Présentation de l'entreprise

| GMCU Résumé de l'examen | |

| Fondé | 1985 |

| Pays/Région Enregistré | Australie |

| Régulation | ASIC (Dépassé) |

| Services | Prêts, comptes bancaires, dépôts à terme, assurances |

| Compte de Démo | ❌ |

| Plateforme de Trading | Application Bancaire Mobile |

| Support Client | Téléphone : 1800 694 628 |

| Email : info@gmcu.com.au | |

| Adresse Postale : PO Box 860, Shepparton, VIC 3632 | |

Informations sur GMCU

GMCU (Goulburn Murray Credit Union Co-Operative Ltd) a été fondé en 1985 et est réglementé par l'ASIC sous le numéro de licence 241364, bien que le statut soit répertorié comme "Dépassé". L'institution propose des services financiers standard tels que des prêts immobiliers, des comptes bancaires personnels et des produits d'assurance, mais ne propose pas d'autres services de trading ou de comptes de démonstration.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Divers canaux de contact | Licence ASIC dépassée |

| Large gamme de services bancaires traditionnels | |

| Multiples choix de comptes | |

| Longue durée d'opération |

GMCU Est-il Légitime ?

Oui, Goulburn Murray Credit Union Co-Operative Ltd (GMCU) est réglementé. Il détient une licence de conseiller en investissement délivrée par la Commission Australienne des Valeurs Mobilières et des Investissements (ASIC) sous le numéro de licence 241364. Cependant, son statut réglementaire est marqué comme Dépassé, ce qui peut indiquer que la licence n'est plus valide ou a dépassé son champ d'application prévu.

