Perfil de la compañía

| Point72 Resumen de la reseña | |

| Registrado | 2010 |

| País/Región de registro | Estados Unidos |

| Regulación | SFC |

| Inversiones | Acciones, inversiones macro globales, inversiones sistemáticas, capital de riesgo |

| Plataforma de trading | / |

| Depósito mínimo | / |

| Soporte al cliente | LinkadIn, Twitter, Facebook, Instagram, YouTube, Glassdoor |

Información de Point72

Point72 es una firma de inversión alternativa global fundada por Steven A. Cohen. Emplea estrategias de inversión discrecional de renta variable larga/corta, sistemáticas y macro, complementadas con una cartera de mercado privado en crecimiento. Las estrategias de inversión ofrecidas incluyen Renta Variable Larga/Corta Discrecional, Inversión Sistemática, Macro Global, y Capital de Riesgo e Inversiones Privadas.

Pros y contras

| Pros | Contras |

| Regulado por SFC | No hay información disponible sobre tarifas |

| No hay canal de contacto directo |

¿Es Point72 legítimo?

Point72 es una firma de inversión global legítima y cumplidora, reguladapor la Comisión de Valores y Futuros de Hong Kong (SFC) bajo el número de licencia AOB349, y sujeta a una estricta regulación. Sin embargo, solo atiende a inversores profesionales que cumplen con los requisitos regulatorios.

¿Qué puedo negociar en Point72?

Los servicios de estrategia de inversión de Point72 incluyen inversiones de renta variable larga/corta. Las inversiones macro globales abarcan renta fija, divisas, crédito líquido, materias primas, derivados, etc. Además, Cubist Systematic Strategies ofrece inversiones sistemáticas, y Point72 Ventures ofrece capital de riesgo y crecimiento de capital.

