Unternehmensprofil

| GMCU Überprüfungszusammenfassung | |

| Gegründet | 1985 |

| Registriertes Land/Region | Australien |

| Regulierung | ASIC (Überschritten) |

| Dienstleistungen | Darlehen, Bankkonten, Festgelder, Versicherungen |

| Demo-Konto | ❌ |

| Handelsplattform | Mobile Banking App |

| Kundenbetreuung | Telefon: 1800 694 628 |

| E-Mail: info@gmcu.com.au | |

| Postanschrift: PO Box 860, Shepparton, VIC 3632 | |

GMCU Informationen

GMCU (Goulburn Murray Credit Union Co-Operative Ltd) wurde 1985 gegründet und wird von ASIC mit der Lizenznummer 241364 reguliert, obwohl der Status als "Überschritten" aufgeführt ist. Die Institution bietet Standardfinanzdienstleistungen wie Hypotheken, persönliche Bankkonten und Versicherungsprodukte an, bietet jedoch keine anderen Handelsdienste oder Demokonten an.

Vor- und Nachteile

| Vorteile | Nachteile |

| Verschiedene Kontaktmöglichkeiten | Überschrittene ASIC-Lizenz |

| Breites Spektrum traditioneller Bankdienstleistungen | |

| Mehrere Kontowahlmöglichkeiten | |

| Lange Betriebszeiten |

Ist GMCU legitim?

Ja, die Goulburn Murray Credit Union Co-Operative Ltd (GMCU) ist reguliert. Sie besitzt eine Anlageberatungslizenz, die von der Australian Securities & Investments Commission (ASIC) unter der Lizenznummer 241364 ausgestellt wurde. Ihr regulatorischer Status wird jedoch als Überschritten gekennzeichnet, was darauf hindeuten kann, dass die Lizenz nicht mehr gültig ist oder ihren beabsichtigten Rahmen überschritten hat.

