Unternehmensprofil

| Point72 Überprüfungszusammenfassung | |

| Registriert | 2010 |

| Registriertes Land/Region | Vereinigte Staaten |

| Regulierung | SFC |

| Investitionen | Aktien, globale Makroinvestitionen, systematische Investitionen, Risikokapital |

| Handelsplattform | / |

| Mindesteinzahlung | / |

| Kundenbetreuung | LinkadIn, Twitter, Facebook, Instagram, YouTube, Glassdoor |

Point72 Informationen

Point72 ist eine globale alternative Investmentfirma, die von Steven A. Cohen gegründet wurde. Sie setzt auf diskretionäre Long/Short-Aktien-, systematische und makroökonomische Anlagestrategien, ergänzt durch ein wachsendes Portfolio im privaten Markt. Die angebotenen Anlagestrategien umfassen diskretionäre Long/Short-Aktien, systematische Investitionen, globale Makroinvestitionen sowie Risikokapital- und Private-Investitionen.

Vor- und Nachteile

| Vorteile | Nachteile |

| Reguliert durch SFC | Keine Gebühreninformationen verfügbar |

| Kein direkter Kontaktkanal |

Ist Point72 legitim?

Point72 ist eine legitime und konforme globale Investmentfirma, reguliert durch die Securities and Futures Commission von Hongkong (SFC) unter der Lizenznummer AOB349 und unterliegt strengen Vorschriften. Sie bedient jedoch nur professionelle Anleger, die die regulatorischen Anforderungen erfüllen.

Was kann ich bei Point72 handeln?

Die Anlagestrategiedienste von Point72 umfassen Long/Short-Aktieninvestitionen. Globale Makroinvestitionen umfassen Festverzinsliche, Devisen, Liquiditätskredite, Rohstoffe, Derivate usw. Darüber hinaus bietet Cubist Systematic Strategies systematische Investitionen, und Point72 Ventures bietet Risikokapital und Wachstumskapital.

