Perfil de la compañía

| KIT Resumen de la reseña | |

| Fundación | 2000 |

| País/Región Registrada | Rusia |

| Regulación | Sin regulación |

| Productos y Servicios | Gestión de activos, conversión de divisas, préstamos con margen, ETFs, acciones, futuros |

| Cuenta Demo | / |

| Apalancamiento | / |

| Spread | / |

| Plataforma de Trading | Valdi Market Access |

| Depósito Mínimo | / |

| Soporte al Cliente | Teléfono: 8 800 700-00-55 |

| Fax: +7 (812) 332 32 91 | |

| Redes Sociales: Telegram, VK, YouTube | |

| Dirección: 69-71, calle Marata, centro de negocios «Renaissance Plaza», San Petersburgo, Rusia, 191119 | |

Información de KIT

KIT Finance, fundada en 2000 y con sede en Rusia, es un bróker no regulado que no está autorizado por el Banco Central de Rusia ni por otras autoridades importantes. Proporciona acceso a los mercados financieros rusos y mundiales utilizando tecnologías de grado institucional como Valdi Market Access.

Pros y Contras

| Pros | Contras |

| Ofrece acceso a los mercados rusos y globales | No regulado |

| Apoya a clientes institucionales y profesionales | Falta de transparencia |

| Larga historia de operación | |

| Herramientas avanzadas de trading e infraestructura | |

| Varios canales de contacto |

¿Es KIT Legítimo?

KIT Finance no es un bróker regulado. Aunque está registrado en Rusia, no está supervisado por ninguna autoridad financiera rusa reconocida, como el Banco Central de Rusia, para fines de corretaje o inversión.

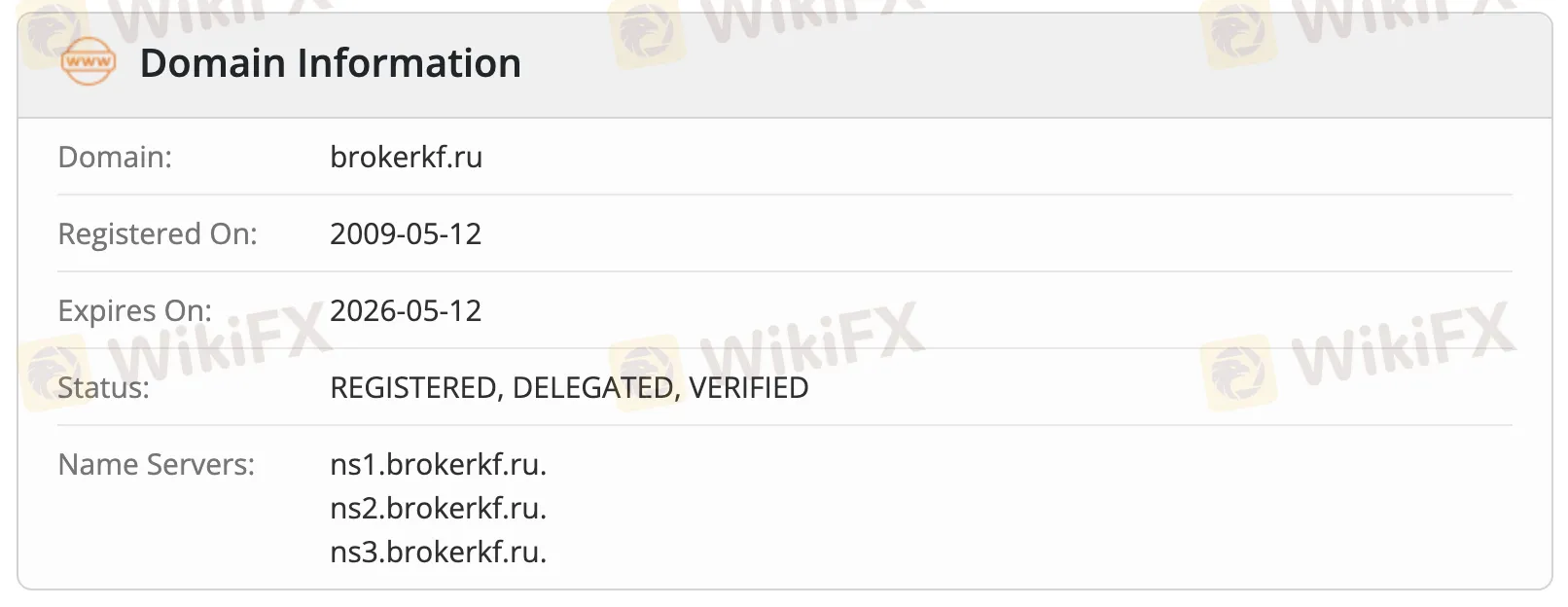

Según los registros WHOIS, el dominio brokerkf.ru se registró el 12 de mayo de 2009 y sigue activo, con el estado "REGISTRADO, DELEGADO, VERIFICADO". El dominio caducará el 12 de mayo de 2026 y está alojado en sus propios servidores de nombres: ns1.brokerkf.ru, ns2.brokerkf.ru y ns3.brokerkf.ru.

