Présentation de l'entreprise

| KIT Résumé de l'examen | |

| Fondé | 2000 |

| Pays/Région Enregistré | Russie |

| Régulation | Pas de régulation |

| Produits et Services | Gestion d'actifs, conversion de devises, prêt sur marge, ETF, actions, contrats à terme |

| Compte de Démo | / |

| Effet de Levier | / |

| Spread | / |

| Plateforme de Trading | Valdi Market Access |

| Dépôt Minimum | / |

| Support Client | Téléphone : 8 800 700-00-55 |

| Fax : +7 (812) 332 32 91 | |

| Réseaux Sociaux : Telegram, VK, YouTube | |

| Adresse : 69-71, rue Marata, Centre d'affaires « Renaissance Plaza », Saint-Pétersbourg, Russie, 191119 | |

Informations sur KIT

KIT Finance, fondé en 2000 et basé en Russie, est un courtier non réglementé qui n'est pas autorisé par la Banque Centrale de Russie ou d'autres autorités majeures. Il offre un accès aux marchés financiers russes et mondiaux en utilisant des technologies de qualité institutionnelle telles que Valdi Market Access.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Offre un accès aux marchés russes et mondiaux | Non réglementé |

| Soutient les clients institutionnels et professionnels | Manque de transparence |

| Longue histoire d'opération | |

| Outils de trading avancés et infrastructure | |

| Divers canaux de contact |

KIT Est-il Légitime ?

KIT Finance n'est pas un courtier réglementé. Bien qu'il soit enregistré en Russie, il n'est pas supervisé par une autorité financière russe reconnue, telle que la Banque Centrale de Russie, pour des activités de courtage ou d'investissement.

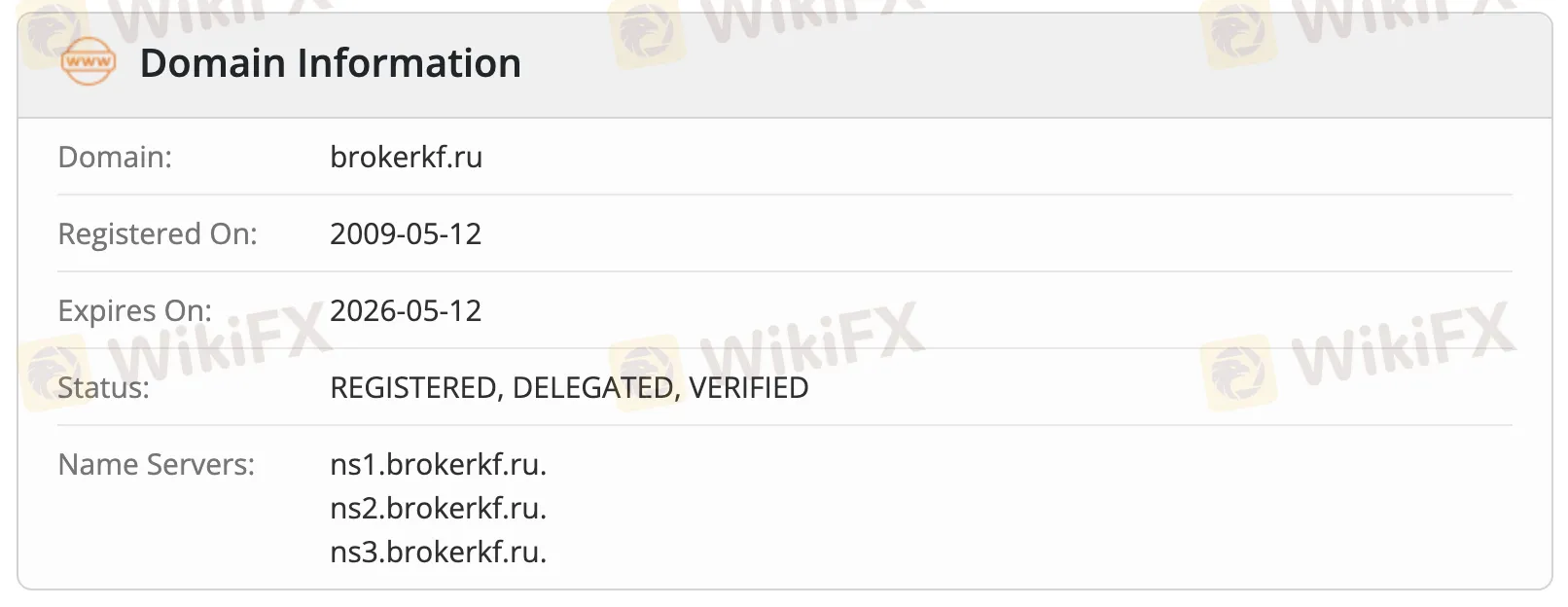

Selon les enregistrements WHOIS, le domaine brokerkf.ru a été enregistré le 12 mai 2009 et est toujours actif, avec le statut "ENREGISTRÉ, DÉLÉGUÉ, VÉRIFIÉ". Le domaine expirera le 12 mai 2026 et est hébergé sur ses propres serveurs de noms : ns1.brokerkf.ru, ns2.brokerkf.ru et ns3.brokerkf.ru.

