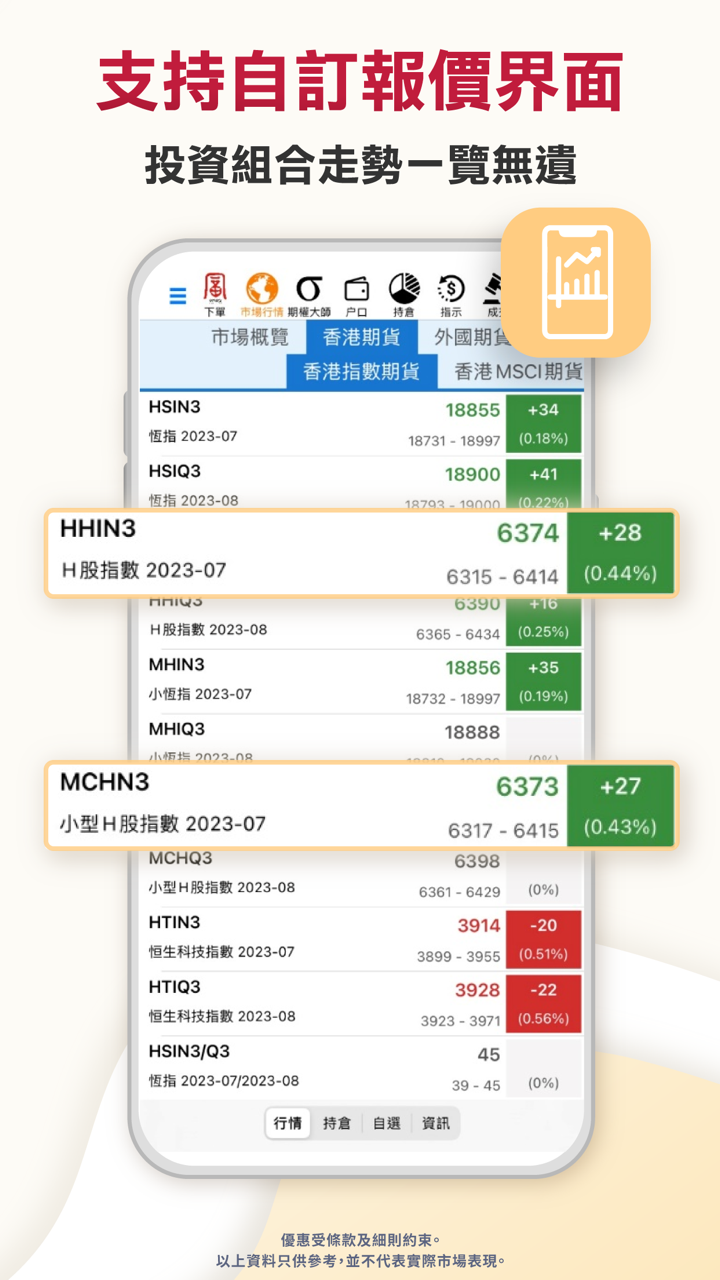

Plateforme de Trading

| Nom de la Plateforme | Pris en Charge | Appareils Disponibles | Convient à |

| Application Fulbright (Mobile) | ✔ | Mobile | Traders Débutants à Intermédiaires |

| Terminal Fulbright (PC) | ✔ | PC | Traders Intermédiaires |

| Plateforme Web Fulbright | ✔ | Navigateur Web | Traders Intermédiaires |

| Terminal Pro Fulbright | ✔ | Téléchargement sur Bureau | Traders Professionnels |

| Trader Rapide Fulbright | ✔ | Téléchargement sur Bureau | Traders Haute Fréquence de HK |

Dépôt et Retrait

Fulbright Financial Group ne facture aucun frais pour les dépôts ou les retraits, bien que les banques puissent appliquer des frais en fonction de la méthode utilisée. Aucun montant de dépôt minimum n'est mentionné.

Options de dépôt

| Méthode de dépôt | Frais de dépôt | Délai de dépôt |

| Dépôt rapide eDDA | ❌ | Instantané |

| FPS (Système de paiement plus rapide) | ~2 heures (9h00 – 17h00 les jours ouvrables)* | |

| Virement bancaire en ligne | 1 à 3 jours ouvrables | |

| Chèque ou mandat de caissier | 2 jours ouvrables et plus |

Options de retrait

| Méthode de retrait | Frais de retrait | Délai de retrait |

| Virement bancaire | ❌ | Traitée le jour même si soumise entre 9h00 et 13h00; sinon le jour ouvrable suivant |

| Chèque | Émis le jour même s'il est soumis pendant les heures de traitement |