Şirket özeti

| KIT İnceleme Özeti | |

| Kuruluş Yılı | 2000 |

| Kayıtlı Ülke/Bölge | Rusya |

| Düzenleme | Düzenleme yok |

| Ürünler ve Hizmetler | Varlık yönetimi, döviz dönüşümü, marj kredisi, ETF'ler, hisse senetleri, vadeli işlemler |

| Deneme Hesabı | / |

| Kaldıraç | / |

| Spread | / |

| İşlem Platformu | Valdi Market Access |

| Minimum Yatırım | / |

| Müşteri Desteği | Telefon: 8 800 700-00-55 |

| Faks: +7 (812) 332 32 91 | |

| Sosyal Medya: Telegram, VK, YouTube | |

| Adres: Marata Cad. 69-71, İş merkezi "Renaissance Plaza", St. Petersburg, Rusya, 191119 | |

KIT Bilgileri

KIT Finans, 2000 yılında kurulmuş ve merkezi Rusya'da bulunan, Rusya Merkez Bankası veya diğer önemli otoriteler tarafından lisanslanmayan düzenlemesiz bir komisyoncudur. Valdi Market Access gibi kurumsal düzeyde teknolojiler kullanarak Rusya ve dünya genelinde finansal piyasalara erişim sağlar.

Artıları ve Eksileri

| Artıları | Eksileri |

| Rusya ve küresel piyasalara erişim sağlar | Düzenlenmemiş |

| Kurumsal ve profesyonel müşterilere destek sağlar | Şeffaflık eksikliği |

| Uzun işletme geçmişi | |

| Gelişmiş işlem araçları ve altyapı | |

| Çeşitli iletişim kanalları |

KIT Güvenilir mi?

KIT Finans düzenlenmiş bir komisyoncu değildir. Rusya'da kayıtlı olmasına rağmen, Rusya Merkez Bankası gibi tanınmış Rus finansal otoriteleri tarafından komisyonculuk veya yatırım amaçları için denetlenmemektedir.

