Buod ng kumpanya

| Point72 Buod ng Pagsusuri | |

| Rehistrado | 2010 |

| Rehistradong Bansa/Rehiyon | Estados Unidos |

| Regulasyon | SFC |

| Investments | Equities, global macro investments, systematic investments, venture capital |

| Plataforma ng Pagtitingi | / |

| Minimum na Deposito | / |

| Suporta sa Customer | LinkadIn, Twitter, Facebook, Instagram, YouTube, Glassdoor |

Impormasyon Tungkol sa Point72

Ang Point72 ay isang pandaigdigang kumpanya ng alternatibong pamumuhunan na itinatag ni Steven A. Cohen. Ito ay gumagamit ng discretionary long/short equity, systematic, at macro investment strategies, na pinapalakipan ng lumalaking pribadong portfolio sa merkado. Ang mga alok na pamamaraan ng pamumuhunan ay kinabibilangan ng Discretionary Long/Short Equity, Systematic Investing, Global Macro, at Venture Capital & Private Investments.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Regulated by SFC | Walang impormasyon tungkol sa bayad na magagamit |

| Walang direktang paraan ng pakikipag-ugnayan |

Tunay ba ang Point72?

Ang Point72 ay isang lehitimo at sumusunod sa batas na pandaigdigang kumpanya ng pamumuhunan, na reguladong Securities and Futures Commission ng Hong Kong (SFC) sa ilalim ng lisensyang numero AOB349, at sumasailalim sa mahigpit na regulasyon. Gayunpaman, ito ay naglilingkod lamang sa propesyonal na mga mamumuhunan na sumusunod sa mga kinakailangang regulasyon.

Ano ang Maaari Kong Itrade sa Point72?

Ang mga serbisyong pang-istratehiya ng pamumuhunan ng Point72 ay kinabibilangan ng mga pamumuhunang long/short equity. Ang global macro investments ay sumasaklaw sa fixed income, forex, liquid credit, commodities, derivatives, at iba pa. Bukod dito, nagbibigay ng systematic investments ang Cubist Systematic Strategies, at ang Point72 Ventures ay nag-aalok ng venture capital at growth equity.