| Estrategias de inversión | Soportadas |

| Inversiones de renta variable larga/corta | ✔ |

| Inversiones macro globales | ✔ |

| Inversiones sistemáticas | ✔ |

| Capital de riesgo y crecimiento de capital | ✔ |

FX1123820651

Perú

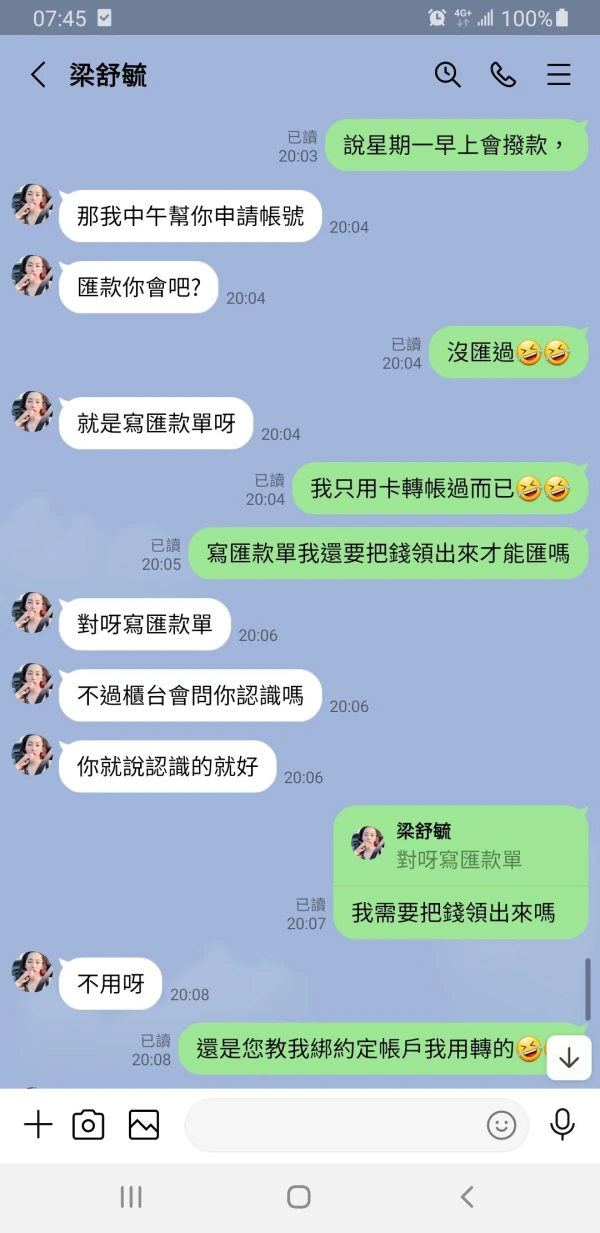

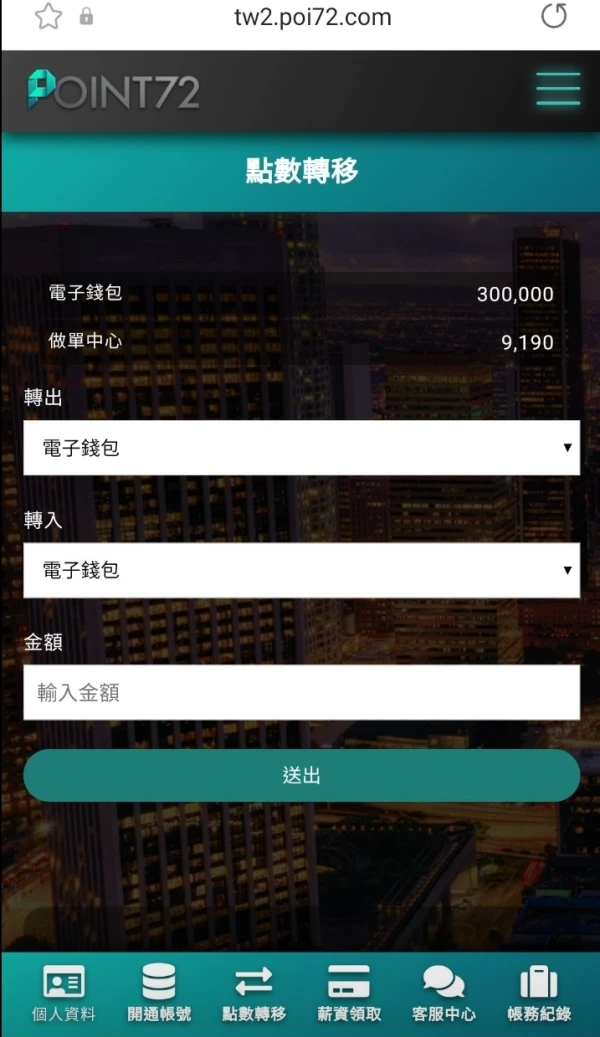

Esta supuesta empresa, llamada POINT 72, opera a través de la plataforma GDCK. Operan fraudulentamente de la siguiente manera: Te dan un bono mínimo de 10 USD para enseñarte a operar, como manipulan la plataforma te hacen ganar enviando señales de ingreso y cierre en criptomonedas siguiendo sus indicaciones. Como te hacen ganar te inducen a aumentar el capital (la asesora o gerente Anna Bansley es la que te acosa con mensajes para incrementar el capital, a propósito ésta persona maneja muchos numero telefónicos, que adjuntaré como prueba), el capital que inviertes sube muy rápidamente, pero cuando ya tienes un elevado capital, aún siguiendo sus indicaciones en cuestión de segundos pierdes todo tu dinero. Me sacaron del grupo donde emiten sus señales por hacer público su modus operandi y me han bloqueado de todos sus números registrados. El capital invertido es alrededor de 15000 USD entre mayo y agosto del presente año 2025. Adjunto uno de los tantos depósitos realizados.

Exposición

FX3845532432

Perú

El broker Point72 a través de la plataforma GDCK pro, no permite transferir criptomonedas a Binance.