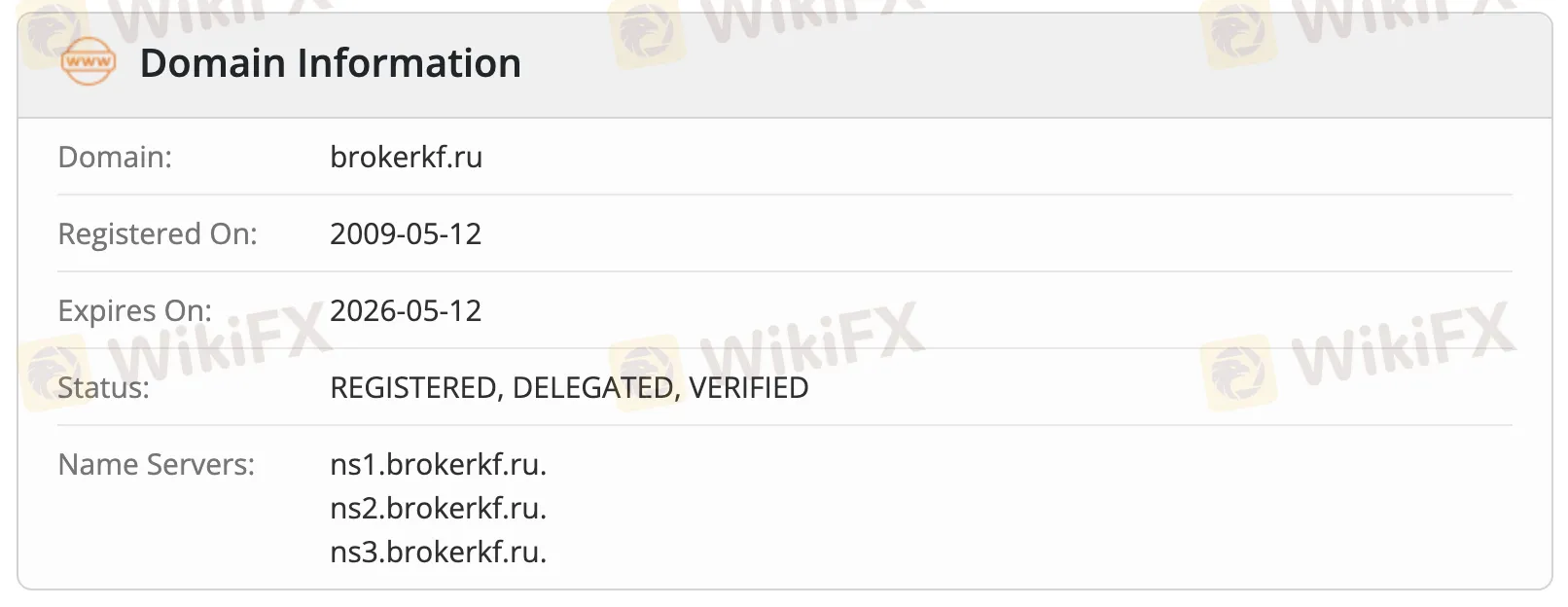

WHOIS kayıtlarına göre, brokerkf.ru alan adı 12 Mayıs 2009 tarihinde kaydedildi ve hala "KAYITLI, DELEGELİ, DOĞRULANDI" durumunda, 12 Mayıs 2026 tarihinde süresi dolacak ve kendi ad sunucularında barındırılıyor: ns1.brokerkf.ru, ns2.brokerkf.ru ve ns3.brokerkf.ru.

