Resumo da empresa

| GMCU Resumo da Revisão | |

| Fundação | 1985 |

| País/Região Registrada | Austrália |

| Regulação | ASIC (Excedido) |

| Serviços | Empréstimos, contas bancárias, depósitos a prazo, seguros |

| Conta Demonstrativa | ❌ |

| Plataforma de Negociação | Aplicativo de Banco Móvel |

| Suporte ao Cliente | Telefone: 1800 694 628 |

| E-mail: info@gmcu.com.au | |

| Endereço de Correio: PO Box 860, Shepparton, VIC 3632 | |

Informações sobre GMCU

GMCU (Goulburn Murray Credit Union Co-Operative Ltd) foi fundada em 1985 e é regulamentada pela ASIC com a licença nº 241364, embora o status seja listado como "Excedido". A instituição oferece serviços financeiros padrão, como empréstimos imobiliários, contas bancárias pessoais e produtos de seguro, mas não oferece outros serviços de negociação ou contas de demonstração.

Prós e Contras

| Prós | Contras |

| Vários canais de contato | Licença ASIC excedida |

| Ampla gama de serviços bancários tradicionais | |

| Múltiplas opções de conta | |

| Tempo de operação longo |

GMCU é Legítimo?

Sim, Goulburn Murray Credit Union Co-Operative Ltd (GMCU) é regulamentada. Possui uma Licença de Consultoria de Investimentos emitida pela Comissão Australiana de Valores Mobiliários e Investimentos (ASIC) sob o número de licença 241364. No entanto, seu status regulatório é marcado como Excedido, o que pode indicar que a licença não é mais válida ou ultrapassou seu escopo pretendido.