| Mga Pamamaraan ng Pamumuhunan | Supported |

| Long/short equity investments | ✔ |

| Global macro investments | ✔ |

| Systematic investments | ✔ |

| Venture capital and growth equity | ✔ |

FX1123820651

Peru

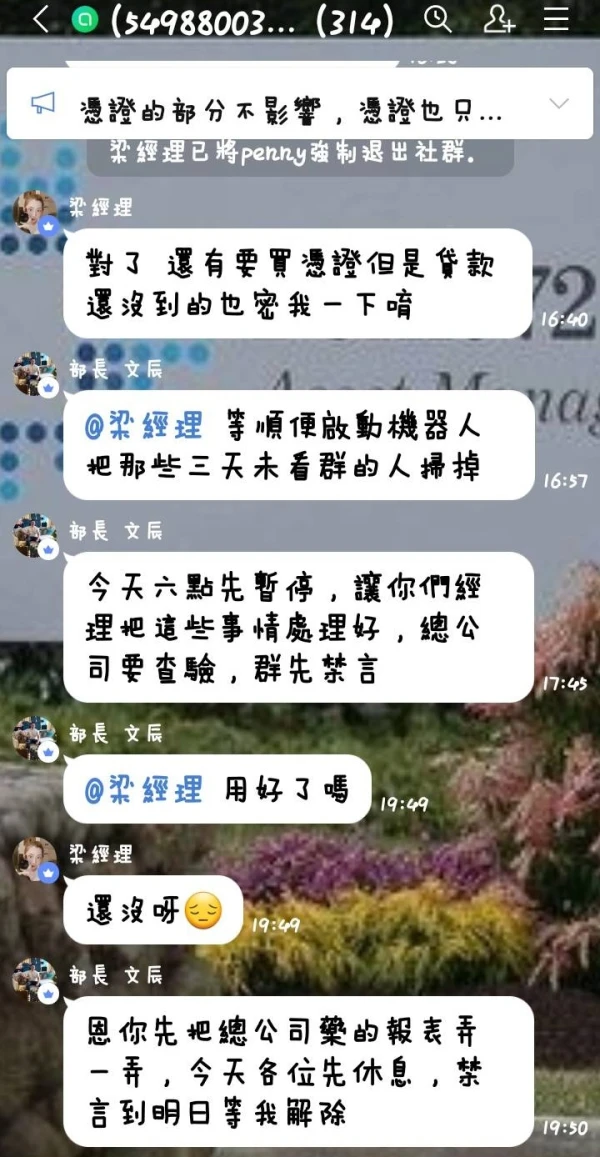

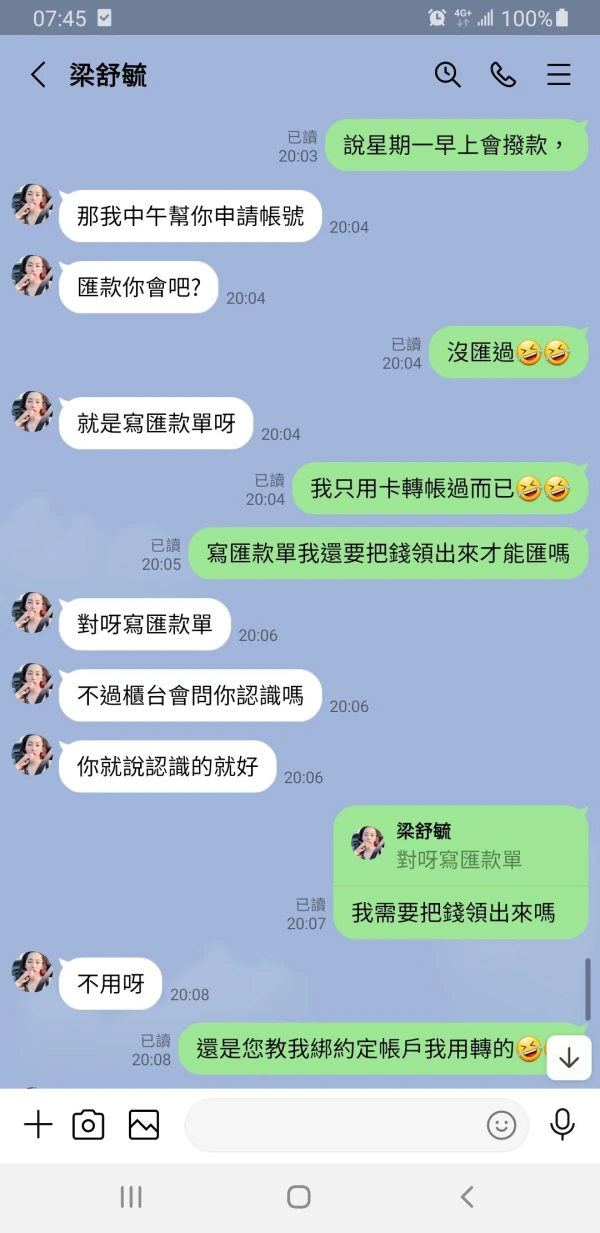

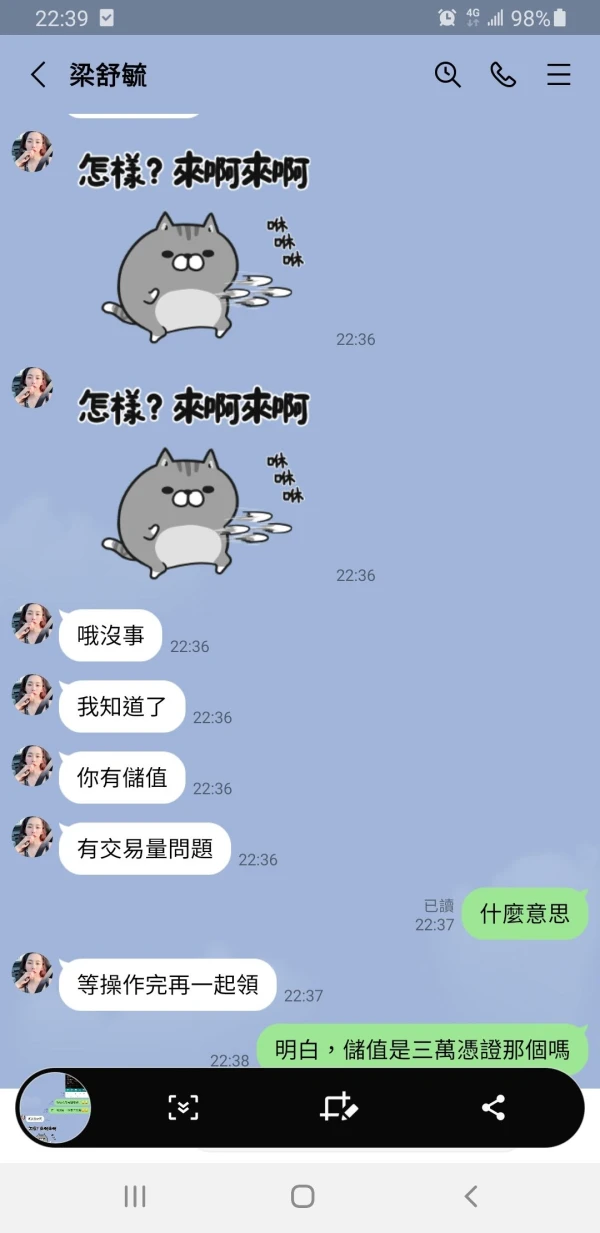

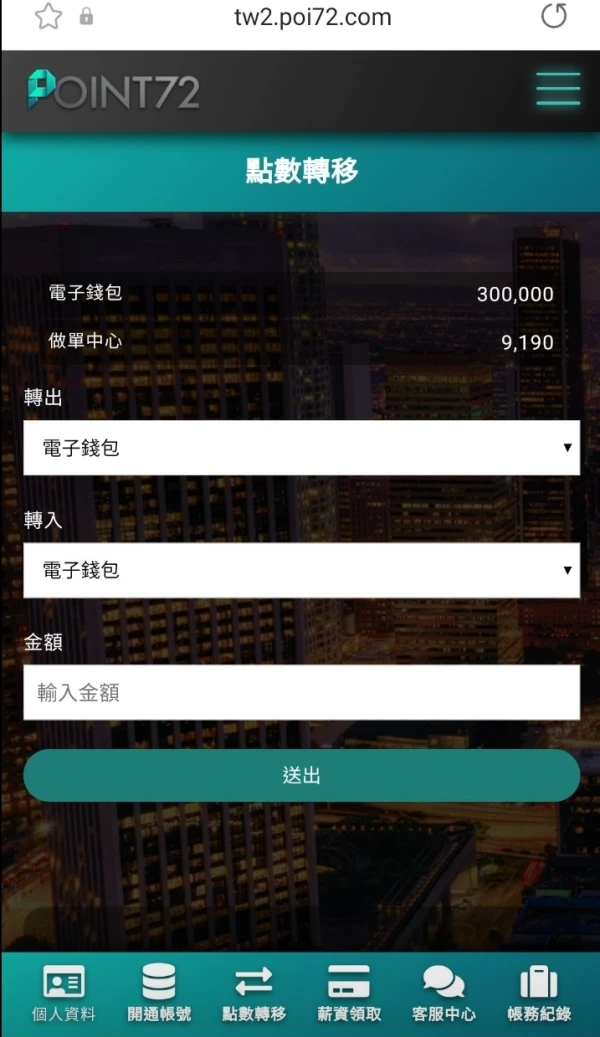

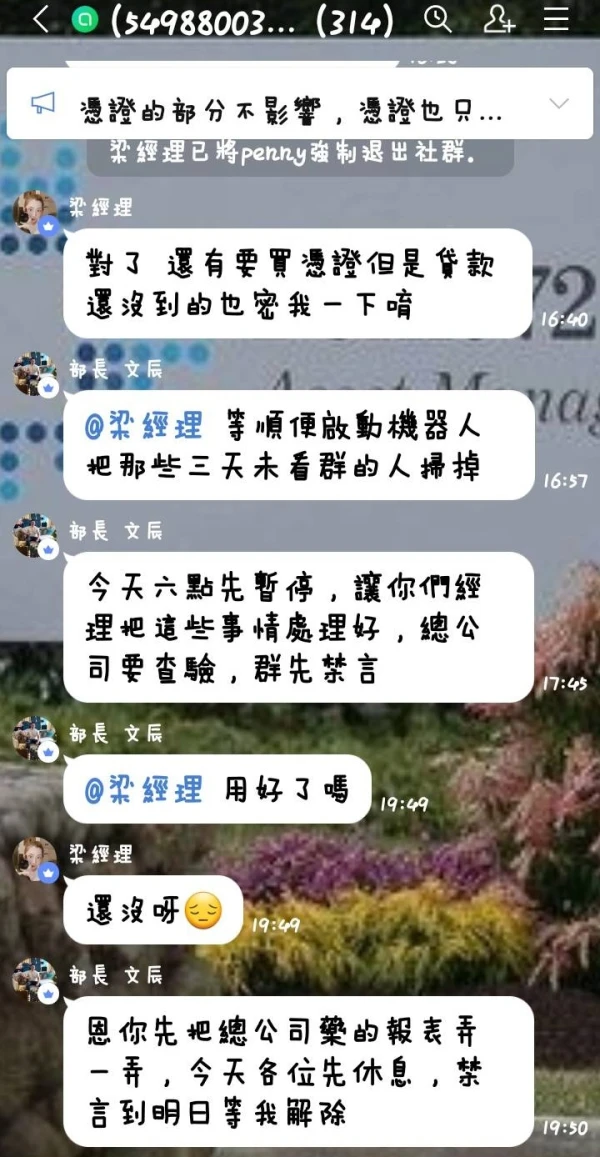

Ang tinatawag na kumpanyang POINT 72, na nagpapatakbo sa pamamagitan ng platform na GDCK, ay gumagawa ng mga pandaraya tulad ng sumusunod: Binibigyan ka nila ng minimum na bonus na $10 para turuan ka kung paano mag-trade. Dahil kontrolado nila ang platform, pinapanalo ka nila sa pamamagitan ng