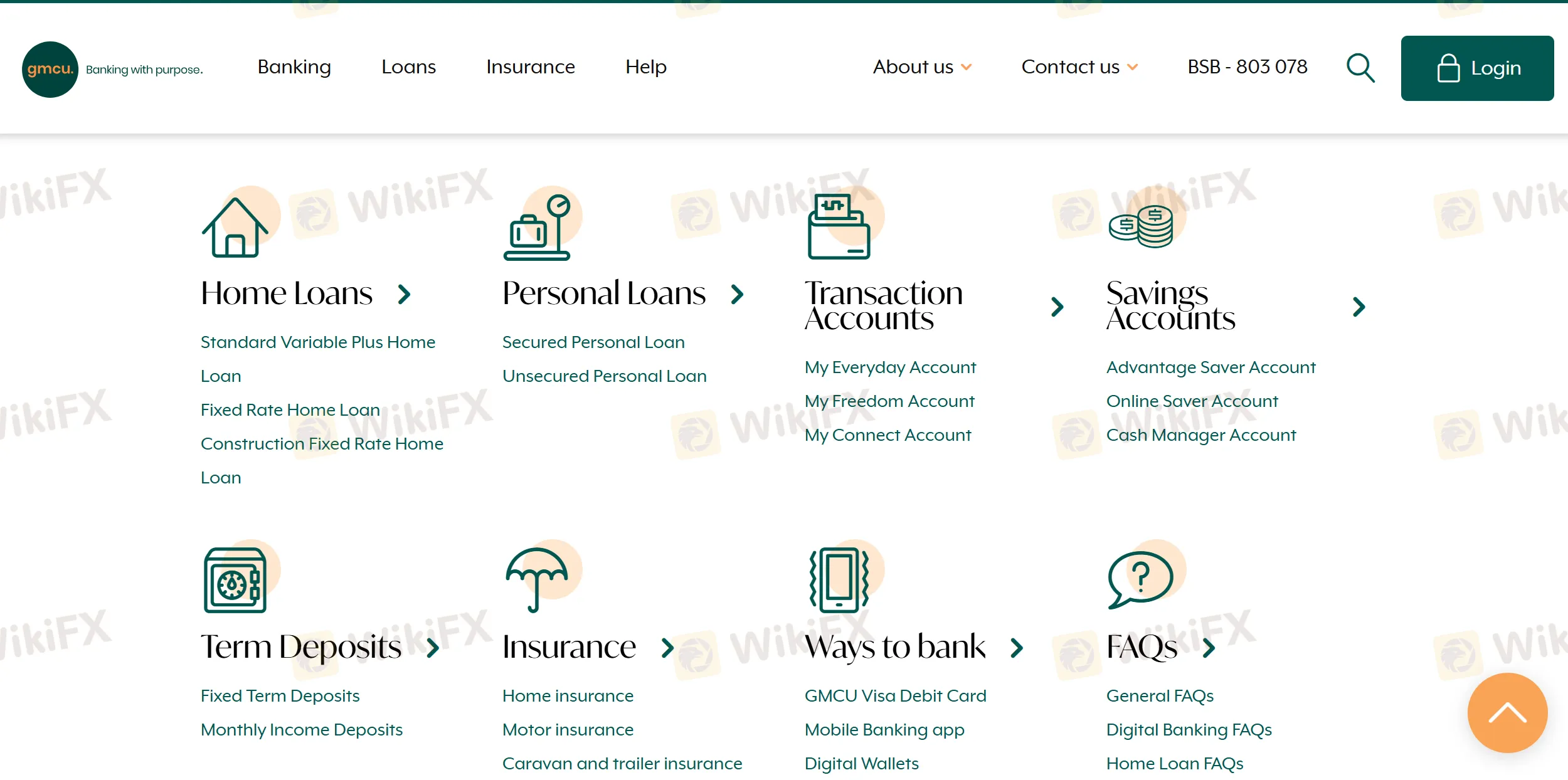

Services de GMCU

GMCU propose une large gamme de services bancaires de détail, y compris des prêts immobiliers et personnels, divers types de comptes, des dépôts à terme et des options d'assurance.

| Catégorie | Services |

| Prêts Immobiliers | Variable Standard Plus, Taux Fixe, Taux de Construction Fixe |

| Prêts Personnels | Prêt Personnel Garanti, Prêt Personnel Non Garanti |

| Comptes de Transaction | Mon Compte Quotidien, Mon Compte Liberté, Mon Compte Connect |

| Comptes d'Épargne | Épargne Avantage, Épargne en Ligne, Compte de Gestion de Trésorerie |

| Dépôts à Terme | Dépôts à Terme Fixe, Dépôts de Revenus Mensuels |

| Assurance | Logement, Automobile, Caravane & Remorque, Assurance Propriétaire |

Type de Compte

GMCU propose plusieurs types de comptes réels adaptés aux besoins bancaires quotidiens, y compris des comptes de transactions personnelles et d'épargne.

| Type de compte | Convient pour |

| Mon compte quotidien | Particuliers ayant besoin d'un compte de transaction général |

| Mon compte liberté | Étudiants ou titulaires de carte de réduction cherchant des exonérations de frais |

| Mon compte connecté | Personnes préférant la banque numérique sans accès en agence |

| Compte épargne avantage | Épargnants réguliers souhaitant un intérêt bonus |

| Compte épargne en ligne | Épargnants axés sur l'Internet |

| Compte gestionnaire de trésorerie | Membres gérant des flux de trésorerie importants |

Frais de GMCU

Les frais de GMCU sont modérés à élevés par rapport aux normes de l'industrie, notamment pour les produits de prêt non garantis tels que les prêts personnels et les découverts.

| Type de prêt | Taux d'intérêt (annuel) |

| Prêt immobilier (Occupé par le propriétaire, <80% LTV) | 5,94% - 5,79% |

| Prêt immobilier (Occupé par le propriétaire, >80%-95% LTV) | 6,34% - 5,79% |

| Prêt immobilier (Investissement, <80% LTV) | 6,14% - 6,09% |

| Prêt immobilier (Investissement, >80%-95% LTV) | 6,54% - 6,09% |

| Prêt personnel (Garanti) | 7,79% |

| Prêt personnel (Non garanti) | 14,95% |

| Découvert (Garanti) | 9,99% - 10,60% |

| Découvert (Non garanti) | 17,69% |

| Prêt professionnel/agricole (Garanti) | 10,54% - 12,00% |

| Prêt professionnel/agricole (Non garanti) | 18,75% |

Plateforme de trading

| Plateforme de trading | Pris en charge | Appareils disponibles |

| Application bancaire mobile | ✔ | iOS, Android |

Dépôt et retrait

GMCU ne mentionne pas explicitement de frais pour les dépôts ou les retraits.

| Méthode de paiement | Frais | Délai de traitement |

| Crédit par virement direct | / | Généralement le jour même |

| Débit par virement direct | Des frais de rejet peuvent s'appliquer en cas de fonds insuffisants | Selon le calendrier du fournisseur |

| Paiements périodiques | / | Selon le calendrier |

| Internet/Banque mobile | / | Instantané ou le jour même |

| Dépôt en agence | / | Instantané ou en fin de journée |