Présentation de l'entreprise

| RBC Résumé de l'examen | |

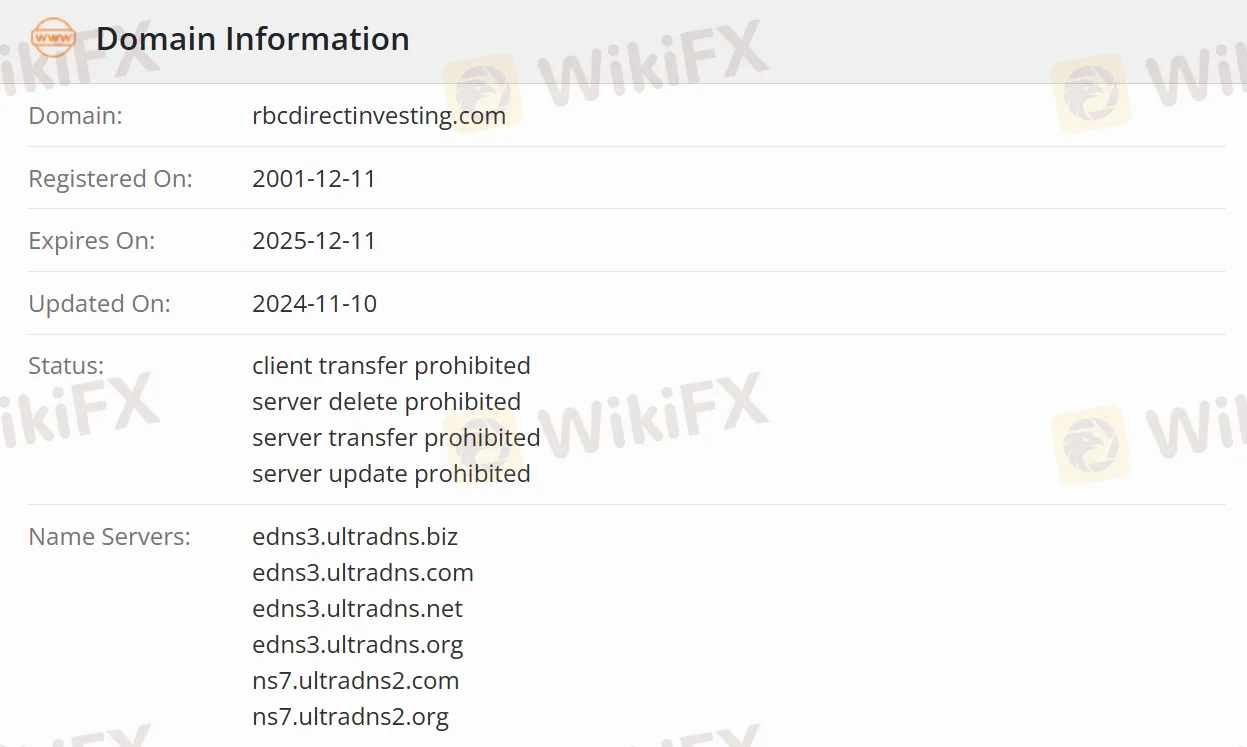

| Inscrit le | 2001-12-11 |

| Pays/Région d'inscription | Canada |

| Régulation | Réglementé |

| Produits d'investissement | Actions, Options, Nouvelles émissions/IPO, ETF, Fonds communs de placement, CPG, Obligations, Or et Argent |

| Plateforme de trading | Plateforme d'investissement en ligne, Application mobile RBC (Mobile) |

| Support client | Numéro gratuit : 1-800-769-2560 |

| International : 1-416-977-1255 | |

| Cantonais et Mandarin : 1-800-667-8668 ou 416-313-8611 | |

| Fax : 1 (888) 722-2388 | |

Informations sur RBC

RBC Direct Investing est une plateforme d'investissement autonome sous la Royal Bank of Canada (RBC), strictement réglementée. Elle propose divers services d'investissement, notamment des actions, des options, des ETF, des fonds communs de placement et des obligations, couvrant 18 marchés mondiaux tels que le Canada et les États-Unis. Soutenant trois méthodes de trading - la plateforme en ligne, l'application mobile et le tableau de bord de trading professionnel - elle répond à tous les types d'investisseurs, des débutants aux traders chevronnés.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Réglementé | Informations de compte non spécifiques |

| Structure de commission basse (aussi bas que 6,95 $ par transaction) | Seuil de frais de maintenance |

| Informations de frais claires | Spread aussi élevé que 1,6% (USD-CAD) |

| Plateformes de trading flexibles |

Est-ce que RBC est légitime ?

L'Organisme canadien de réglementation des placements régule RBC, son numéro de licence n'étant pas divulgué, et RBC respecte strictement les réglementations sur les valeurs mobilières canadiennes.

Que puis-je trader sur RBC ?