Exposición

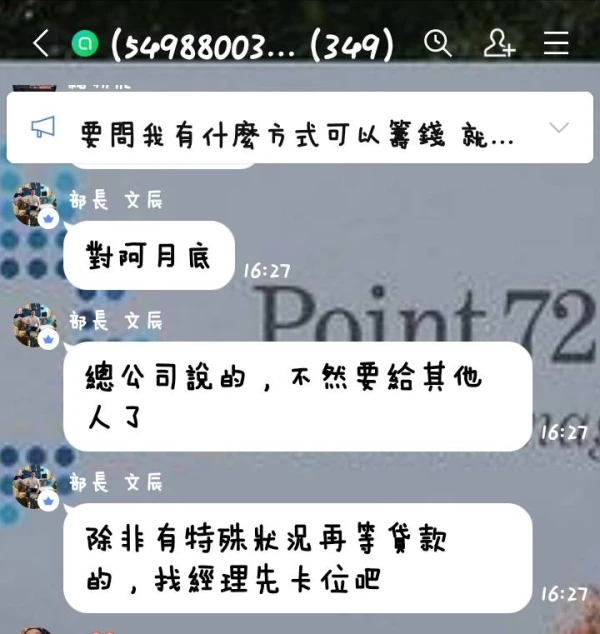

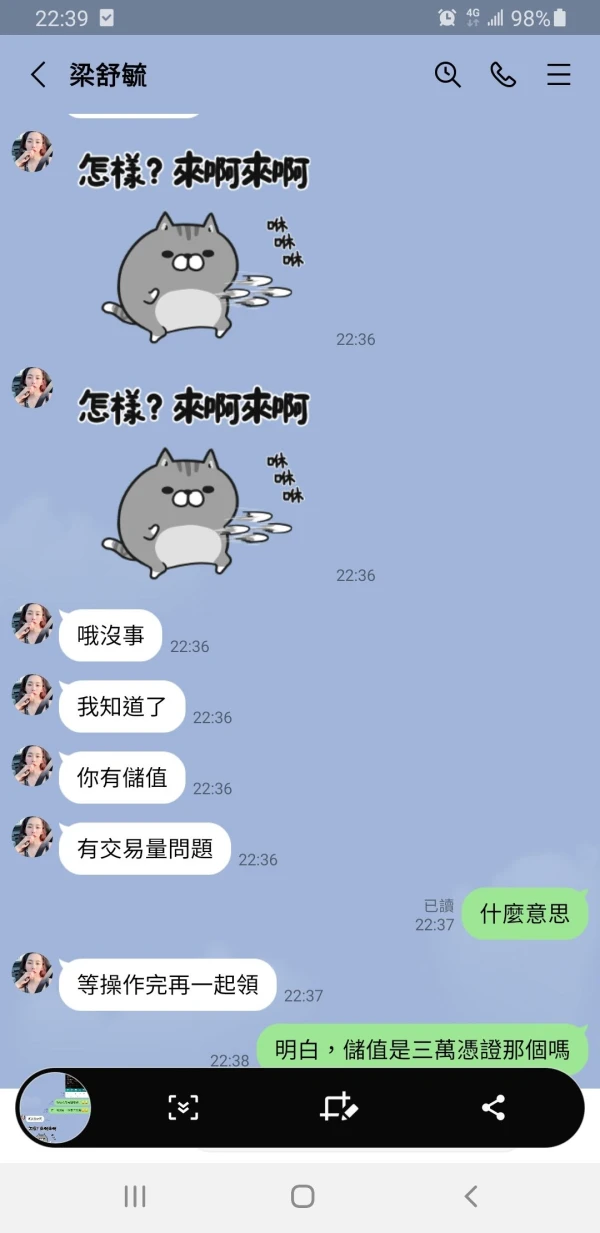

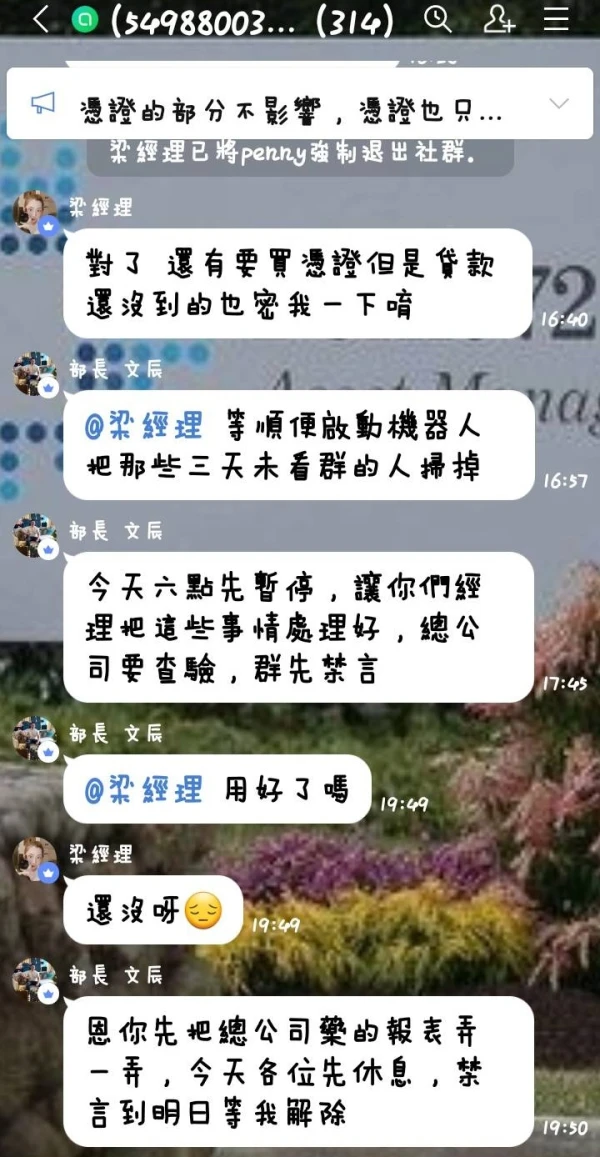

王兆雲

Taiwán

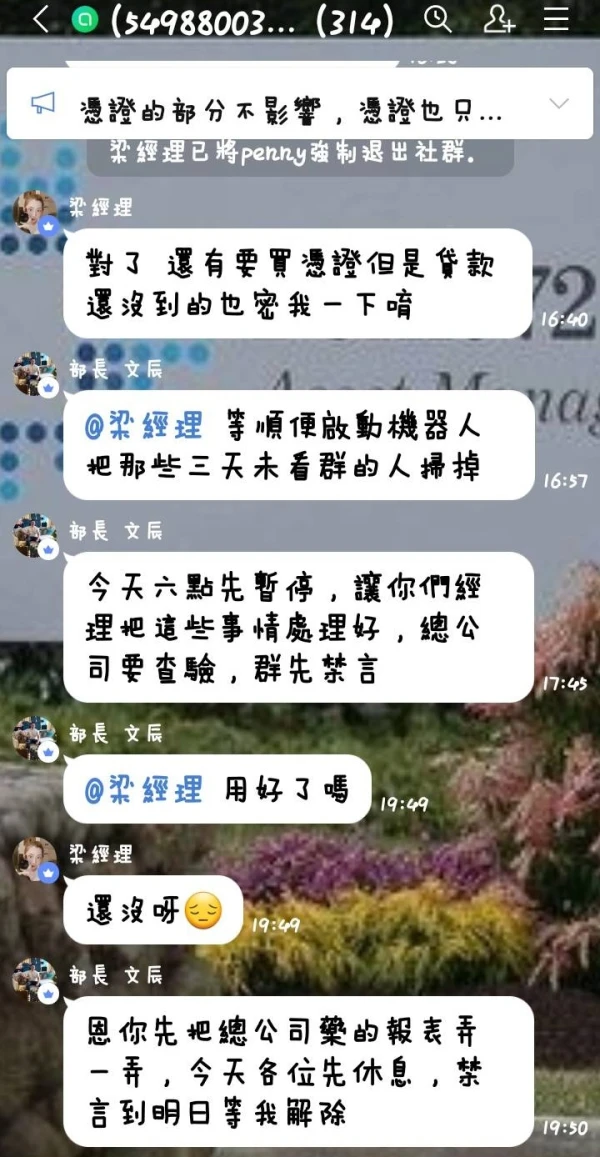

