مقدمة عن الشركة

| KIT ملخص المراجعة | |

| تأسست | 2000 |

| البلد/المنطقة المسجلة | روسيا |

| التنظيم | لا يوجد تنظيم |

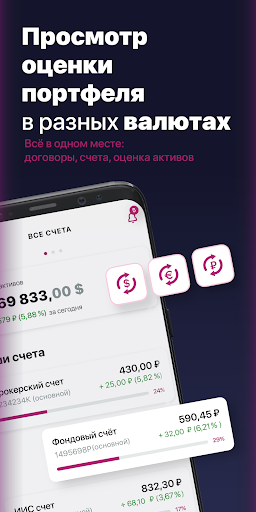

| المنتجات والخدمات | إدارة الأصول، تحويل العملات، الرهون البنكية، صناديق تداول البورصة المتداولة، الأسهم، العقود الآجلة |

| حساب تجريبي | / |

| الرافعة المالية | / |

| الانتشار | / |

| منصة التداول | Valdi Market Access |

| الحد الأدنى للإيداع | / |

| دعم العملاء | الهاتف: 8 800 700-00-55 |

| الفاكس: +7 (812) 332 32 91 | |

| وسائل التواصل الاجتماعي: تليجرام، VK، يوتيوب | |

| العنوان: 69-71، شارع ماراتا، مركز أعمال "رينيسانس بلازا"، سانت بطرسبرغ، روسيا، 191119 | |

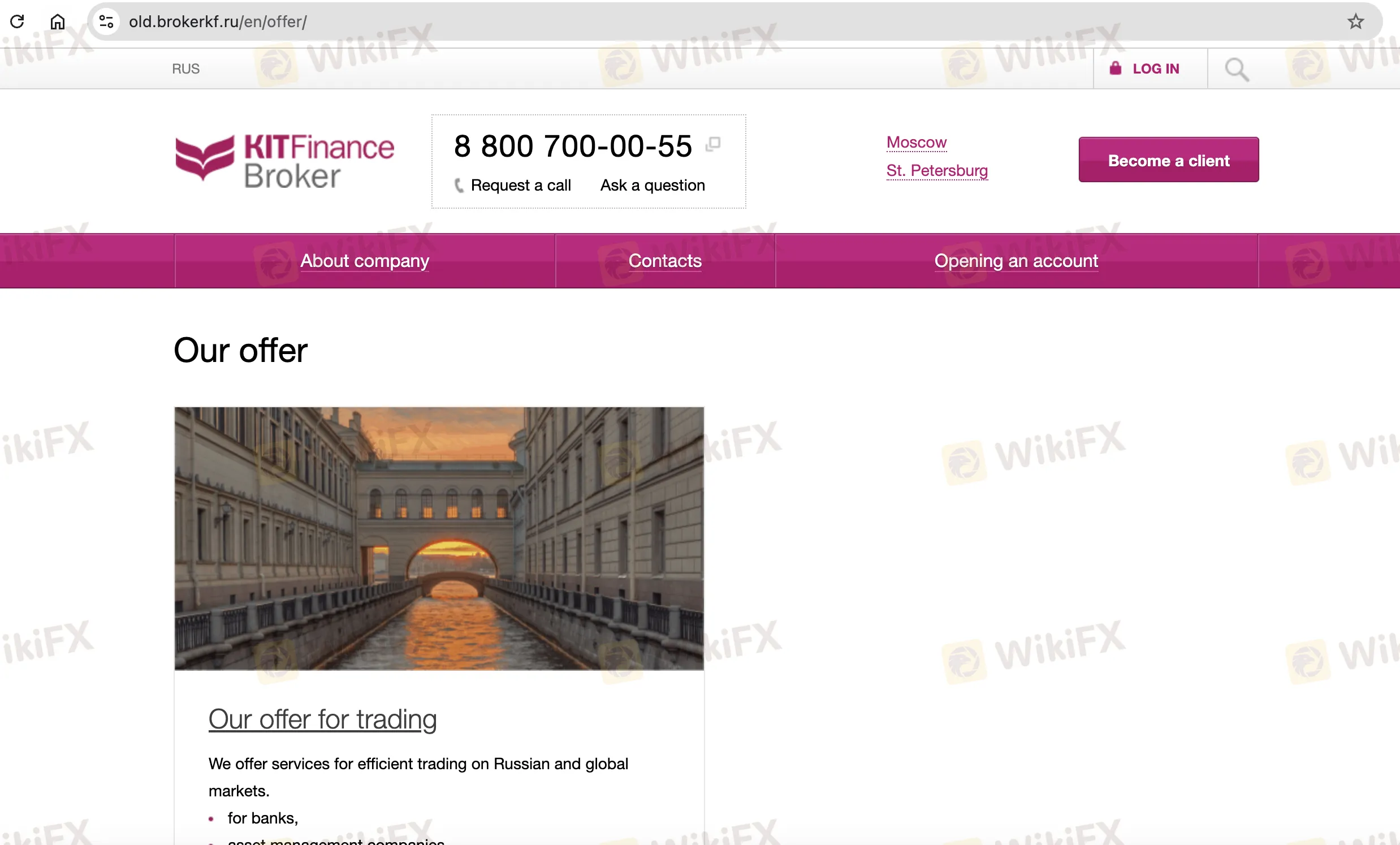

معلومات KIT

KIT Finance، التي تأسست في عام 2000 ومقرها في روسيا، هي وسيط غير منظم غير مرخص من قبل البنك المركزي الروسي أو أي سلطات رئيسية أخرى. توفر الوصول إلى الأسواق المالية الروسية والعالمية باستخدام تقنيات عالية المستوى مثل Valdi Market Access.

الإيجابيات والسلبيات

| الإيجابيات | السلبيات |

| يوفر الوصول إلى الأسواق الروسية والعالمية | غير منظم |

| يدعم العملاء المؤسسيين والمحترفين | نقص في الشفافية |

| تاريخ عمل طويل | |

| أدوات تداول متقدمة وبنية تحتية | |

| قنوات اتصال متنوعة |

هل KIT شرعية؟

KIT Finance ليست وسيطًا منظمًا. على الرغم من تسجيلها في روسيا، إلا أنها لا تخضع لأي سلطة مالية روسية معترف بها، مثل البنك المركزي الروسي، لأغراض الوساطة أو الاستثمار.

