Resumo da empresa

| KIT Resumo da Revisão | |

| Fundação | 2000 |

| País/Região Registrada | Rússia |

| Regulação | Sem regulação |

| Produtos e Serviços | Gestão de ativos, conversão de moeda, empréstimo de margem, ETFs, ações, futuros |

| Conta Demonstrativa | / |

| Alavancagem | / |

| Spread | / |

| Plataforma de Negociação | Valdi Market Access |

| Depósito Mínimo | / |

| Suporte ao Cliente | Telefone: 8 800 700-00-55 |

| Fax: +7 (812) 332 32 91 | |

| Redes Sociais: Telegram, VK, YouTube | |

| Endereço: 69-71, rua Marata, centro empresarial "Renaissance Plaza", São Petersburgo, Rússia, 191119 | |

Informações sobre KIT

KIT Finance, fundada em 2000 e sediada na Rússia, é uma corretora não regulamentada que não possui licença do Banco Central da Rússia ou de outras autoridades importantes. Ela oferece acesso aos mercados financeiros russos e mundiais utilizando tecnologias de nível institucional, como o Valdi Market Access.

Prós e Contras

| Prós | Contras |

| Oferece acesso aos mercados russo e global | Não regulamentado |

| Suporta clientes institucionais e profissionais | Falta de transparência |

| Histórico de operação longo | |

| Ferramentas avançadas de negociação e infraestrutura | |

| Vários canais de contato |

KIT é Legítimo?

KIT Finance não é uma corretora regulamentada. Embora seja registrada na Rússia, não é supervisionada por nenhuma autoridade financeira russa reconhecida, como o Banco Central da Rússia, para fins de corretagem ou investimento.

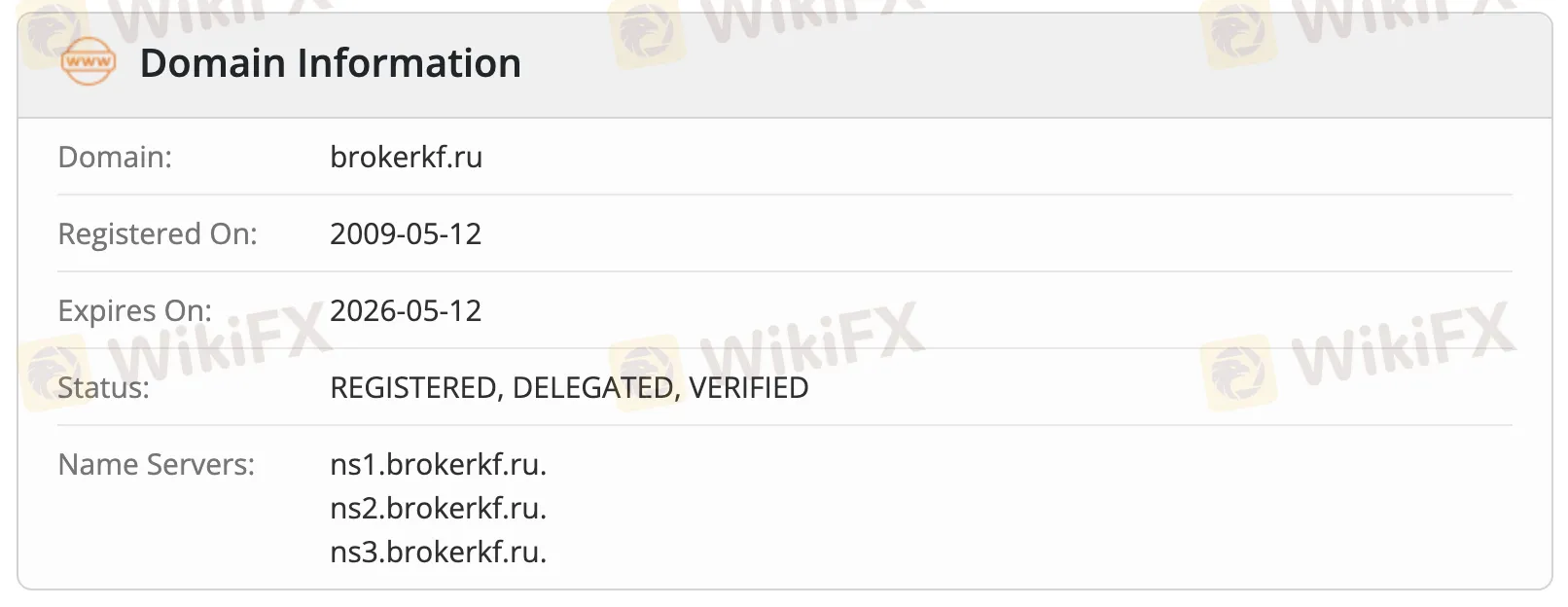

De acordo com os registros WHOIS, o domínio brokerkf.ru foi registrado em 12 de maio de 2009 e ainda está ativo, com o status "REGISTRADO, DELEGADO, VERIFICADO". O domínio expirará em 12 de maio de 2026 e está hospedado em seus próprios servidores de nome: ns1.brokerkf.ru, ns2.brokerkf.ru e ns3.brokerkf.ru.