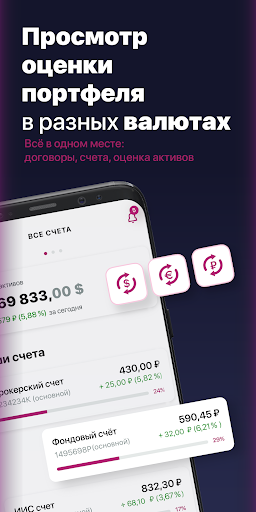

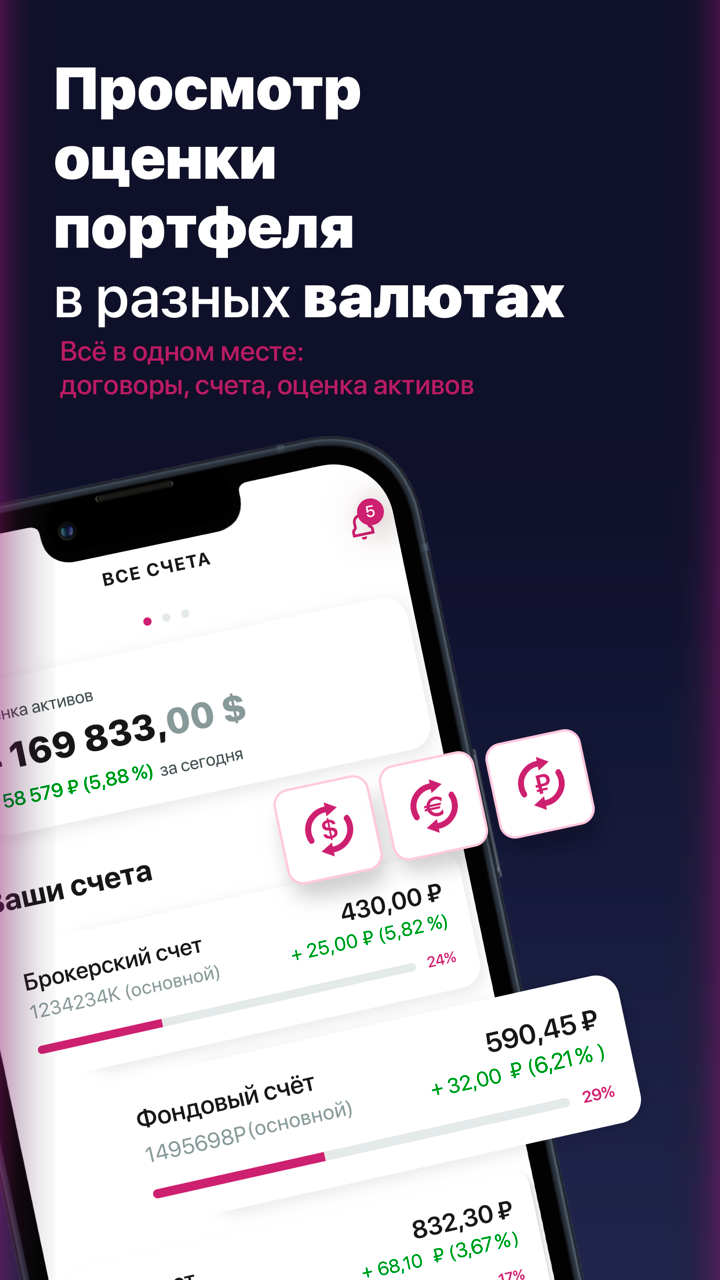

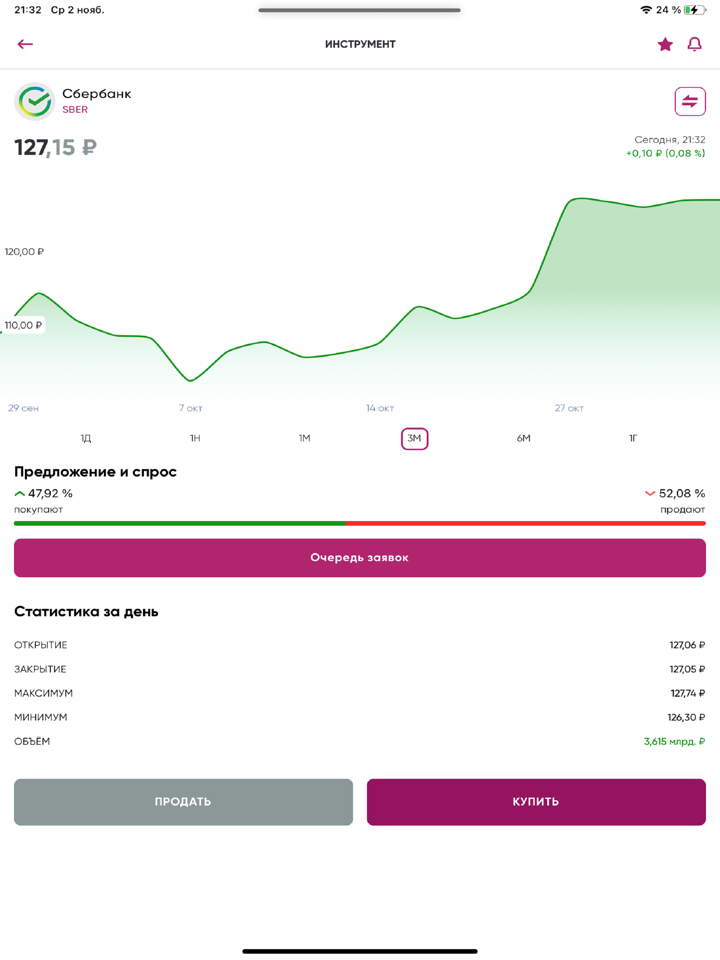

