Présentation de l'entreprise

| Consorsbank Résumé de l'examen | |

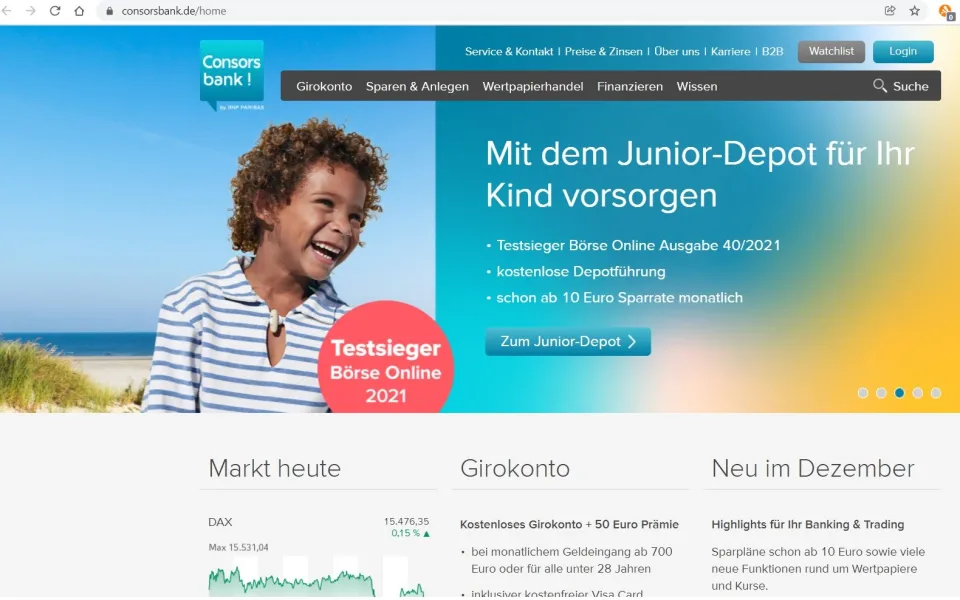

| Fondé | 1994 |

| Pays/Région d'enregistrement | Allemagne |

| Régulation | Pas de régulation |

| Produits d'investissement | ETFs, fonds, actions, or, obligations, dérivés, options, contrats à terme, CFD |

| Plateforme de trading | Consorsbank App |

| Support Client | Horaires de service : Lun. – Dim. : 7h30 – 22h00 |

| Tél : 0911 / 369–30 00 | |

Informations sur Consorsbank

Consorsbank est une institution financière fondée en Allemagne en 1994, proposant de nombreux produits d'investissement et d'épargne, accessibles via son application mobile.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Longue histoire | Manque de régulation |

| Produits d'investissement complets | Informations limitées sur les frais de trading |

Consorsbank est-il légitime ?

Consorsbank est une plateforme non réglementée. Veuillez être conscient du risque !

Le domaine consorsbank.de sur WHOIS a été mis à jour le 13 novembre 2024.

Produits d'Investissement

| Produits d'Investissement | Pris en charge |

| ETFs | ✔ |

| Fonds | ✔ |

| Actions | ✔ |

| Or | ✔ |

| Obligations | ✔ |

| Dérivés | ✔ |

| Options | ✔ |

| Contrats à terme | ✔ |

| CFD | ✔ |

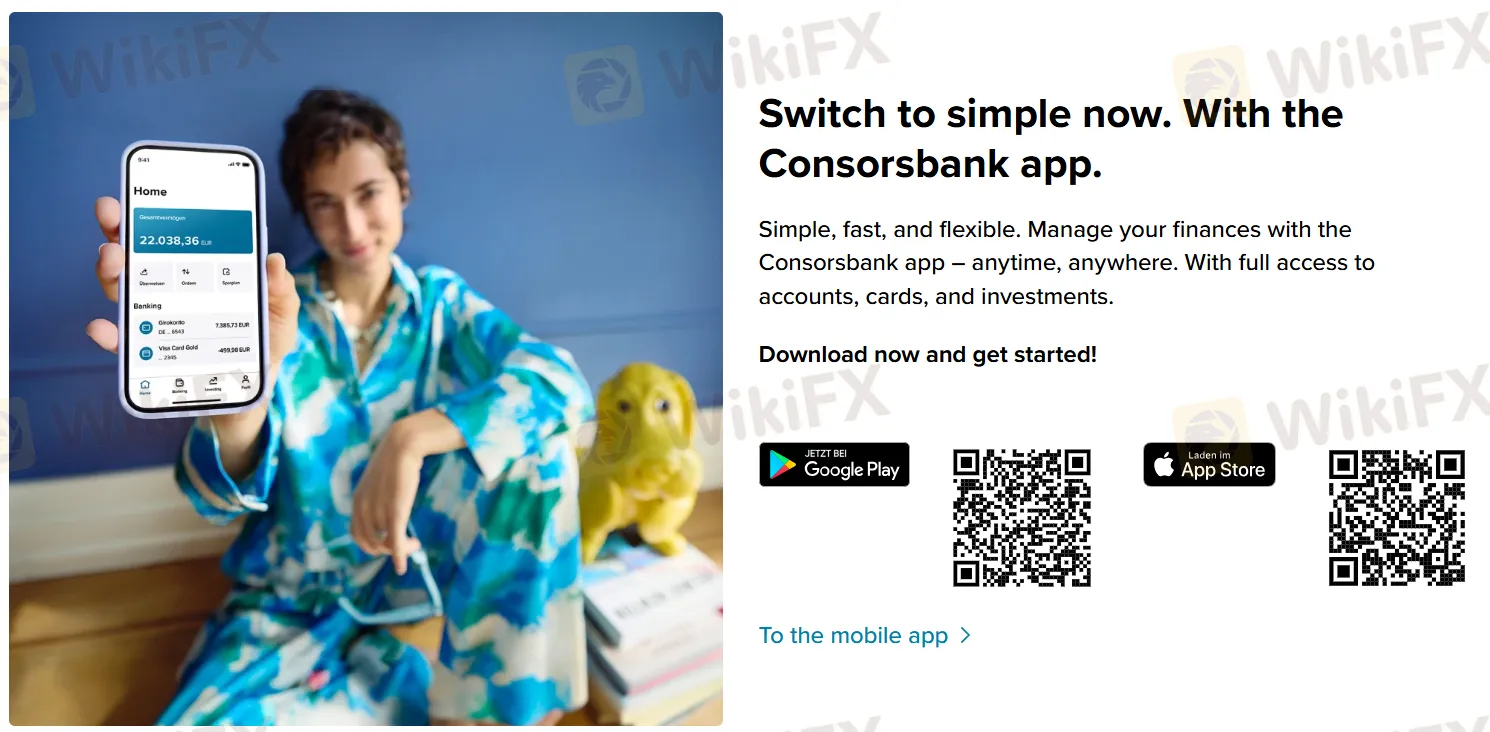

Plateforme de Trading

| Plateforme de Trading | Pris en charge | Appareils Disponibles |

| Consorsbank App | ✔ | iOS, Android |