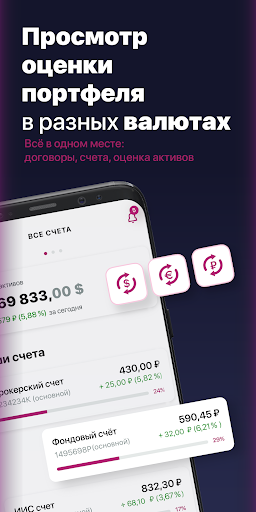

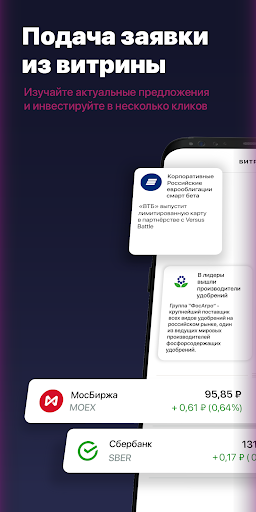

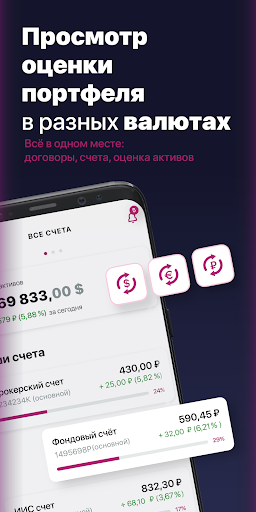

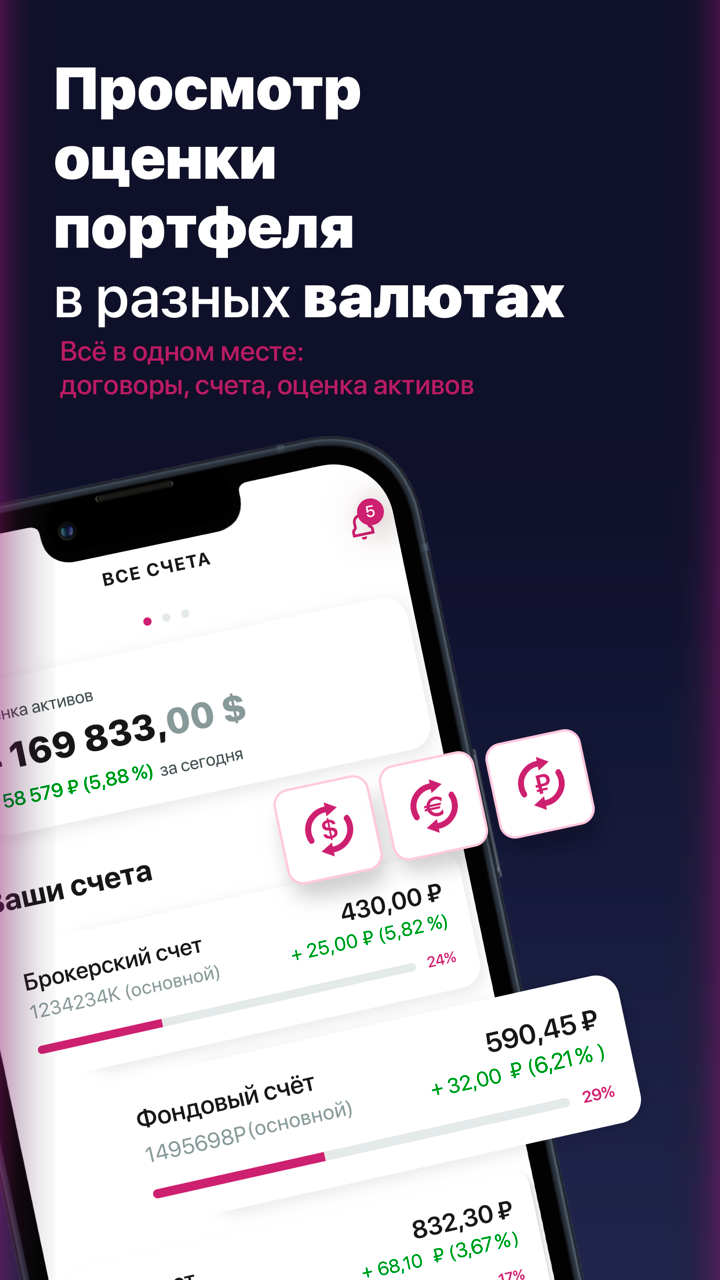

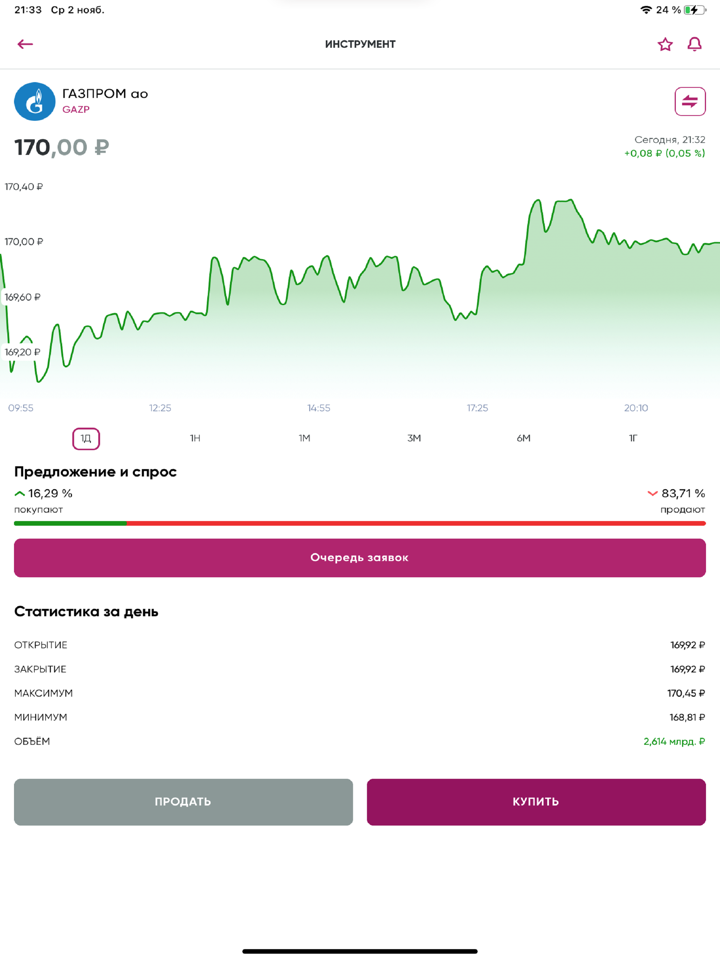