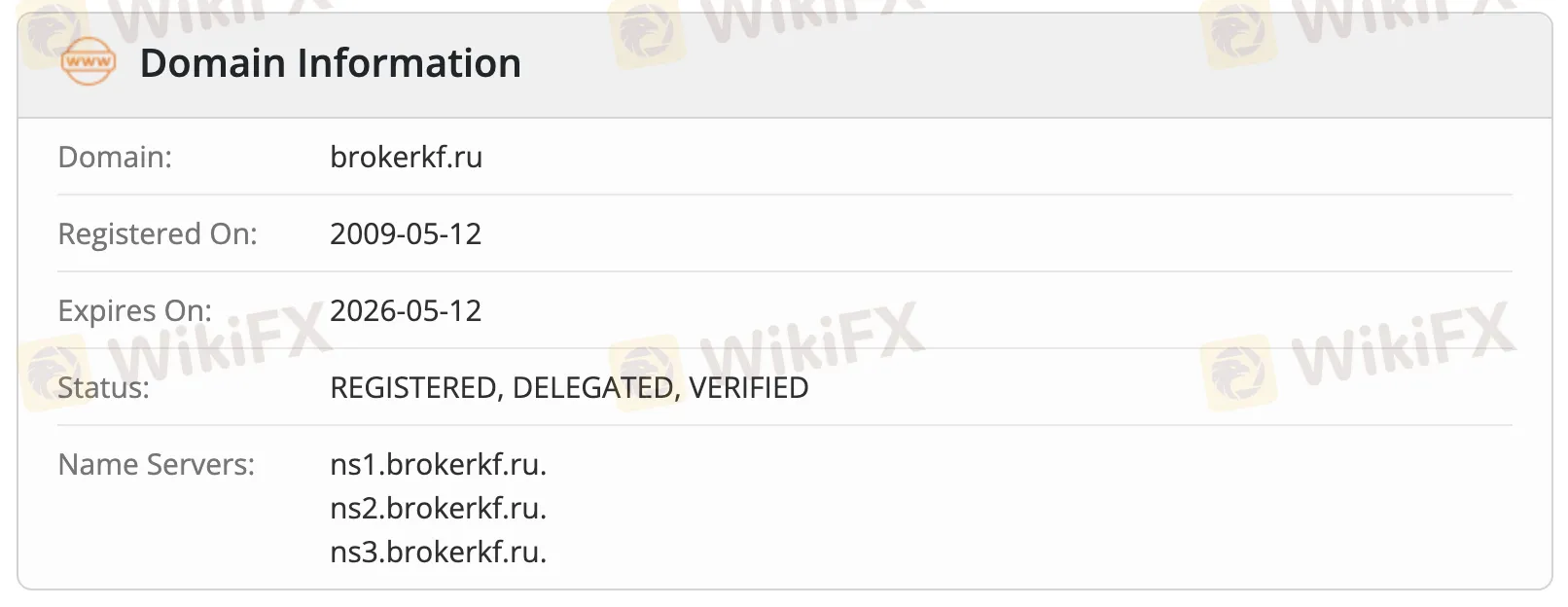

وفقًا لسجلات WHOIS، تم تسجيل نطاق brokerkf.ru في 12 مايو 2009 وهو ما زال حيًا، بحالة "مسجل، مفوض، تم التحقق منه". سينتهي النطاق في 12 مايو 2026، ويتم استضافته على خوادم أسماءه الخاصة: ns1.brokerkf.ru، ns2.brokerkf.ru، وns3.brokerkf.ru.