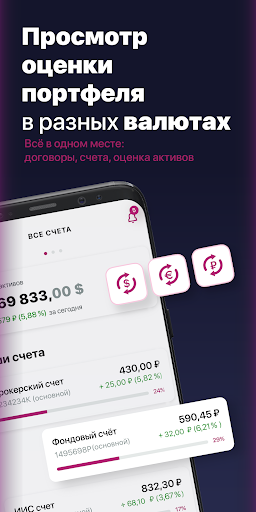

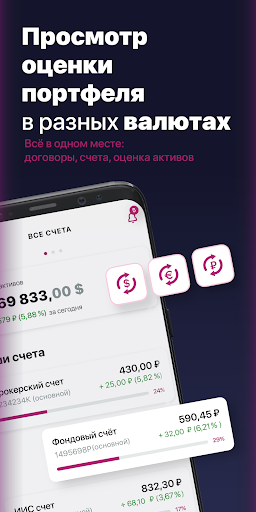

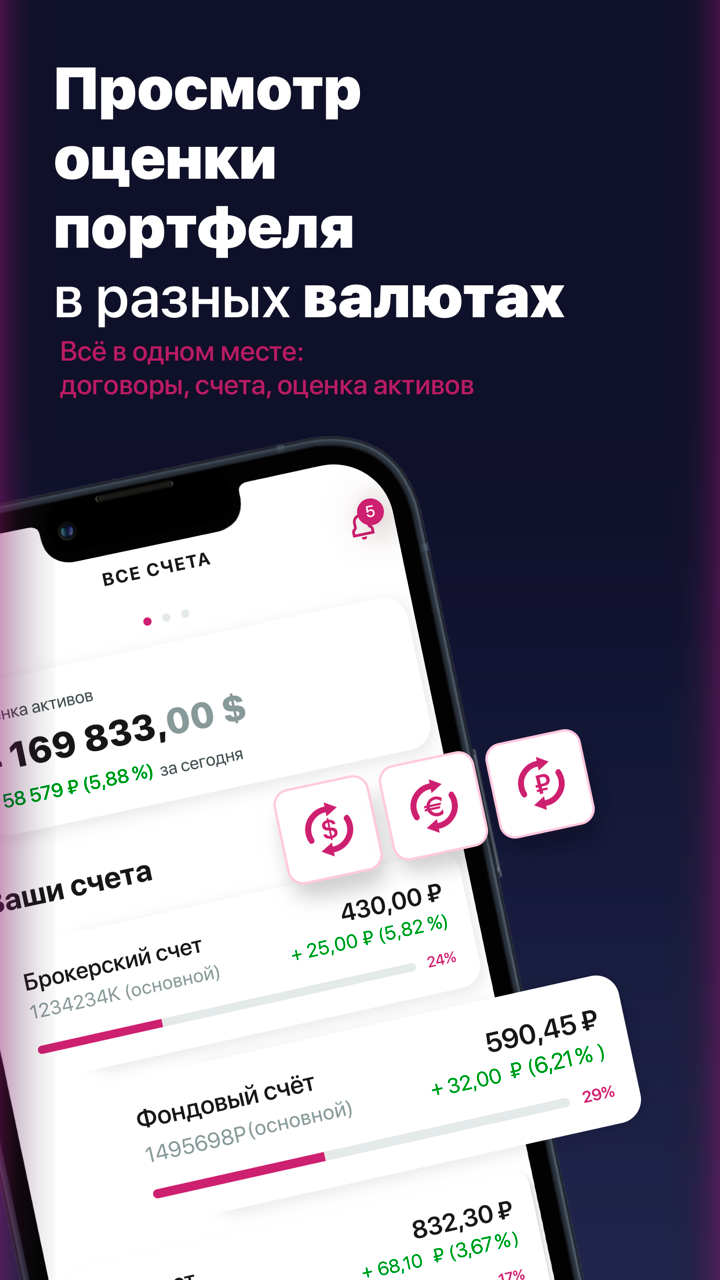