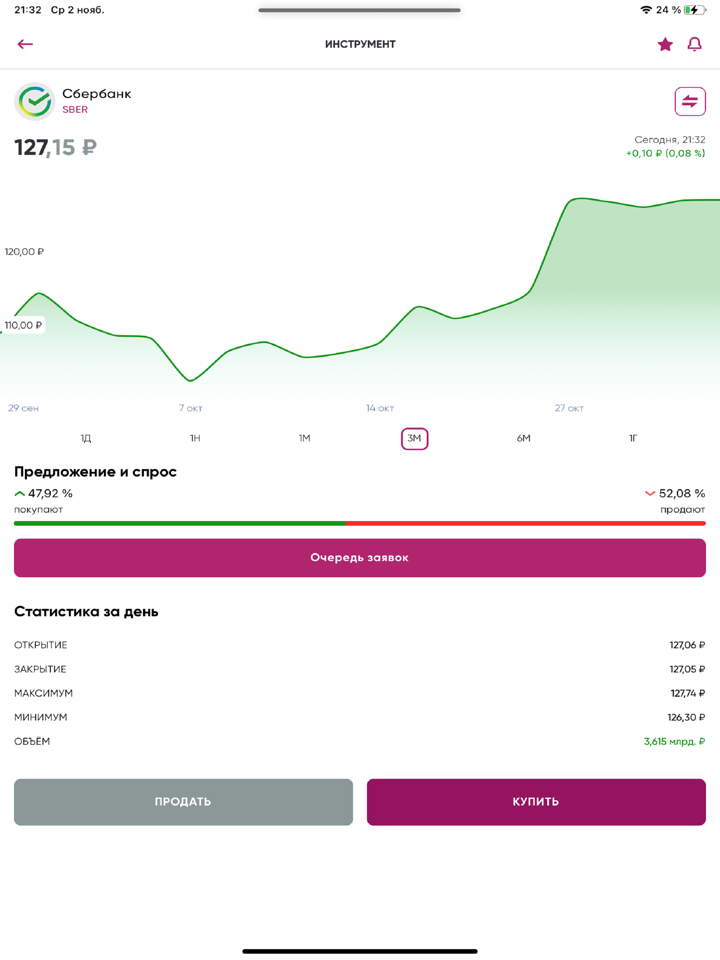

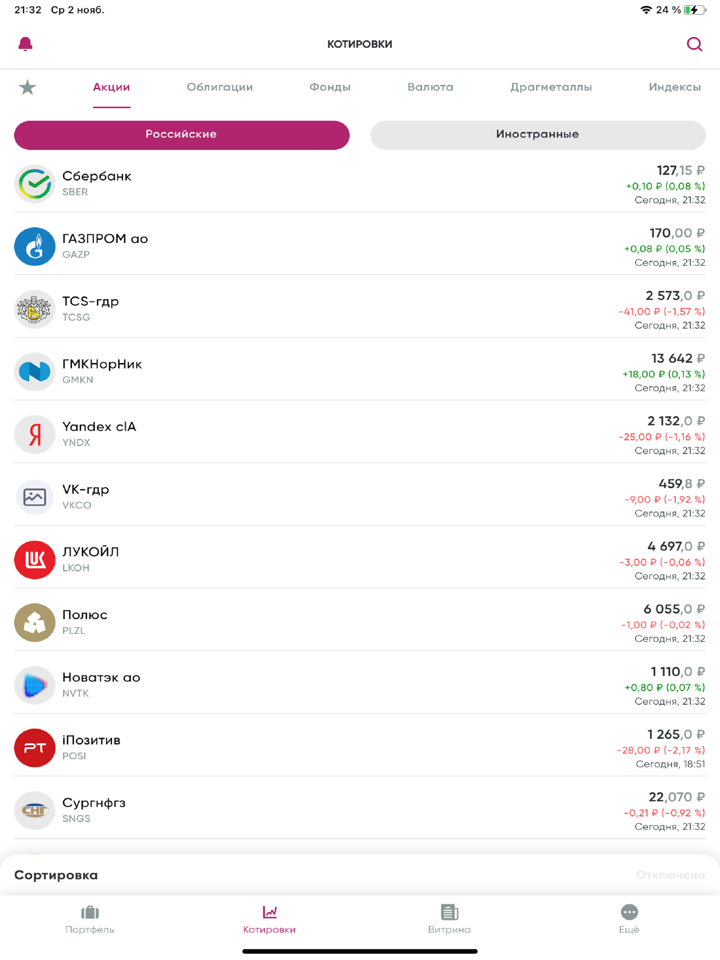

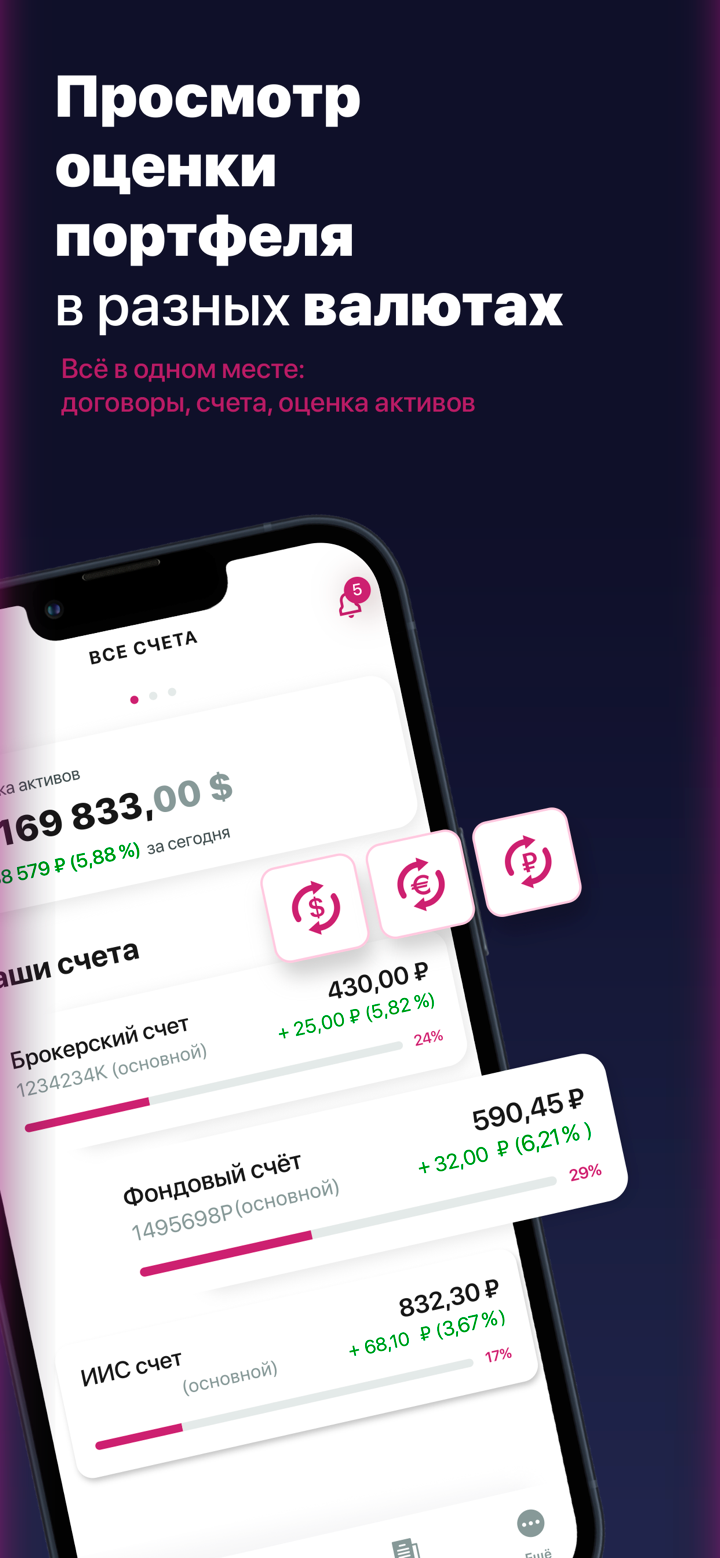

Produtos e Serviços

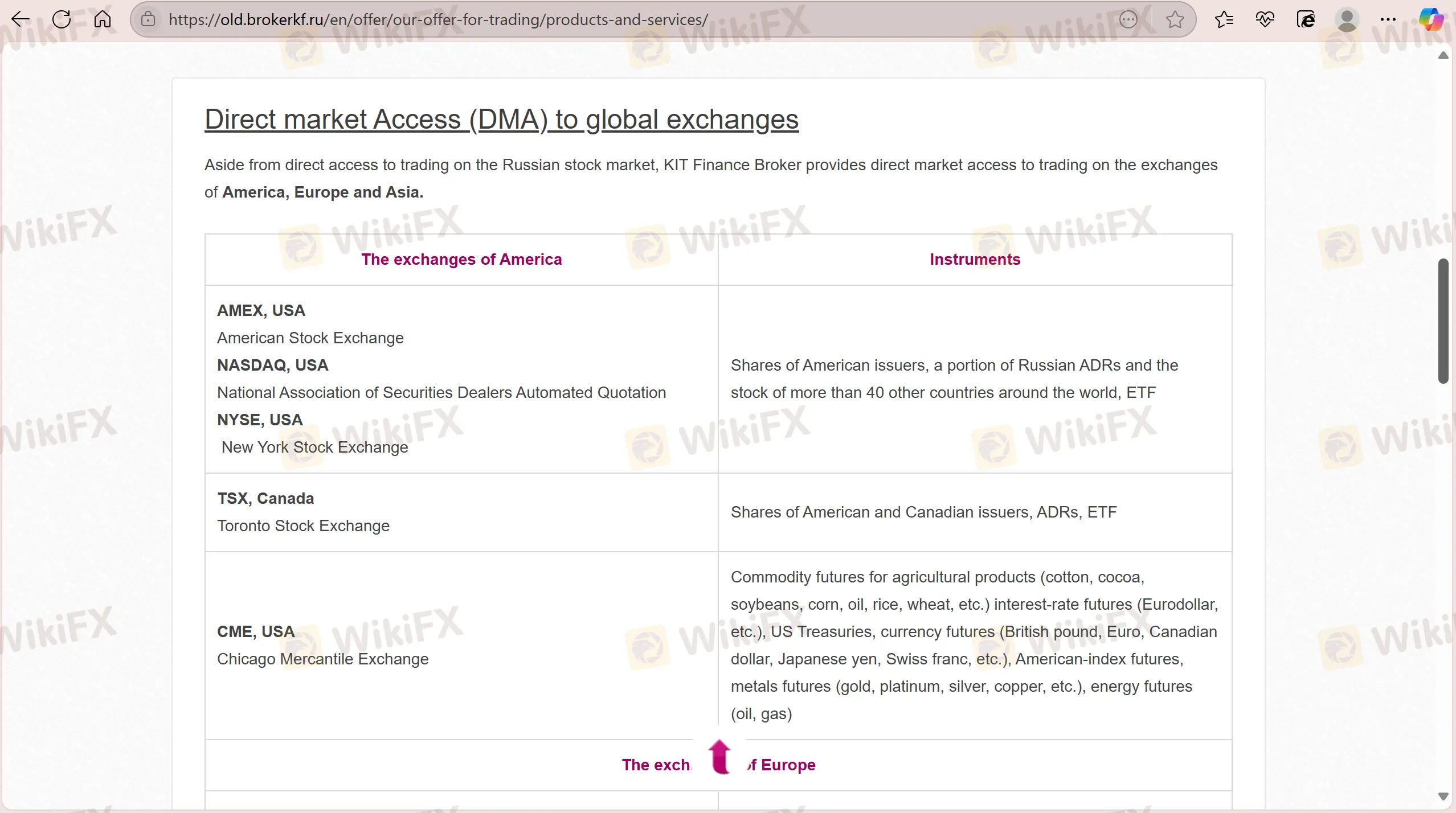

KIT Finance fornece serviços de corretagem e negociação para os mercados russo e global, atendendo tanto a clientes institucionais (bancos, companhias de seguros, gestores de ativos) quanto a pessoas físicas.