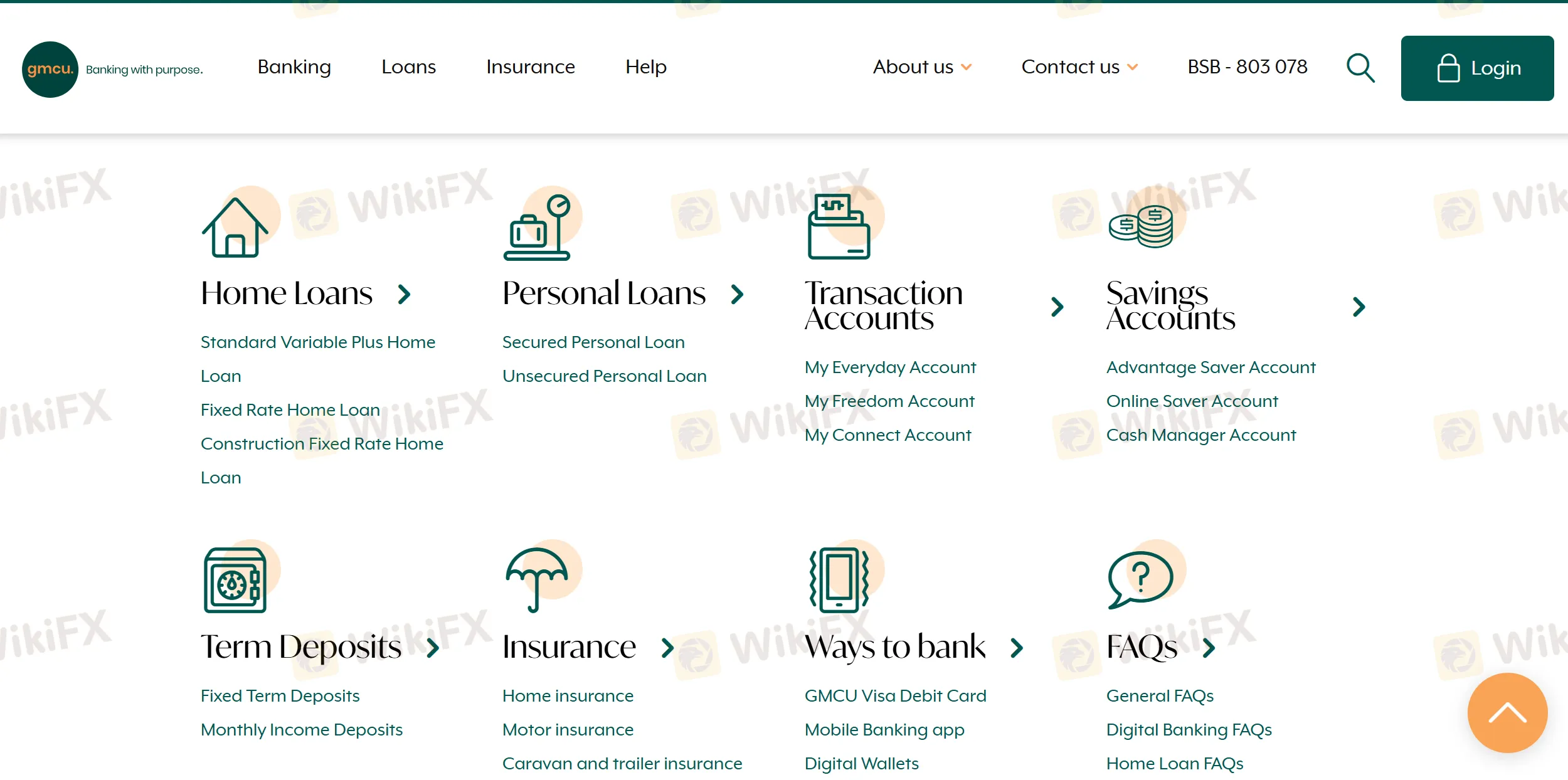

Serviços de GMCU

GMCU oferece uma ampla gama de serviços bancários de varejo, incluindo empréstimos imobiliários e pessoais, vários tipos de contas, depósitos a prazo e opções de seguro.

| Categoria | Serviços |

| Empréstimos Imobiliários | Padrão Variável Plus, Taxa Fixa, Taxa Fixa de Construção |

| Empréstimos Pessoais | Empréstimo Pessoal Garantido, Empréstimo Pessoal Não Garantido |

| Contas de Transação | Minha Conta Diária, Minha Conta Liberdade, Minha Conta Conexão |

| Contas de Poupança | Poupador de Vantagens, Poupador Online, Conta Gerente de Caixa |

| Depósitos a Prazo | Depósitos a Prazo Fixo, Depósitos de Renda Mensal |

| Seguro | Casa, Automóvel, Caravana e Reboque, Seguro de Proprietário |

Tipo de Conta

GMCU oferece vários tipos de contas reais (ao vivo) adaptadas às necessidades bancárias do dia a dia, incluindo contas de transações pessoais e poupança.

| Tipo de Conta | Adequado para |

| Minha Conta do Dia a Dia | Indivíduos que precisam de uma conta de transação geral |

| Minha Conta Liberdade | Estudantes ou titulares de cartão de concessão que buscam isenções de taxas |

| Minha Conta Conectada | Pessoas que preferem serviços bancários digitais sem acesso a agências |

