Buod ng kumpanya

| KIT Buod ng Pagsusuri | |

| Itinatag | 2000 |

| Rehistradong Bansa/Rehiyon | Russia |

| Regulasyon | Walang regulasyon |

| Mga Produkto at Serbisyo | Asset management, currency conversion, margin lending, ETFs, stocks, futures |

| Demo Account | / |

| Levadura | / |

| Spread | / |

| Platform ng Paggawa ng Kalakalan | Valdi Market Access |

| Minimum na Deposito | / |

| Suporta sa Customer | Telepono: 8 800 700-00-55 |

| Fax: +7 (812) 332 32 91 | |

| Social Media: Telegram, VK, YouTube | |

| Address: 69-71, Marata str., Business center «Renaissance Plaza», St. Petersburg, Russia, 191119 | |

Impormasyon ng KIT

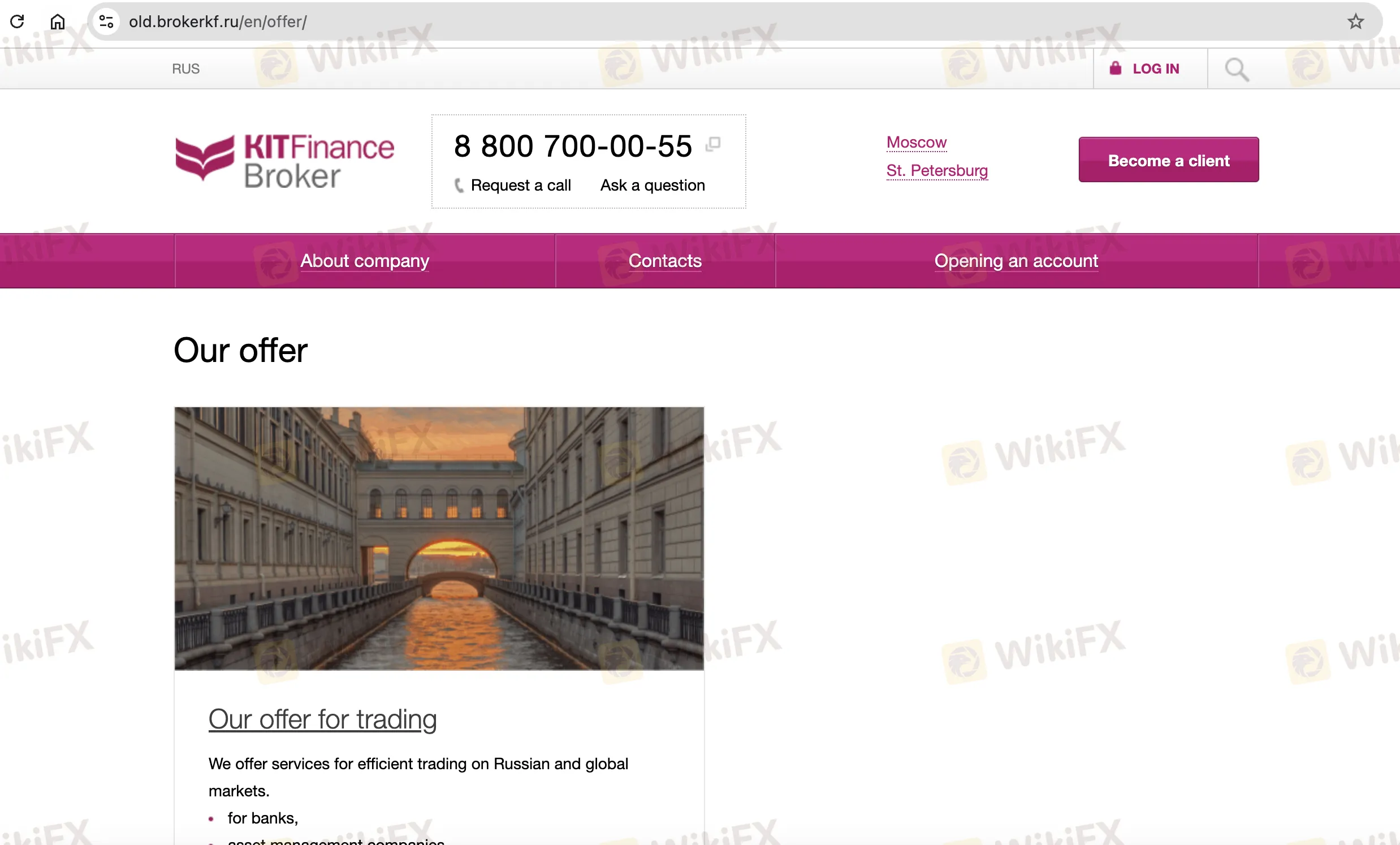

Ang KIT Finance, na itinatag noong 2000 at may punong tanggapan sa Russia, ay isang hindi nairehistrong broker na hindi lisensyado ng Central Bank of Russia o anumang pangunahing awtoridad. Nagbibigay ito ng access sa Russian at pandaigdigang mga merkado ng pinansyal gamit ang mga teknolohiyang pang-institusyon tulad ng Valdi Market Access.

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| Nag-aalok ng access sa parehong Russian at pandaigdigang merkado | Hindi nairehistro |

| Suporta sa mga institusyonal at propesyonal na kliyente | Kawalan ng transparensya |

| Mahabang kasaysayan ng operasyon | |

| Mga advanced na tool at imprastruktura sa kalakalan | |

| Iba't ibang mga paraan ng pakikipag-ugnayan |

Tunay ba ang KIT?

Ang KIT Finance ay hindi isang nairehistrong broker. Bagaman ito ay rehistrado sa Russia, hindi ito binabantayan ng anumang kinikilalang Russian financial authority, tulad ng Central Bank of Russia, para sa mga layuning brokerage o investing.