GMCU Dienstleistungen

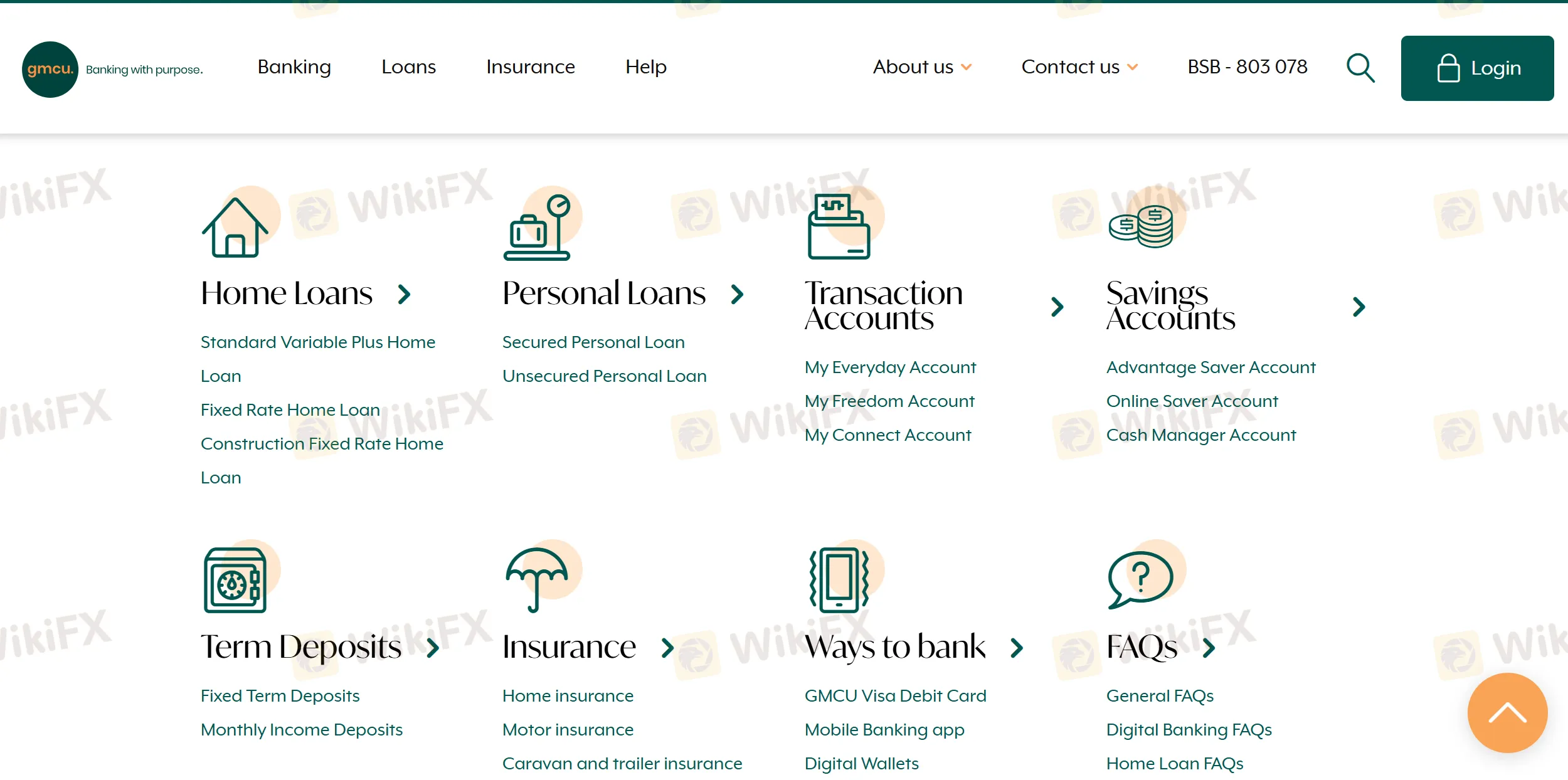

GMCU bietet eine breite Palette von Einzelhandelsbankdienstleistungen an, darunter Hypotheken, persönliche Darlehen, verschiedene Arten von Konten, Festgelder und Versicherungsoptionen.

| Kategorie | Dienstleistungen |

| Hypotheken | Standard Variable Plus, Festzins, Bau Festzins |

| Persönliche Darlehen | Gesichertes persönliches Darlehen, Ungesichertes persönliches Darlehen |

| Transaktionskonten | Mein Alltagskonto, Mein Freiheitskonto, Mein Verbindungskonto |

| Sparbücher | Vorteilssparer, Online-Sparer, Cash-Manager-Konto |

| Festgelder | Festgelder, Monatliche Einkommensgelder |

| Versicherung | Hausrat, Kfz, Wohnwagen & Anhänger, Vermieter-Versicherung |

Kontotyp

GMCU bietet mehrere Arten von Echtzeitkonten an, die auf die täglichen Bankbedürfnisse zugeschnitten sind, einschließlich persönlicher Transaktions- und Sparkonten.

| Kontotyp | Geeignet für |

| Mein Alltagskonto | Einzelpersonen, die ein allgemeines Transaktionskonto benötigen |

| Mein Freiheitskonto | Studenten oder Inhaber von Ermäßigungskarten, die Gebührenerlasse suchen |

| Mein Verbindungskonto | Menschen, die digitales Banking ohne Filialzugang bevorzugen |