| Anlagestrategien | Unterstützt |

| Long/Short-Aktieninvestitionen | ✔ |

| Globale Makroinvestitionen | ✔ |

| Systematische Investitionen | ✔ |

| Risikokapital und Wachstumskapital | ✔ |

FX1123820651

Peru

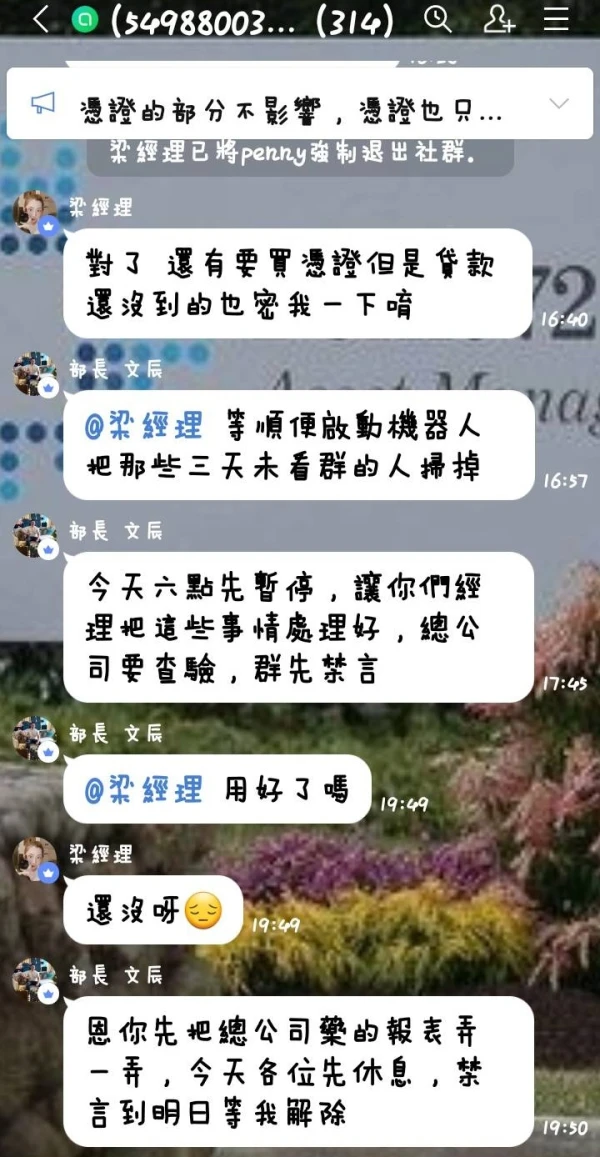

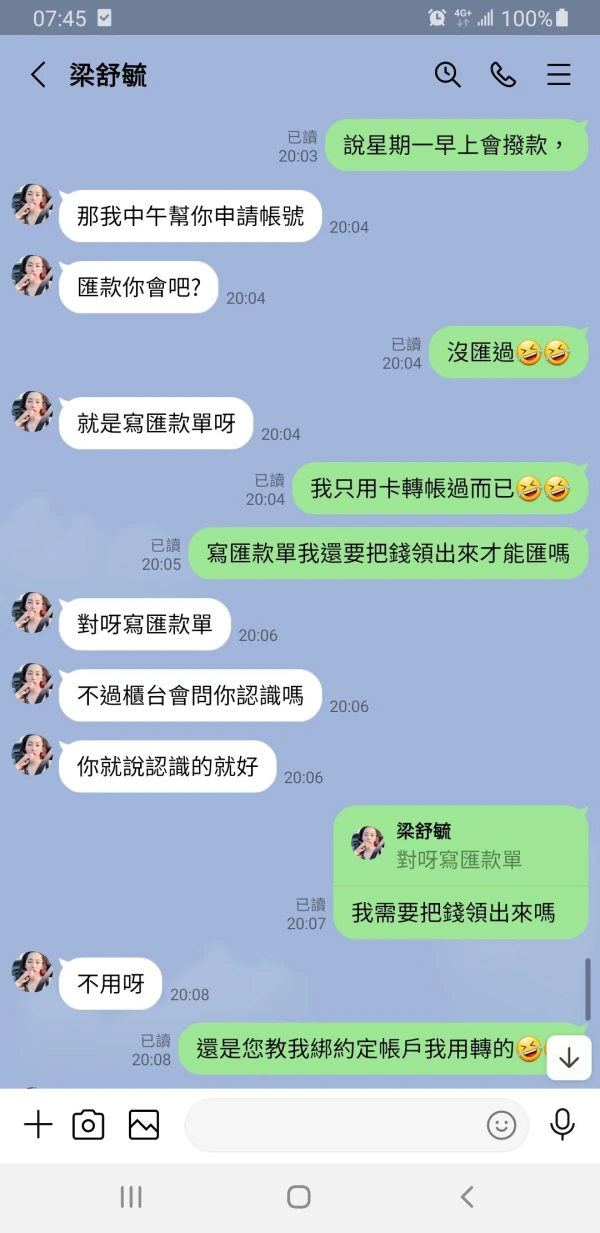

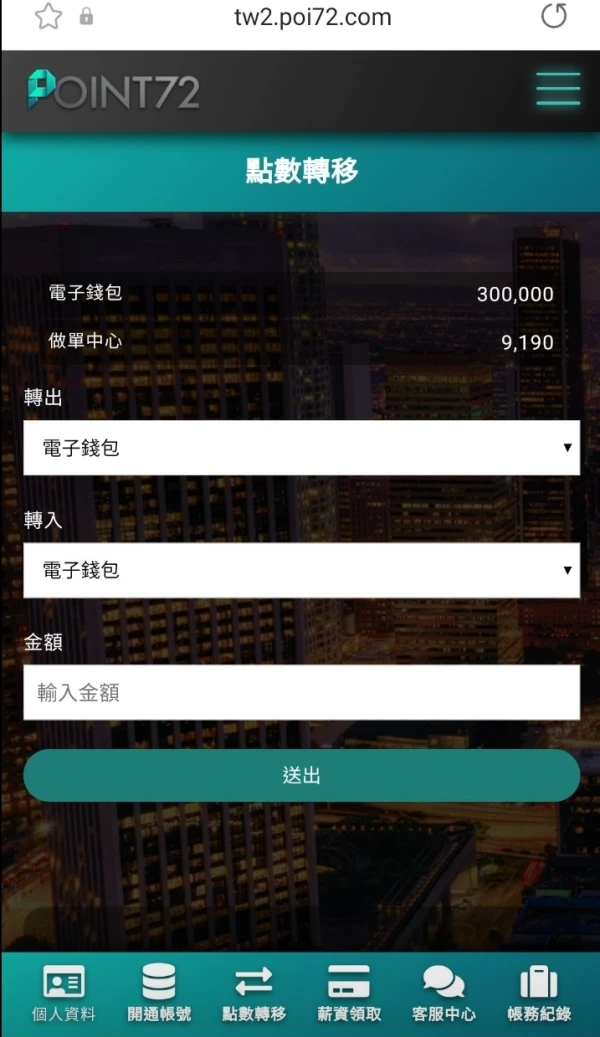

Die sogenannte Firma POINT 72, die über die GDCK-Plattform operiert, betrügt wie folgt: Sie geben Ihnen einen Mindestbonus von 10 $, um Ihnen das Handeln beizubringen. Da sie die Plattform manipulieren, lassen sie Sie gewinnen, indem sie Ein- und Ausstiegssignale für Kryptowährungen senden, denen Sie folgen sollen. Während sie Ihnen Gewinne bescheren, verleiten sie Sie dann dazu, Ihr Kapital zu erhöhen. Die Beraterin oder Managerin, Anna Bansley, ist diejenige, die mich mit Nachrichten belästigte, mehr Geld einzuzahlen. Es ist erwähnenswert, dass diese Person viele verschiedene Telefonnummern verwendet, die ich als Beweis anhängen werde. Das von Ihnen investierte Kapital scheint sehr schnell zu wachsen. Sobald Sie jedoch einen beträchtlichen Betrag investiert haben, verlieren Sie selbst bei Befolgung ihrer Anweisungen innerhalb von Sekunden Ihr gesamtes Geld. Ich wurde entfernt. aus der Gruppe, in der sie Signale zur Aufdeckung ihrer Vorgehensweise ausgesendet haben und von allen ihren registrierten Nummern gesperrt wurden. Das insgesamt investierte Kapital belief sich zwischen Mai und August dieses Jahres (2025) auf etwa 15.000 US-Dollar. Ich füge einen der vielen Einzahlungsbelege als Nachweis bei.

Exposition

FX3845532432

Peru

Der Broker Point72 erlaubt über die GDCK Pro-Plattform keine Überweisungen von Kryptowährungen an Binance.