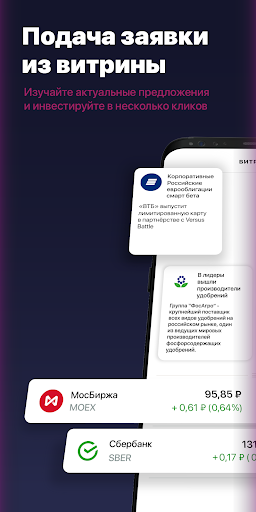

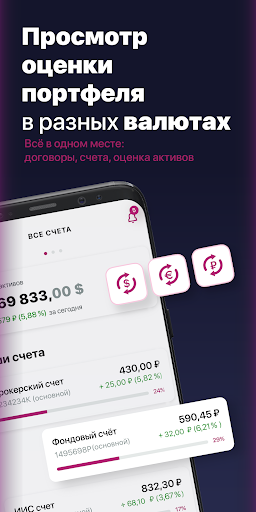

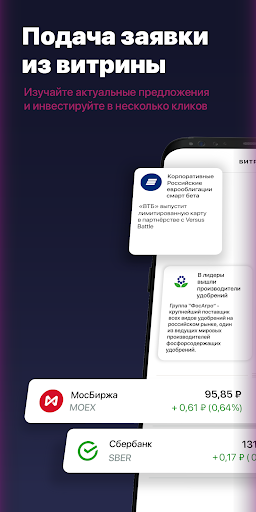

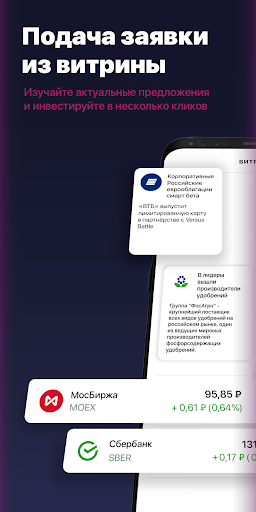

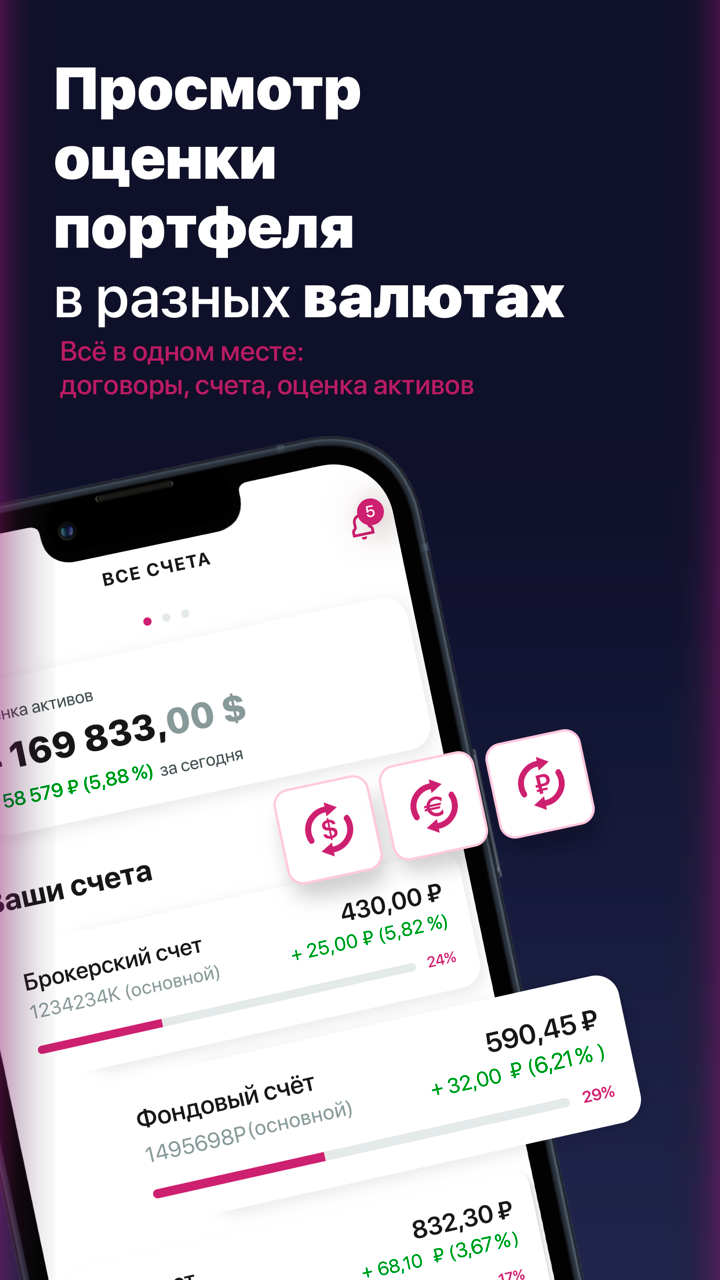

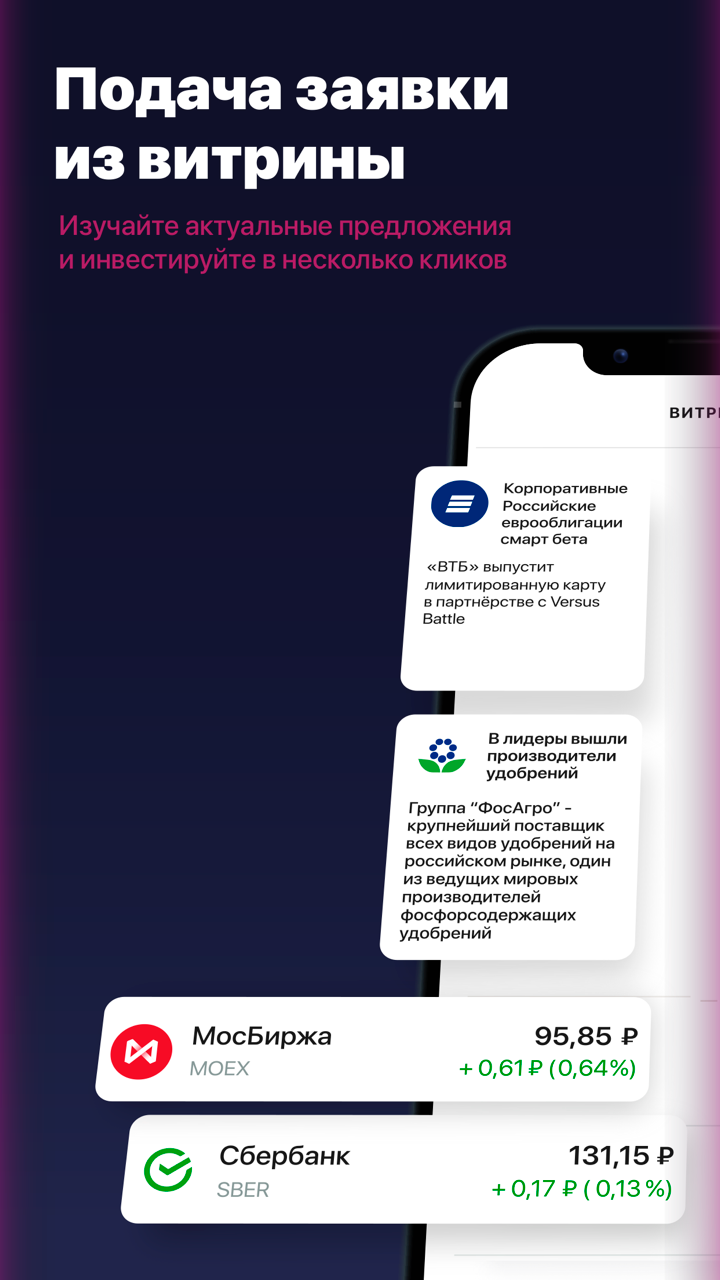

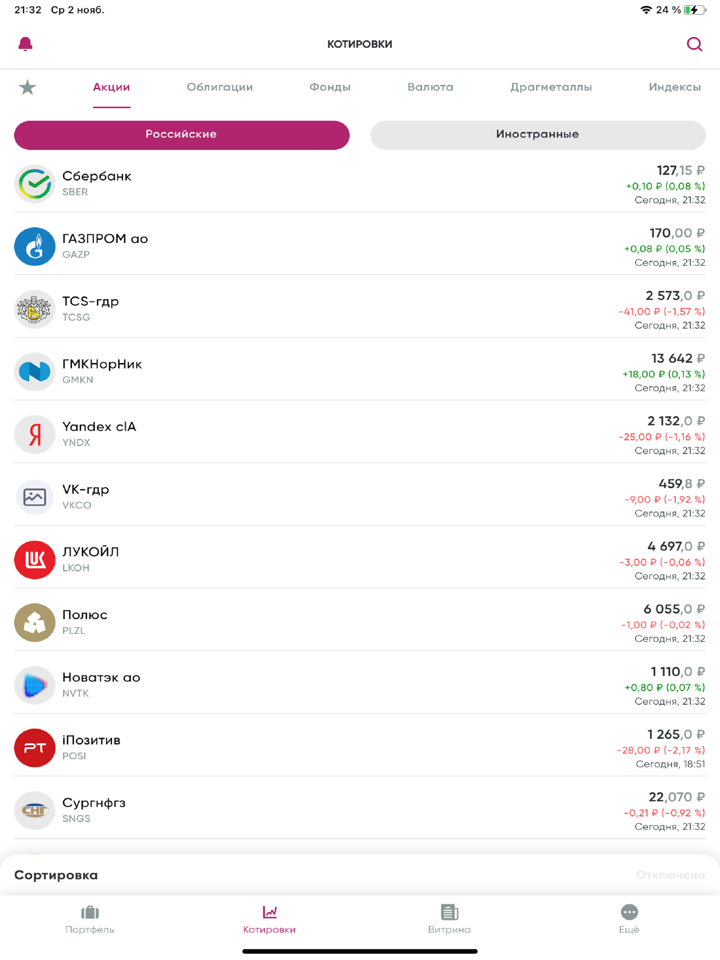

