Présentation de l'entreprise

| RGL Résumé de l'examen | |

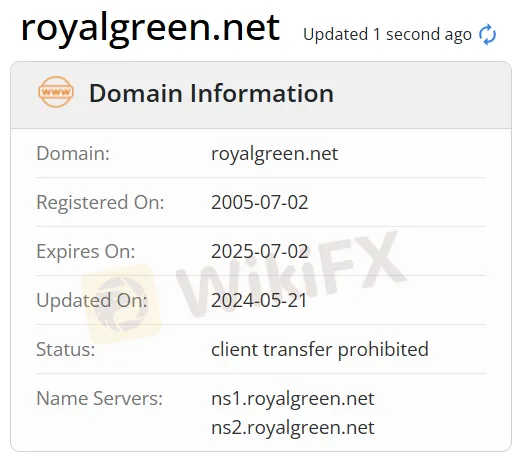

| Fondé | 2005 |

| Pays/Région enregistré | Bangladesh |

| Régulation | Pas de régulation |

| Services | Cloud privé, Cloud public, Serveur privé virtuel, IaaS, PaaS, SaaS, Pare-feu en tant que service, Routeur en tant que service, Protection DDoS en tant que service (Solution F5), Sauvegarde en tant que service, Récupération après sinistre en tant que service, Équilibrage de charge en tant que service, Élastique, Calcul en tant que service, Serveur dédié en tant que service, Sécurité des données intégrée, Chiffrement des données, Conteneurs en tant que service, WAF en tant que service- WAP (Solution F5), Connectivité Internet dédiée, Connectivité de données nationale, Solutions de téléphonie IP et IPPBX, Services informatiques gérés, Services et solutions cloud, Enregistrement de domaine et hébergement web, Services et solutions de messagerie, Solutions logicielles |

| Plateforme de trading | bKash |

| Support client | Support 24/7, formulaire de contact |

| Tél : +880 9603-111999; +88-09603-777777 | |

| Email : sales@royalgreen.net; support@pacecloud.com | |

| Adresse : Royal Green Ltd, 114 Motijheel C/A, Niveau-9,11,12,17,18, Dhaka-1000 | |

| Réseaux sociaux : Facebook, X, YouTube, LinkedIn | |

Informations sur RGL

RGL est un fournisseur de services Internet non réglementé, fondé au Bangladesh en 2005. Il propose des produits et services pour le Cloud privé, le Cloud public, le Serveur privé virtuel, l'Infrastructure en tant que service (IaaS), la Plateforme en tant que service (PaaS), le Logiciel en tant que service (SaaS), le Pare-feu en tant que service, le Routeur en tant que service, la Protection DDoS en tant que service (Solution F5), la Sauvegarde en tant que service, la Récupération après sinistre en tant que service, l'Équilibrage de charge en tant que service, l'Élasticité, le Calcul en tant que service, le Serveur dédié en tant que service, la Sécurité des données intégrée, le Chiffrement des données, les Conteneurs en tant que service, le WAF en tant que service- WAP (Solution F5), la Connectivité Internet dédiée, la Connectivité de données nationale, les Solutions de téléphonie IP et IPPBX, les Services informatiques gérés, les Services et solutions cloud, l'Enregistrement de domaine et l'hébergement web, les Services et solutions de messagerie, les Solutions logicielles.

Avantages et inconvénients

| Avantages | Inconvénients |

| Temps d'opération prolongé | Site web inaccessible (partiel) |

| Divers canaux de contact | Manque de régulation |

| Divers services | Manque de transparence |

| Options de paiement diverses | Frais facturés |

RGL est-il légitime ?

No. RGL actuellement n'a aucune réglementation valide. Veuillez être conscient du risque !