pagpapadala ng mga signal para sa pagpasok at paglabas sa mga cryptocurrency para sundan mo. Habang pinapakinabangan ka nila, hinihikayat ka nilang dagdagan ang iyong puhunan. Ang tagapayo o manager na si Anna Bansley ang umaligid sa akin sa pamamagitan ng mga mensahe para mag-deposito ng mas maraming pondo. Dapat pansinin na ang taong ito ay gumagamit ng maraming iba't ibang numero ng telepono, na aking ikakabit bilang ebidensya. Ang puhunan mong inilagay ay tila napakabilis lumago. Gayunpaman, kapag malaki na ang iyong na-invest, kahit sinusunod mo ang kanilang mga tagubilin, nawawala ang lahat ng iyong pera sa loob lamang ng ilang segundo. Ako ay tinanggal mula sa grupo kung saan sila ay naglabas ng mga senyales para ilantad ang kanilang modus operandi at na-block na sa lahat ng kanilang rehistradong numero. Ang kabuuang puhunang inilagay ay humigit-kumulang $15,000 USD sa pagitan ng Mayo at Agosto ng taong ito (2025). Ikakabit ko ang isa sa maraming resibo ng deposito bilang patunay.

Paglalahad

FX3845532432

Peru

Ang broker na Point72 sa pamamagitan ng platform na GDCK pro ay hindi nagpapahintulot ng paglilipat ng mga cryptocurrency sa Binance.

Paglalahad

王兆雲

Taiwan

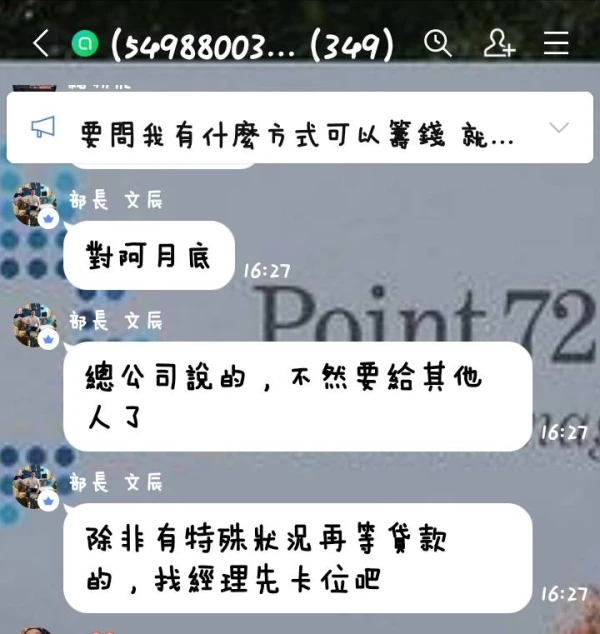

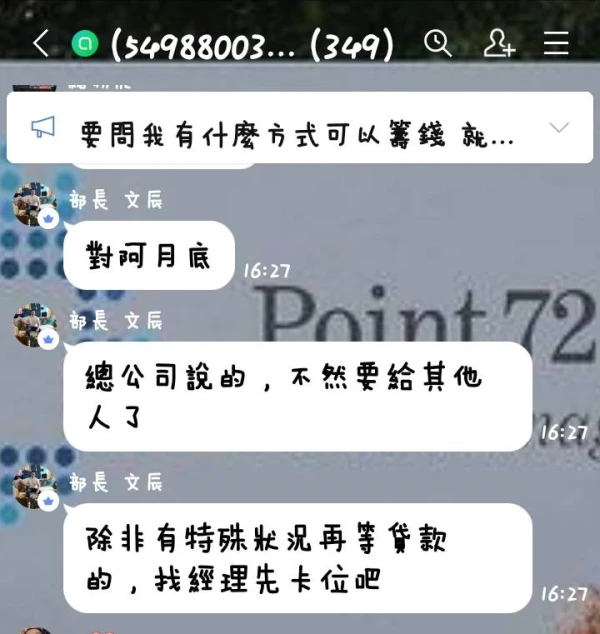

Idinagdag ka nila sa Facebook at nagpanggap na isang kumpanya sa Taiwan. Nag-chat sila sa grupo at kinumbinsi ka na sila ay tunay na kumpanya. Mag-ingat sa scam na ito.