Ürünler ve Hizmetler

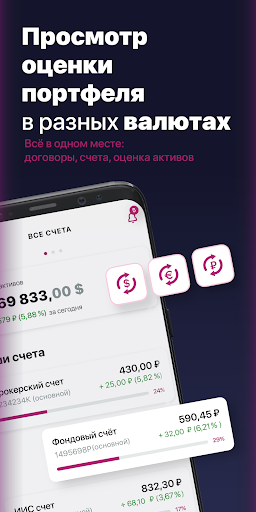

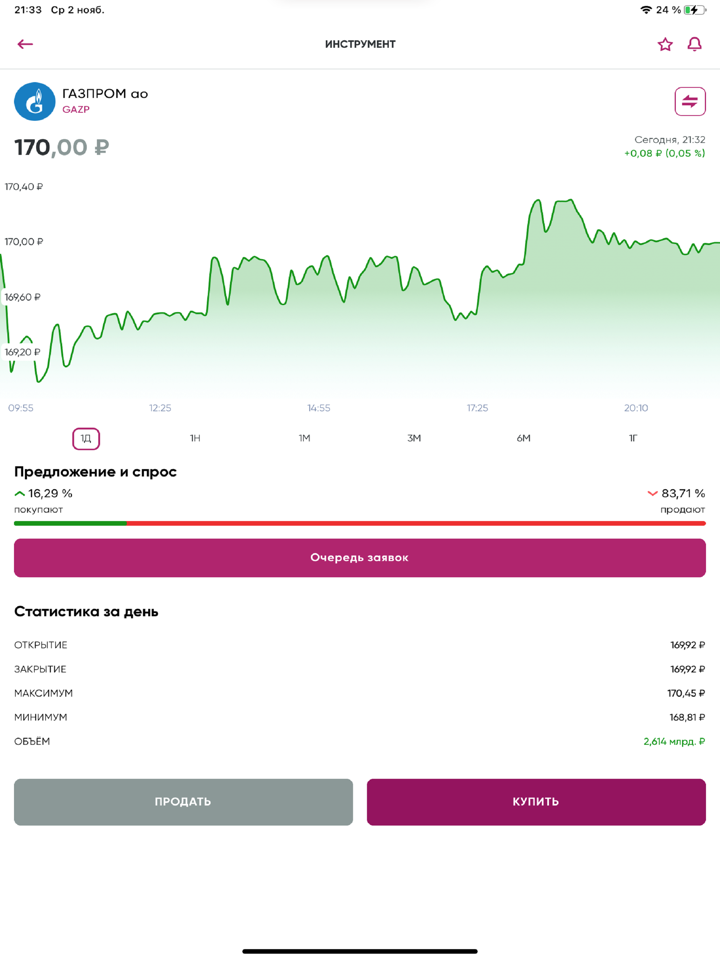

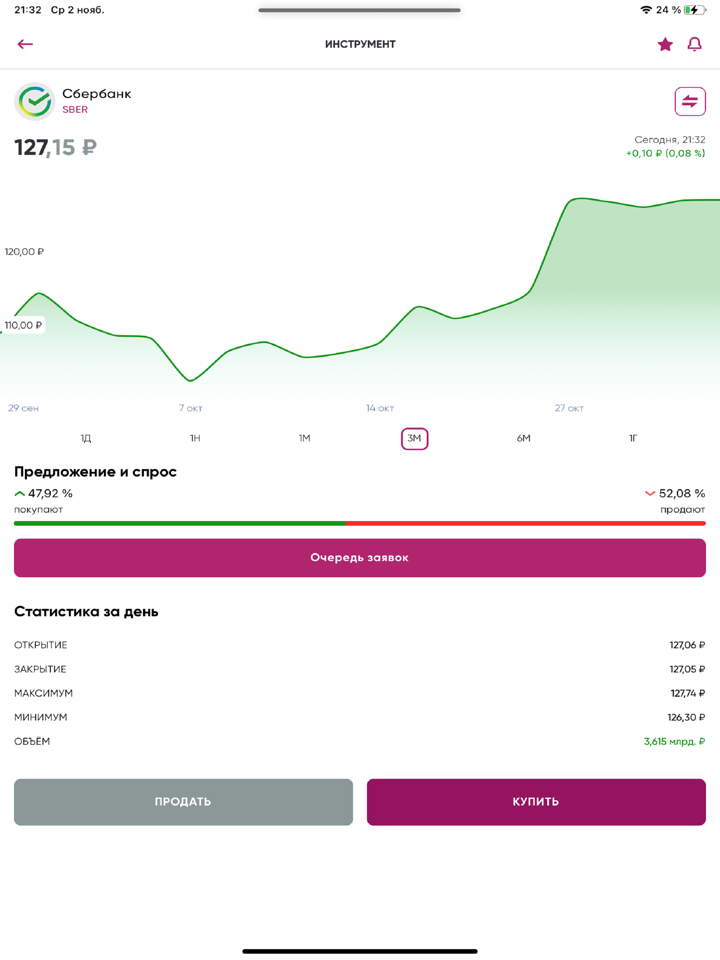