| Vorteilssparkonto | Regelmäßige Sparer, die Bonuszinsen wünschen |

| Online-Sparkonto | Online-orientierte Sparer |

| Cash-Manager-Konto | Mitglieder, die größere Geldströme verwalten |

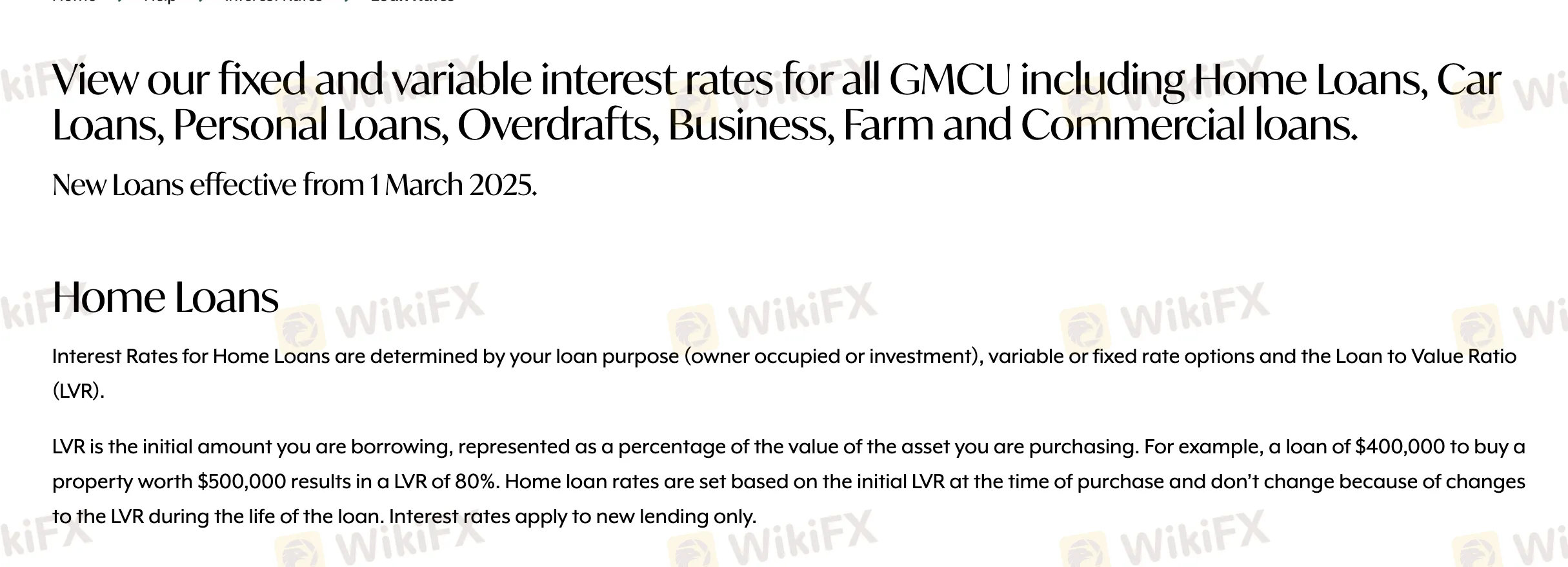

GMCU Gebühren

Die Gebühren von GMCU sind im Vergleich zu Branchenstandards moderat bis hoch, insbesondere bei unbesicherten Kreditprodukten wie Privatkrediten und Überziehungskrediten.

| Kreditart | Zinssatz (p.a.) |

| Hypothekendarlehen (Eigenheimbesitzer, <80% Beleihungsquote) | 5,94% - 5,79% |

| Hypothekendarlehen (Eigenheimbesitzer, >80%-95% Beleihungsquote) | 6,34% - 5,79% |

| Hypothekendarlehen (Investition, <80% Beleihungsquote) | 6,14% - 6,09% |

| Hypothekendarlehen (Investition, >80%-95% Beleihungsquote) | 6,54% - 6,09% |

| Privatkredit (Besichert) | 7,79% |

| Privatkredit (Unbesichert) | 14,95% |

| Überziehungskredit (Besichert) | 9,99% - 10,60% |

| Überziehungskredit (Unbesichert) | 17,69% |

| Geschäfts-/Landwirtschaftsdarlehen (Besichert) | 10,54% - 12,00% |

| Geschäfts-/Landwirtschaftsdarlehen (Unbesichert) | 18,75% |

Handelsplattform

| Handelsplattform | Unterstützt | Verfügbare Geräte |

| Mobile Banking App | ✔ | iOS, Android |

Einzahlung und Auszahlung

GMCU erwähnt nicht explizit, dass Gebühren erhoben werden für Einzahlungen oder Auszahlungen.

| Zahlungsmethode | Gebühren | Verarbeitungszeit |

| Direkte Einzahlung per Gutschrift | / | In der Regel am selben Tag |

| Direkte Einzahlung per Lastschrift | Bei unzureichenden Mitteln können Rücklastschriftgebühren anfallen | Basierend auf dem Lieferantenplan |

| Periodische Zahlungen | / | Wie geplant |

| Internet-/Mobile Banking | / | Instant oder am selben Tag |

| Einzahlung in der Filiale | / | Sofort oder bis zum Ende des Tages |