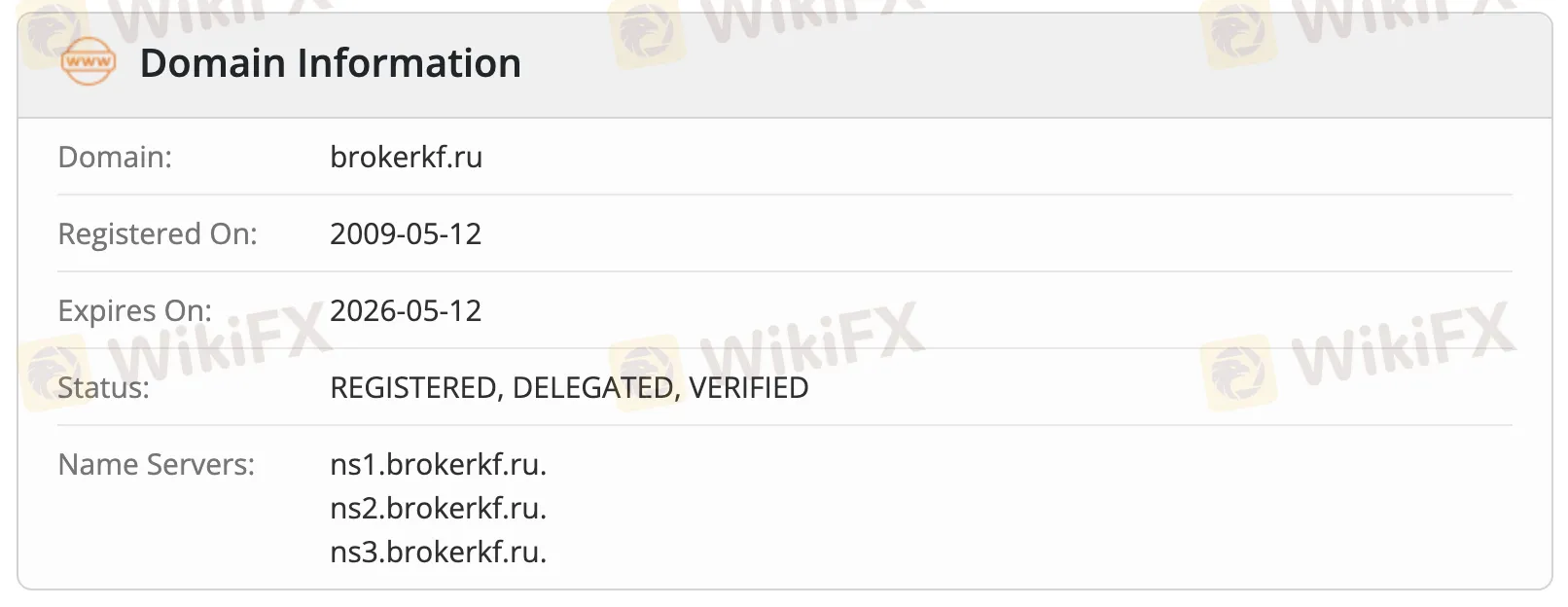

Ayon sa mga rekord ng WHOIS, ang domain na brokerkf.ru ay rehistrado noong Mayo 12, 2009 at patuloy na buhay, na may status na "REHISTRADO, DELEGADO, NA-SUBUKAN". Ang domain ay mag-eexpire sa Mayo 12, 2026, at ito ay inihohost sa kanyang sariling mga name servers: ns1.brokerkf.ru, ns2.brokerkf.ru, at ns3.brokerkf.ru.