Paglalahad

健乐

Tunisia

Ang Point72 ay isang kilalang kumpanya ng pamamahala ng hedge fund na may masaganang karanasan sa pamumuhunan at isang malakas na propesyonal na koponan. Ang kanilang website ay nagbibigay ng maraming impormasyon sa pamumuhunan at mga mapagkukunan, kabilang ang mga pinakabagong balita sa merkado, data, at mga ulat sa pananaliksik. Bilang karagdagan, nagbibigay sila ng ilang mapagkukunang pang-edukasyon upang matulungan ang mga baguhang mamumuhunan na mas maunawaan at makabisado ang kaalaman at kasanayan sa pamumuhunan. Sa konklusyon, ang Point72 ay isang napaka mapagkakatiwalaan at kapansin-pansing institusyon ng pamumuhunan.

Positibo

陳王馬杰

Hong Kong

Ang nilalaman ng website ng kumpanyang ito ay medyo manipis, nang walang anumang impormasyon sa regulasyon, at nakakita ako ng ilang tao na na-scam. Panganib! Ang tanging bagay na maaaring umapela sa akin ay na ito ay nasa loob ng higit sa 15 taon, ngunit iyon ay wala kung ikukumpara sa seguridad.

Positibo

李惟

Taiwan

May nanloko ng mga tao sa pangalan ng American Bohao research company. Niloko nila ako ng 100000 yuan.

Paglalahad

王兆雲

Taiwan

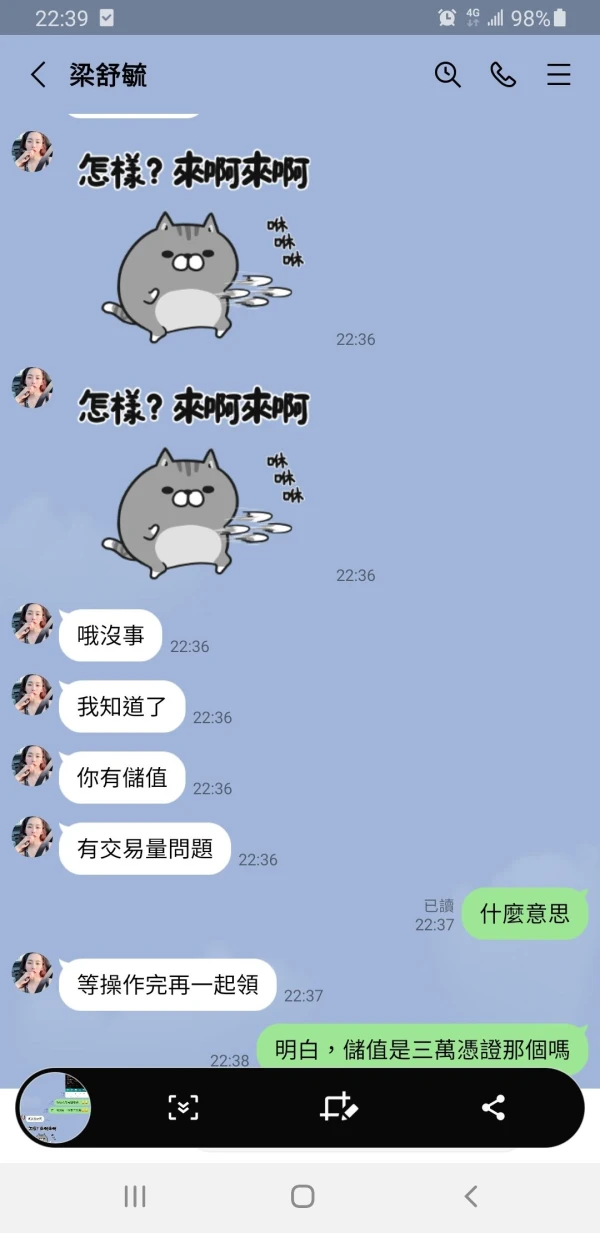

Nag-deposito ako ng $ 1000 at nais na mag-withdraw nang tumaas ito sa $ 2000. Ngunit nakansela ang pag-atras. Binago nito ang website nang maraming beses. Mag-ingat.

Paglalahad