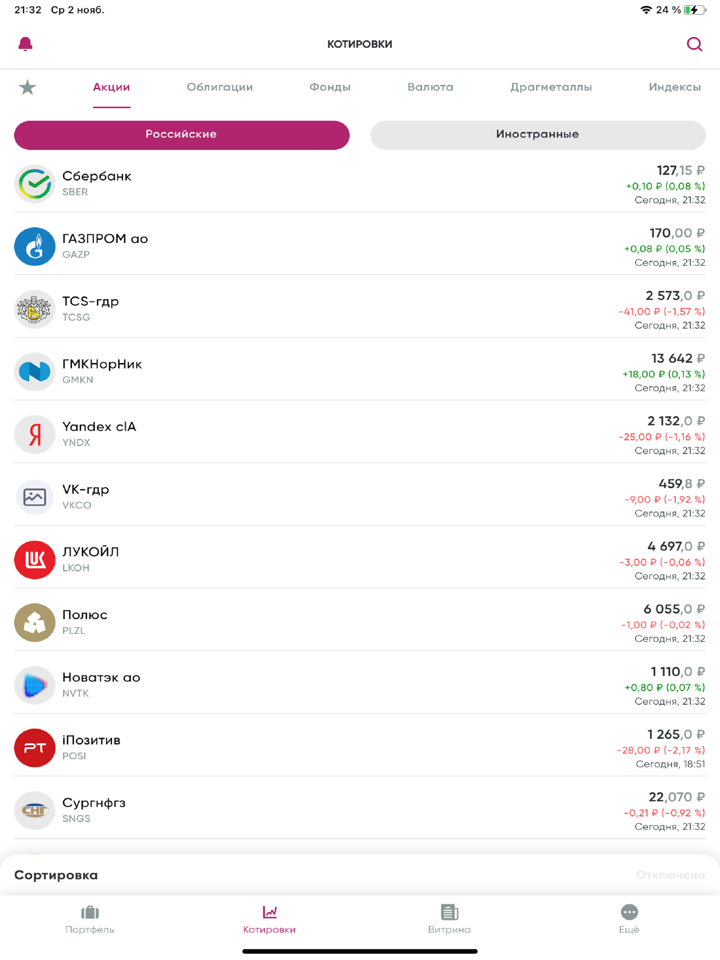

Productos y Servicios

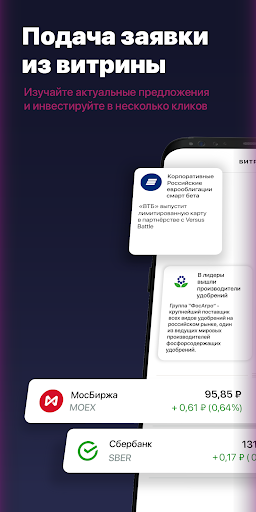

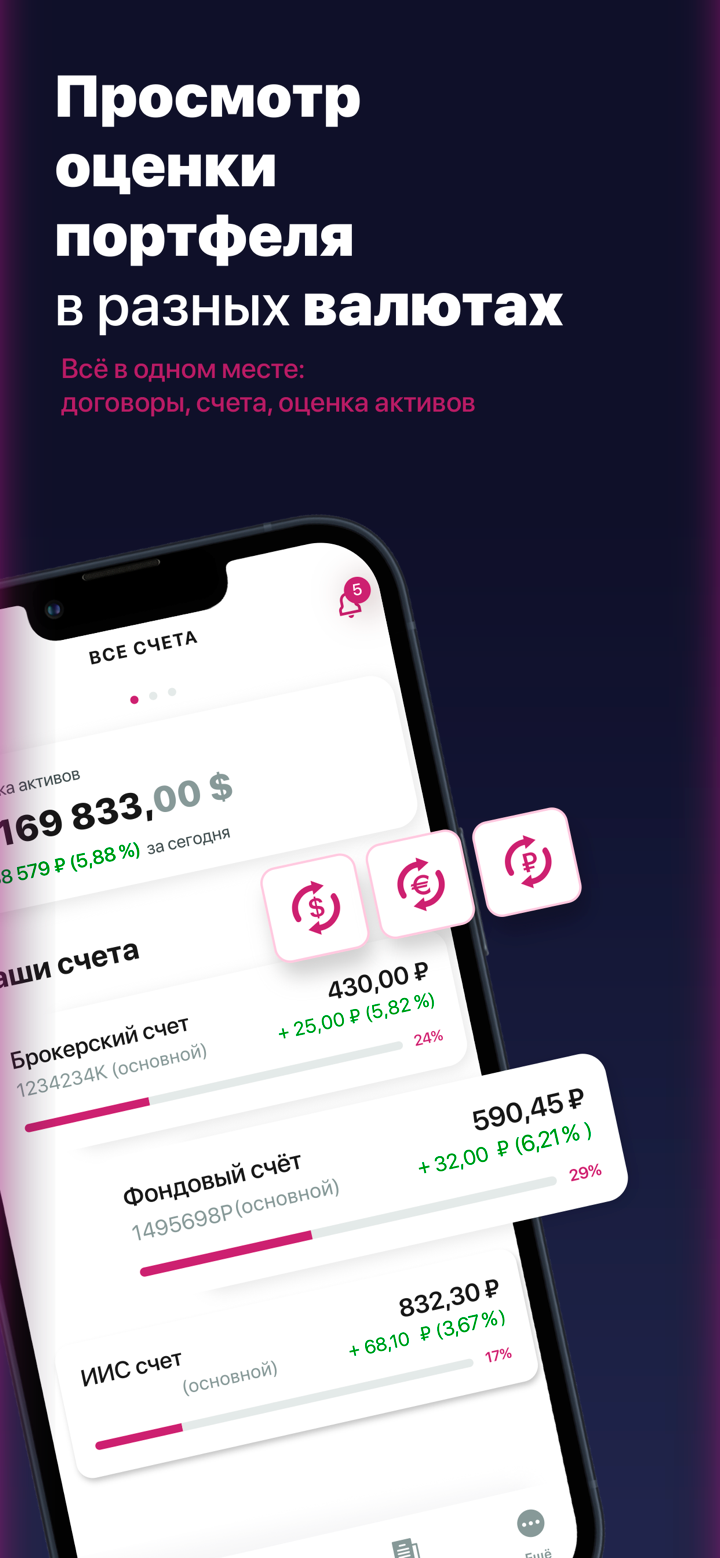