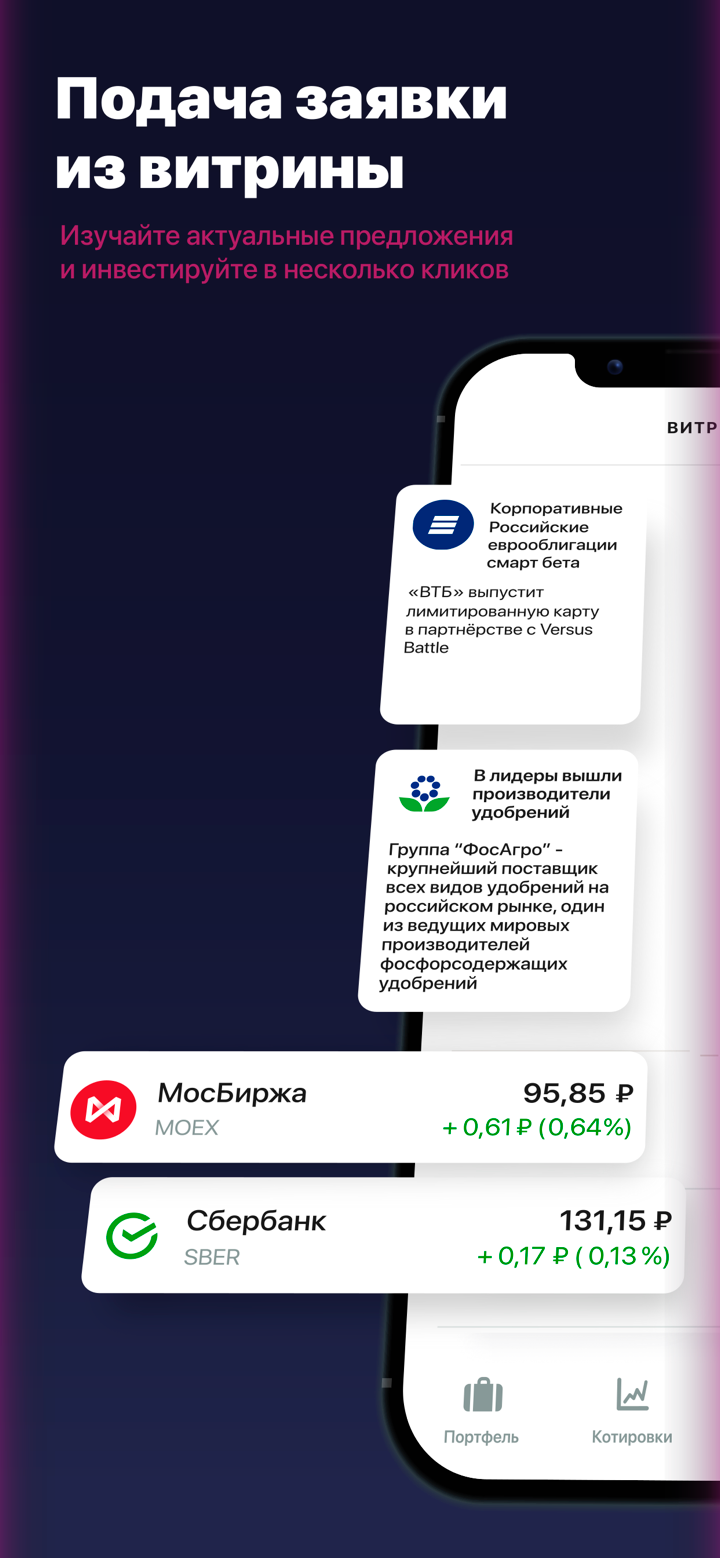

المنتجات والخدمات

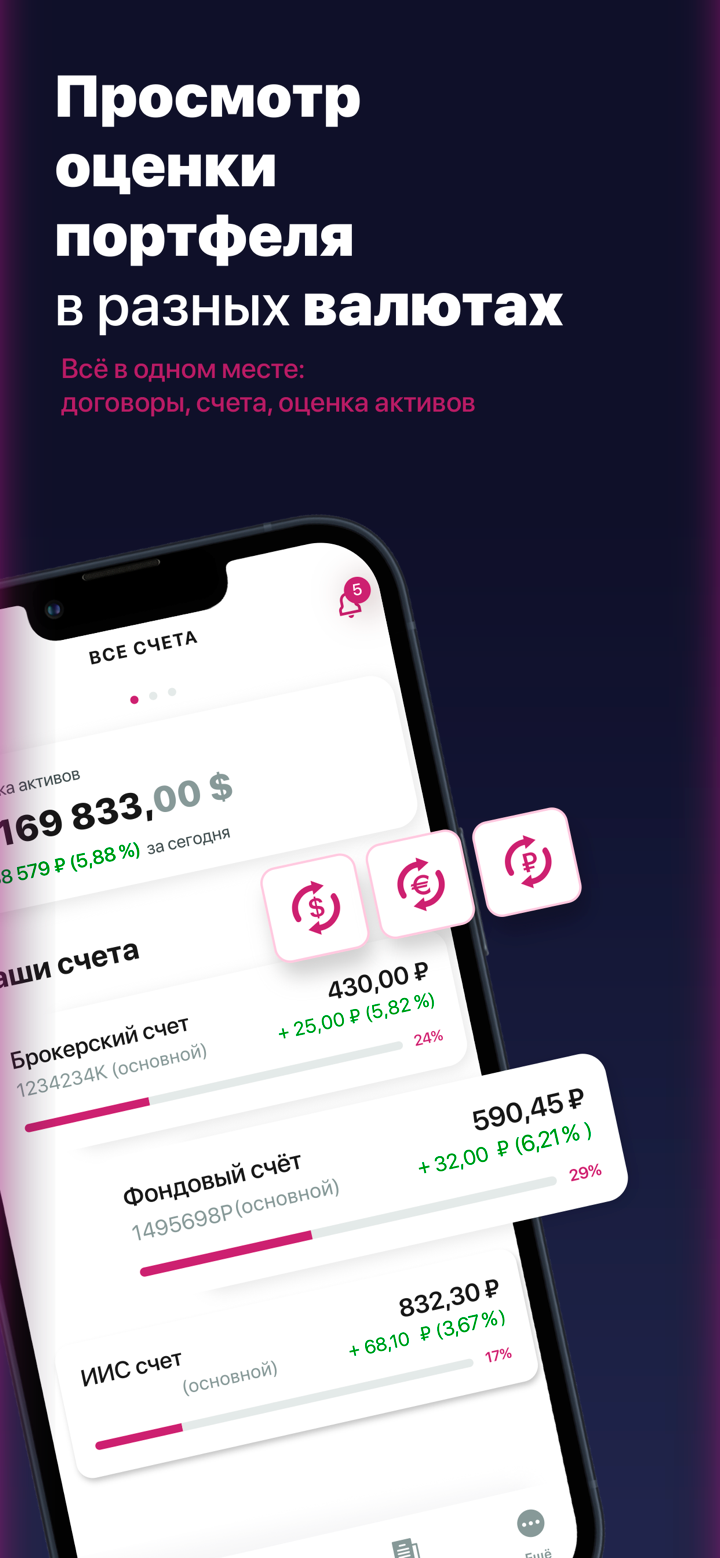

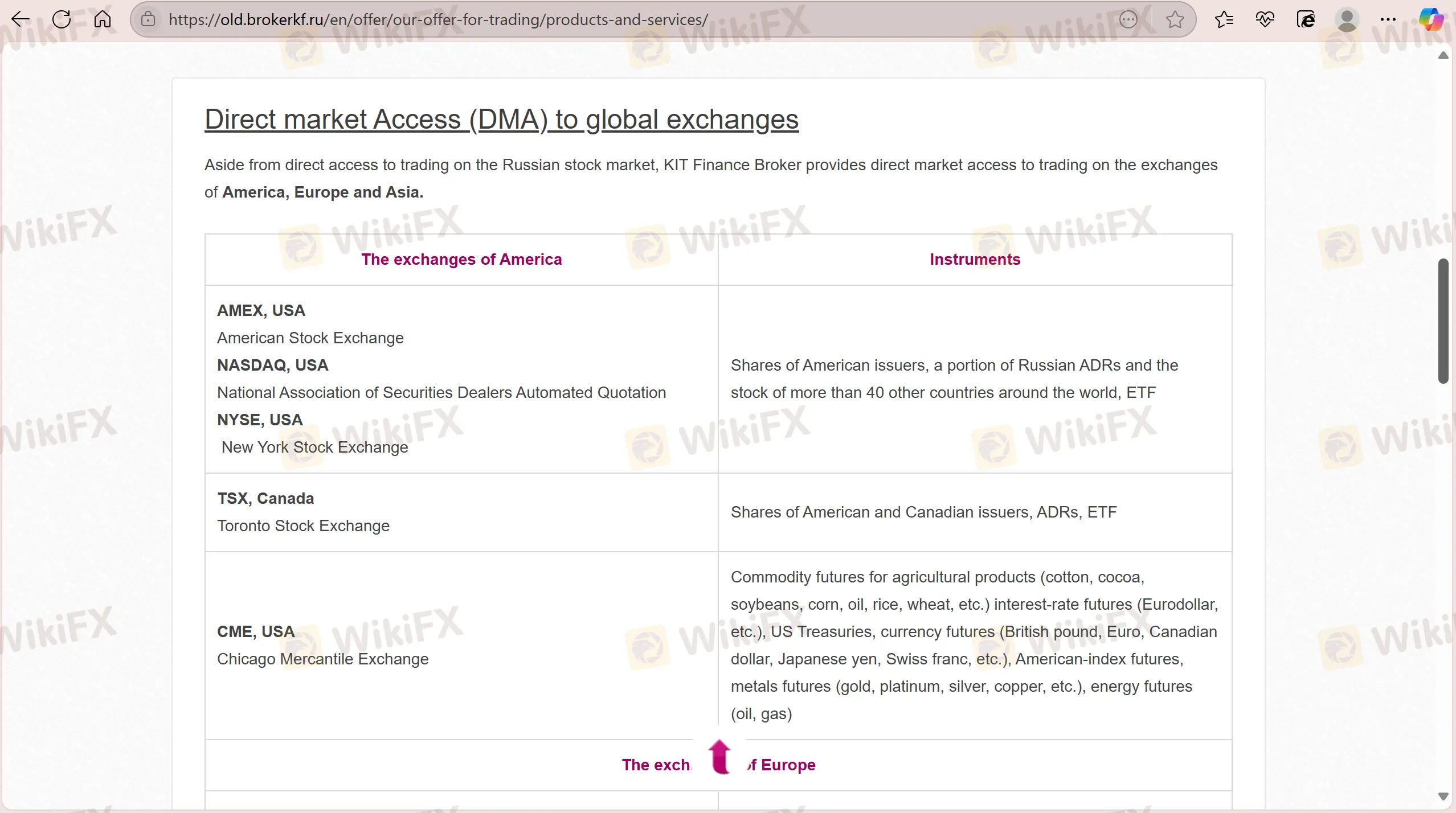

KIT Finance توفر خدمات وساطة وتداول للأسواق الروسية والعالمية، مخدمة لكل من العملاء المؤسسيين (البنوك، شركات التأمين، مديري الأصول) والأفراد الخاصين.

