회사 소개

| GMCU 리뷰 요약 | |

| 설립 연도 | 1985 |

| 등록 국가/지역 | 호주 |

| 규제 | ASIC (초과) |

| 서비스 | 대출, 은행 계좌, 만기 예금, 보험 |

| 데모 계정 | ❌ |

| 거래 플랫폼 | 모바일 뱅킹 앱 |

| 고객 지원 | 전화: 1800 694 628 |

| 이메일: info@gmcu.com.au | |

| 우편 주소: PO Box 860, Shepparton, VIC 3632 | |

GMCU 정보

GMCU (Goulburn Murray Credit Union Co-Operative Ltd)은 1985년에 설립되었으며 ASIC의 규제를 받고 있으며 라이센스 번호는 241364이지만 상태는 "초과"로 표시됩니다. 이 기관은 주택 대출, 개인 은행 계좌, 보험 상품과 같은 표준 금융 서비스를 제공하지만 다른 거래 서비스나 데모 계정은 제공하지 않습니다.

장단점

| 장점 | 단점 |

| 다양한 연락 채널 | ASIC 라이센스 초과 |

| 다양한 전통적인 은행 서비스 | |

| 다양한 계정 선택 | |

| 운영 시간이 길다 |

GMCU 합법적인가요?

네, Goulburn Murray Credit Union Co-Operative Ltd (GMCU)은 규제를 받고 있습니다. 라이센스 번호 241364로 호주 증권 거래 위원회 (ASIC)에서 발급한 투자 자문 라이센스를 보유하고 있습니다. 그러나 규제 상태가 "초과"로 표시되어 있어 라이센스가 더 이상 유효하지 않거나 의도된 범위를 벗어난 것일 수 있습니다.