Mga Produkto at Serbisyo

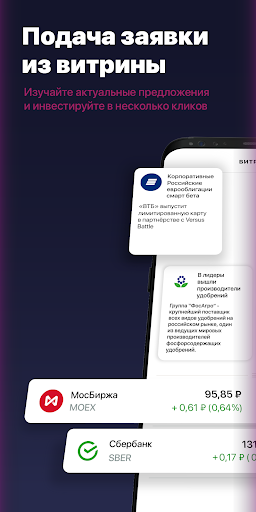

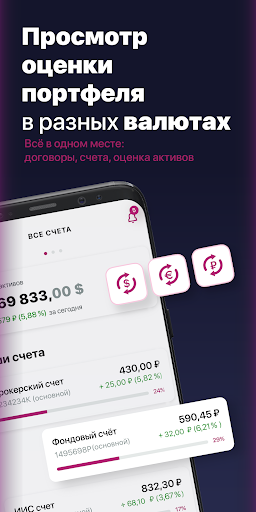

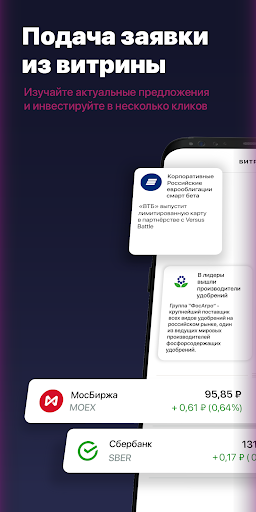

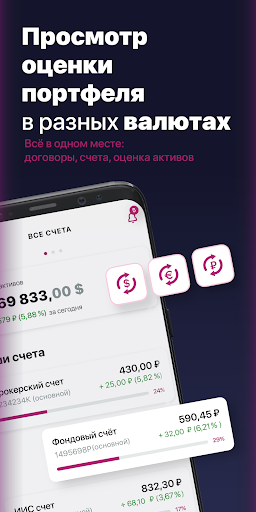

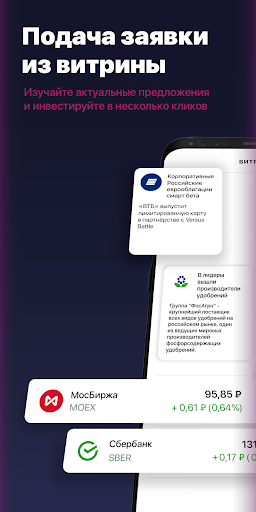

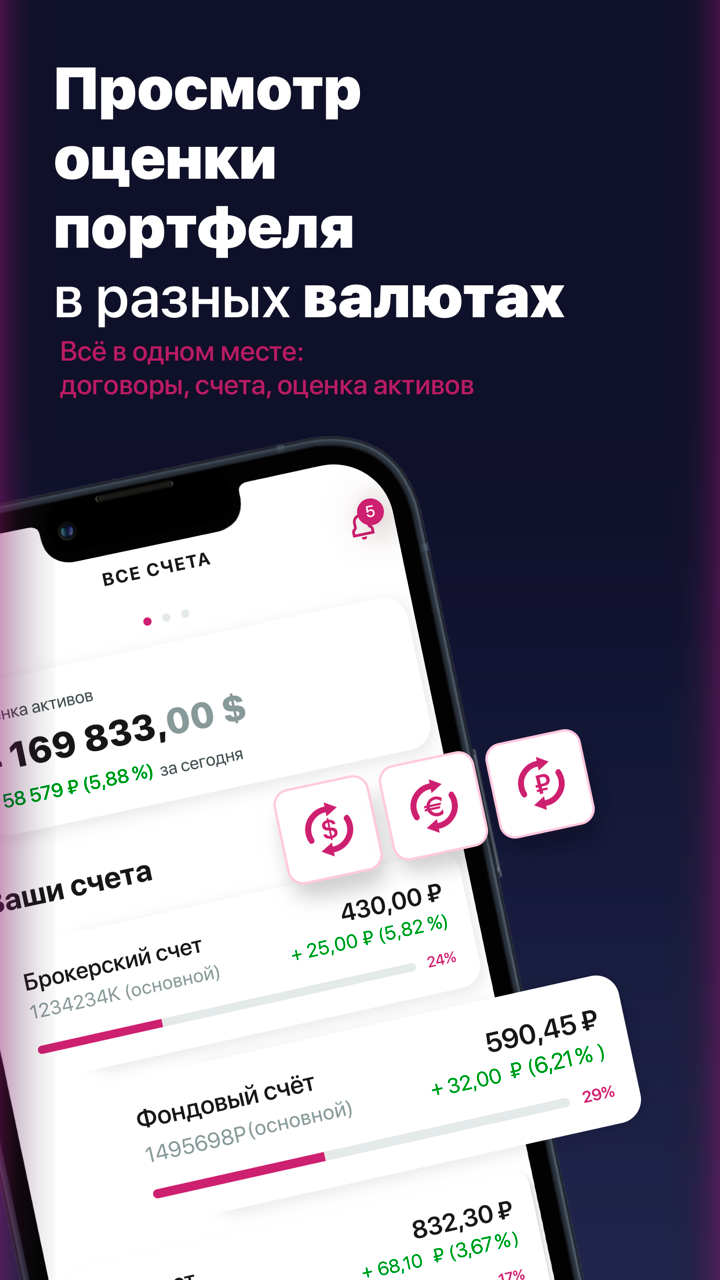

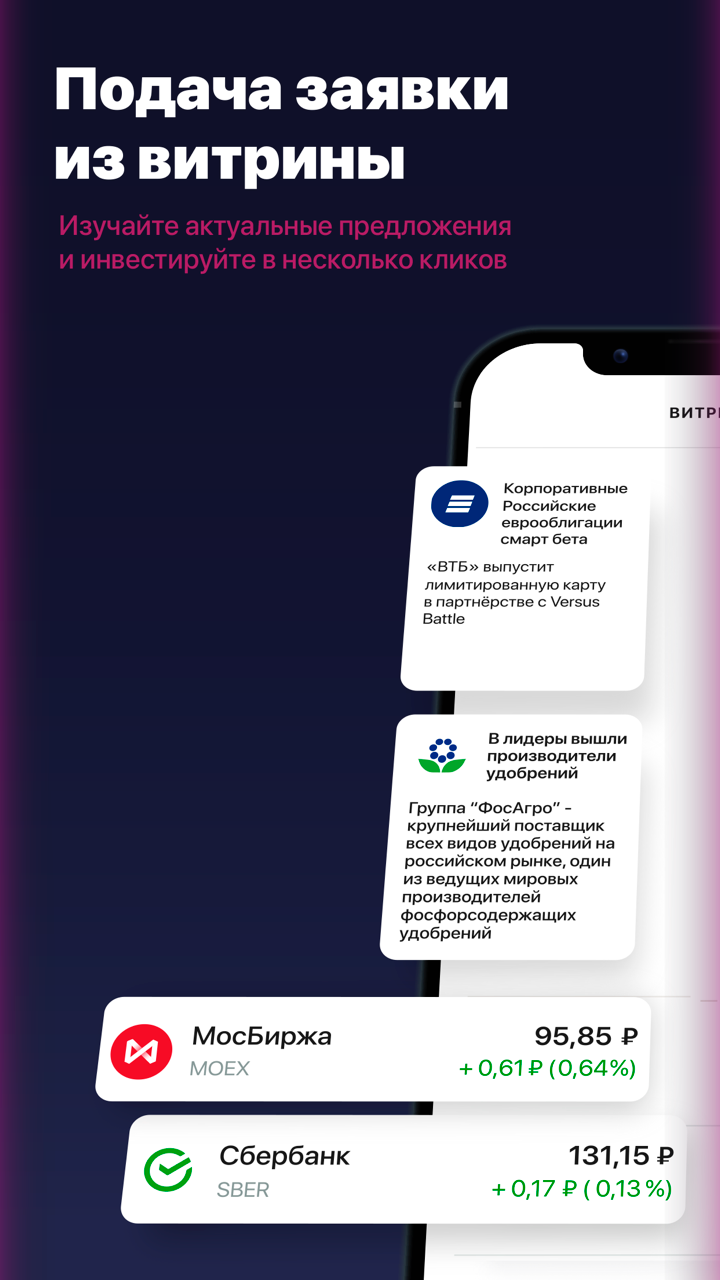