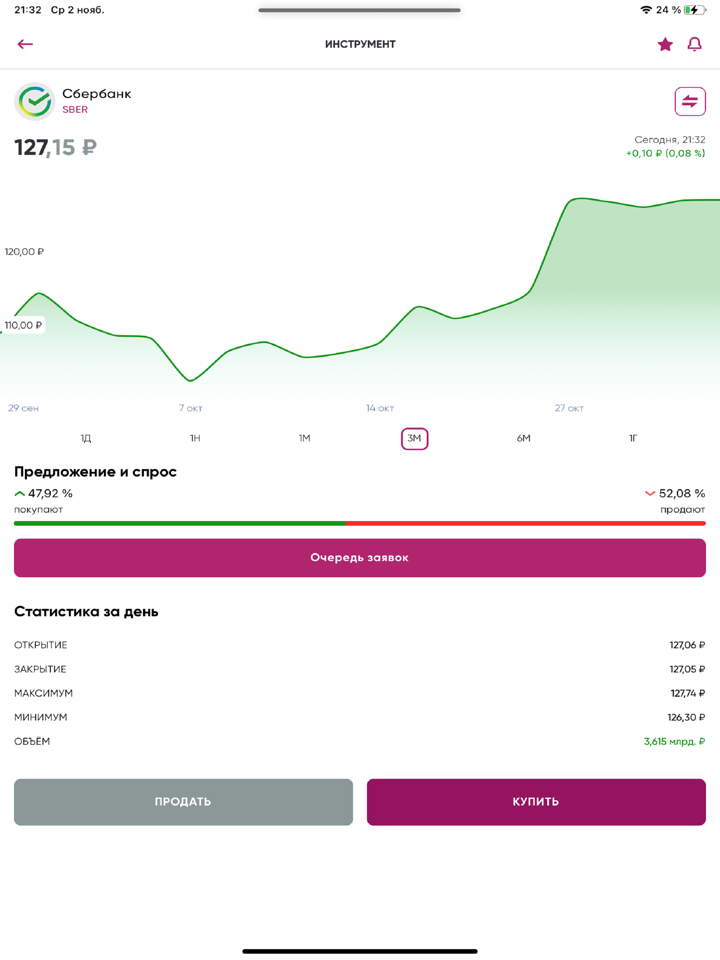

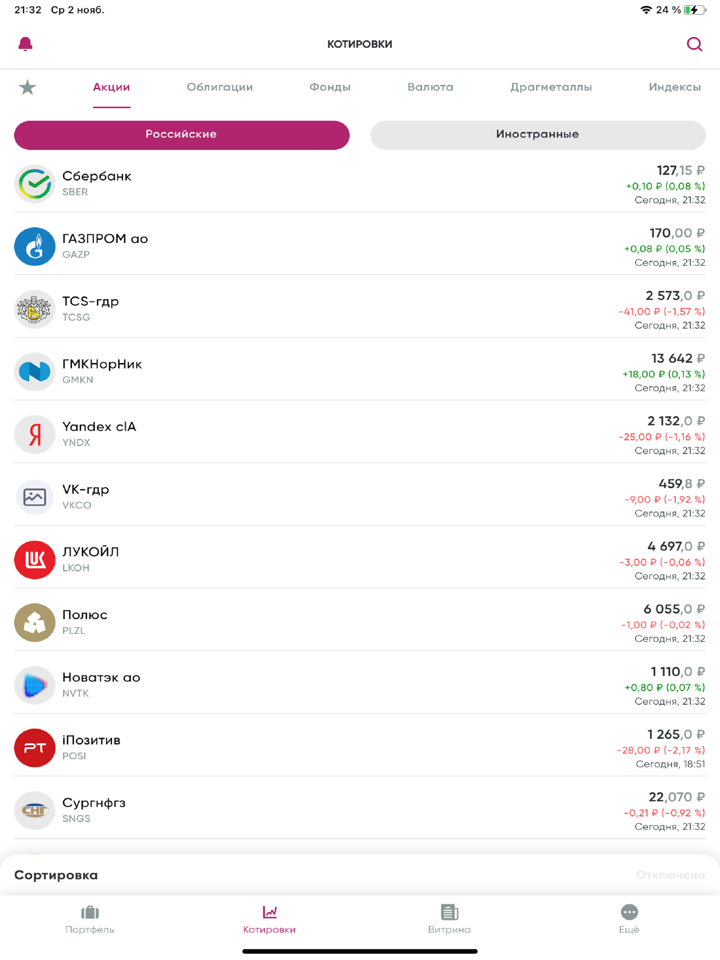

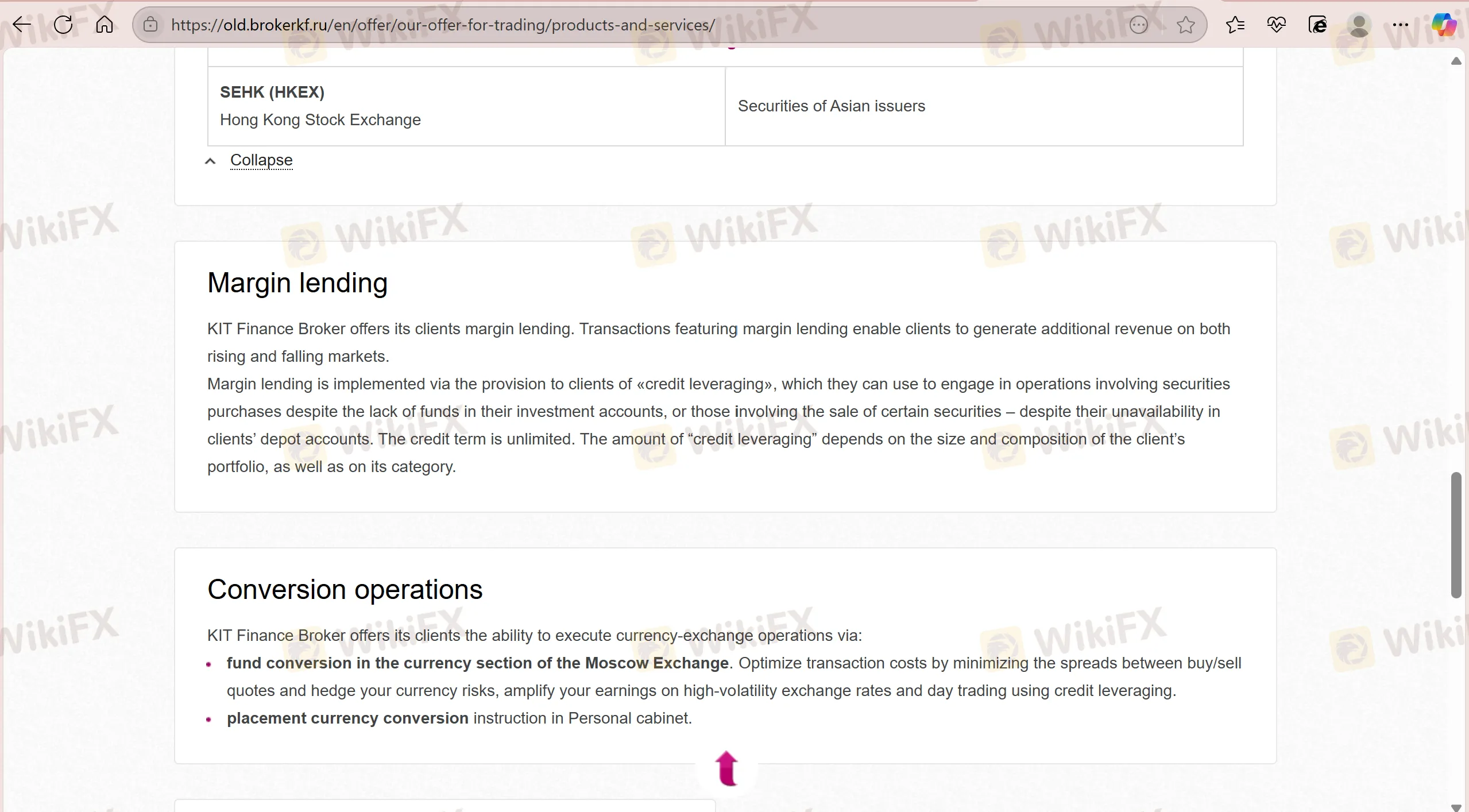

Produits et Services