Exposition

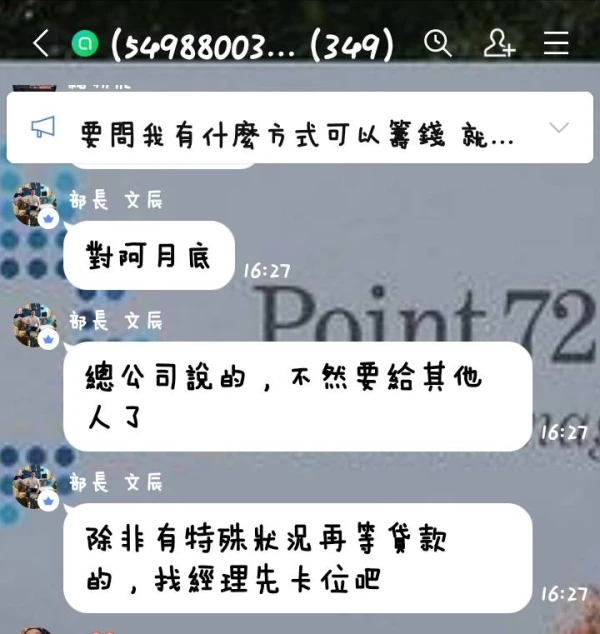

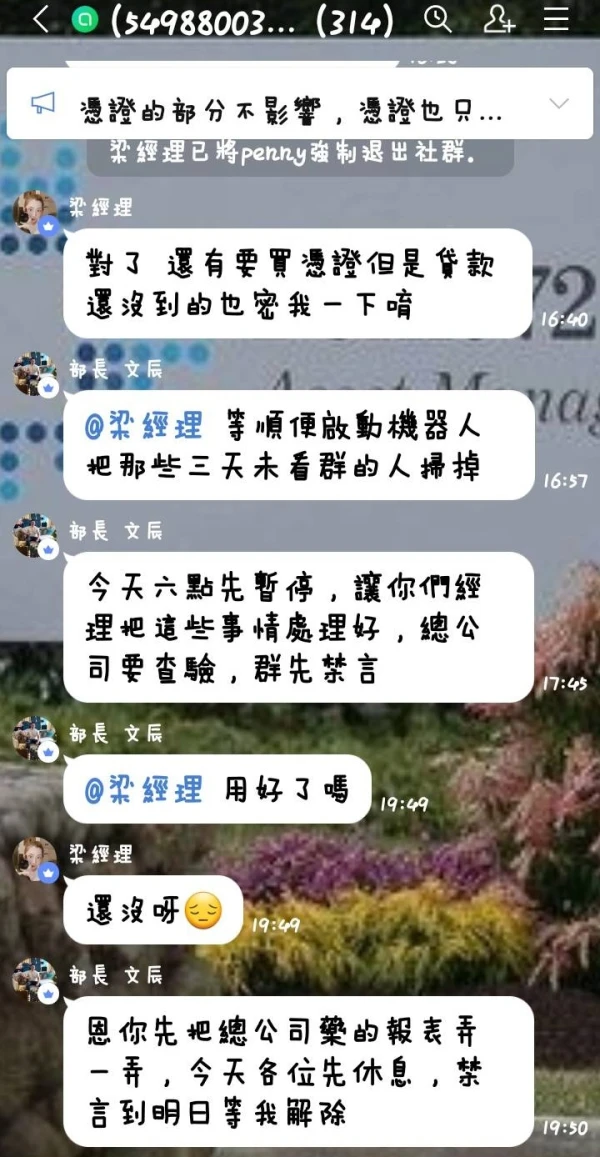

王兆雲

Taiwan

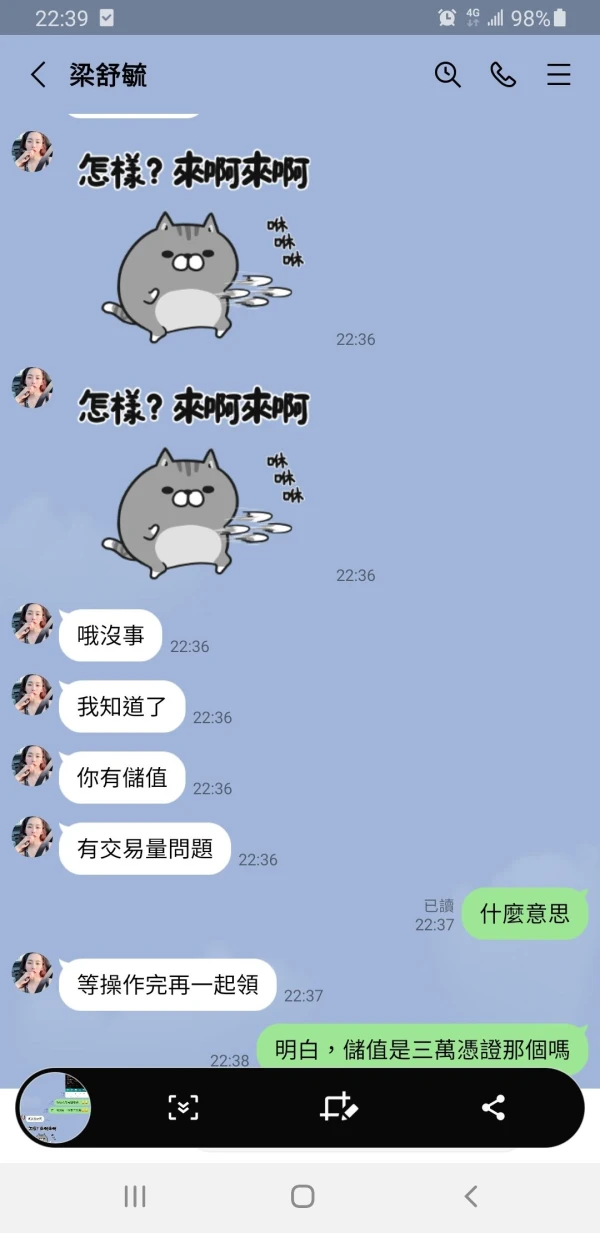

Sie haben Sie auf Facebook hinzugefügt und sich als Unternehmen in Taiwan ausgegeben. Sie plauderten in der Gruppe und überzeugten Sie, dass sie echte Gesellschaft waren. Hüten Sie sich vor diesem Betrug.

