Présentation de l'entreprise

| Standard BankRésumé de l'examen | |

| Fondé | 1998 |

| Pays/Région d'enregistrement | Afrique du Sud |

| Régulation | Pas de régulation |

| Instruments de marché | CFDs, ETFs, Indices, Forex, Actions et Métaux |

| Compte de démonstration | / |

| Effet de levier | / |

| Spread | / |

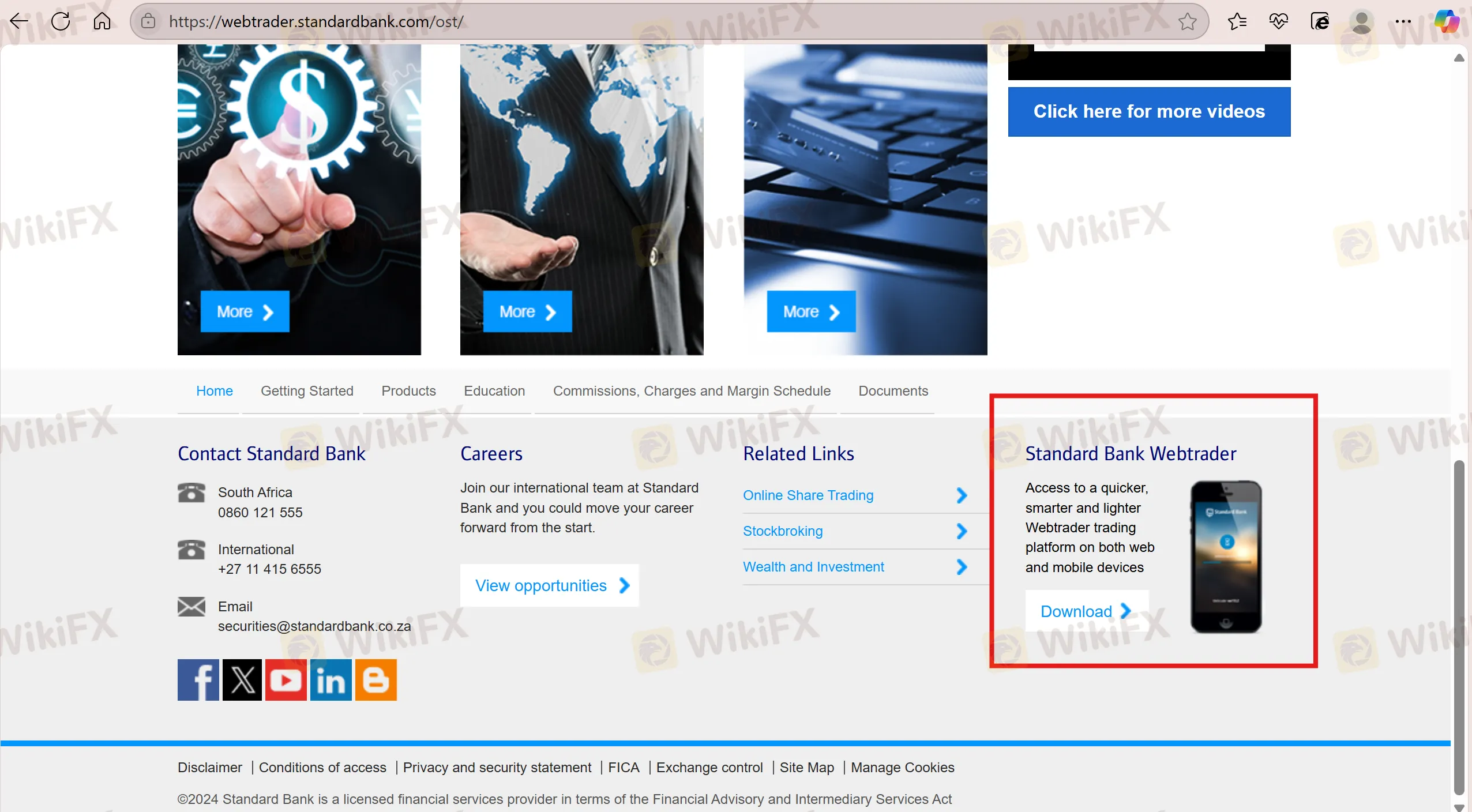

| Plateforme de trading | Standard Bank Webtrader |

| Dépôt minimum | / |

| Support client | Email : securities@standardbank.co.za |

| Tél : 0860 121 555 (Afrique du Sud) | |

| Tél : +27 11 415 6555 (International) | |

| Réseaux sociaux : Facebook, YouTube, LinkedIn, Twitter, Blogger | |

Informations sur Standard Bank

Standard Bank a été créé en 1998 et enregistré en Afrique du Sud. Il propose plus de 20 275 instruments négociables, y compris des CFD, des ETF, des indices, du forex, des actions et des métaux, et prend en charge le trading via la plateforme Standard Bank Webtrader. Bien qu'il propose une variété de produits et services financiers sans frais de transaction, l'entreprise n'est pas réglementée et manque d'informations détaillées sur les fonctionnalités du compte. Les investisseurs doivent faire preuve de prudence quant à sa légitimité et sa transparence. De plus, les dépôts entraînent des frais de 0,05 $ US et les règlements prennent généralement deux jours ouvrables pour être finalisés.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Une variété de produits financiers | Pas de régulation |