RBC propose des actions canadiennes et américaines, y compris des actions ordinaires et privilégiées, des actions nouvellement émises, des options, des droits et des bons de souscription, des fonds communs de placement en actions, des fonds négociés en bourse (FNB), et des investissements à revenu fixe tels que des bons du Trésor, des obligations et des certificats de placement garanti (CPG).

| Produits | Instruments Négociables | Pris en Charge |

| Investissements en Actions | Actions | ✔ |

| Options | ✔ | |

| Nouvelles émissions/IPO | ✔ | |

| Diversification Intégrée | FNB | ✔ |

| Fonds Communs de Placement | ✔ | |

| Investissements à Revenu Fixe | CPG | ✔ |

| Obligations | ✔ | |

| Métaux Précieux | Or et Argent | ✔ |

Type de Compte

RBC propose des comptes enregistrés avec des avantages fiscaux et des comptes non enregistrés.

Comptes Enregistrés

CELI (Compte d'Épargne Libre d'Impôt)

REER (Régime enregistré d'épargne-retraite)

CEAP (Compte d'Épargne pour l'Accession à la Propriété)

REEE (Régime enregistré d'épargne-études)

FERR (Fonds enregistré de revenu de retraite)

Comptes Non Enregistrés

Comptes en espèces, comptes sur marge, et comptes d'entreprise/fiducie pour les investisseurs institutionnels (soutenant les structures d'entreprise/partenariat).

Frais de RBC

Commission

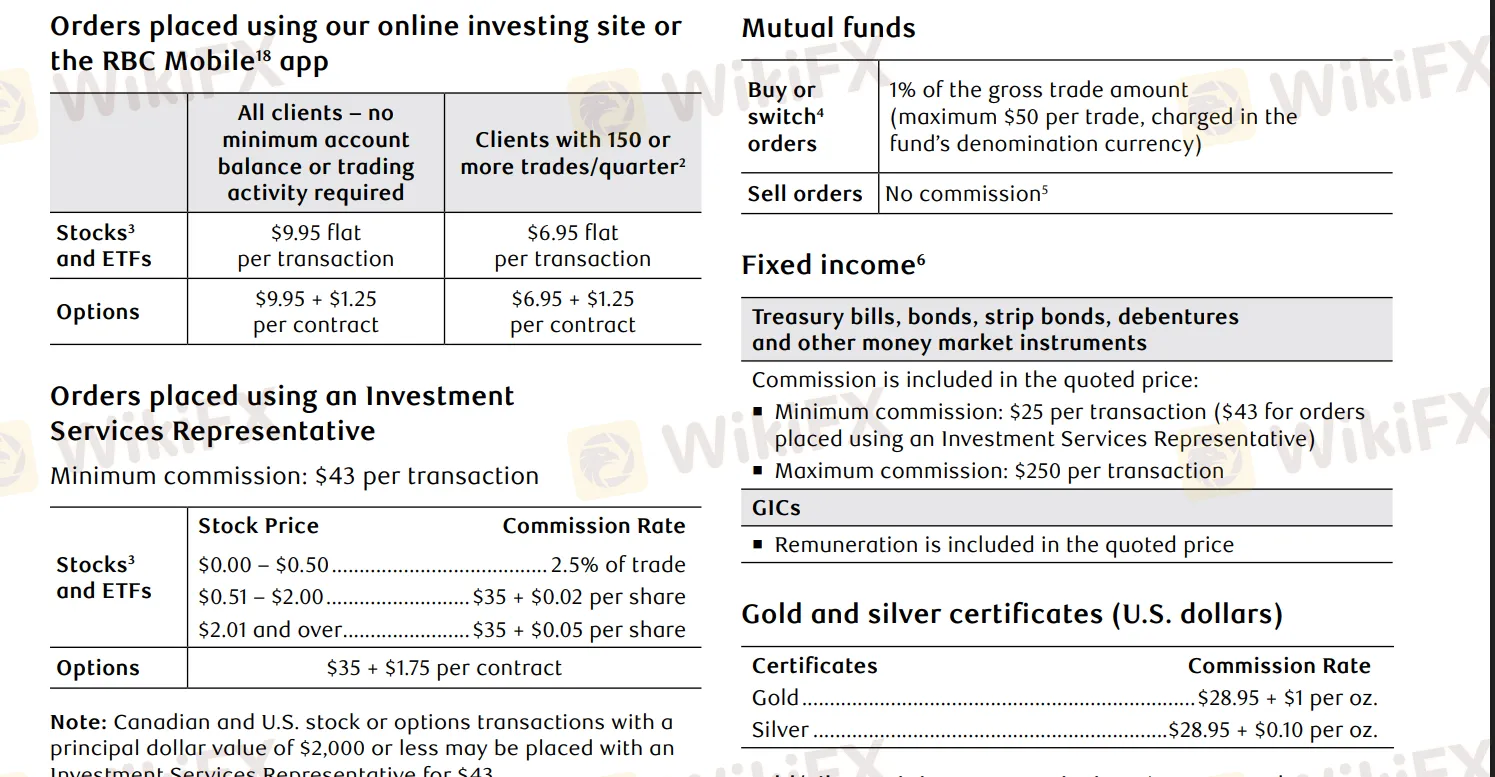

| Actifs | Détails de la Commission |

| Trading d'Actions/FNB | En ligne : 9,95 $ par transaction (moins de 150 transactions par trimestre), 6,95 $ par transaction (150+ transactions par trimestre) |