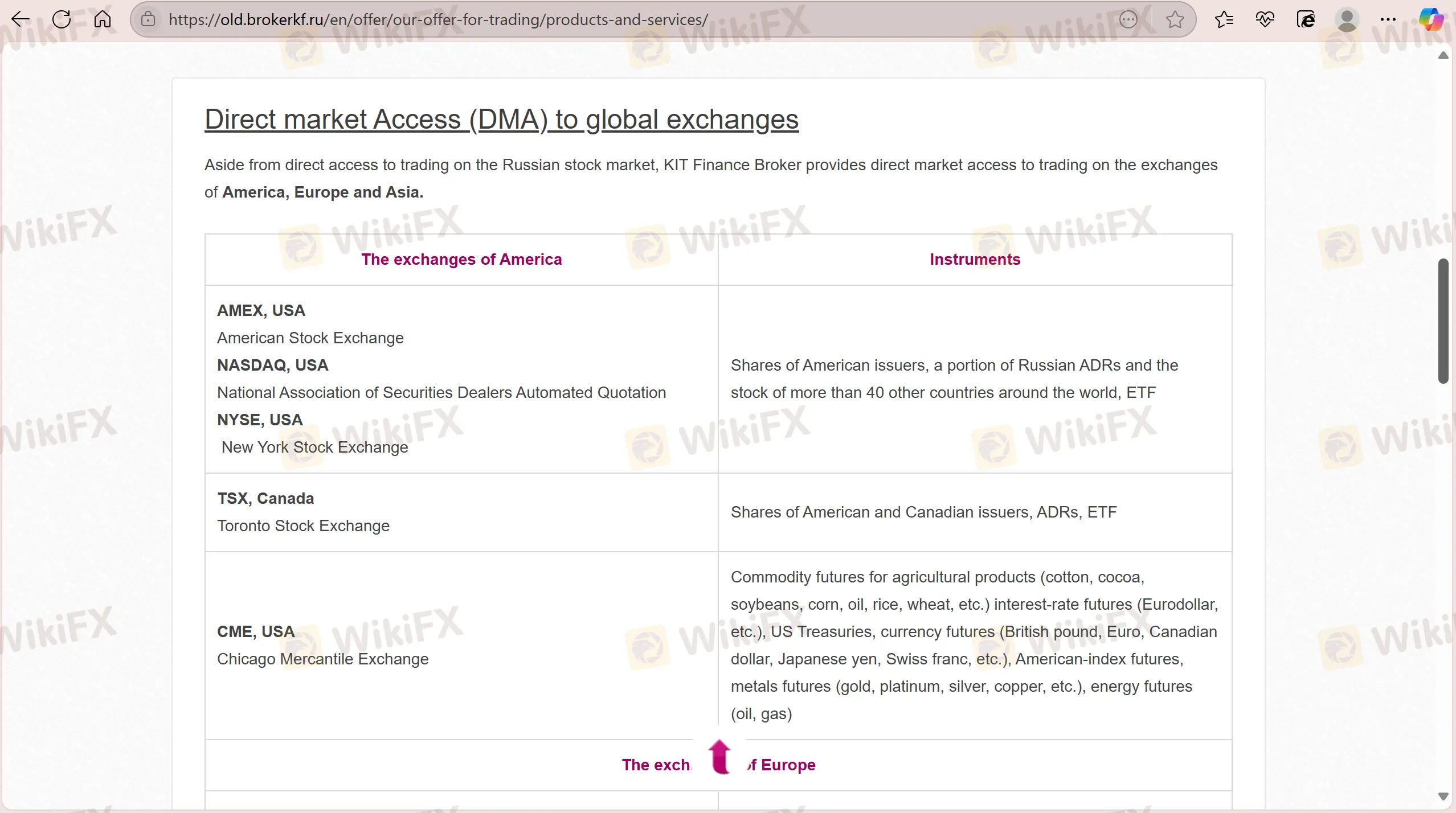

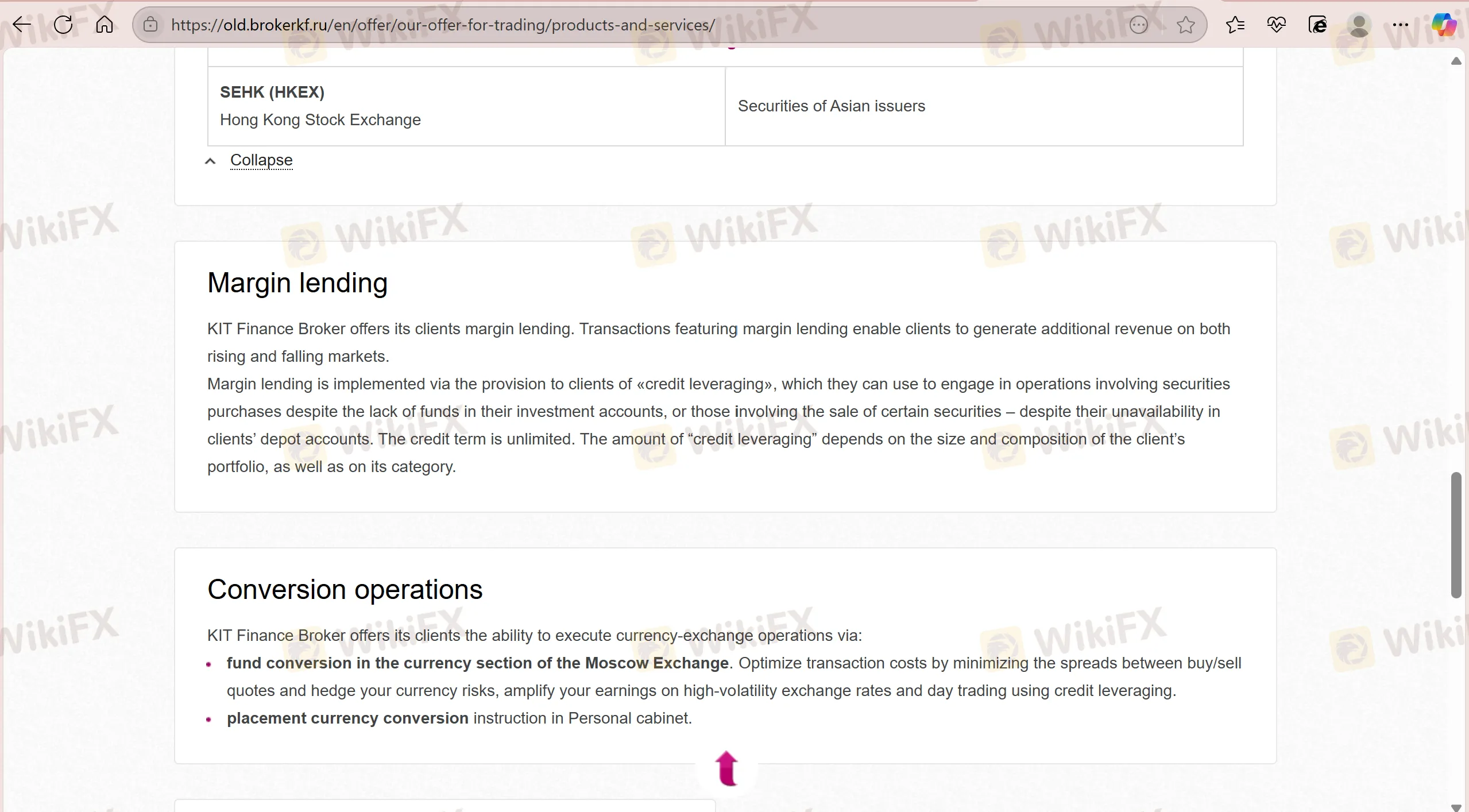

KIT Finance proporciona servicios de corretaje y trading para los mercados rusos y globales, atendiendo tanto a clientes institucionales (bancos, compañías de seguros, gestores de activos) como a particulares.