| المنتجات / الخدمات | مدعوم |

| الأسهم | ✔ |

| صناديق الاستثمار المتداولة (ETFs) | ✔ |

| العقود الآجلة (Futures) | ✔ |

| إدارة الأصول | ✔ |

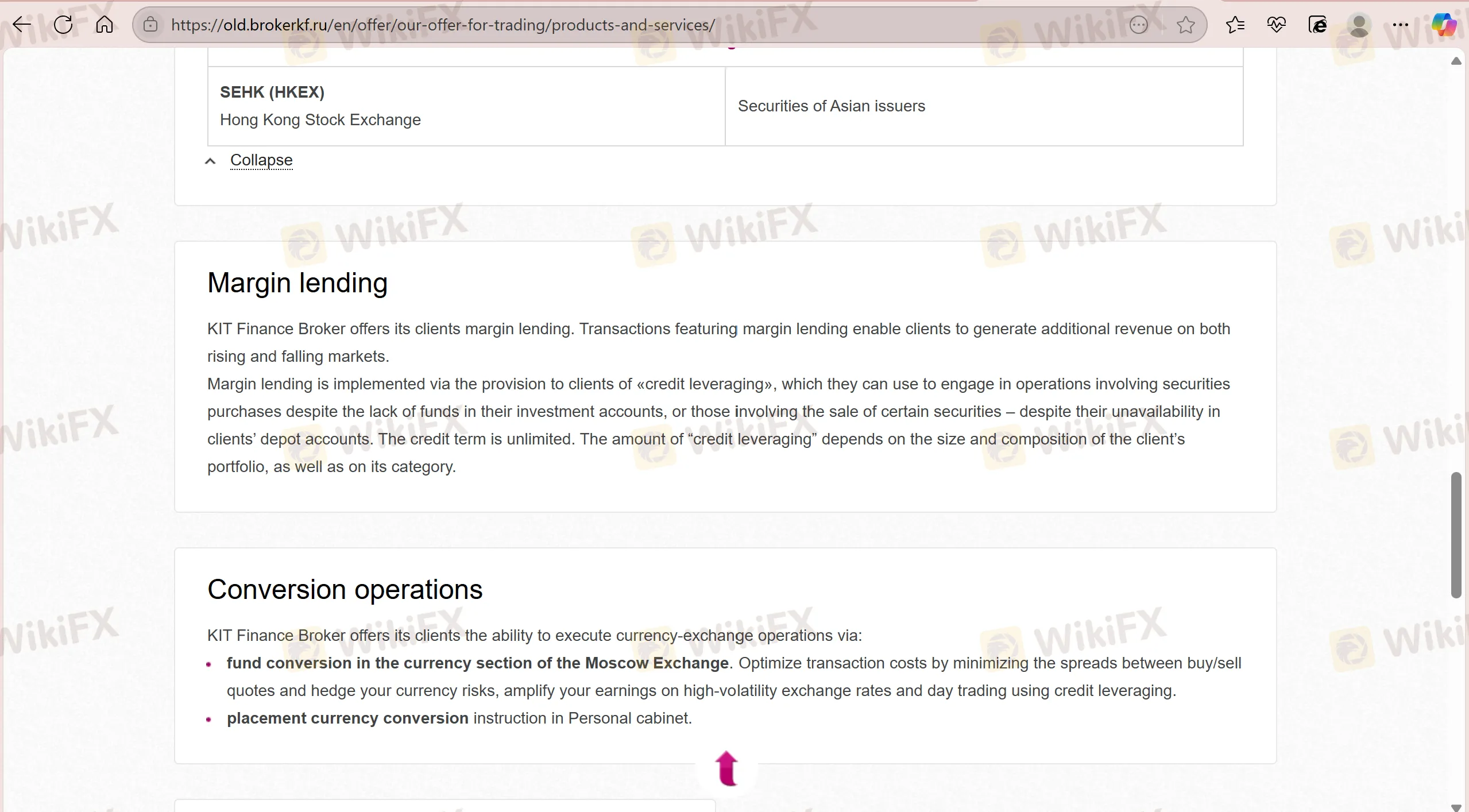

| الإقراض بالهامش | ✔ |

| تحويل العملات | ✔ |

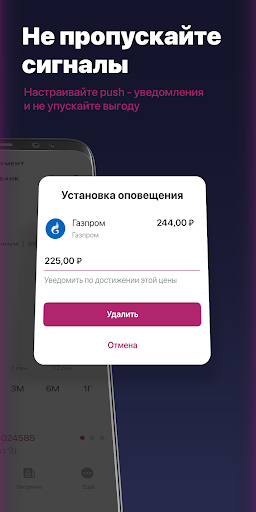

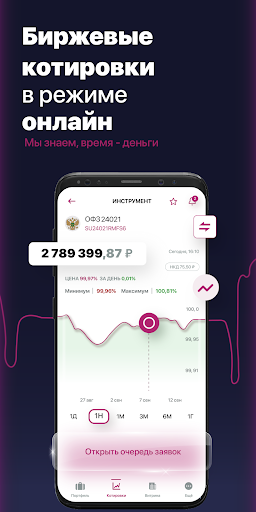