| Trading d'Options | En ligne : 9,95 $ par transaction + 1,25 $ par contrat (faible fréquence), 6,95 $ par transaction + 1,25 $ par contrat (haute fréquence) |

| Achats de Fonds Communs de Placement | Commission de 1 % (maximum de 50 $) |

| Or | 28,95 $ + 1 $ par once |

| Argent | 28,95 $ + 0,10 $ par once |

| Revenu Fixe | À partir de 25 $ par transaction |

Taux de change des spreads

| Montant de la transaction (USD) | Spread (bps) | Spread (%) |

| 0 $ à 24 999 $ | 230 | 1,6% |

| 25 000 $ à 99 999 $ | 145 | 1,0% |

| 100 000 $ à 499 999 $ | 85 | 0,6% |

| 500 000 $ à 999 999 $ | 50 | 0,4% |

| 1 000 000 $ à 1 999 999 $ | 25 | 0,2% |

| 2 000 000,01 $ et plus | Pas plus de 10 bps | 0,1% |

Si les actifs sont inférieurs à 15 000 $, des frais de maintenance trimestriels de 25 $ sont requis (exonération disponible). De plus, les virements bancaires au Canada ou aux États-Unis coûtent 45 $ par transaction.

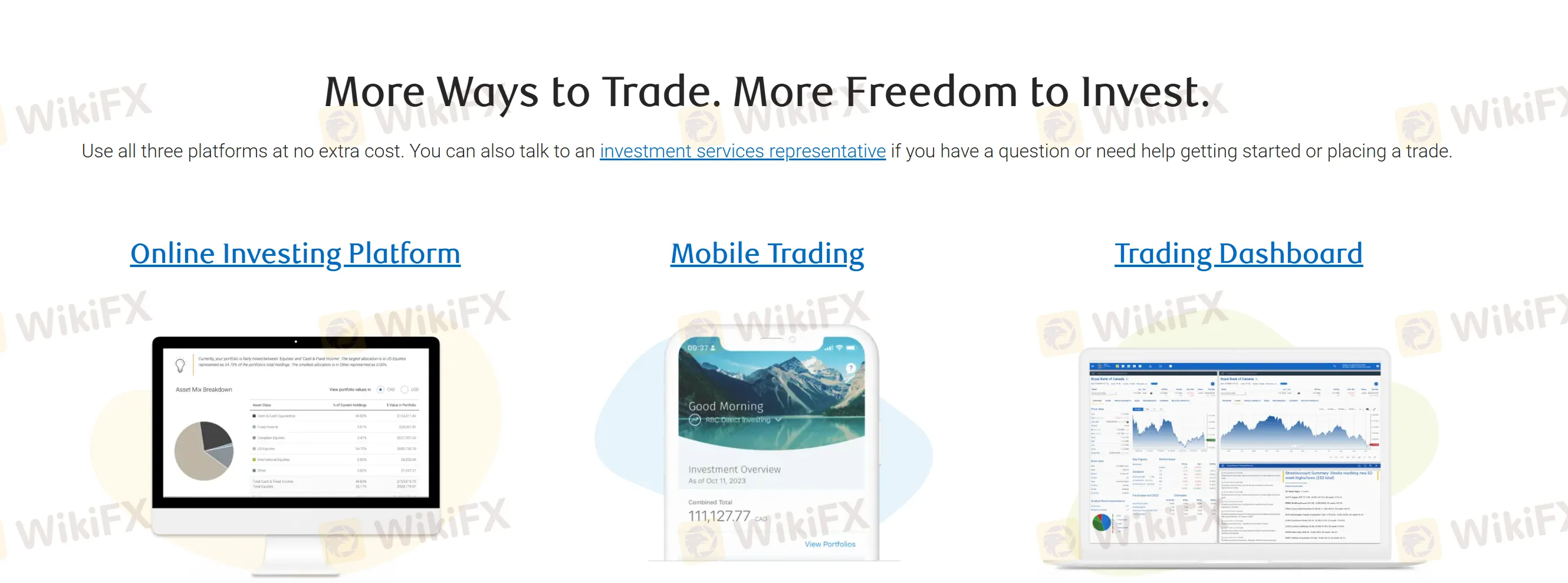

Plateforme de trading

RBC propose une plateforme d'investissement en ligne adaptée à une analyse complète, offrant un compte de démonstration. De plus, l'application mobile RBC permet un trading mobile pratique, tandis que les outils de tableau de bord de trading de qualité professionnelle sont conçus pour les traders à haute fréquence et les investisseurs institutionnels.

Bonus

Les traders qui transfèrent des actifs de ≥ 15 000 $ seront remboursés jusqu'à 200 $ pour les frais de transfert de compte de leur courtier d'origine.