| Longue histoire d'opération | Informations limitées sur les détails de trading |

| Divers canaux de contact | Frais de dépôt facturés |

Standard Bank est-il légitime ?

Standard Bank n'est pas réglementé, donc les traders doivent faire preuve de prudence lorsqu'ils tradent.

Que puis-je trader sur Standard Bank ?

Standard Bank propose une large gamme de plus de 20 275 instruments de trading, y compris CFDs, ETFs, Indices, Forex, Actions et Métaux.

| Instruments négociables | Pris en charge |

| CFDs | ✔ |

| ETFs | ✔ |

| Indices | ✔ |

| Forex | ✔ |

| Fonds | ✔ |

| Actions | ✔ |

| Métaux | ✔ |

| Obligations | ❌ |

| Cryptomonnaies | ❌ |

| Options | ❌ |

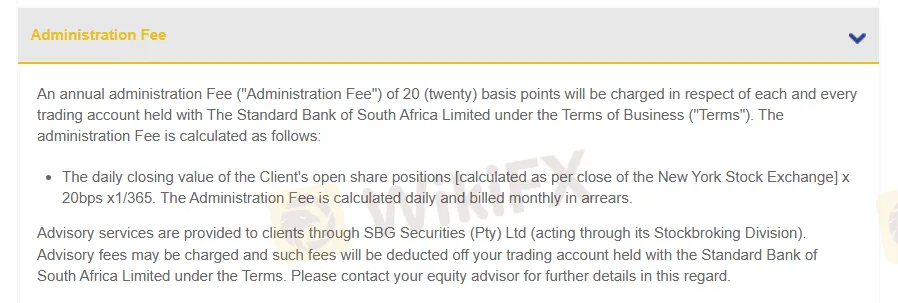

Frais

Frais d'administration : 20 points de base seront facturés.

Plateforme de trading

Standard Bank prend en charge le trading sur la plateforme Standard Bank Webtrader. La plateforme ne facture pas de frais de transaction, et le règlement est effectué dans les deux jours ouvrables.

| Plateforme de trading | Pris en charge | Appareils disponibles | Convient pour |

| Standard Bank Webtrader | ✔ | Mobile, Web | / |

| MT4 | ❌ | / | Débutants |

| MT5 | ❌ | / | Traders expérimentés |

Dépôt et retrait

Les clients peuvent effectuer des dépôts et des retraits principalement par virement bancaire, et des frais de 0,05 $ US seront facturés pour les dépôts.