| Produtos / Serviços | Suportado |

| Ações | ✔ |

| ETFs | ✔ |

| Futuros | ✔ |

| Gestão de Ativos | ✔ |

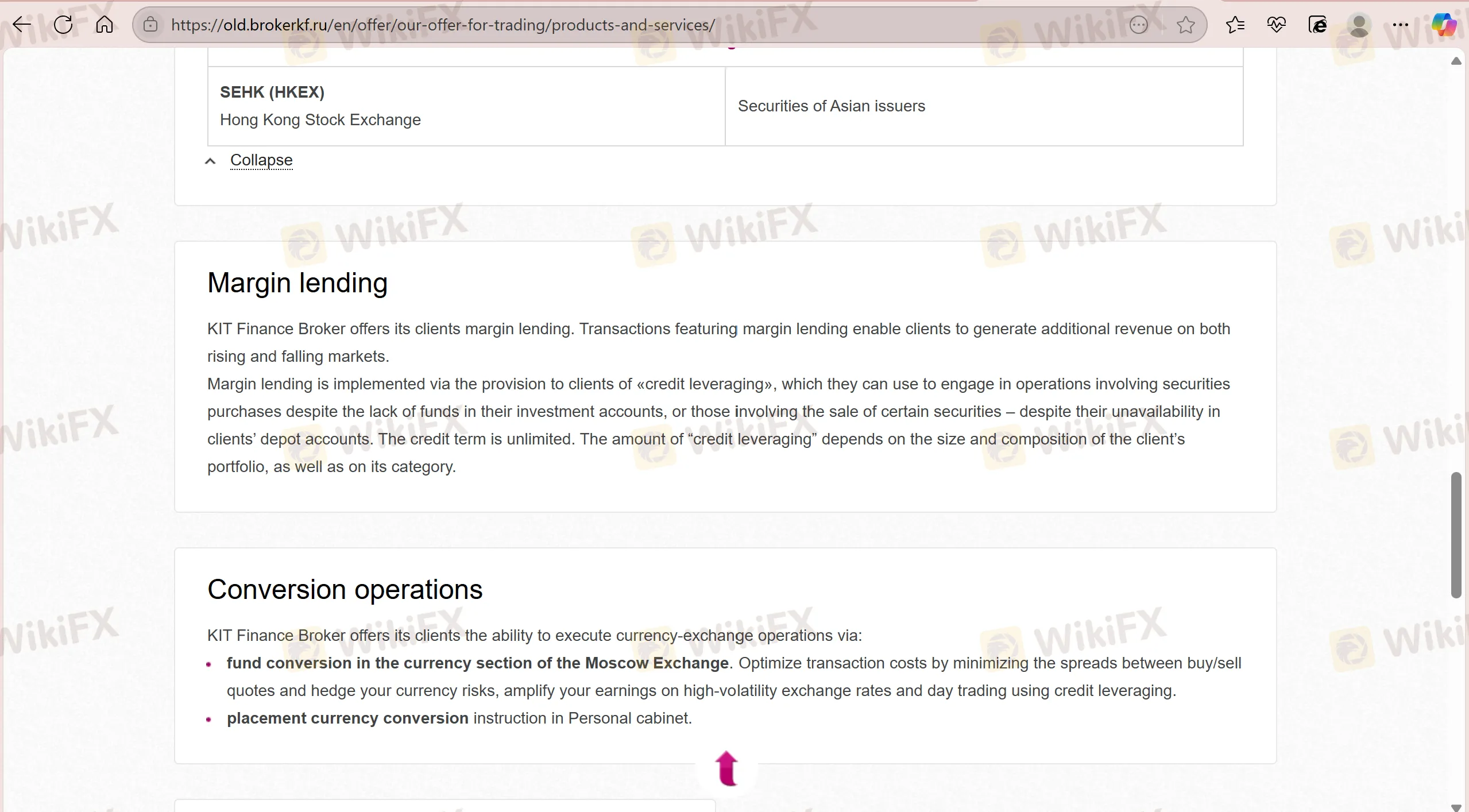

| Empréstimo de Margem | ✔ |

| Conversão de Moeda | ✔ |

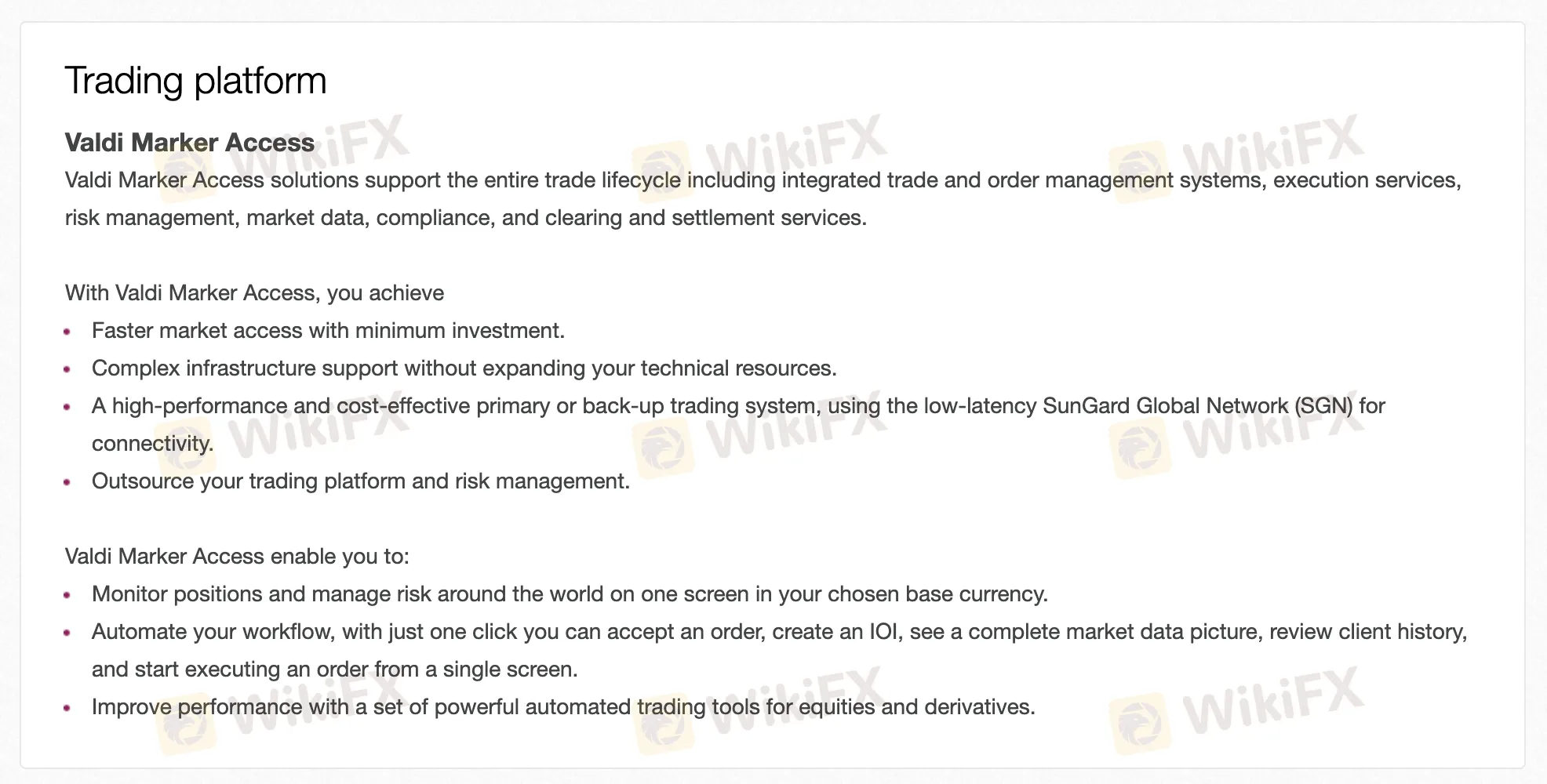

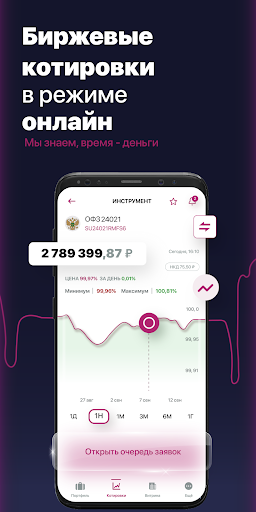