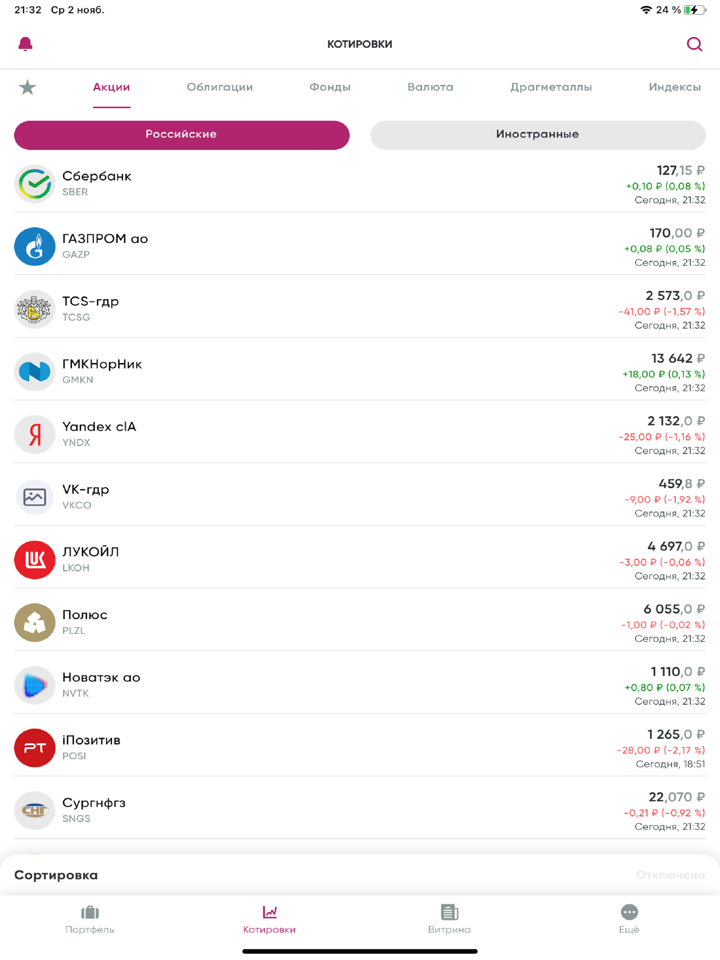

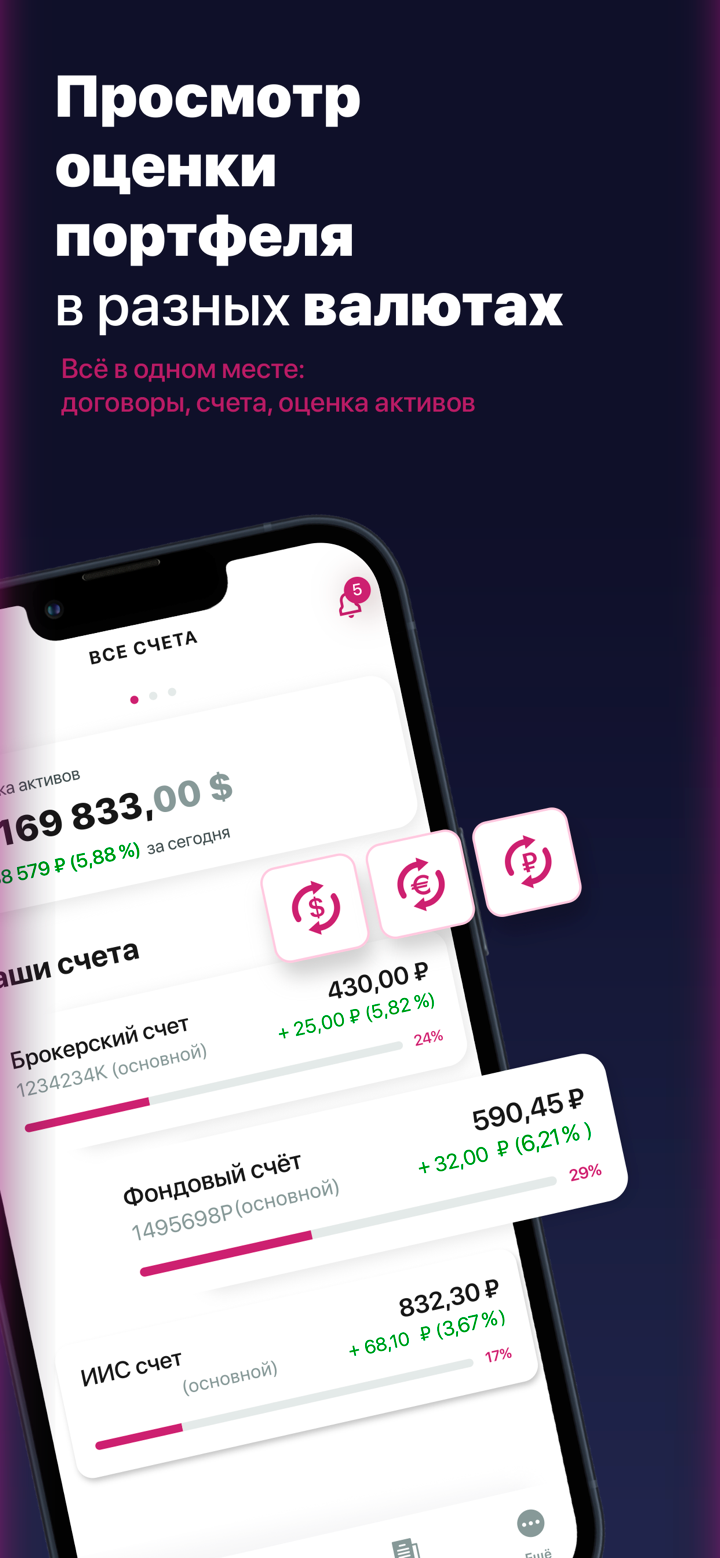

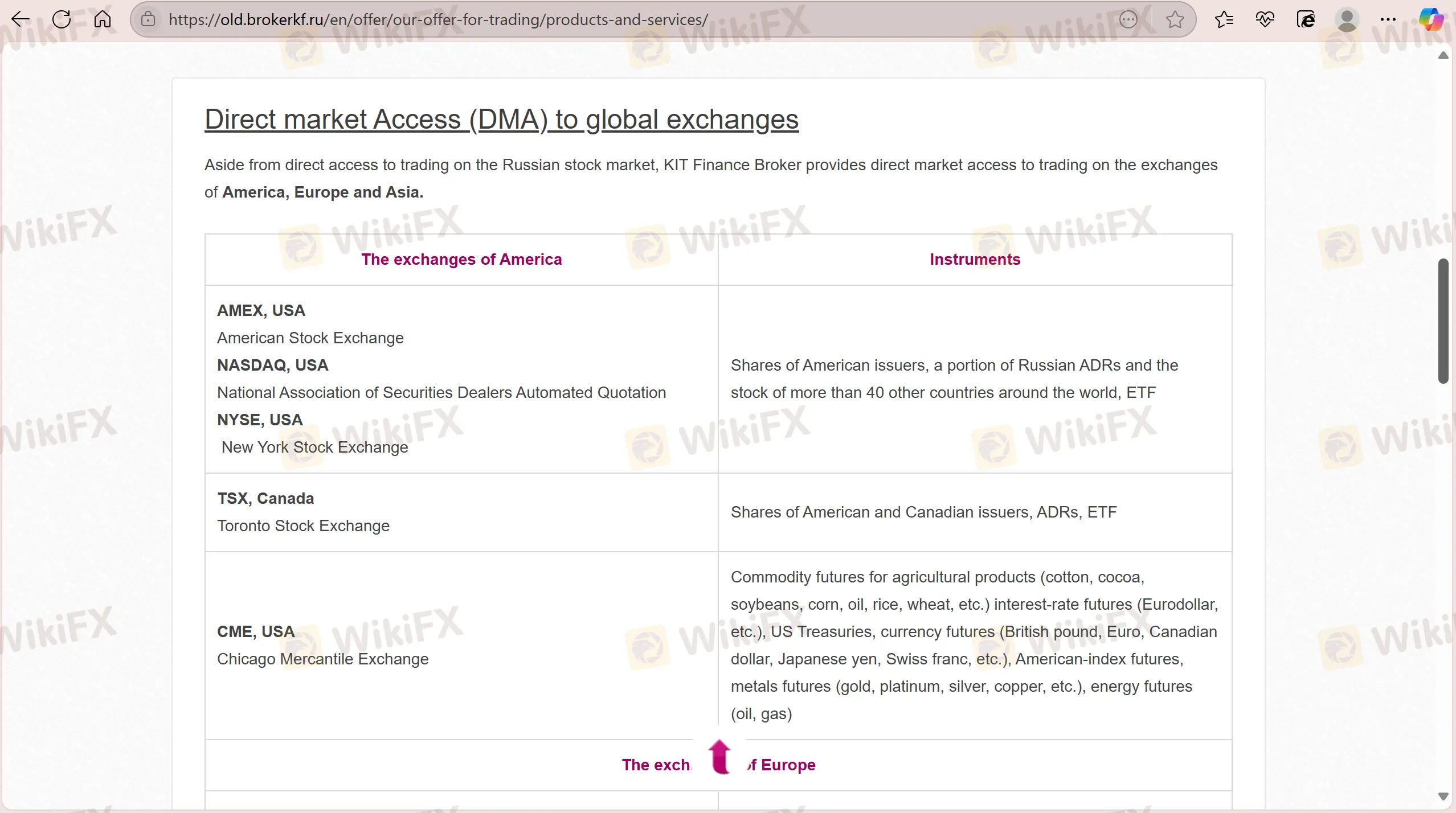

KIT Finance ay nagbibigay ng serbisyong brokerage at trading para sa Russian at global markets, na naglilingkod sa mga institutional clients (mga bangko, kumpanya ng seguro, asset managers) at pribadong indibidwal.