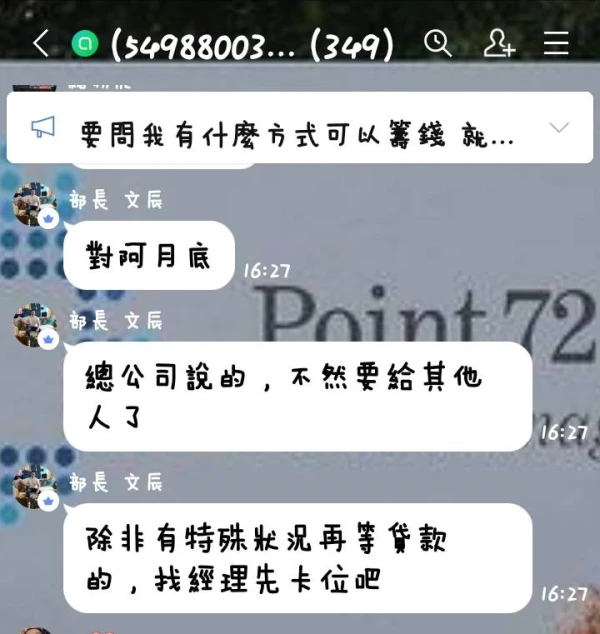

Te agregaron a Facebook y fingieron ser una empresa en Taiwán. Charlaron en el grupo y te convencieron de que eran una verdadera compañía. Tenga cuidado con esta estafa.