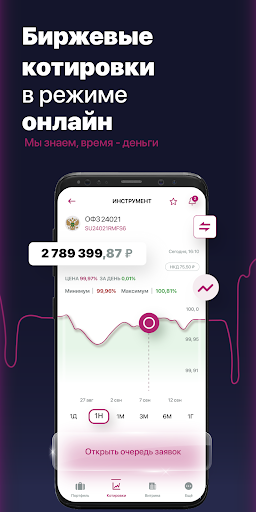

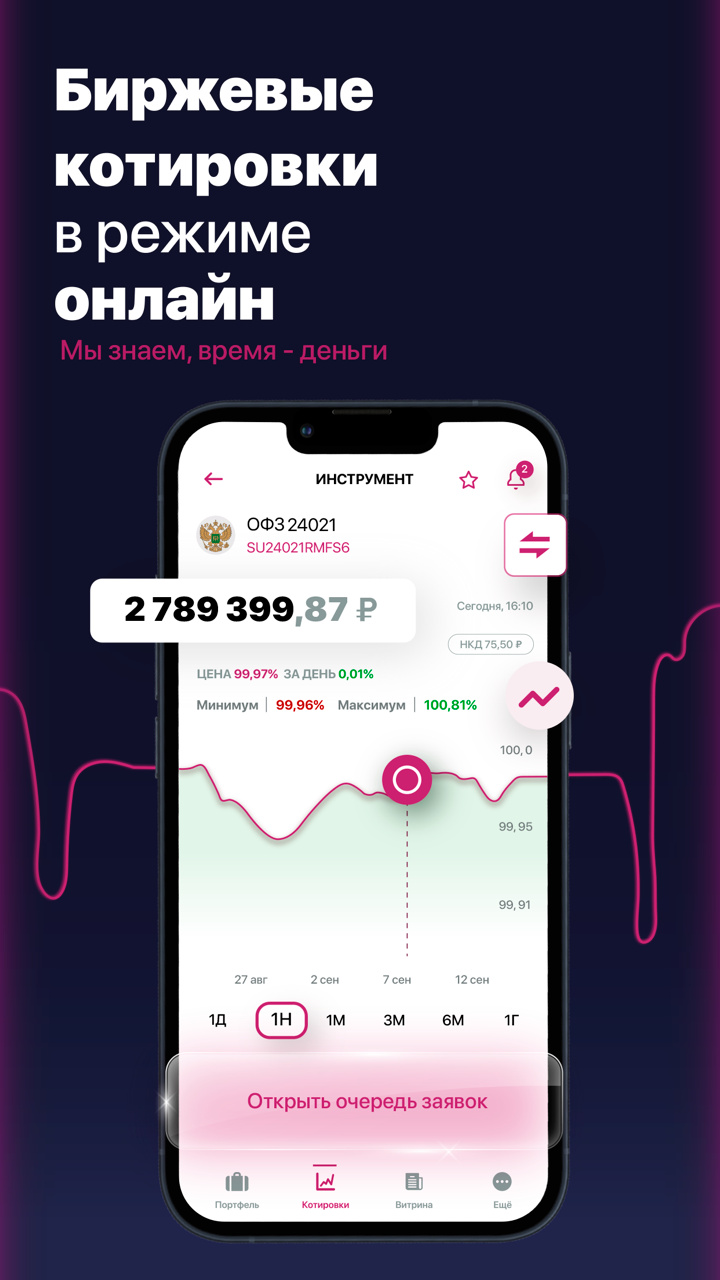

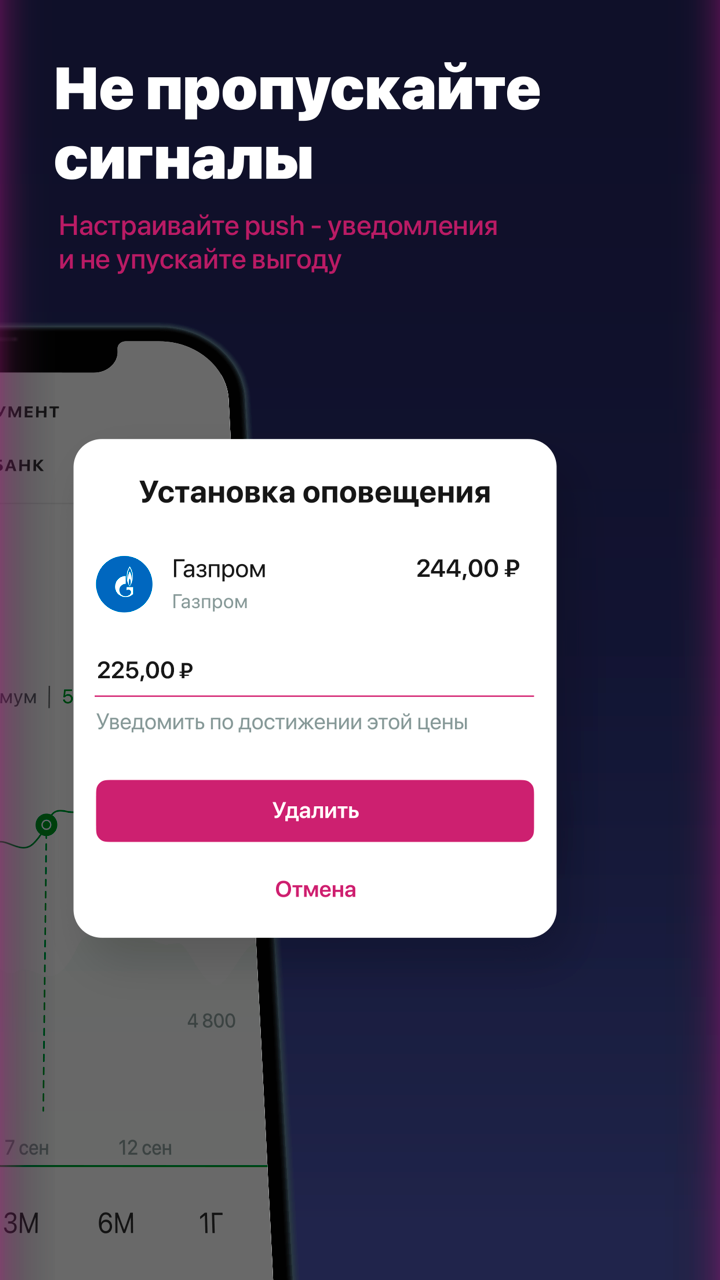

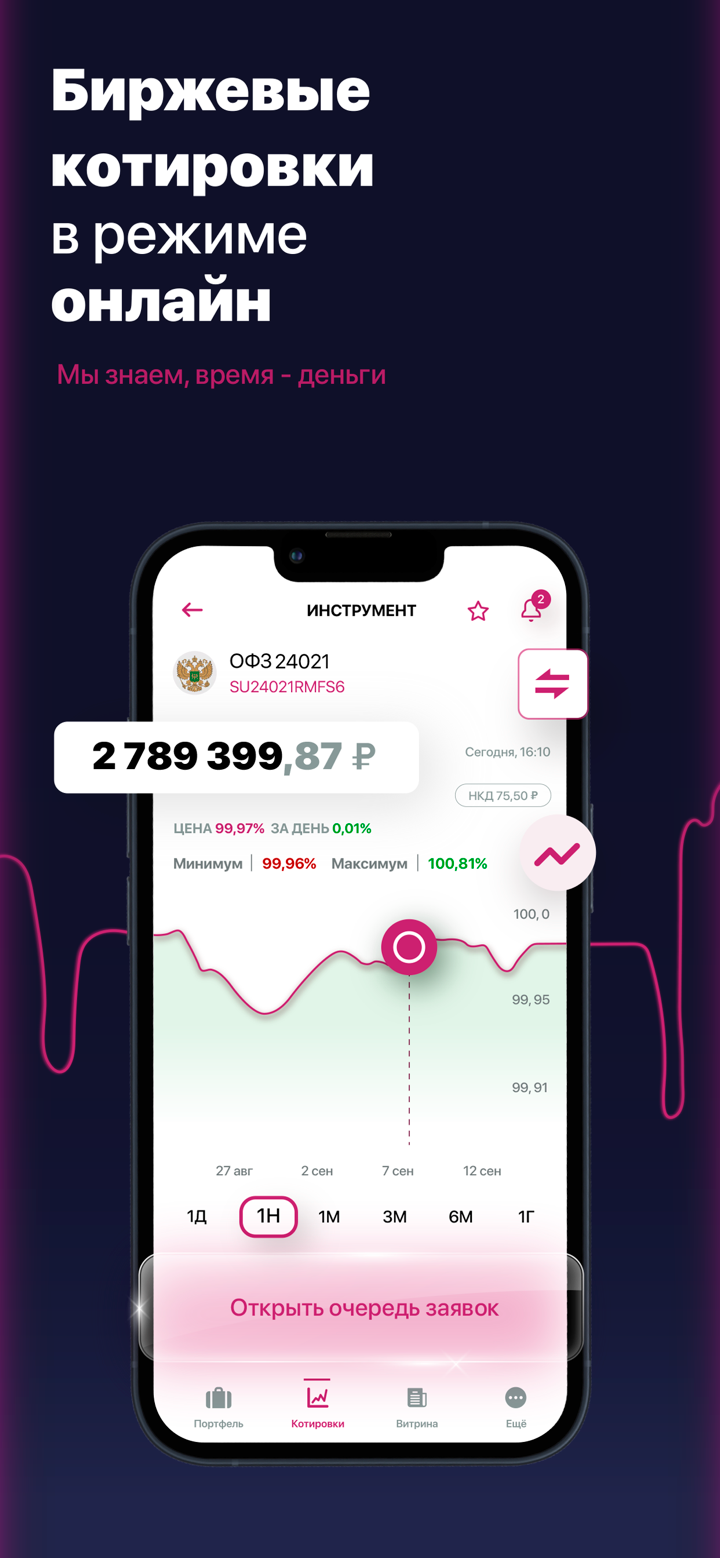

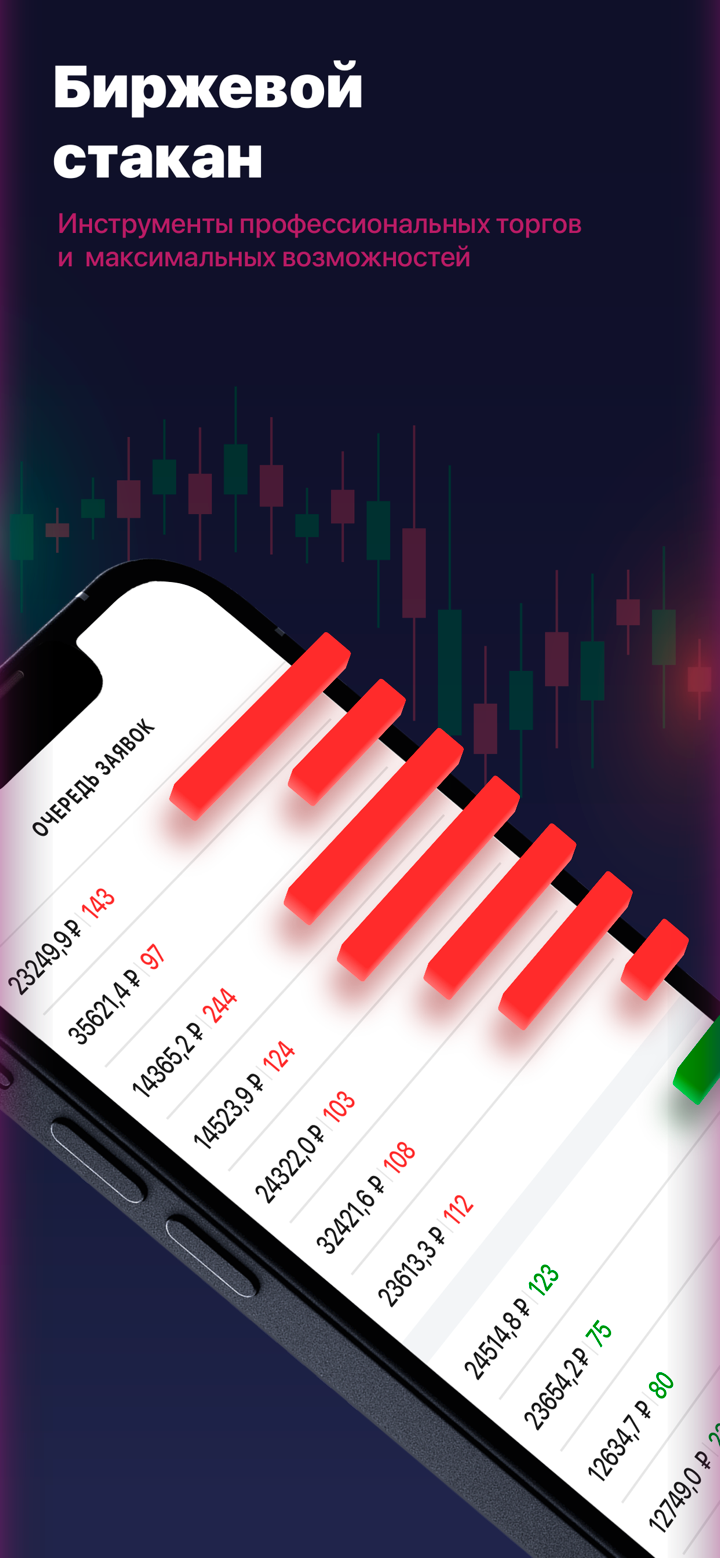

Plataforma de Negociação

KIT Finance oferece o Valdi Market Access, uma plataforma de negociação robusta voltada principalmente para usuários institucionais e profissionais. Ela cobre todo o ciclo de vida da transação, desde a execução até o gerenciamento de riscos, conformidade e liquidação, com ênfase em velocidade, automação e comunicação de baixa latência via SunGard Global Network (SGN). Não é destinada a usuários de varejo casuais.

| Plataforma de Negociação | Suportado | Dispositivos Disponíveis | Adequado para |

| Valdi Market Access | ✔ | Desktop (Windows) | / |

| MT4 | ❌ | / | Iniciantes |

| MT5 | ❌ | / | Traders experientes |