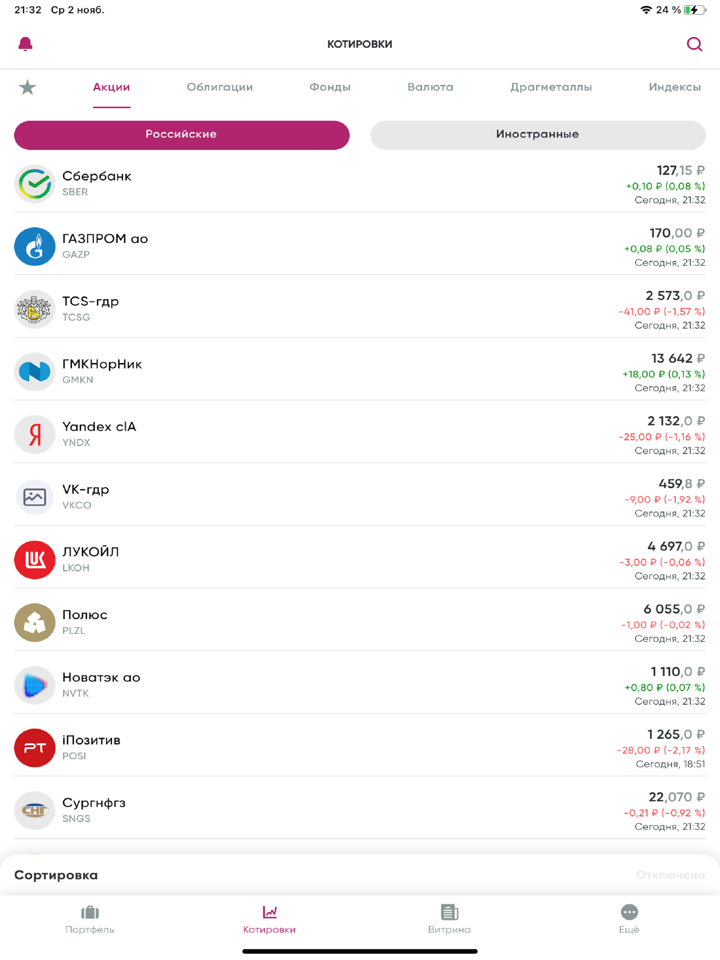

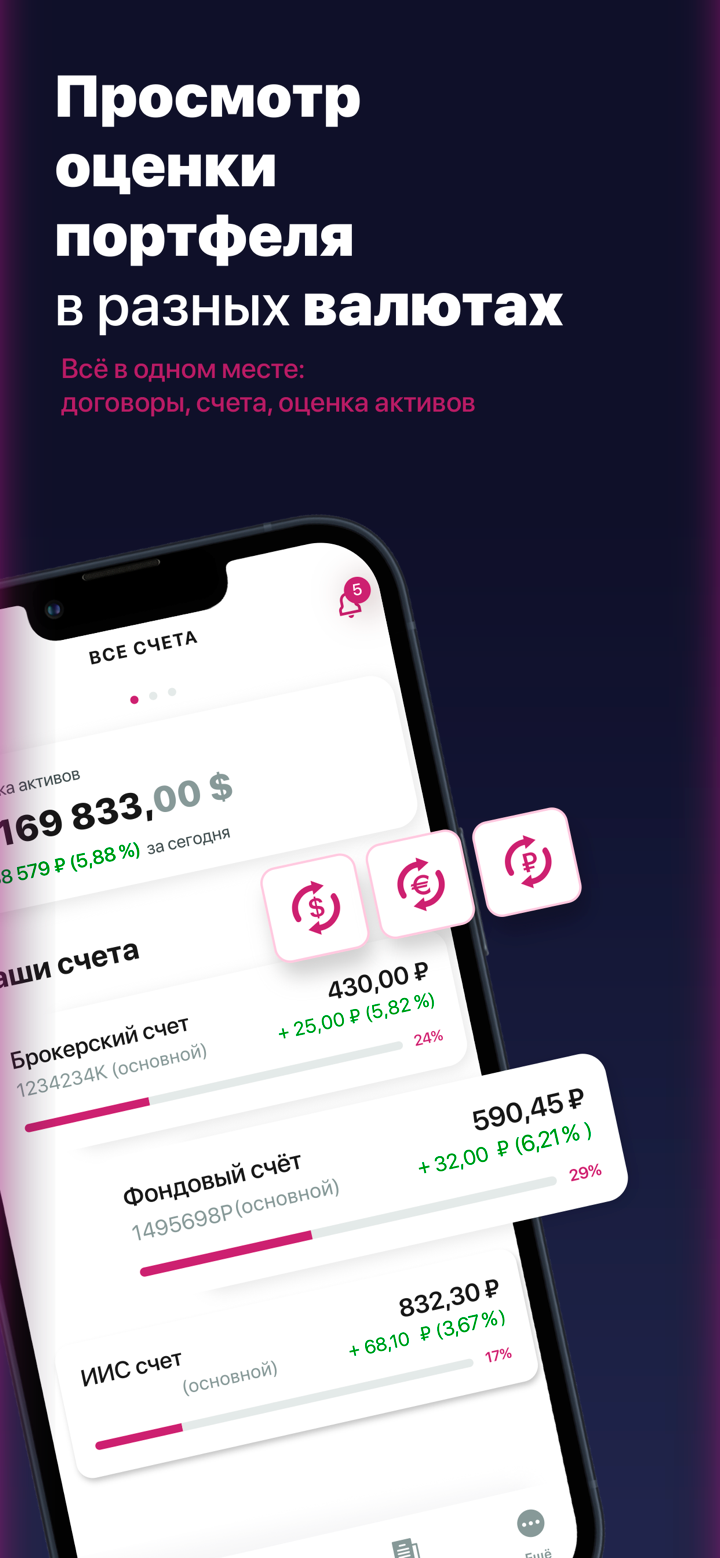

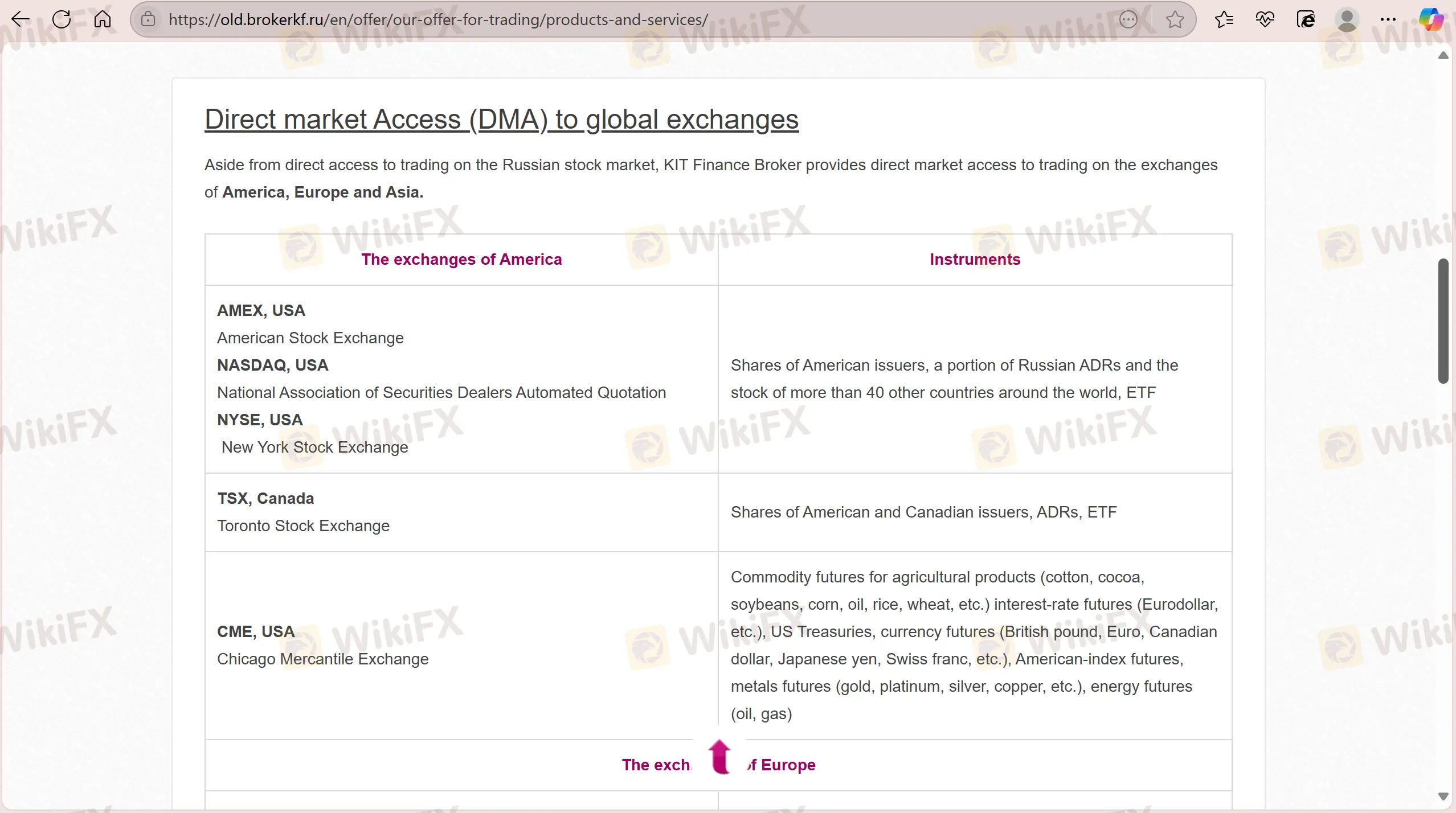