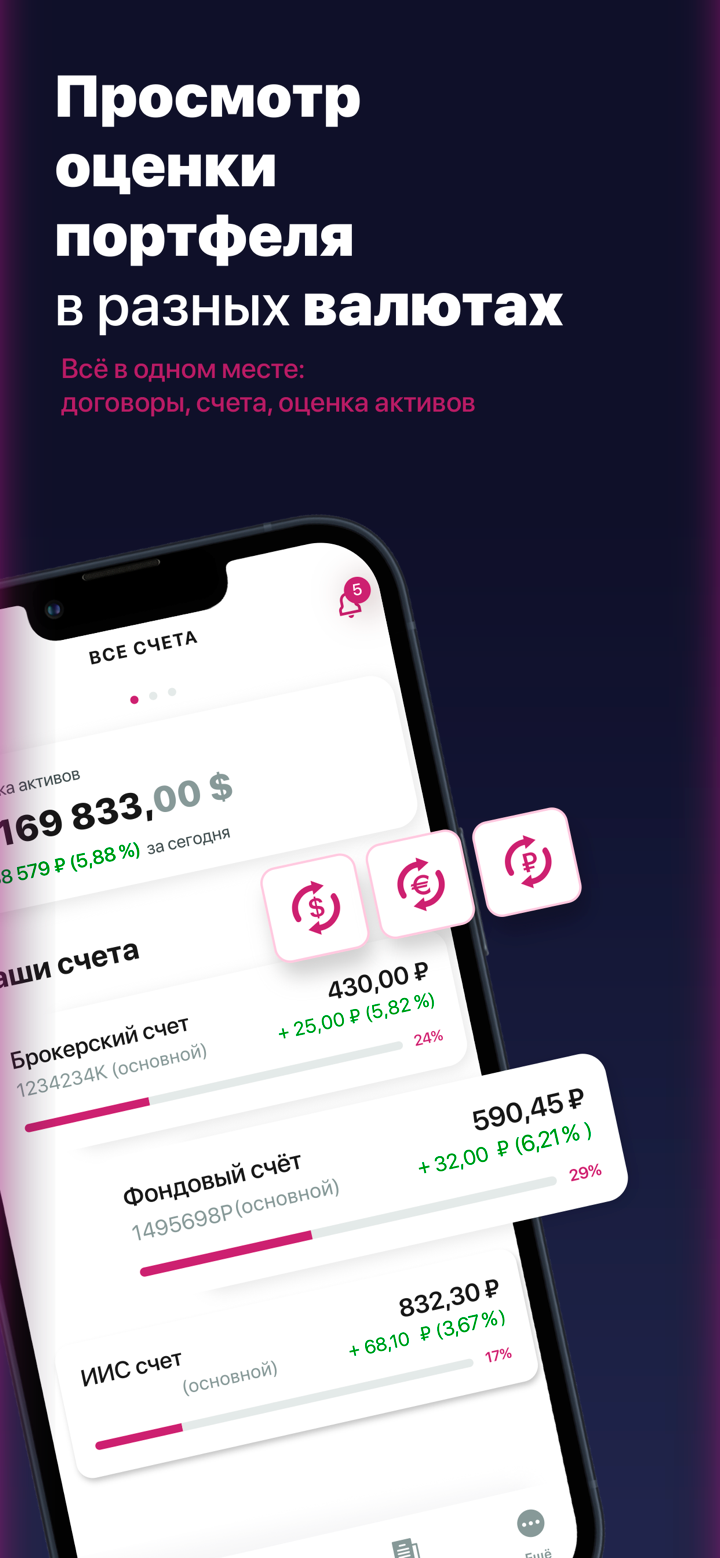

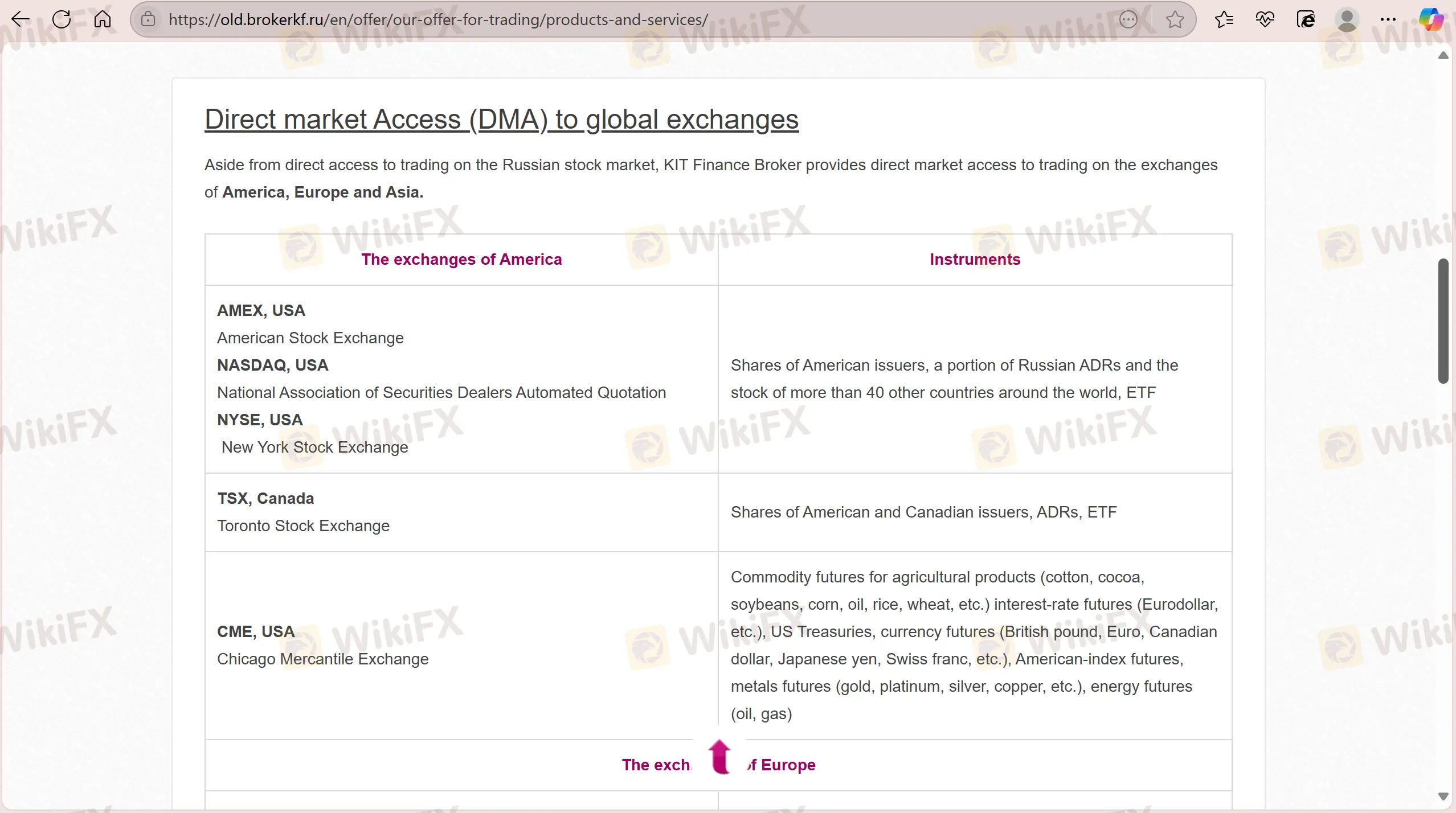

KIT Finance fournit des services de courtage et de trading pour les marchés russes et mondiaux, à la fois pour les clients institutionnels (banques, compagnies d'assurance, gestionnaires d'actifs) et les particuliers.