Services de RGL

| Services | Pris en charge |

| Cloud privé, public | ✔ |

| Serveur virtuel privé | ✔ |

| Infrastructure en tant que service (IaaS) | ✔ |

| Plateforme en tant que service (PaaS) | ✔ |

| Logiciel en tant que service (SaaS) | ✔ |

| Firewall en tant que service | ✔ |

| Routeur en tant que service | ✔ |

| Protection contre les attaques DDoS en tant que service (Solution F5) | ✔ |

| Sauvegarde en tant que service | ✔ |

| Récupération après sinistre en tant que service | ✔ |

| Équilibrage de charge en tant que service | ✔ |

| Élastique | ✔ |

| Calcul en tant que service | ✔ |

| Serveur dédié en tant que service | ✔ |

| Sécurité des données - Intégrée | ✔ |

| Chiffrement des données | ✔ |

| Conteneurs en tant que service | ✔ |

| WAF en tant que service - WAP (Solution F5) | ✔ |

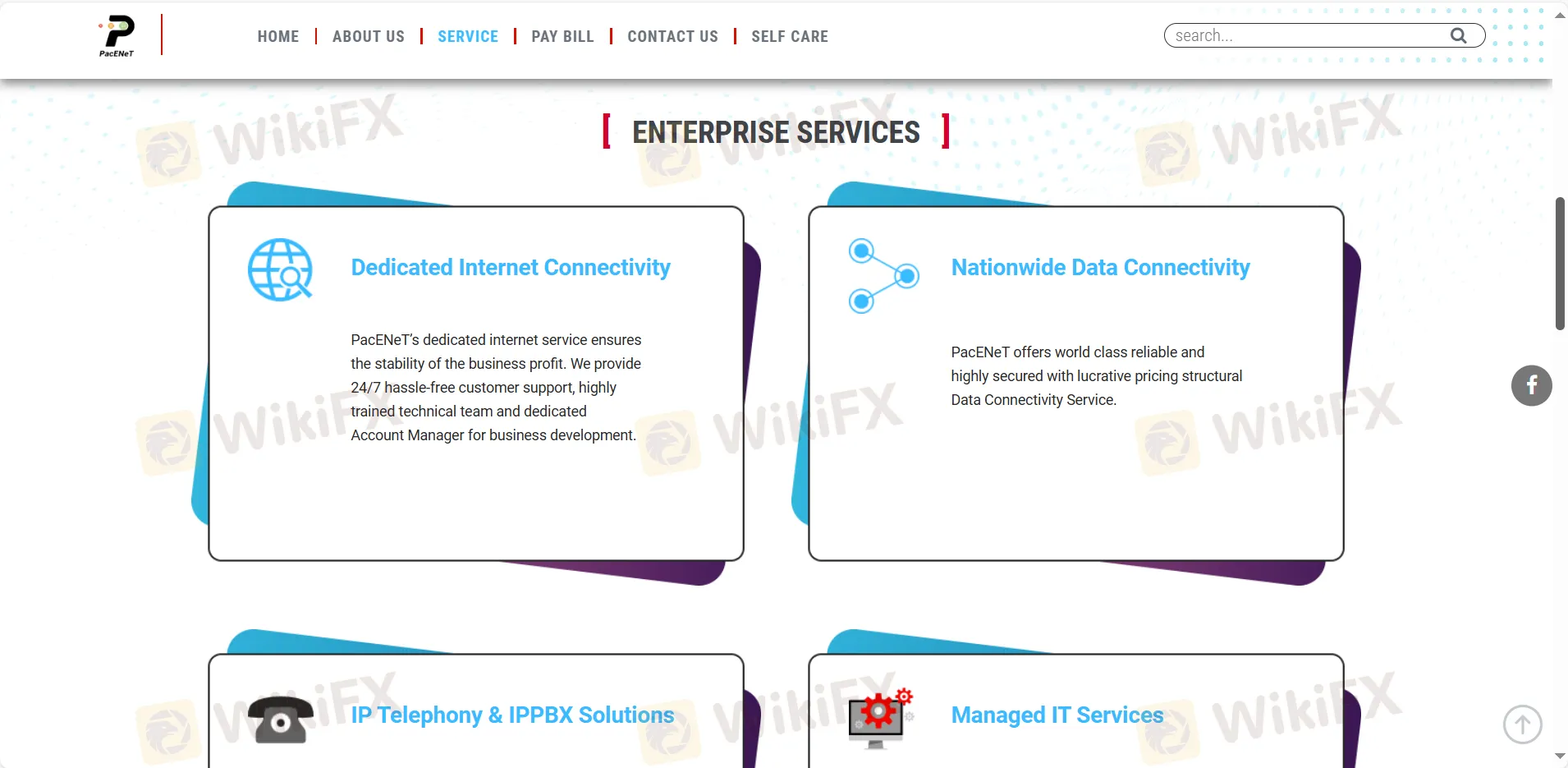

| Connectivité Internet dédiée | ✔ |

| Connectivité de données nationale | ✔ |