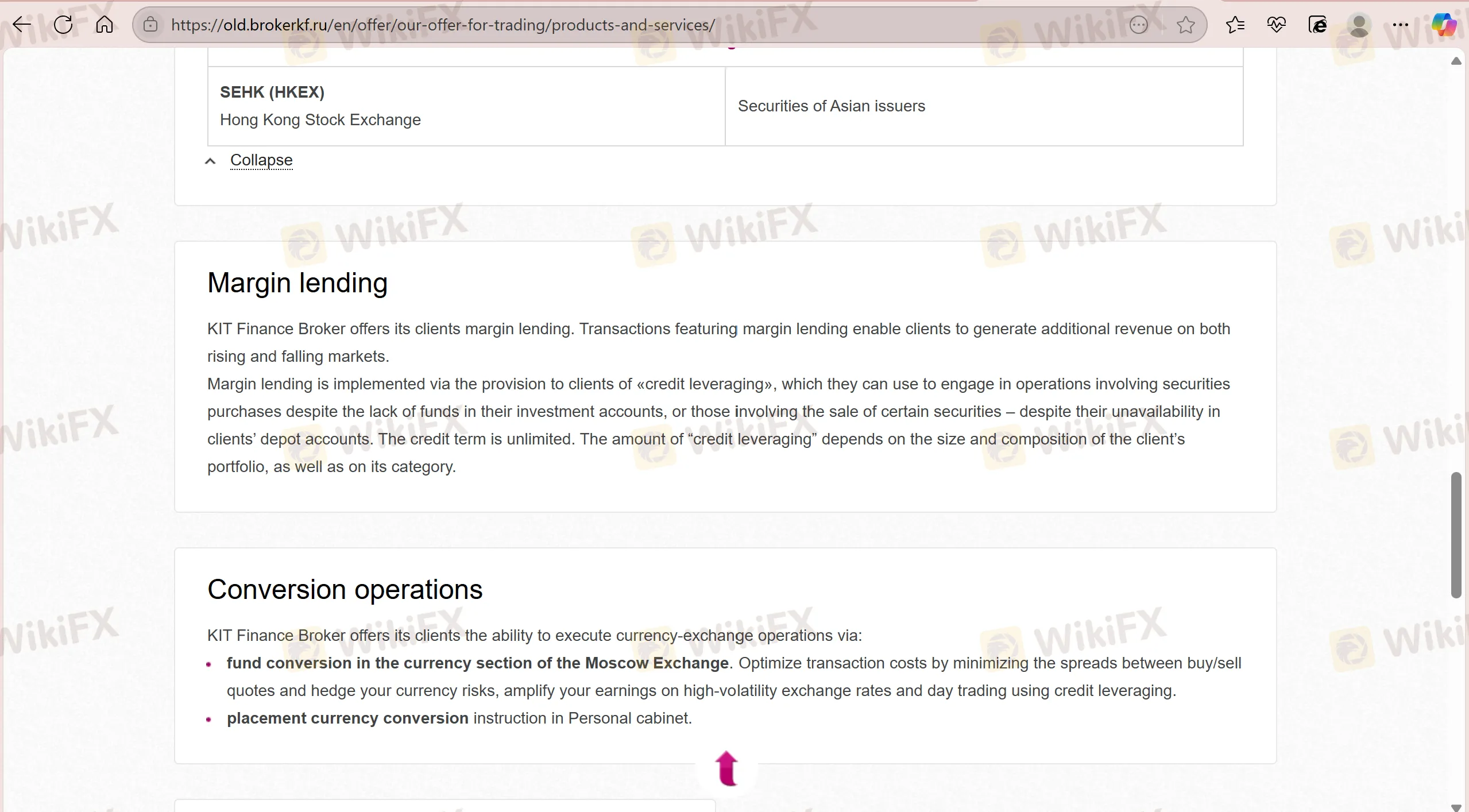

KIT Finans, Rus ve küresel piyasalar için aracılık ve ticaret hizmetleri sunmaktadır ve hem kurumsal müşterilere (bankalar, sigorta şirketleri, varlık yöneticileri) hem de bireysel müşterilere hizmet vermektedir.