| Productos / Servicios | Soportado |

| Acciones | ✔ |

| ETFs | ✔ |

| Futuros | ✔ |

| Gestión de Activos | ✔ |

| Préstamo con Margen | ✔ |

| Conversión de Divisas | ✔ |

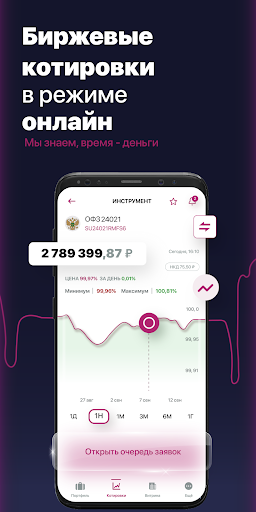

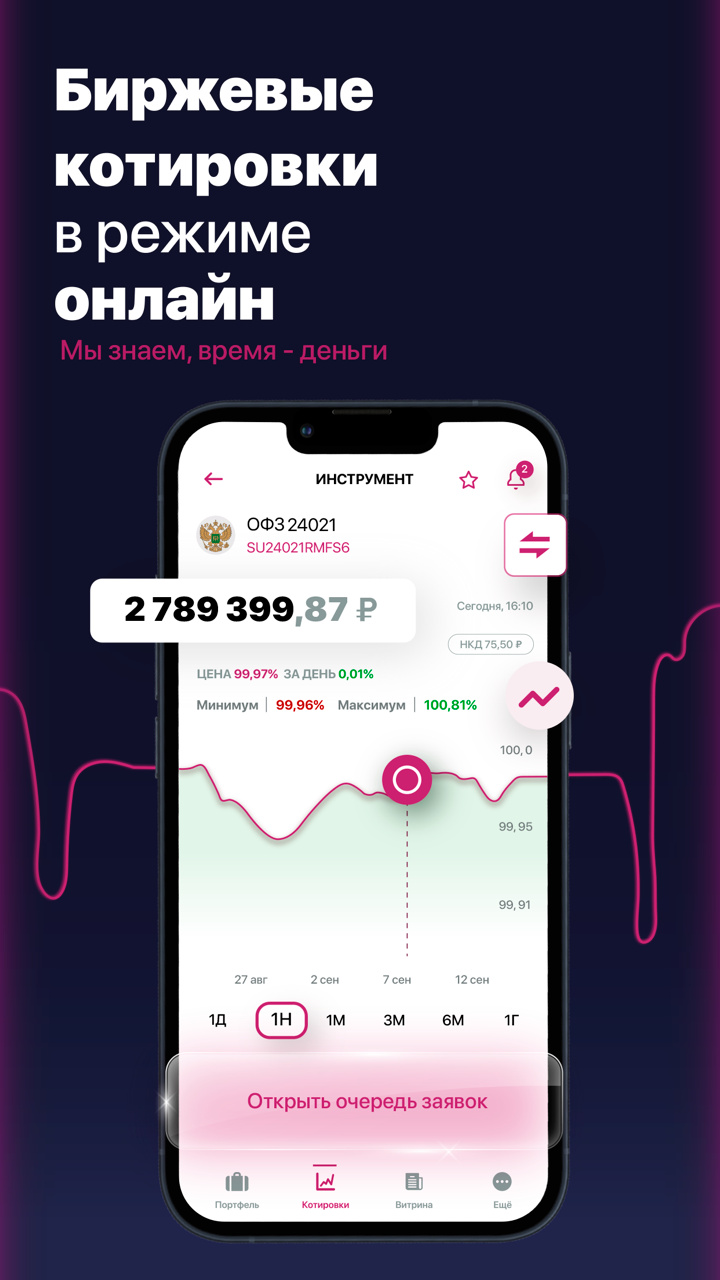

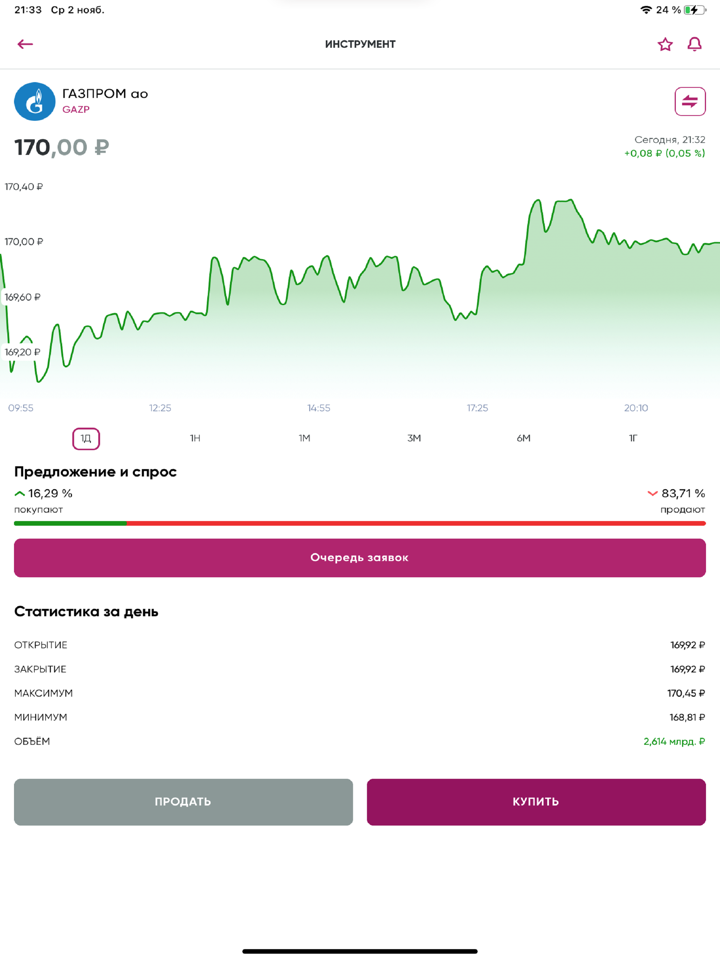

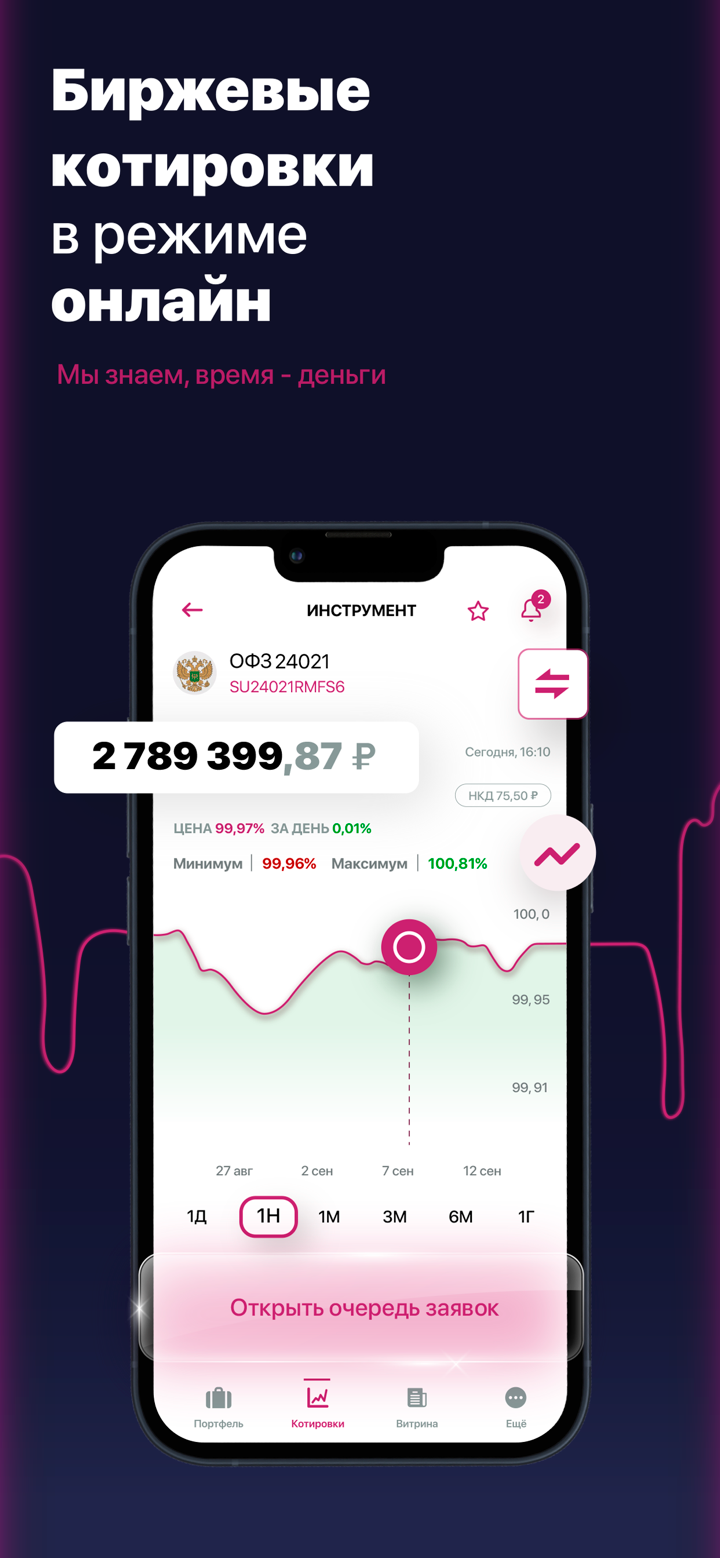