| Produits / Services | Pris en charge |

| Actions | ✔ |

| ETFs | ✔ |

| Contrats à terme | ✔ |

| Gestion d'actifs | ✔ |

| Prêt sur marge | ✔ |

| Conversion de devises | ✔ |

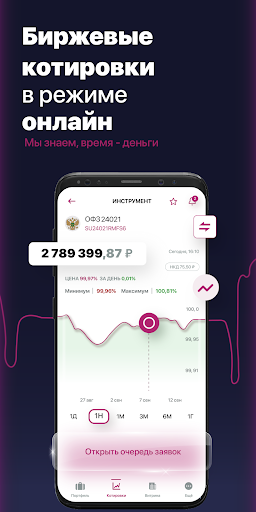

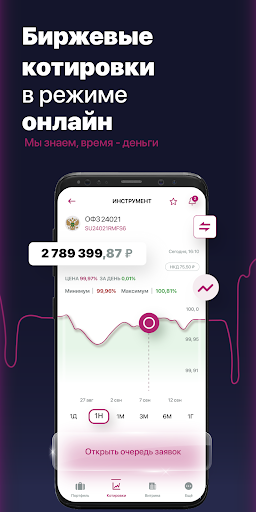

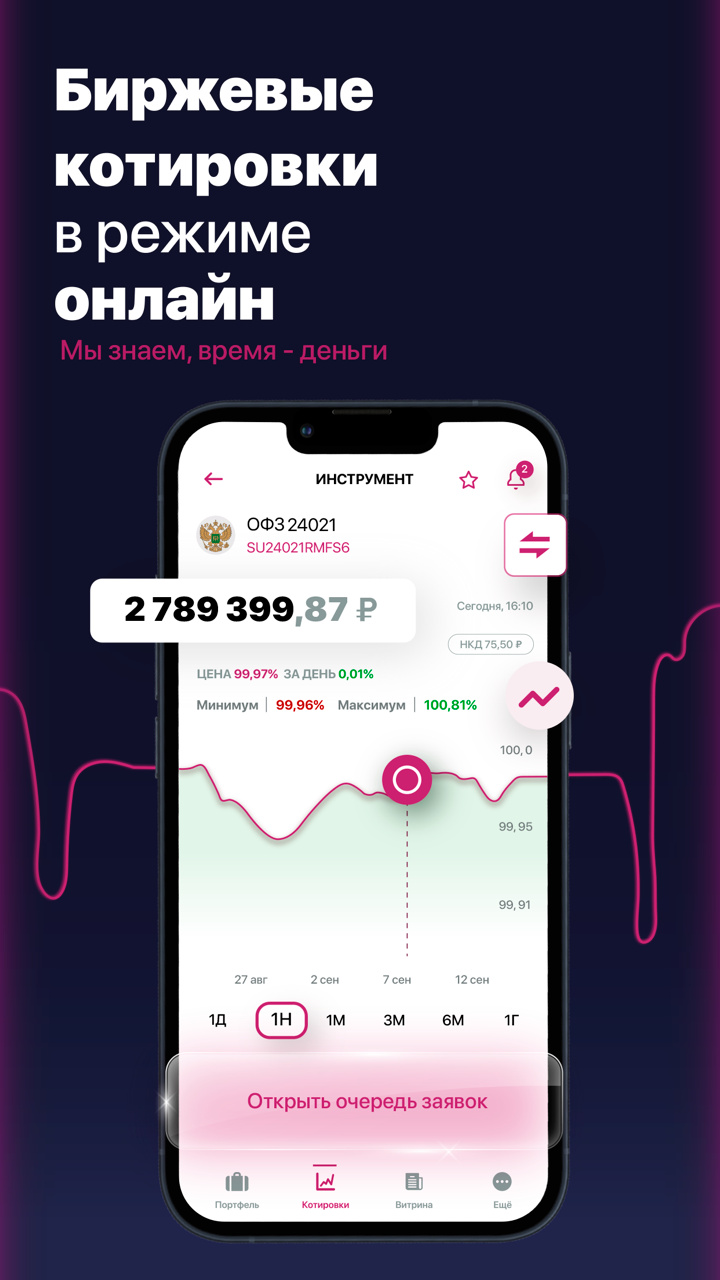

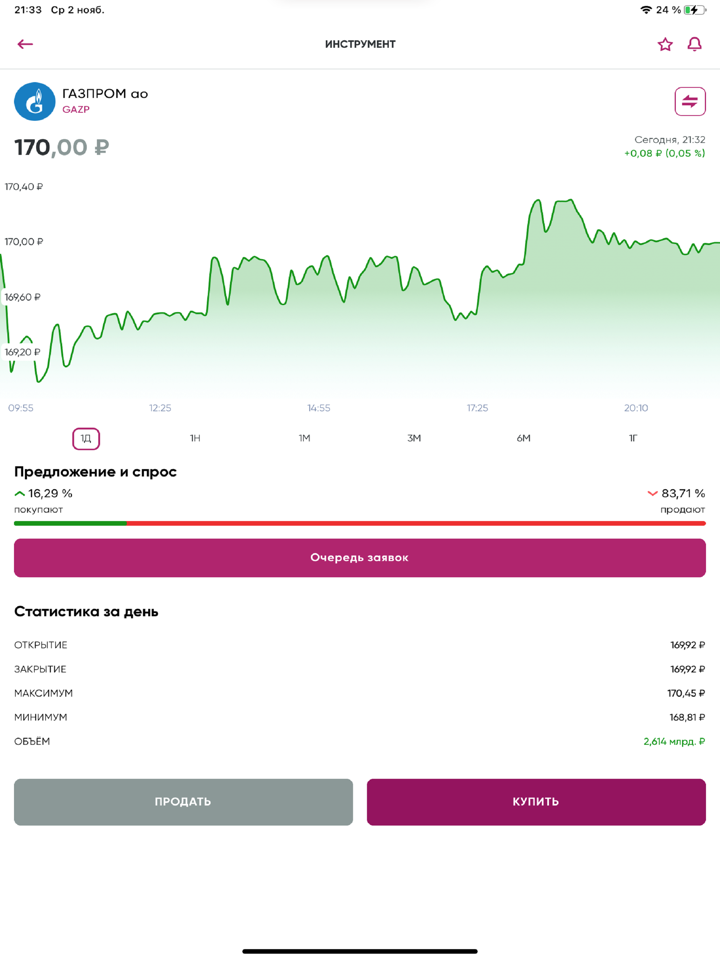

Plateforme de trading

