公司簡介

| GMCU 檢討摘要 | |

| 成立年份 | 1985 |

| 註冊國家/地區 | 澳洲 |

| 監管 | ASIC(已超出) |

| 服務 | 貸款、銀行帳戶、定期存款、保險 |

| 模擬帳戶 | ❌ |

| 交易平臺 | 手機銀行應用程式 |

| 客戶支援 | 電話:1800 694 628 |

| 電郵:info@gmcu.com.au | |

| 郵寄地址:PO Box 860, Shepparton, VIC 3632 | |

GMCU 資訊

GMCU(Goulburn Murray Credit Union Co-Operative Ltd)成立於1985年,受ASIC監管,牌照號碼為241364,但狀態標記為「已超出」。該機構提供標準金融服務,如房屋貸款、個人銀行帳戶和保險產品,但不提供其他交易服務或模擬帳戶。

優缺點

| 優點 | 缺點 |

| 多種聯絡途徑 | 已超出ASIC牌照 |

| 廣泛的傳統銀行服務範疇 | |

| 多種帳戶選擇 | |

| 長時間運作 |

GMCU 是否合法?

是的,Goulburn Murray Credit Union Co-Operative Ltd(GMCU)受到監管。根據澳洲證券及投資委員會(ASIC)頒發的投資諮詢牌照,牌照號碼為241364。然而,其監管狀態標記為「已超出」,這可能表示牌照已不再有效或超出其預定範圍。