| Mga Produkto / Serbisyo | Supported |

| Stocks | ✔ |

| ETFs | ✔ |

| Futures | ✔ |

| Asset Management | ✔ |

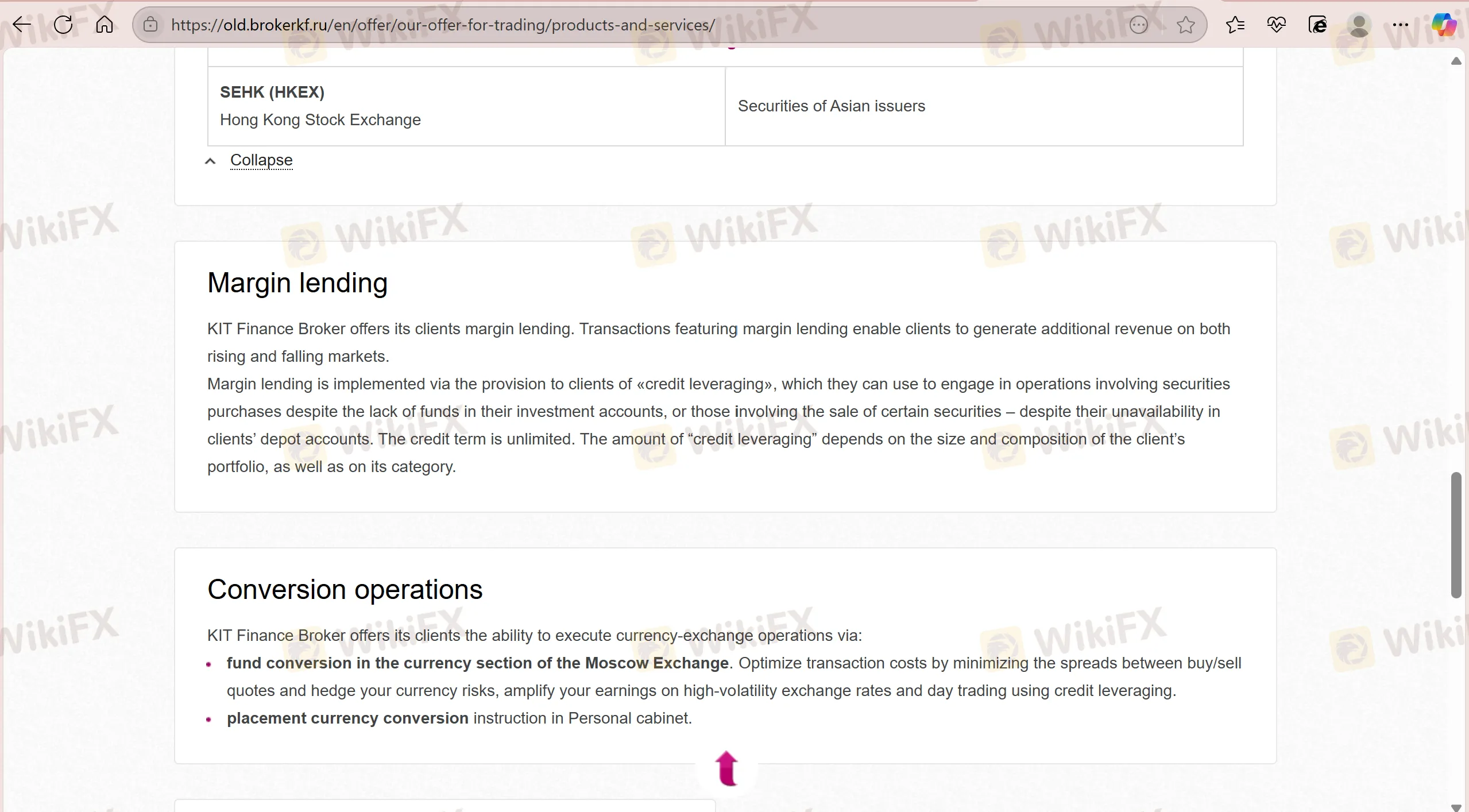

| Margin Lending | ✔ |

| Currency Conversion | ✔ |

Plataforma ng Paggagalaw

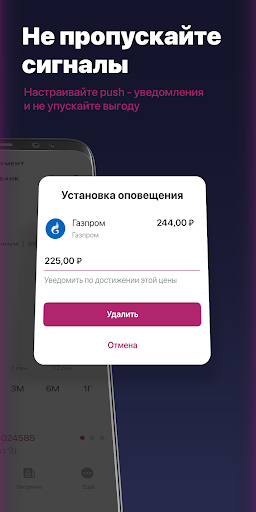

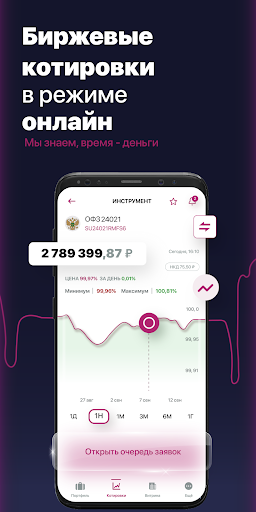