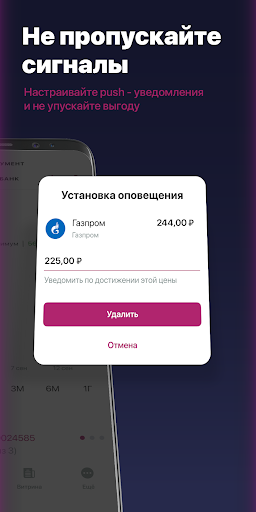

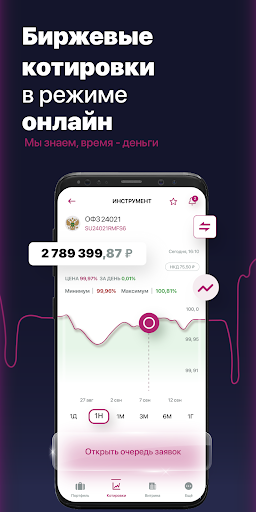

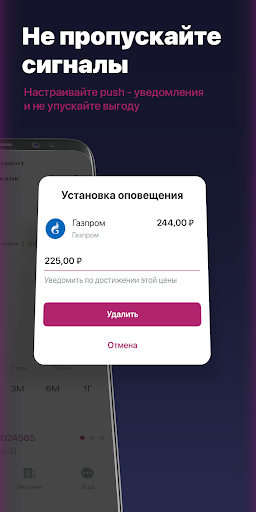

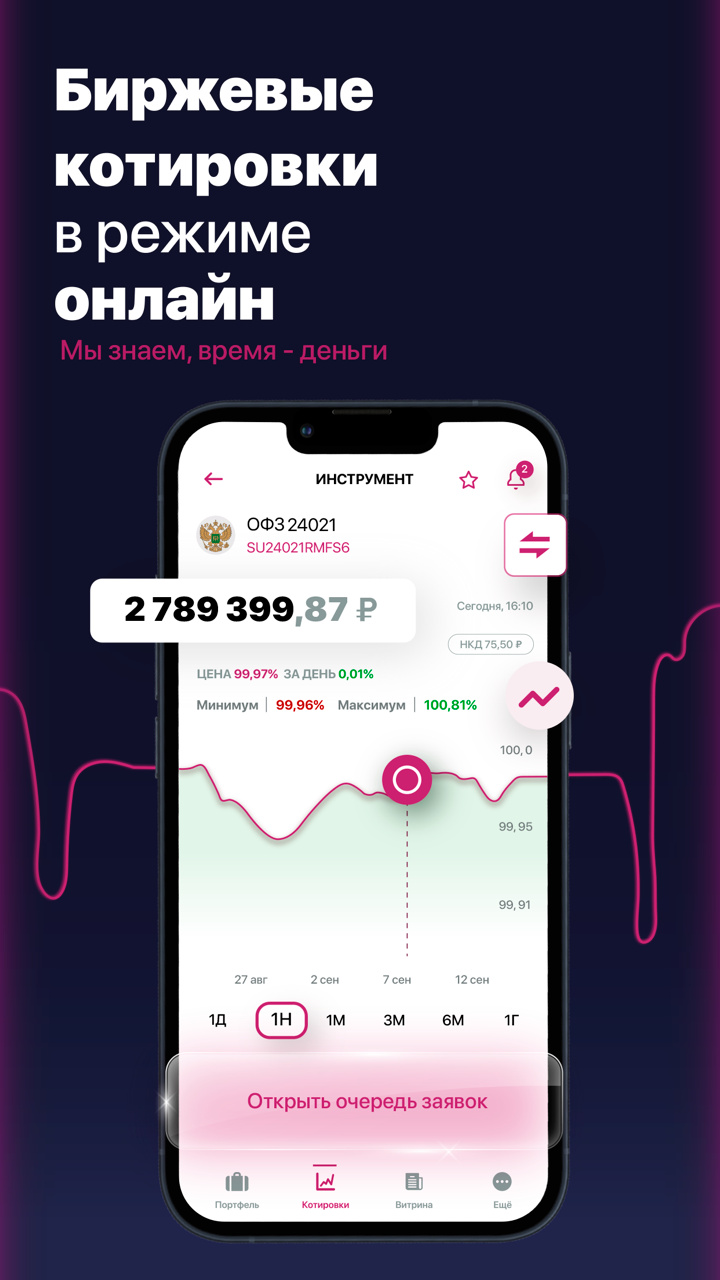

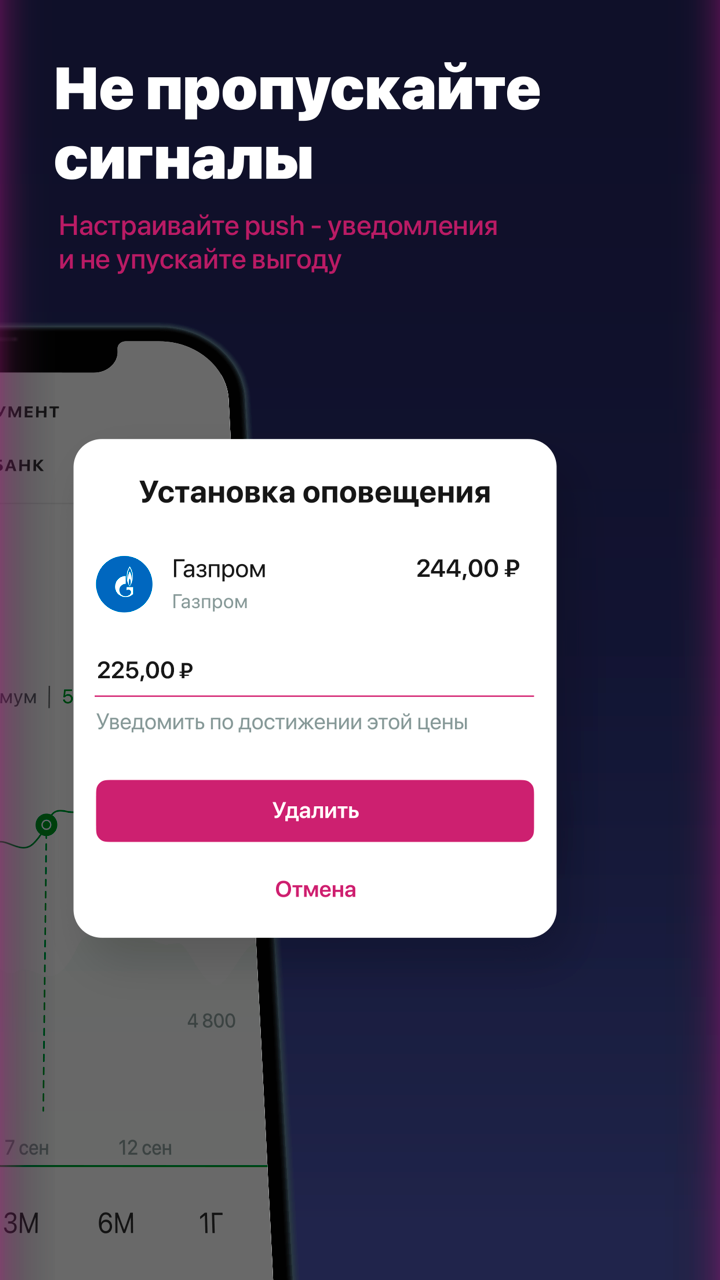

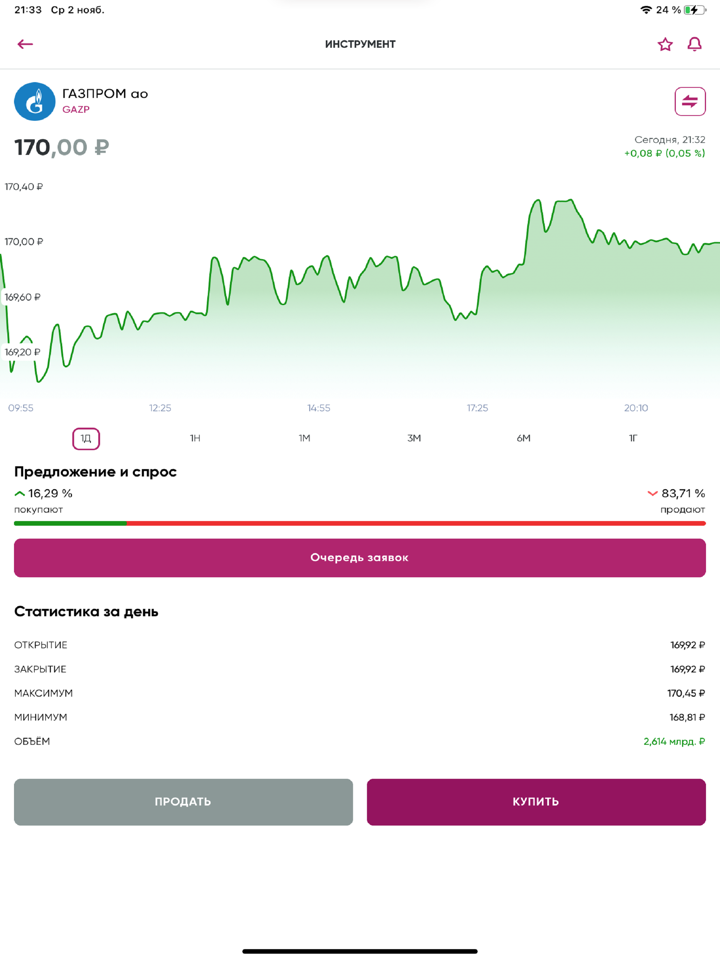

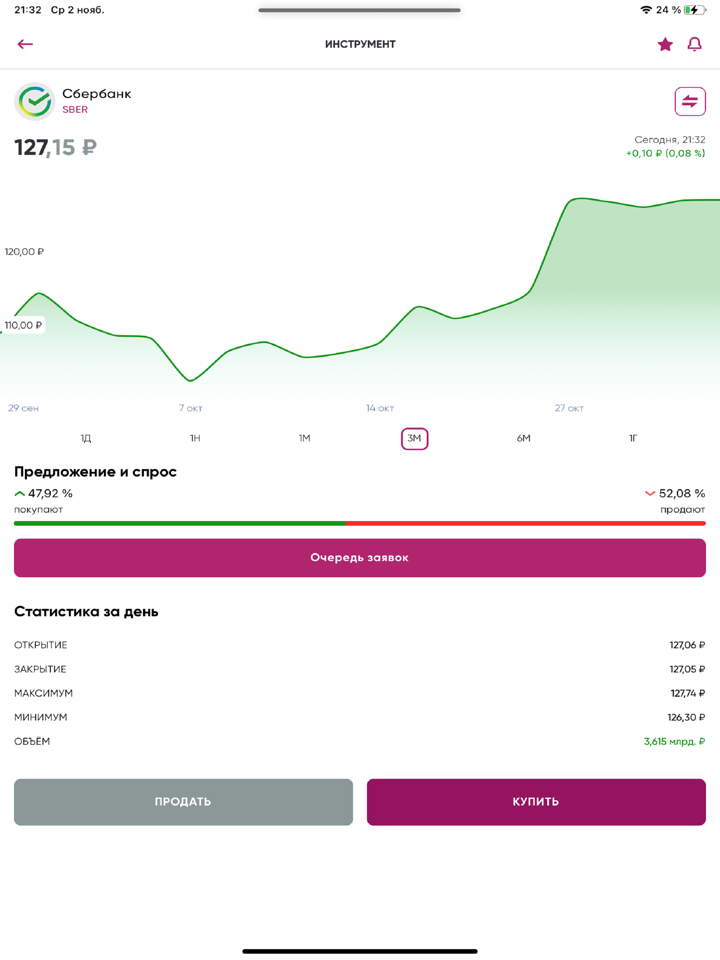

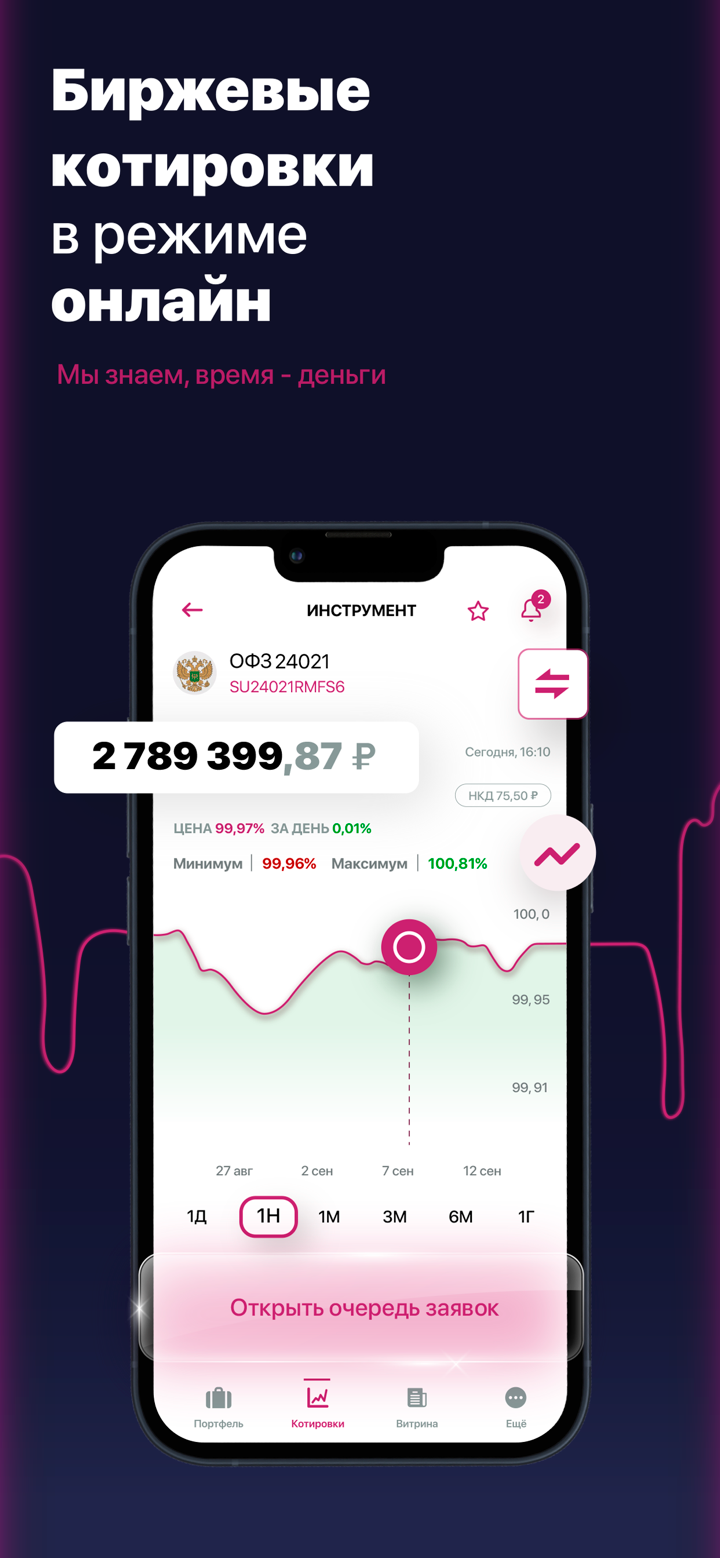