| Téléphonie IP et solutions IPPBX | ✔ |

| Services informatiques gérés | ✔ |

| Services et solutions cloud | ✔ |

| Enregistrement de domaine et hébergement web | ✔ |

| Service et solutions de messagerie | ✔ |

| Solutions logicielles | ✔ |

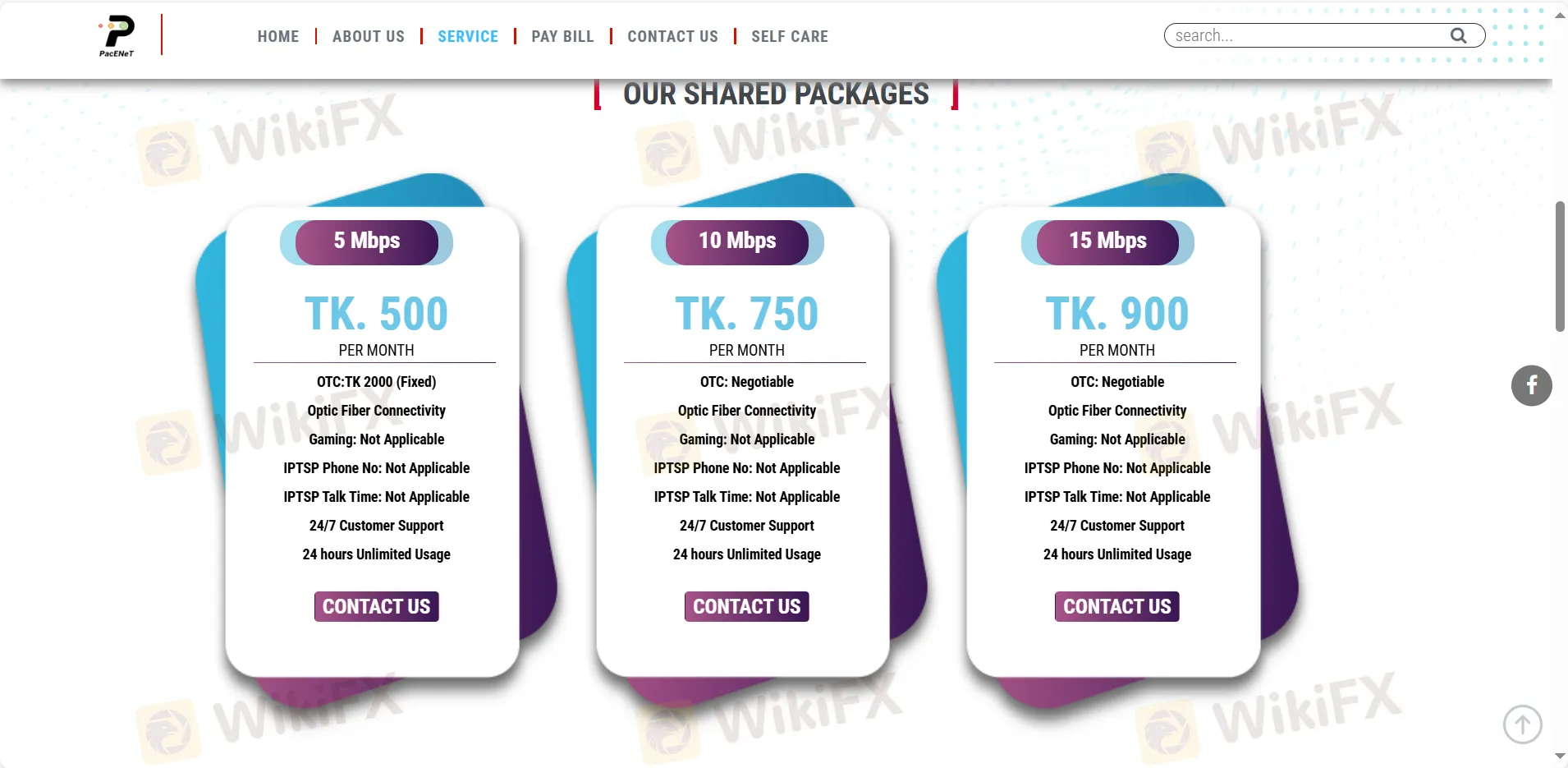

Frais de RGL

| Type | Frais |

| 5 Mbps | TK. 500 par mois |

| 10 Mbps | TK. 750 par mois |

| 15 Mbps | TK. 900 par mois |

| 20 Mbps | TK. 1050 par mois |

| 30 Mbps | TK. 1550 par mois |

| 40 Mbps | TK. 1950 par mois |

| 50 Mbps | TK. 2450 par mois |

| 75 Mbps | TK. 3400 par mois |

| 100 Mbps | TK. 4500 par mois |

Plateforme de trading

| Plateforme de trading | Pris en charge | Appareils disponibles |

| Application bKash | ✔ | Mobile |

Dépôt et retrait

Le fournisseur de services Internet accepte les paiements effectués via Master, Visa, UnionPay et autres. Aucun montant minimum de retrait défini et aucun frais spécifié.