Exposición

健乐

Túnez

Point72 es una conocida empresa de gestión de fondos de cobertura con una gran experiencia en inversiones y un sólido equipo profesional. Su sitio web proporciona una gran cantidad de información y recursos de inversión, incluidas las últimas noticias de mercado, datos e informes de investigación. Además, brindan algunos recursos educativos para ayudar a los inversionistas novatos a comprender y dominar mejor los conocimientos y habilidades de inversión. En conclusión, Point72 es una institución de inversión muy confiable y notable.

Positivo

陳王馬杰

Hong Kong

El contenido del sitio web de esta empresa es bastante escaso, sin ninguna información reglamentaria, y he visto que varias personas han sido estafadas. ¡Peligro! Lo único que podría atraerme es que existe desde hace más de 15 años, pero eso no es nada comparado con la seguridad.

Positivo

李惟

Taiwán

Alguien engañó a la gente en nombre de la empresa de investigación estadounidense Bohao. Me estafaron 100000 yuanes.

Exposición

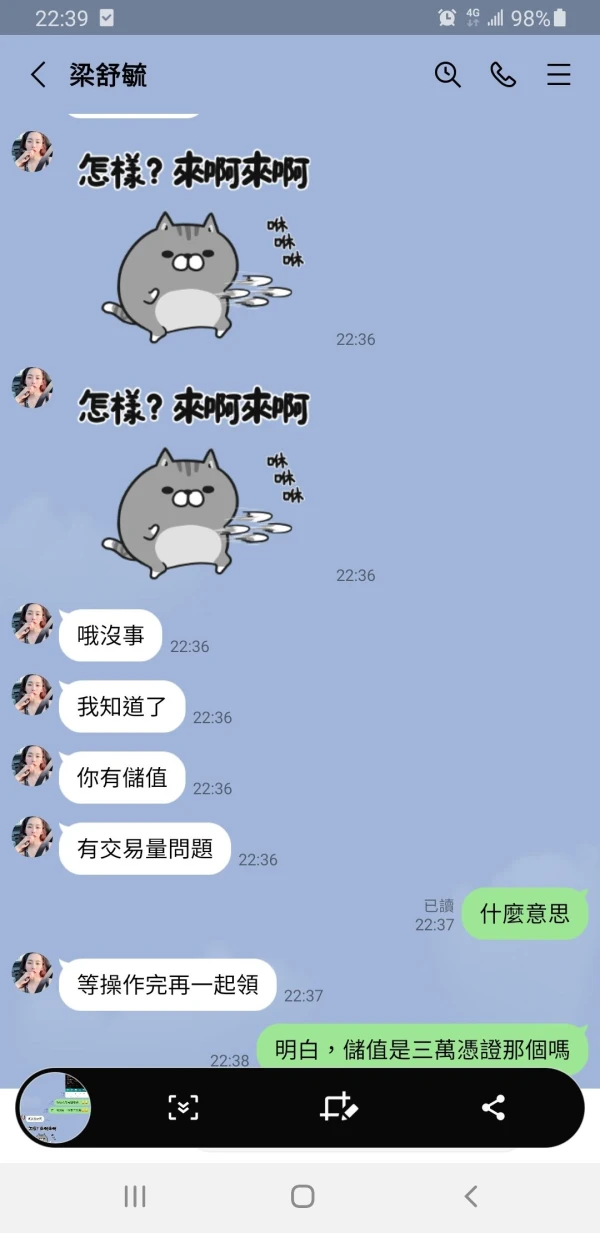

王兆雲

Taiwán

Deposité $ 1000 y quise retirar cuando aumentó a $ 2000. Pero el retiro fue cancelado. Cambió de sitio web varias veces. Tener cuidado.

Exposición