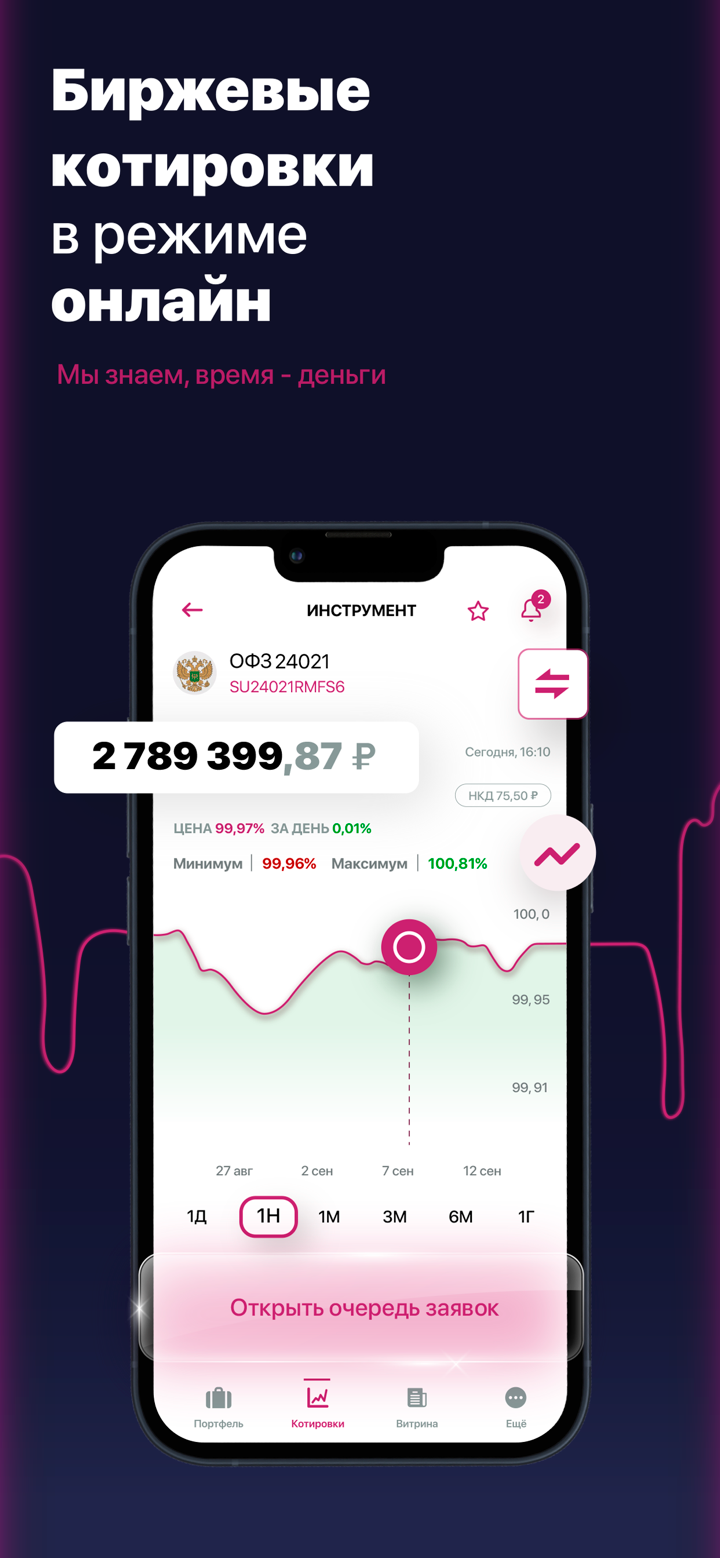

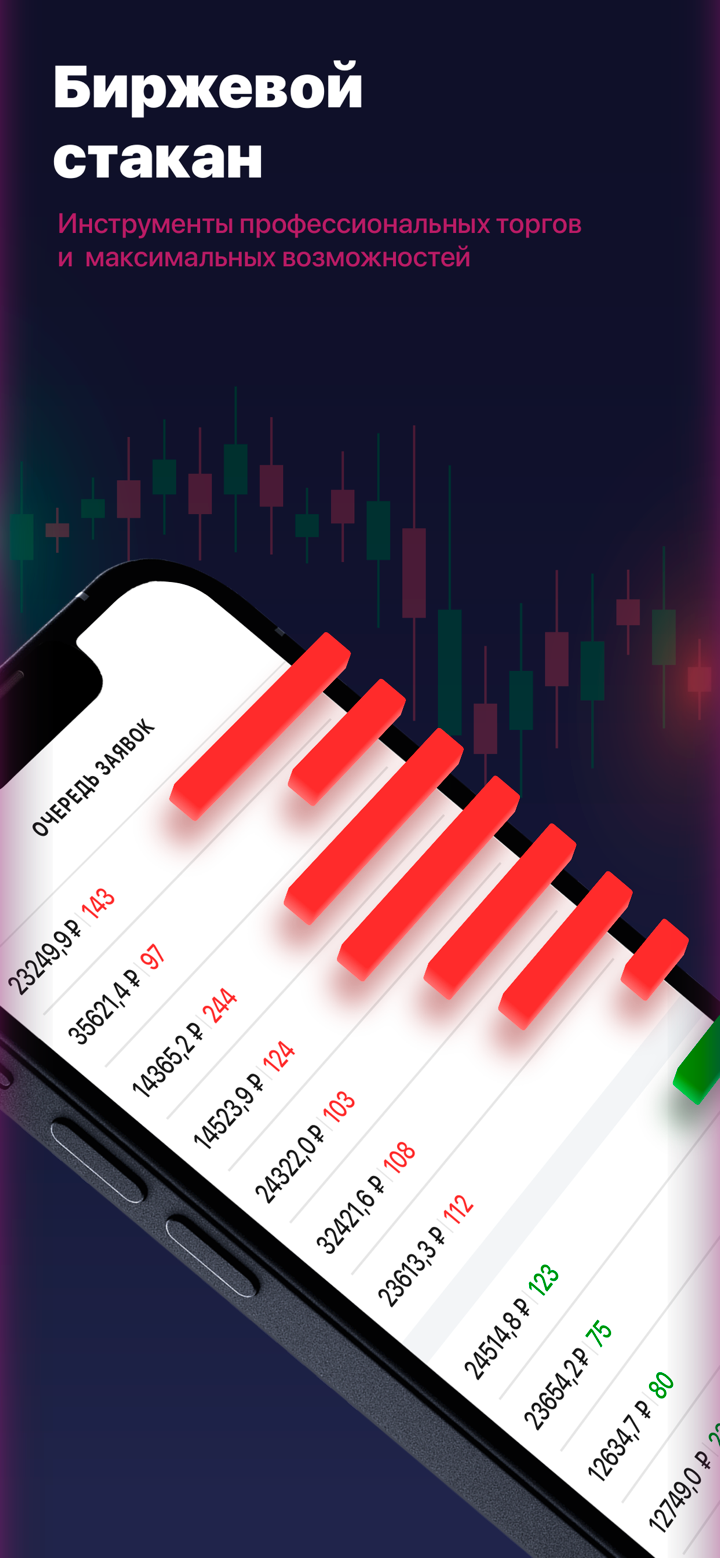

KIT Finance propose Valdi Market Access, une plateforme de trading robuste principalement destinée aux utilisateurs institutionnels et professionnels. Elle couvre le cycle complet des transactions, de l'exécution à la gestion des risques, la conformité et le règlement, en mettant l'accent sur la vitesse, l'automatisation et la communication à faible latence via le réseau mondial SunGard (SGN). Elle n'est pas destinée aux utilisateurs occasionnels.

| Plateforme de trading | Pris en charge | Appareils disponibles | Convient pour |

| Valdi Market Access | ✔ | Bureau (Windows) | / |

| MT4 | ❌ | / | Débutants |

| MT5 | ❌ | / | Traders expérimentés |