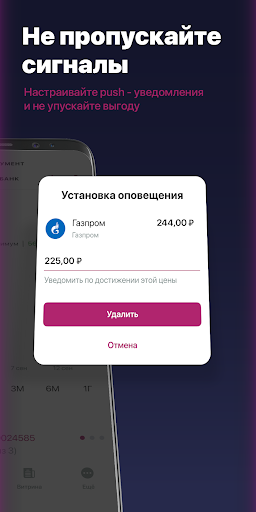

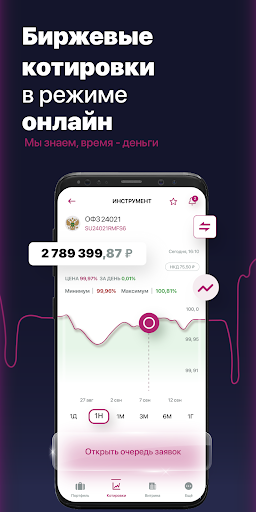

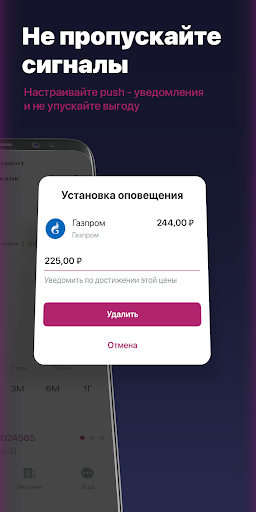

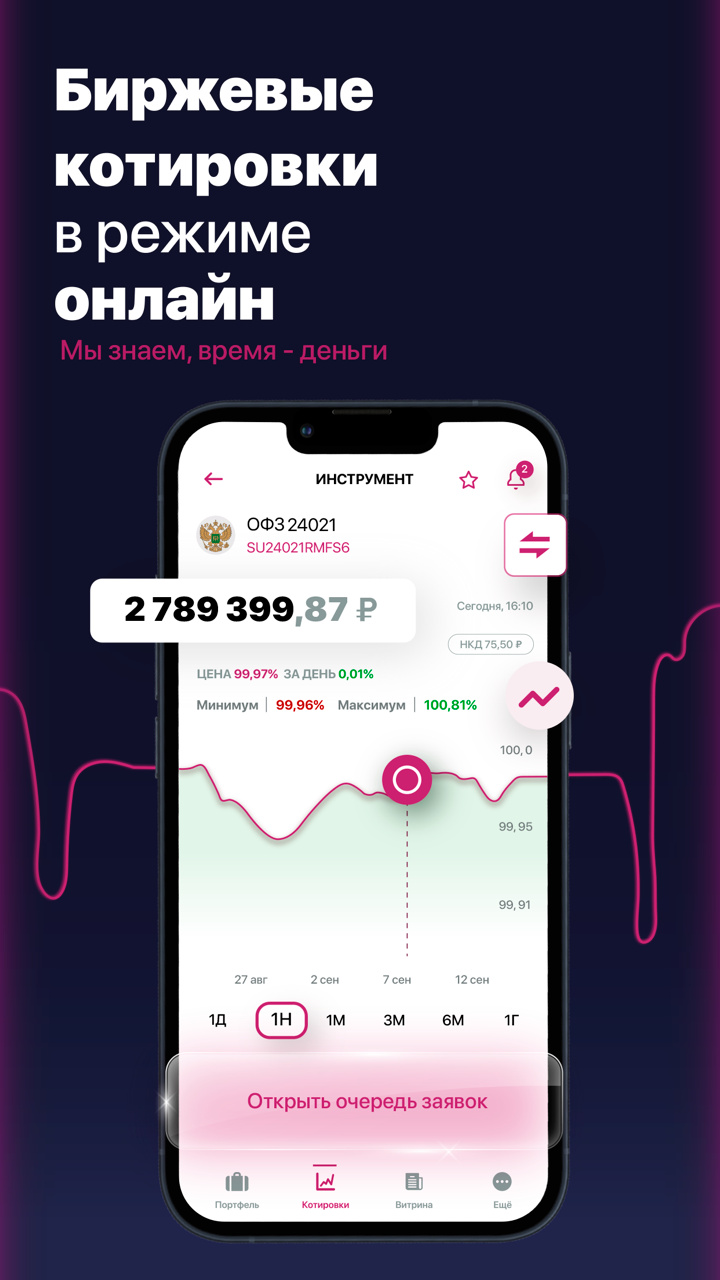

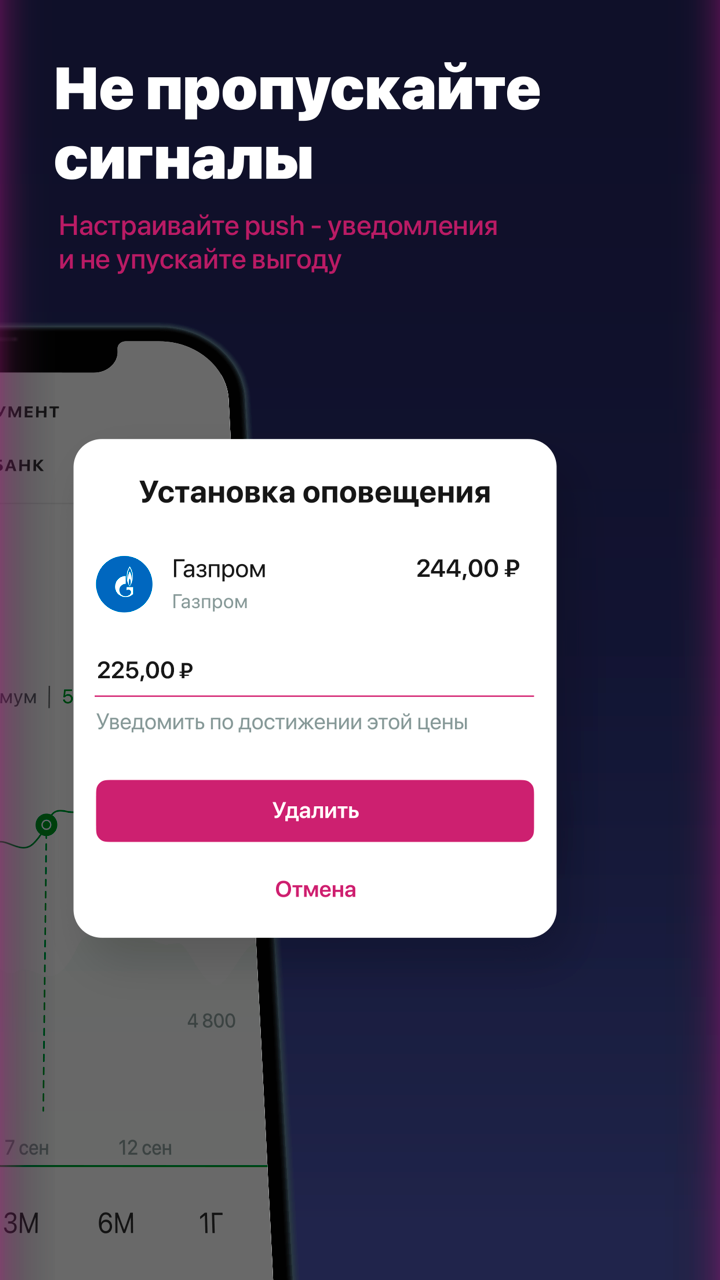

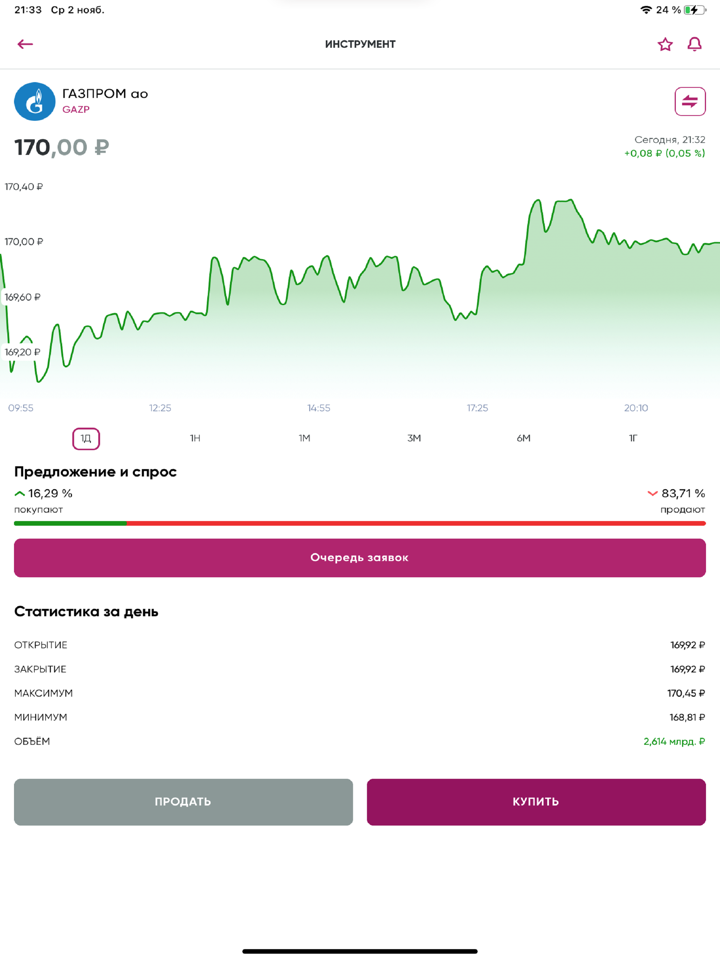

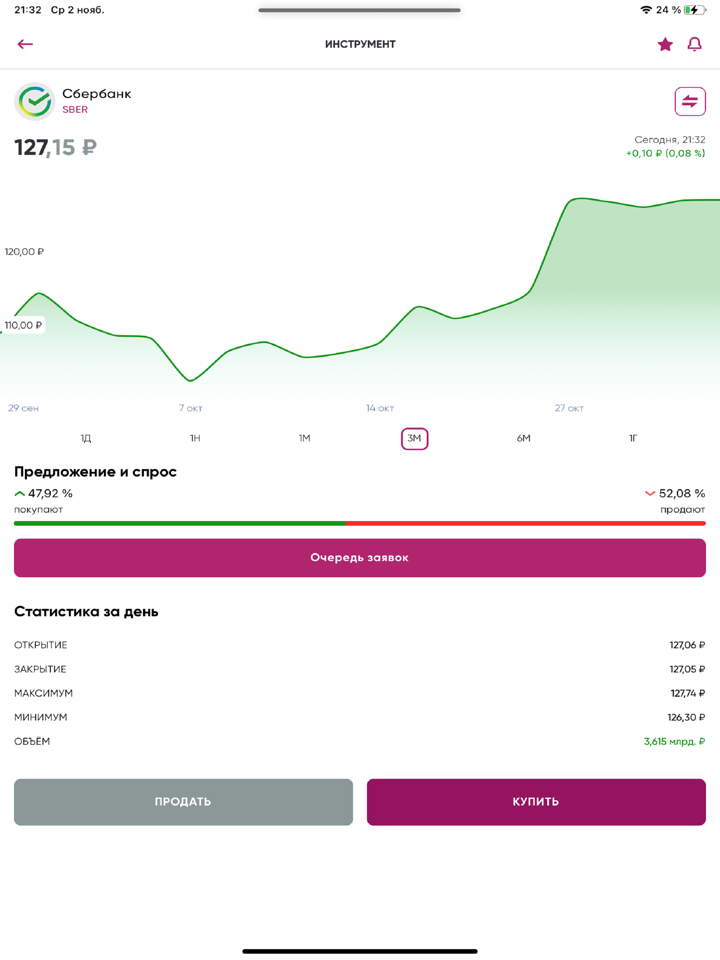

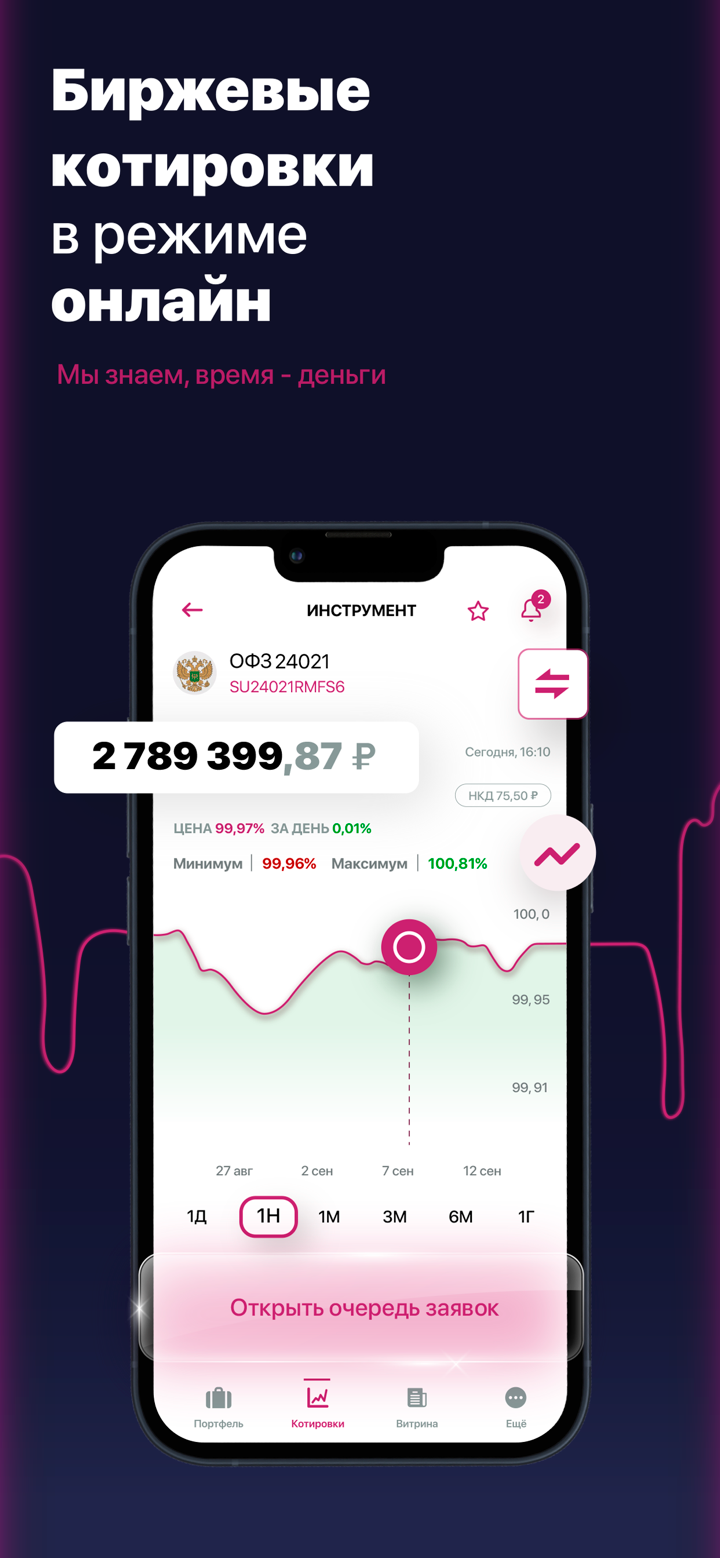

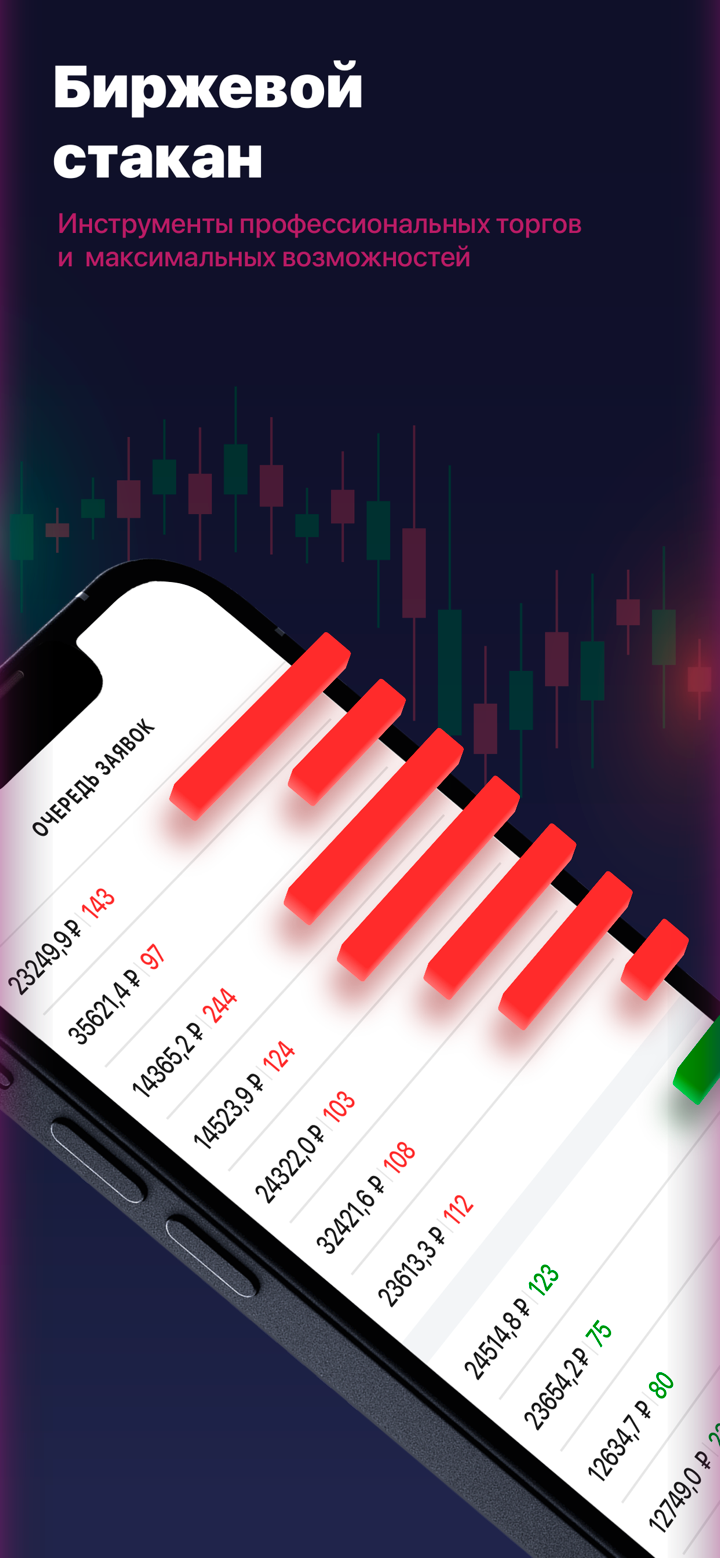

KIT Finance ay nagbibigay ng Valdi Market Access, isang matatag na platform ng pag-trade na pangunahing nakatuon sa mga institutional at propesyonal na gumagamit. Ito ay sumasaklaw sa buong proseso ng transaksyon, mula sa execution hanggang sa risk management, compliance, at settlement, na may emphasis sa bilis, automation, at low-latency communication sa pamamagitan ng SunGard Global Network (SGN). Ito ay hindi inilaan para sa casual retail users.

| Plataforma ng Paggagalaw | Supported | Available Devices | Suitable for |

| Valdi Market Access | ✔ | Desktop (Windows) | / |

| MT4 | ❌ | / | Mga Beginners |

| MT5 | ❌ | / | Mga Experienced traders |