Exposition

健乐

Tunesien

Point72 ist eine bekannte Hedgefonds-Verwaltungsgesellschaft mit umfassender Anlageerfahrung und einem starken professionellen Team. Ihre Website bietet eine Fülle von Anlageinformationen und Ressourcen, einschließlich der neuesten Marktnachrichten, Daten und Forschungsberichte. Darüber hinaus bieten sie einige Bildungsressourcen, um Anfängern dabei zu helfen, Anlagekenntnisse und -fähigkeiten besser zu verstehen und zu beherrschen. Zusammenfassend ist Point72 eine sehr vertrauenswürdige und bemerkenswerte Investmentinstitution.

Positive

陳王馬杰

Hongkong

Der Inhalt der Website dieses Unternehmens ist ziemlich dünn, ohne regulatorische Informationen, und ich habe gesehen, dass mehrere Leute betrogen wurden. Achtung! Das einzige, was mich ansprechen könnte, ist, dass es seit über 15 Jahren existiert, aber das ist nichts im Vergleich zu Sicherheit.

Positive

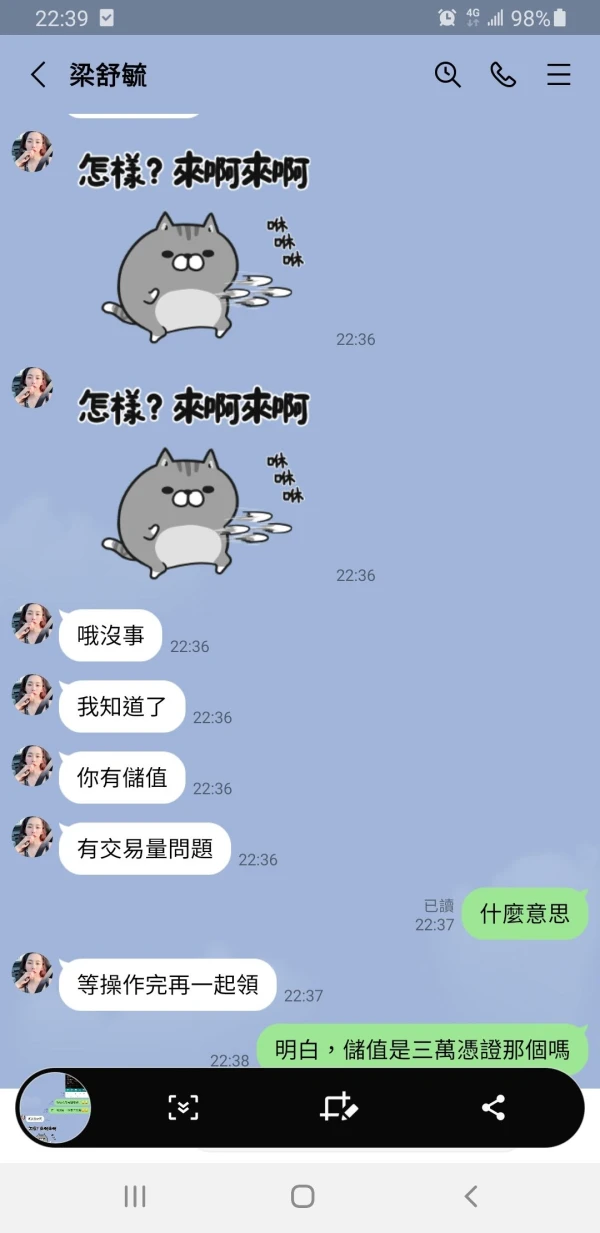

李惟

Taiwan

Jemand hat Leute im Namen des amerikanischen Bohao-Forschungsunternehmens betrogen. Sie haben mich mit 100.000 Yuan betrogen.

Exposition

王兆雲

Taiwan

Ich habe 1000 $ eingezahlt und wollte abheben, als es auf 2000 $ anstieg. Aber die Auszahlung wurde storniert. Es hat die Website mehrmals geändert. In acht nehmen.

Exposition