GMCU 서비스

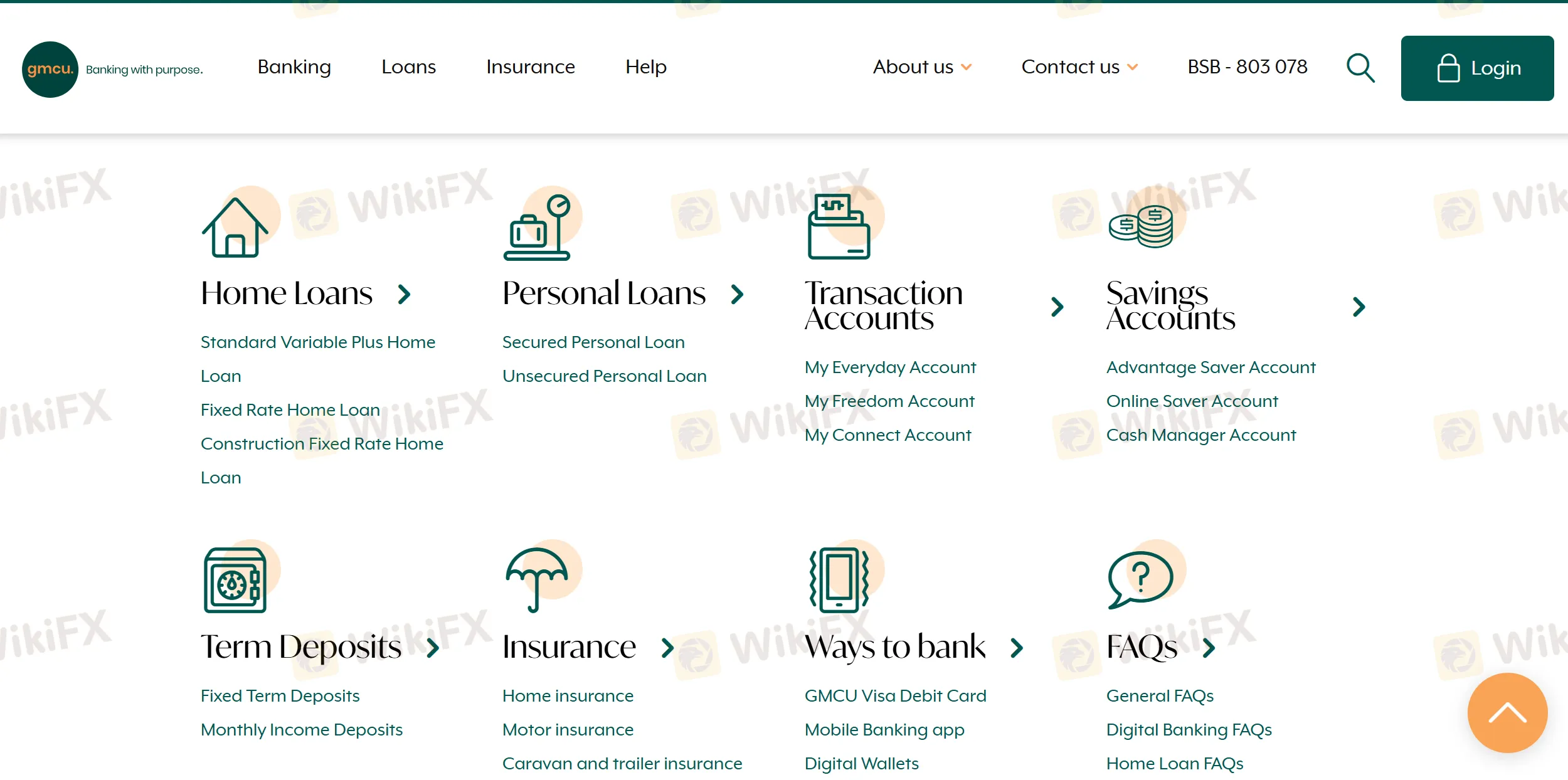

GMCU은 주택 및 개인 대출, 다양한 계정 유형, 만기 예금 및 보험 옵션을 포함한 다양한 소매 은행 서비스를 제공합니다.

| 카테고리 | 서비스 |

| 주택 대출 | 표준 변동 금리 플러스, 고정 금리, 건설 고정 금리 |

| 개인 대출 | 담보 대출, 무담보 대출 |

| 거래 계좌 | 마이 에브리데이 계정, 마이 프리덤 계정, 마이 커넥트 계정 |

| 저축 계좌 | 어드밴티지 세이버, 온라인 세이버, 캐시 매니저 계정 |

| 만기 예금 | 고정 기간 예금, 월 수입 예금 |

| 보험 | 주택, 자동차, 캐러밴 및 트레일러, 임대인 보험 |

계정 유형

GMCU은 일상적인 은행 업무에 맞춘 여러 종류의 실제(실시간) 계좌를 제공하며 개인 거래 및 저축 계좌를 포함합니다.

| 계좌 유형 | 적합 대상 |

| 나의 일상 계좌 | 일반 거래 계좌가 필요한 개인 |

| 나의 자유 계좌 | 수업료 면제를 원하는 학생 또는 할인 카드 소지자 |

| 나의 연결 계좌 | 지점 접근이 없는 디지털 뱅킹을 선호하는 사람들 |

| 장점 저축 계좌 | 보너스 이자를 원하는 정기 저축자 |

| 온라인 저축 계좌 | 온라인 중심의 저축자 |

| 현금 관리자 계좌 | 대규모 현금 흐름을 관리하는 회원 |

GMCU 수수료

GMCU의 수수료는 특히 개인 대출 및 초과 인출과 같은 무담보 대출 상품에 비해 산업 기준에 비해 중간에서 높은 편입니다.

| 대출 유형 | 이자율 (연간 기준) |

| 주택 대출 (자가 주택, LVR <80%) | 5.94% - 5.79% |

| 주택 대출 (자가 주택, LVR >80%-95%) | 6.34% - 5.79% |

| 투자용 주택 대출 (LVR <80%) | 6.14% - 6.09% |

| 투자용 주택 대출 (LVR >80%-95%) | 6.54% - 6.09% |

| 개인 대출 (담보 대출) | 7.79% |

| 개인 대출 (무담보 대출) | 14.95% |

| 초과 인출 (담보 대출) | 9.99% - 10.60% |

| 초과 인출 (무담보 대출) | 17.69% |

| 사업/농장 대출 (담보 대출) | 10.54% - 12.00% |

| 사업/농장 대출 (무담보 대출) | 18.75% |

거래 플랫폼

| 거래 플랫폼 | 지원 | 사용 가능한 장치 |

| 모바일 뱅킹 앱 | ✔ | iOS, Android |

입출금

GMCU은 입금 또는 출금에 대해 수수료를 명시적으로 부과하지 않습니다.

| 결제 방법 | 수수료 | 처리 시간 |

| 직접 입금 | / | 일반적으로 당일 |

| 직접 출금 | 자금 부족 시 거절 수수료가 부과될 수 있음 | 공급 업체 일정에 따라 |

| 주기적인 지불 | / | 일정에 따라 |

| 인터넷/모바일 뱅킹 | / | 즉시 또는 당일 |

| 지점 내 입금 | / | 즉시 또는 당일 종료 |