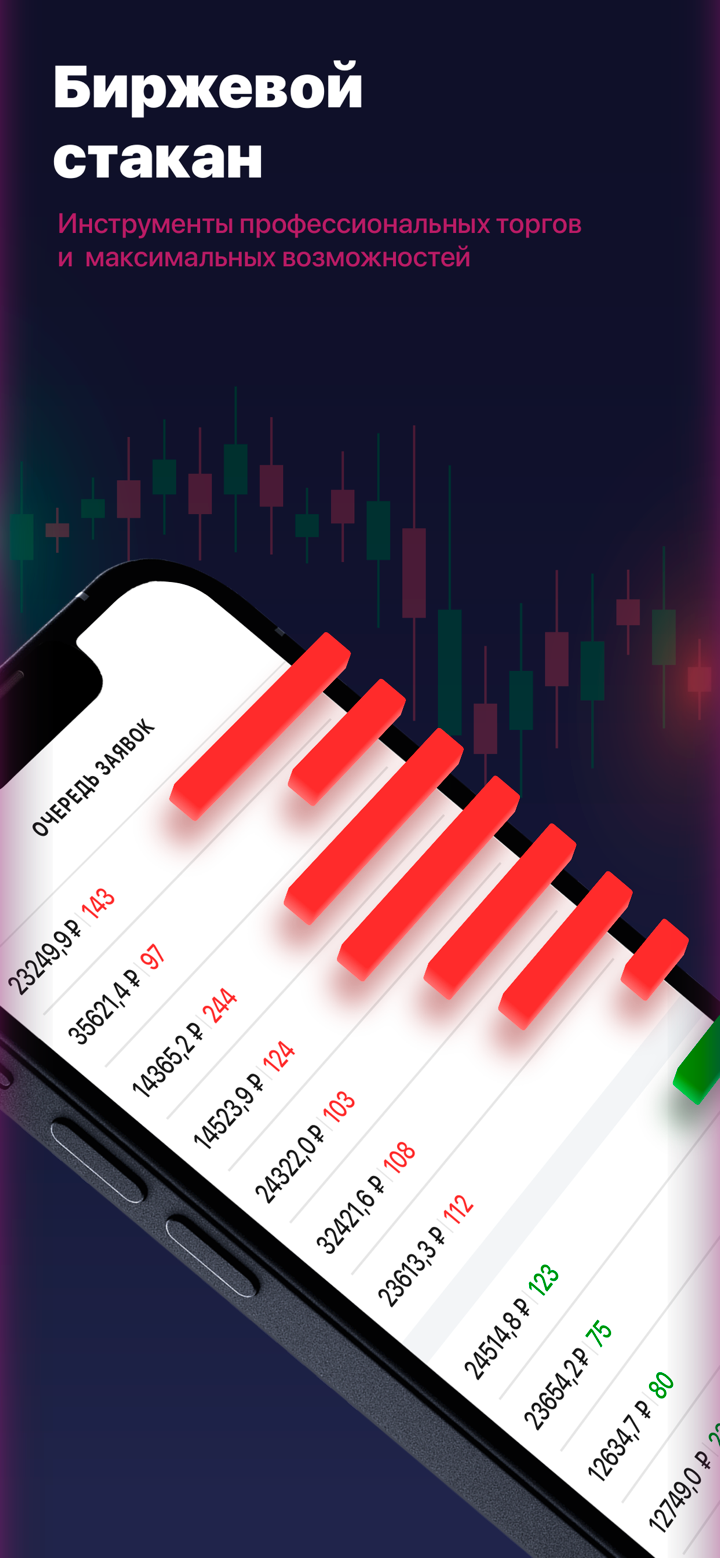

Plataforma de Trading

KIT Finance ofrece Valdi Market Access, una plataforma de trading robusta dirigida principalmente a usuarios institucionales y profesionales. Cubre todo el ciclo de transacciones, desde la ejecución hasta la gestión de riesgos, cumplimiento y liquidación, con énfasis en la velocidad, automatización y comunicación de baja latencia a través de la SunGard Global Network (SGN). No está destinada a usuarios minoristas casuales.

| Plataforma de Trading | Soportado | Dispositivos Disponibles | Adecuado para |

| Valdi Market Access | ✔ | Escritorio (Windows) | / |

| MT4 | ❌ | / | Principiantes |

| MT5 | ❌ | / | Traders Experimentados |