Présentation de l'entreprise

| CompassRésumé de l'examen | |

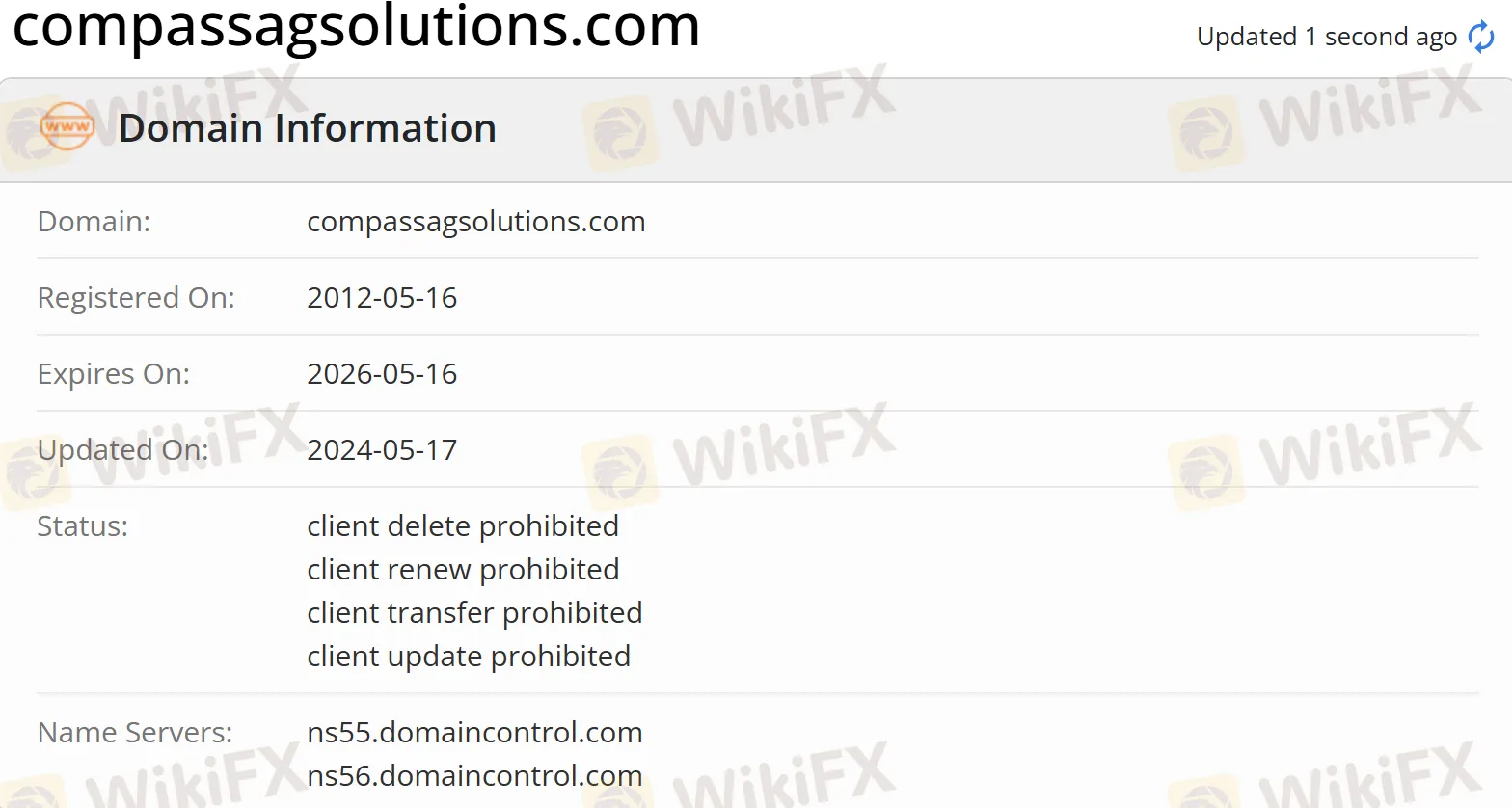

| Fondé | 2012 |

| Pays/Région d'enregistrement | USA |

| Régulation | NFA (Clone suspect) |

| Service | Compass Hedging, Compass Ag Insurance, Solutions logicielles |

| Assistance clientèle | Formulaire de contact |

| Tél: 970-372-0482; 866-433-4350 | |

| Adresse: 123 N College Ave, Suite 350 Fort Collins, CO 80524 | |

| Réseaux sociaux: Twitter, Facebook, LinkedIn | |

Compass a été enregistré en 2012 aux États-Unis. Il propose trois types de services: Compass Hedging, Compass Ag Insurance et Solutions logicielles. Il se concentre principalement sur les produits agricoles et la gestion des risques, en particulier pour les propriétaires de bétail. Cependant, Compass détient une licence NFA suspecte, ce qui signifie que des risques potentiels peuvent exister.

Avantages et inconvénients

| Avantages | Inconvénients |

| Longue durée d'exploitation | Licence NFA suspecte |

| Solutions spécifiques pour l'agro-industrie | |

| Multiples canaux de support client |

Compass est-il légitime?

Non, il détient actuellement une licence clone suspecte de la NFA. Veuillez être conscient des risques!

| Autorité de régulation | Statut actuel | Entité agréée | Pays réglementé | Type de licence | Numéro de licence |

| National Futures Association (NFA) | Clone suspect | COMPASS HEDGING LLC | USA | Licence de services financiers courants | 0442312 |

Services de Compass

Compass propose trois types de services: Compass Hedging, Compass Ag Insurance et Solutions logicielles. De plus, ces services sont principalement destinés à l'agro-industrie, en particulier à l'élevage de bovins. Compass fournit des conseils aux propriétaires de bovins et offre des informations stratégiques sur la gestion des risques.