| Ürünler / Hizmetler | Desteklenen |

| Hisse Senetleri | ✔ |

| ETF'ler | ✔ |

| Vadeli İşlemler | ✔ |

| Varlık Yönetimi | ✔ |

| Teminatlı Borç Verme | ✔ |

| Döviz Dönüşümü | ✔ |

İşlem Platformu

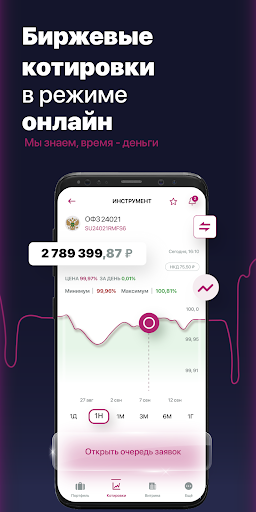

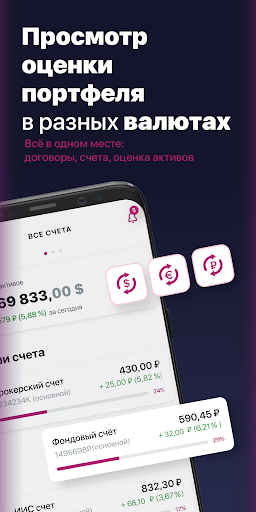

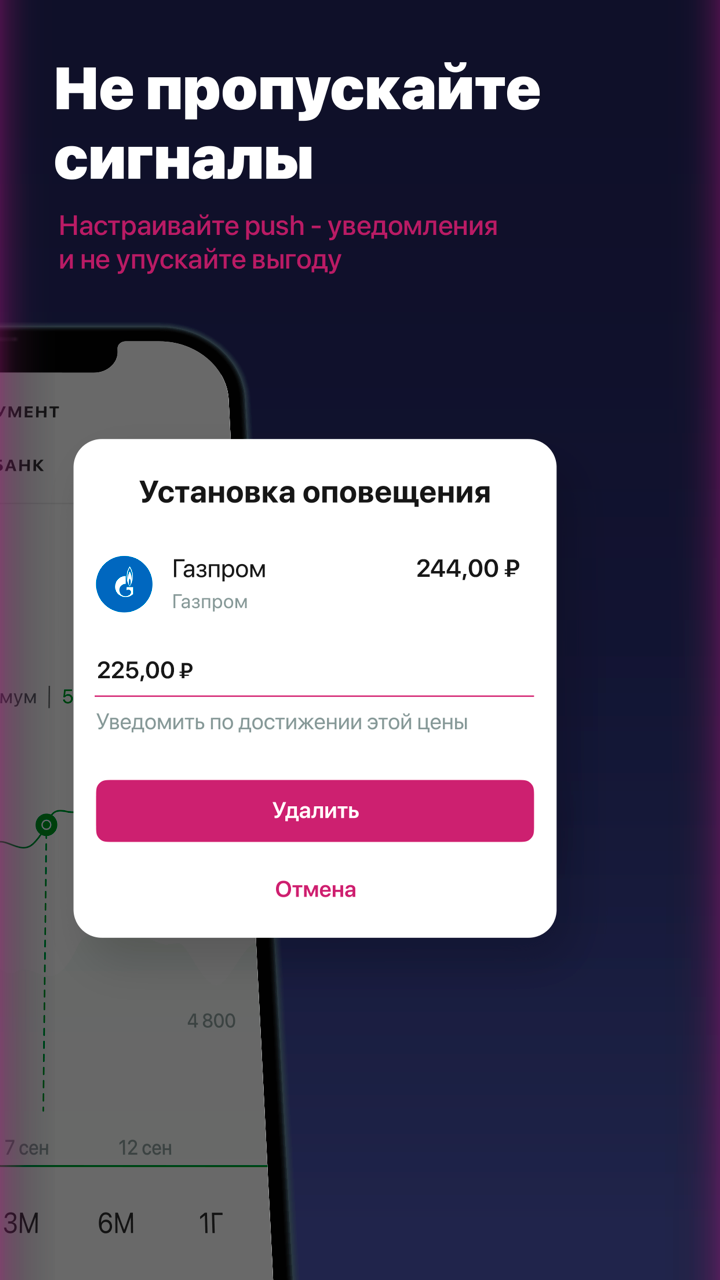

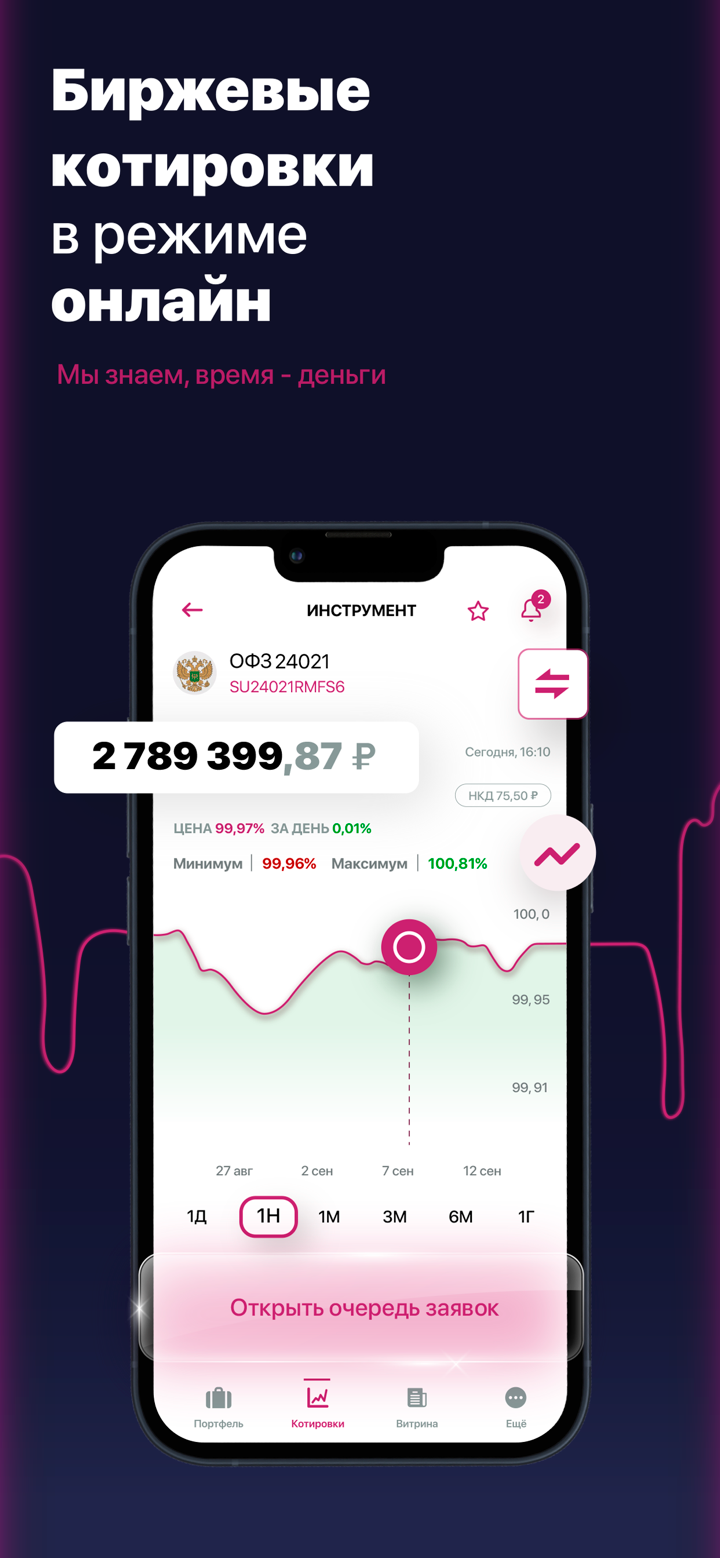

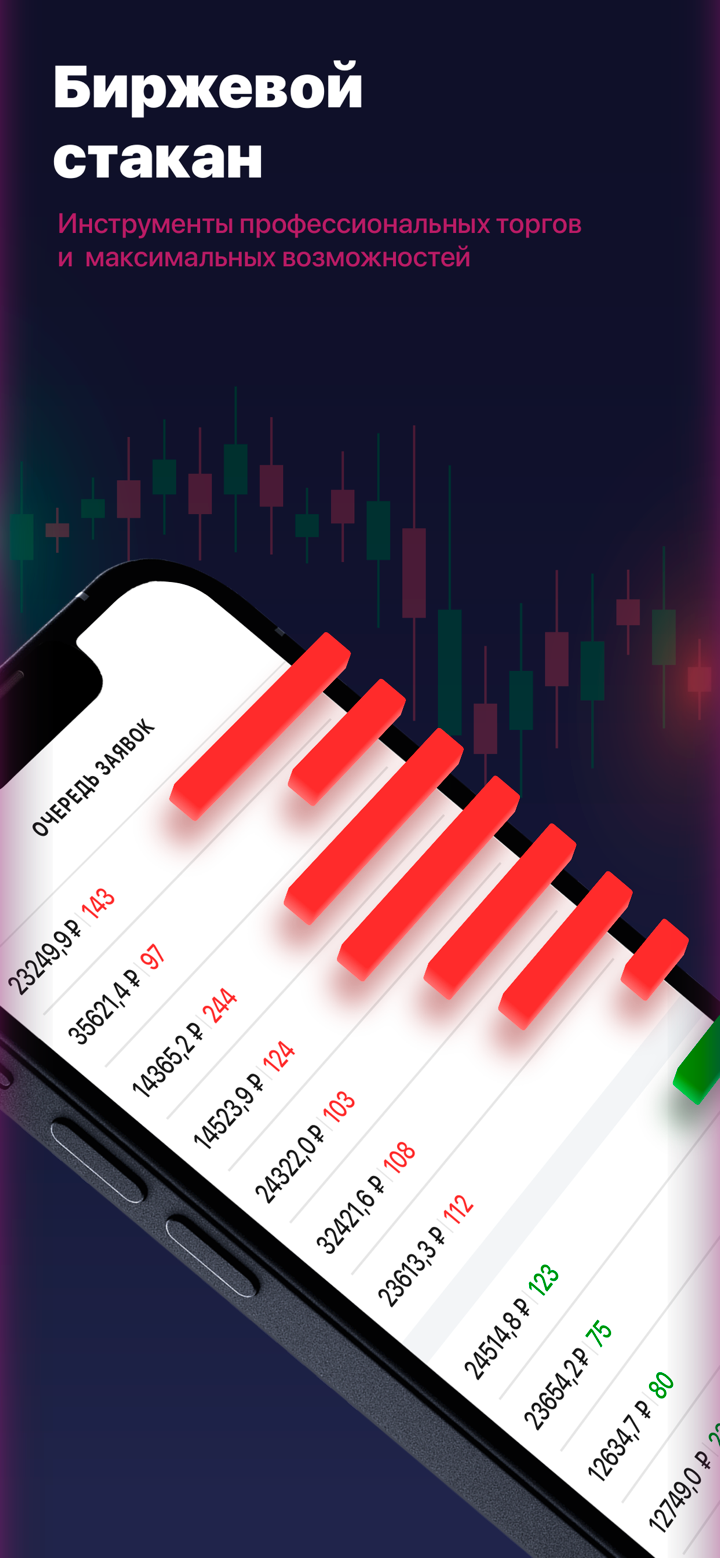

KIT Finans, kurumsal ve profesyonel kullanıcılara yönelik geniş ölçüde hizmet veren sağlam bir işlem platformu olan Valdi Market Access'i sunmaktadır. Tam işlem yaşam döngüsünü kapsar, yürütmeden risk yönetimine, uyumluluğa ve uzlaşmaya kadar hükmetmektedir ve hız, otomasyon ve düşük gecikmeli iletişim konusunda SunGard Global Network (SGN) aracılığıyla vurgu yapar. Sıradan perakende kullanıcılar için tasarlanmamıştır.

| İşlem Platformu | Desteklenen | Mevcut Cihazlar | Uygun |

| Valdi Market Access | ✔ | Masaüstü (Windows) | / |

| MT4 | ❌ | / | Başlangıç Seviyesi |

| MT5 | ❌ | / | Deneyimli işlemciler |