Buod ng kumpanya

| GMCU Buod ng Pagsusuri | |

| Itinatag | 1985 |

| Rehistradong Bansa/Rehiyon | Australia |

| Regulasyon | ASIC (Nalampasan) |

| Serbisyo | Mga Pautang, mga account sa bangko, term deposits, insurance |

| Demo Account | ❌ |

| Platform ng Pagtrade | Mobile Banking App |

| Suporta sa Kustomer | Telepono: 1800 694 628 |

| Email: info@gmcu.com.au | |

| Mail Address: PO Box 860, Shepparton, VIC 3632 | |

Impormasyon Tungkol sa GMCU

Ang GMCU (Goulburn Murray Credit Union Co-Operative Ltd) ay itinatag noong 1985 at niregula sa ilalim ng ASIC na may lisensiyang Numero 241364, bagaman ang status ay nakalista bilang "Nalampasan." Ang institusyon ay nagbibigay ng mga karaniwang serbisyong pinansyal tulad ng mga pautang sa bahay, personal na mga account sa bangko, at mga produkto ng insurance, ngunit hindi nag-aalok ng iba pang mga serbisyong pangkalakalan o demo account.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Iba't ibang mga paraan ng pakikipag-ugnayan | Nalampasan ang lisensiyang ASIC |

| Malawak na hanay ng tradisyonal na mga serbisyong bangko | |

| Maraming pagpipilian ng account | |

| Mahabang oras ng operasyon |

Tunay ba ang GMCU?

Oo, ang Goulburn Murray Credit Union Co-Operative Ltd (GMCU) ay niregula. Mayroon itong Investment Advisory License na inisyu ng Australia Securities & Investments Commission (ASIC) sa ilalim ng lisensiyang numero 241364. Gayunpaman, ang regulatory status nito ay naka-marka bilang Nalampasan, na maaaring magpahiwatig na ang lisensya ay hindi na balido o lumampas sa inaasahang saklaw nito.