GMCU 服務

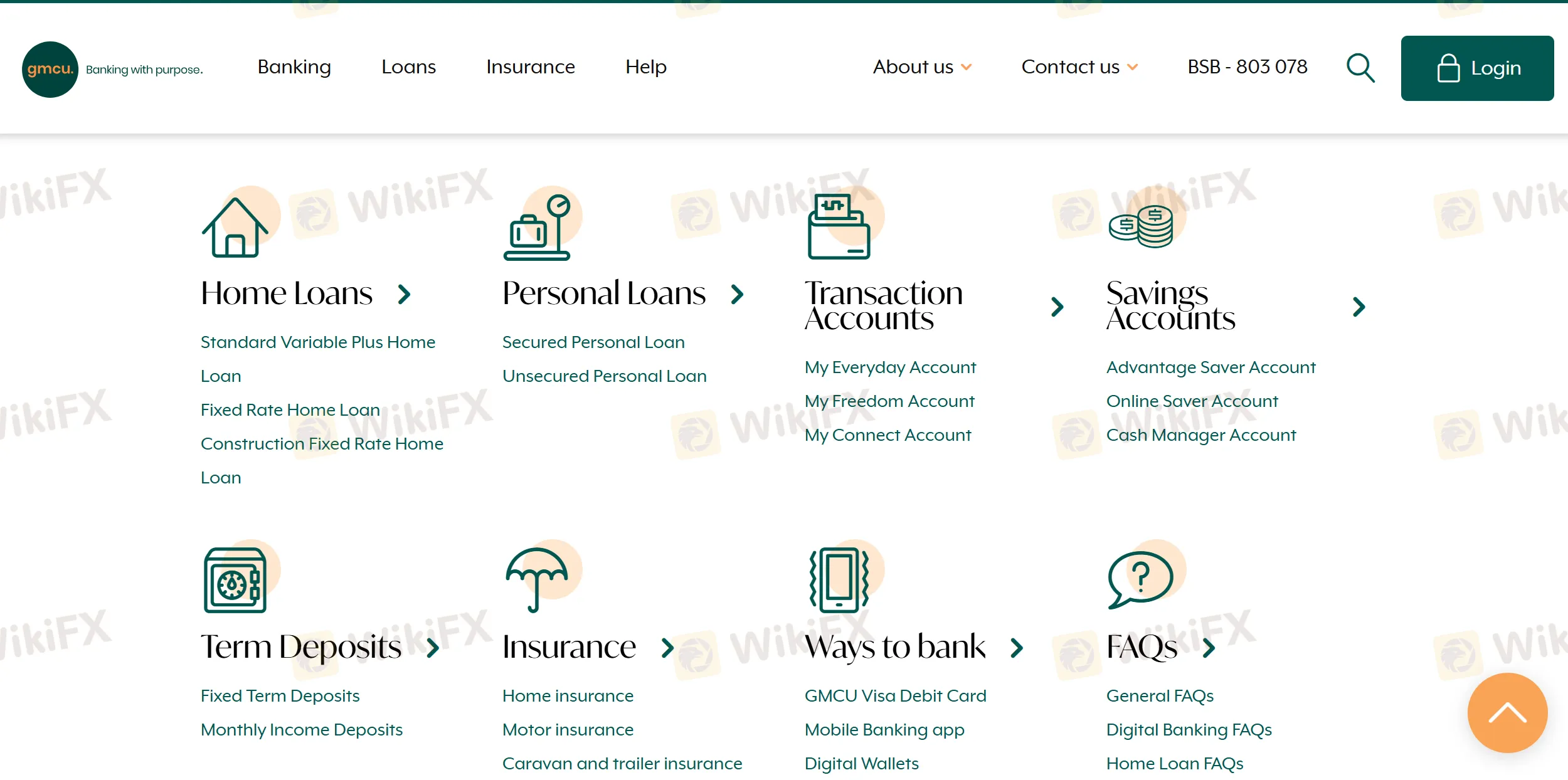

GMCU 提供廣泛的零售銀行服務,包括房屋和個人貸款、各種帳戶類型、定期存款和保險選擇。

| 類別 | 服務 |

| 房屋貸款 | 標準變動利率、固定利率、建築固定利率 |

| 個人貸款 | 有擔保個人貸款、無擔保個人貸款 |

| 交易帳戶 | 我的每日帳戶、我的自由帳戶、我的聯繫帳戶 |

| 儲蓄帳戶 | 優勢儲蓄、網上儲蓄、現金管理帳戶 |

| 定期存款 | 固定期限存款、每月收入存款 |

| 保險 | 房屋、汽車、房車及拖車、房東保險 |

帳戶類型

GMCU 提供多種真實(活躍)帳戶,以滿足日常銀行需求,包括個人交易和儲蓄帳戶。

| 帳戶類型 | 適合對象 |

| 我的日常帳戶 | 需要一般交易帳戶的個人 |

| 我的自由帳戶 | 尋求免費豁免的學生或持有優待卡的人士 |

| 我的聯繫帳戶 | 偏好無需分行訪問的數碼銀行服務的人士 |

| 優惠儲蓄帳戶 | 希望獲得獎金利息的定期儲蓄者 |

| 網上儲蓄帳戶 | 專注於網上儲蓄的人士 |

| 現金管理帳戶 | 管理較大現金流的會員 |

GMCU 費用

GMCU 的費用與行業標準相比屬於中高水平,特別是對於像個人貸款和透支這樣的無擔保貸款產品。

| 貸款類型 | 利率(每年) |

| 房屋貸款(自住房,<80% LVR) | 5.94% - 5.79% |

| 房屋貸款(自住房,>80%-95% LVR) | 6.34% - 5.79% |

| 房屋貸款(投資房,<80% LVR) | 6.14% - 6.09% |

| 房屋貸款(投資房,>80%-95% LVR) | 6.54% - 6.09% |

| 個人貸款(有擔保) | 7.79% |

| 個人貸款(無擔保) | 14.95% |

| 透支(有擔保) | 9.99% - 10.60% |

| 透支(無擔保) | 17.69% |

| 企業/農場貸款(有擔保) | 10.54% - 12.00% |

| 企業/農場貸款(無擔保) | 18.75% |

交易平台

| 交易平台 | 支援 | 可用設備 |

| 手機銀行應用程式 | ✔ | iOS、Android |

存款和提款

GMCU 並未明確提及對存款或提款收取費用。

| 付款方式 | 費用 | 處理時間 |

| 直接入賬 | / | 通常當天 |

| 直接扣款 | 如果資金不足,可能會收取拒絕付款費用 | 根據供應商時間表 |

| 定期付款 | / | 按計劃安排 |

| 網上/手機銀行 | / | 即時或當天 |

| 分行存款 | / | 即時或當天完成 |