| Conta Poupança de Vantagem | Poupadores regulares que desejam juros extras |

| Conta Poupança Online | Poupadores focados em serviços online |

| Conta Gerente de Caixa | Membros que gerenciam fluxos de caixa maiores |

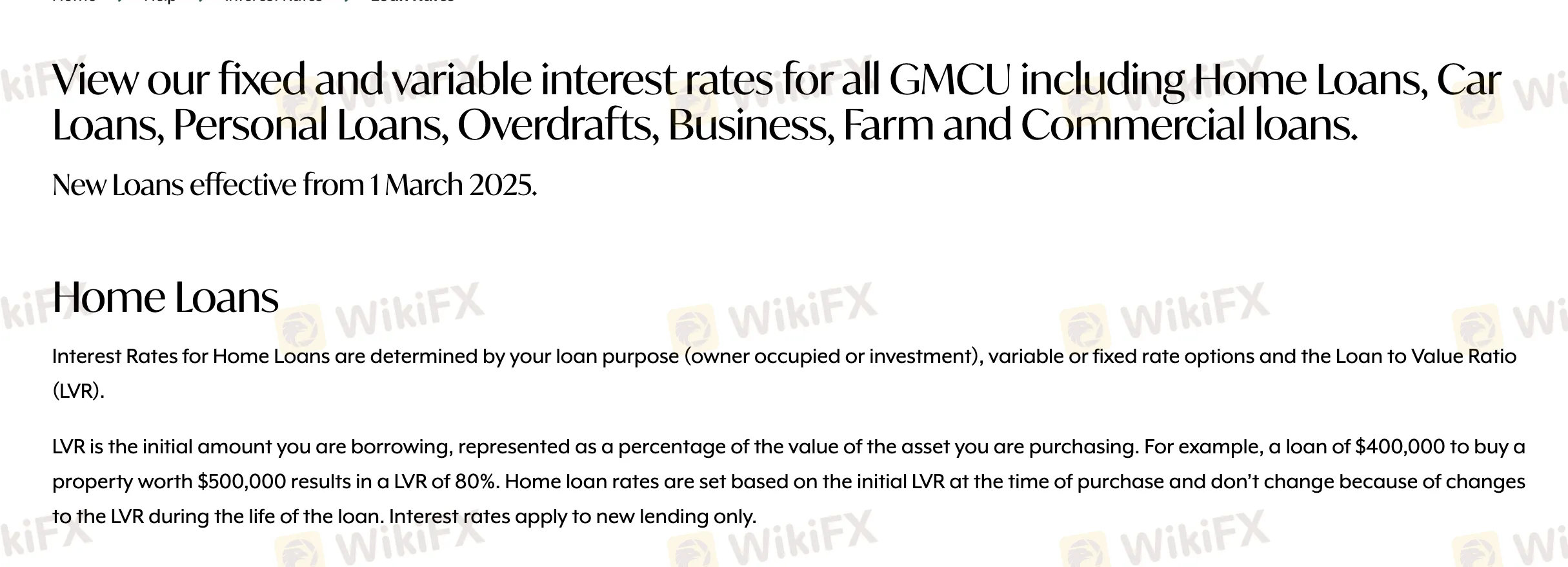

Taxas do GMCU

As taxas do GMCU são moderadas a altas em comparação com os padrões da indústria, especialmente para produtos de empréstimos não garantidos, como empréstimos pessoais e cheque especial.

| Tipo de Empréstimo | Taxa de Juros (a.a.) |

| Empréstimo Imobiliário (Ocupado pelo Proprietário, <80% LTV) | 5,94% - 5,79% |

| Empréstimo Imobiliário (Ocupado pelo Proprietário, >80%-95% LTV) | 6,34% - 5,79% |

| Empréstimo Imobiliário (Investimento, <80% LTV) | 6,14% - 6,09% |

| Empréstimo Imobiliário (Investimento, >80%-95% LTV) | 6,54% - 6,09% |

| Empréstimo Pessoal (Garantido) | 7,79% |

| Empréstimo Pessoal (Não Garantido) | 14,95% |

| Limite de Cheque Especial (Garantido) | 9,99% - 10,60% |

| Limite de Cheque Especial (Não Garantido) | 17,69% |

| Empréstimo Empresarial/Agrícola (Garantido) | 10,54% - 12,00% |

| Empréstimo Empresarial/Agrícola (Não Garantido) | 18,75% |

Plataforma de Negociação

| Plataforma de Negociação | Compatível | Dispositivos Disponíveis |

| Aplicativo de Banco Móvel | ✔ | iOS, Android |

Depósito e Saque

GMCU não menciona explicitamente a cobrança de taxas para depósitos ou saques.

| Método de Pagamento | Taxas | Tempo de Processamento |

| Crédito por Transferência Direta | / | Normalmente no mesmo dia |

| Débito por Transferência Direta | Podem ser aplicadas taxas de devolução se houver fundos insuficientes | Com base no cronograma do fornecedor |

| Pagamentos Periódicos | / | Conforme agendado |

| Internet/Banco Móvel | / | Instantâneo ou no mesmo dia |

| Depósito em Agência | / | Instantâneo ou até o final do dia |