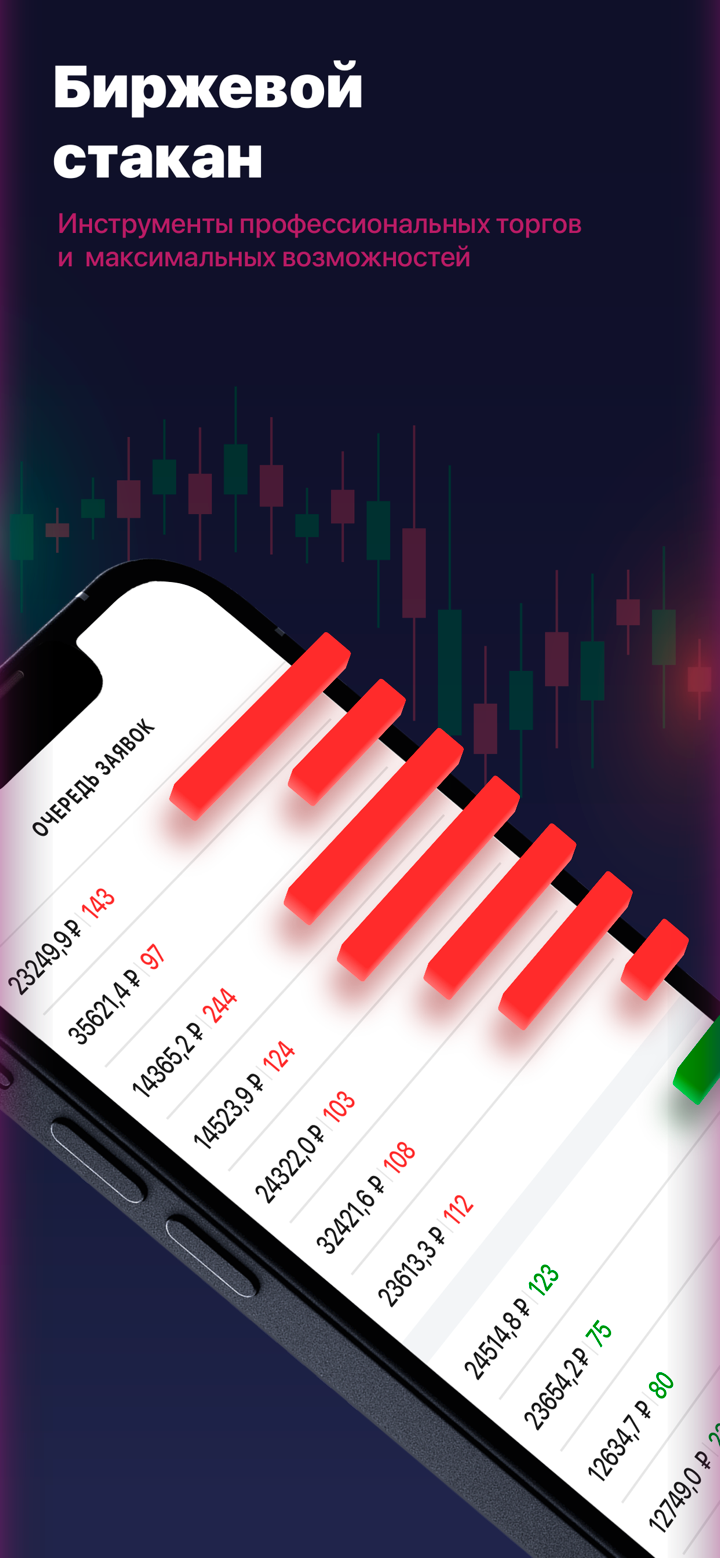

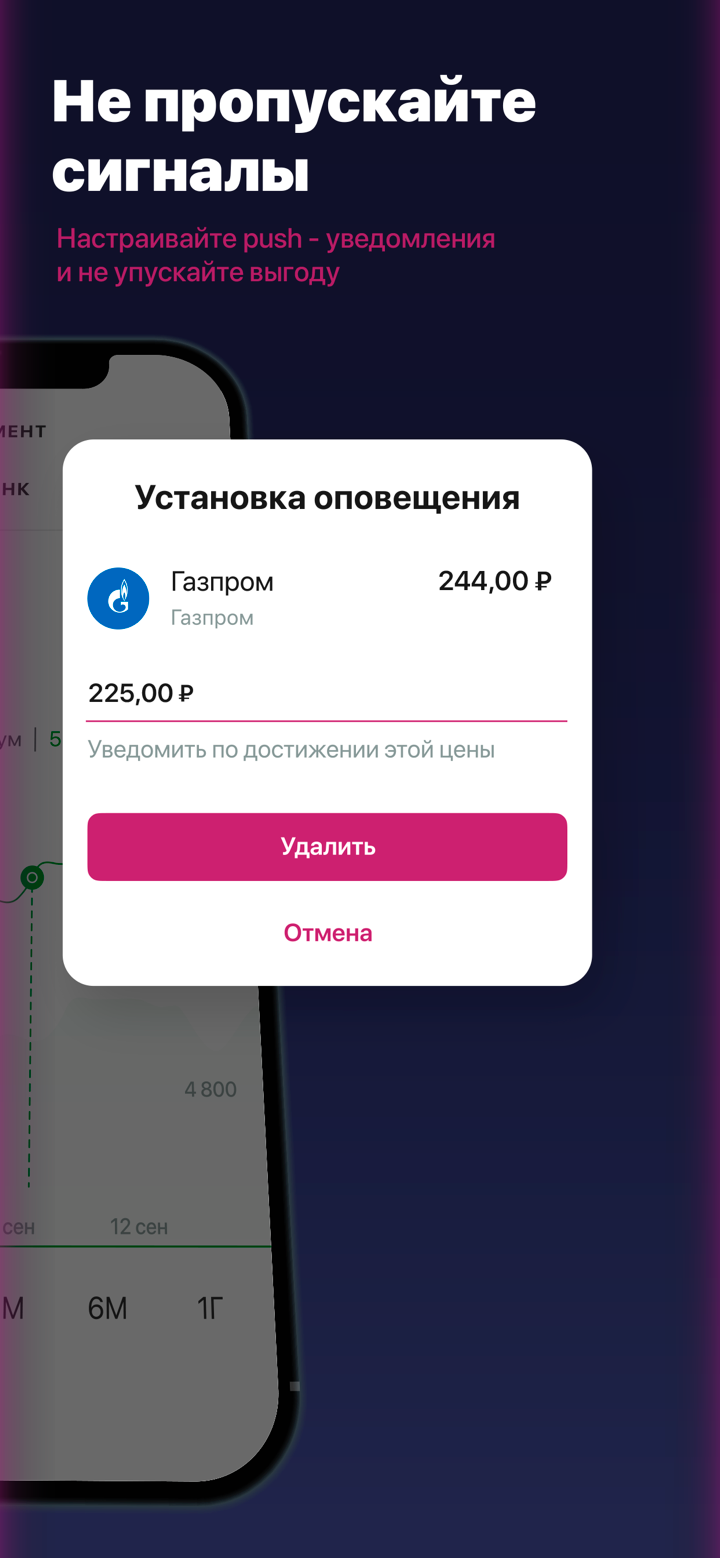

منصة التداول

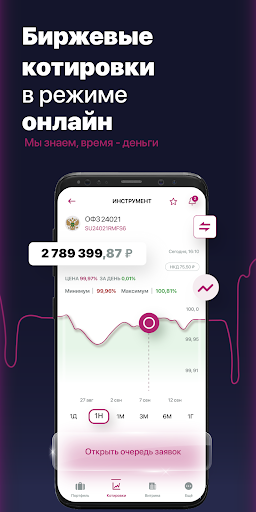

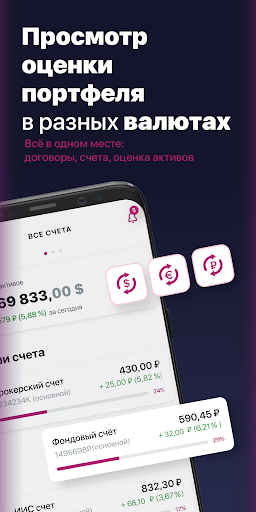

KIT Finance توفر Valdi Market Access، وهي منصة تداول قوية موجهة بشكل كبير نحو المستخدمين المؤسسيين والمحترفين. تغطي دورة حياة الصفقات بالكامل، من التنفيذ إلى إدارة المخاطر والامتثال والتسوية، مع التركيز على السرعة والتلقائية والاتصال ذو الكفاءة المنخفضة عبر شبكة SunGard Global Network (SGN). ليست مخصصة للمستخدمين التجزئة العاديين.

| منصة التداول | مدعوم | الأجهزة المتاحة | مناسبة لـ |

| Valdi Market Access | ✔ | سطح المكتب (ويندوز) | / |

| MT4 | ❌ | / | المبتدئين |

| MT5 | ❌ | / | المتداولين المتمرسين |