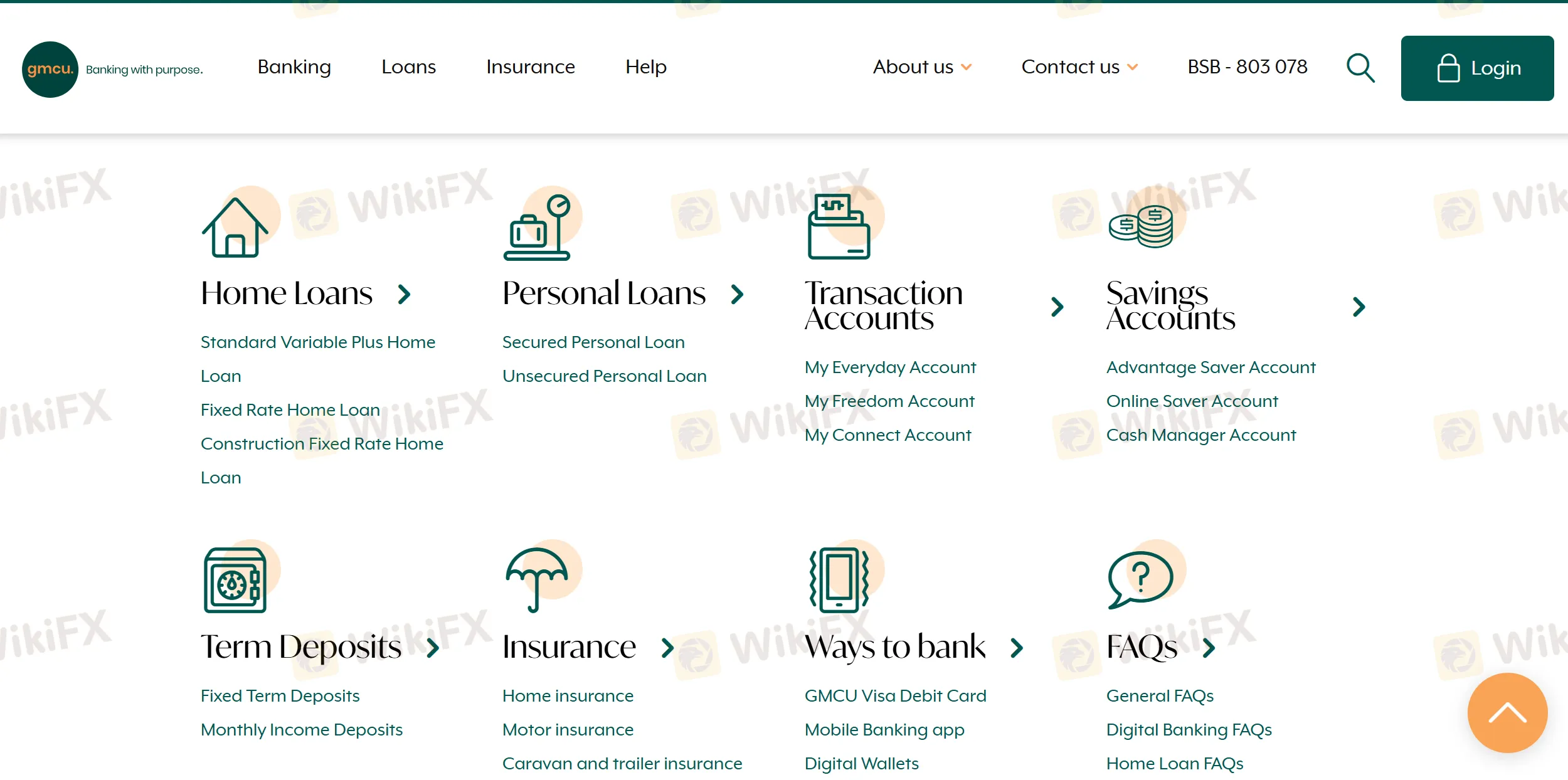

Mga Serbisyo ng GMCU

Ang GMCU ay nag-aalok ng malawak na hanay ng mga serbisyong pang-retail banking kabilang ang mga pautang sa bahay at personal, iba't ibang uri ng account, term deposits, at mga opsyon sa insurance.

| Kategorya | Serbisyo |

| Pautang sa Bahay | Standard Variable Plus, Fixed Rate, Construction Fixed Rate |

| Personal na Pautang | Secured Personal Loan, Unsecured Personal Loan |

| Mga Account sa Transaksyon | My Everyday Account, My Freedom Account, My Connect Account |

| Mga Account sa Ipon | Advantage Saver, Online Saver, Cash Manager Account |

| Term Deposits | Fixed Term Deposits, Monthly Income Deposits |

| Insurance | Home, Motor, Caravan & Trailer, Landlord Insurance |

Uri ng Account

GMCU ay nag-aalok ng ilang uri ng tunay (live) na mga account na naaangkop sa pang-araw-araw na pangangailangan sa bangko, kabilang ang personal transaction at savings accounts.

| Uri ng Account | Naaangkop para sa |

| Aking Everyday Account | Mga indibidwal na nangangailangan ng pangkalahatang account sa transaksyon |

| Aking Freedom Account | Mga mag-aaral o may hawak ng concession card na naghahanap ng fee waivers |

| Aking Connect Account | Mga taong mas pinipili ang digital banking na walang access sa branch |

| Advantage Saver Account | Mga regular na nag-iipon na nagnanais ng bonus interest |

| Online Saver Account | Mga nagfo-focus sa online na nag-iipon |

| Cash Manager Account | Mga miyembro na namamahala ng mas malalaking cash flows |

Mga Bayad ng GMCU

Ang mga bayad ng GMCU ay katamtaman hanggang mataas kung ihahambing sa pamantayan ng industriya, lalo na para sa mga produkto ng walang kasiguraduhan tulad ng personal loans at overdrafts.

| Uri ng Pautang | Interest Rate (p.a.) |

| Home Loan (Owner Occupied, <80% LVR) | 5.94% - 5.79% |

| Home Loan (Owner Occupied, >80%-95% LVR) | 6.34% - 5.79% |

| Home Loan (Investment, <80% LVR) | 6.14% - 6.09% |

| Home Loan (Investment, >80%-95% LVR) | 6.54% - 6.09% |

| Personal Loan (Secured) | 7.79% |

| Personal Loan (Unsecured) | 14.95% |

| Overdraft (Secured) | 9.99% - 10.60% |

| Overdraft (Unsecured) | 17.69% |

| Business/Farm Loan (Secured) | 10.54% - 12.00% |

| Business/Farm Loan (Unsecured) | 18.75% |

Platform ng Pagtetrade

| Platform ng Pagtetrade | Supported | Available Devices |

| Mobile Banking App | ✔ | iOS, Android |

Pagdedeposito at Pagwiwithdraw

Ang GMCU ay hindi tuwirang nagsasabi ng pagpapataw ng bayad para sa mga deposito o withdrawals.

| Pamamaraan ng Pagbabayad | Bayad | Oras ng Paghahandle |

| Direct Entry Credit | / | Karaniwang sa parehong araw |

| Direct Entry Debit | Maaaring mag-apply ng dishonour fees kung kulang ang pondo | Batay sa iskedyul ng supplier |

| Periodical Payments | / | Ayon sa iskedyul |

| Internet/Mobile Banking | / | Instant o sa parehong araw |

| In-branch Deposit | / | Instant o sa katapusan ng araw |