Buod ng kumpanya

| RBC Buod ng Pagsusuri | |

| Nakarehistro Noong | 2001-12-11 |

| Nakarehistrong Bansa/Rehiyon | Canada |

| Regulasyon | Regulado |

| Mga Produkto ng Pamumuhunan | Stocks, Options, Mga bagong isyu/IPOs, ETFS, Mutual Funds, GICs, Bonds, Gold, at Silver |

| Platform ng Paggagalaw | Online investment platform, RBC Mobile App (Mobile) |

| Suporta sa Customer | Toll-Free: 1-800-769-2560 |

| Overseas: 1-416-977-1255 | |

| Cantonese at Mandarin: 1-800-667-8668 o 416-313-8611 | |

| Fax: 1 (888) 722-2388 | |

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| Regulado | Hindi tiyak na impormasyon ng account |

| Mababang istraktura ng komisyon (mababa hanggang $6.95 bawat trade) | Maintenance fee threshold |

| Malinaw na impormasyon sa fee | Spread na mataas hanggang 1.6% (USD-CAD) |

| Flexible na mga trading platform |

Ano ang Maaari Kong I-trade sa RBC?

RBC nag-aalok ng mga Canadian at U.S. stocks, kabilang ang karaniwang at preferred shares, bagong isyu ng stocks, options, rights at warrants, equity, fixed income, at money market mutual funds, exchange-traded funds (ETFs), at mga fixed income investment tulad ng treasury bills, bonds, at guaranteed investment certificates (GICs).

| Mga Produkto | Mga Tradable Instrumento | Supported |

| Investment sa Equity | Stocks | ✔ |

| Options | ✔ | |

| Bagong isyu/lPOs | ✔ | |

| Built-in Diversification | ETFs | ✔ |

| Mutual Funds | ✔ | |

| Investment sa Fixed-Income | GICs | ✔ |

| Bonds | ✔ | |

| Mga Precio ng Metal | Ginto at Pilak | ✔ |

Uri ng Account

RBC nag-aalok ng mga rehistradong account na may mga benepisyo sa buwis at mga hindi rehistradong account.

Rehistradong Account

TFSA (Tax-Free Savings Account)

RRSP (Registered Retirement Savings Plan)

FHSA (First-Time Home Savings Account)

RESP (Registered Education Savings Plan)

RRIF (Registered Retirement Income Fund)

Hindi Rehistradong Account

Mga cash account, margin account, at corporate/trust account para sa institutional investors (sumusuporta sa corporate/partnership structures).

RBC Fees

Komisyon

| Ari-arian | Mga Detalye ng Komisyon |

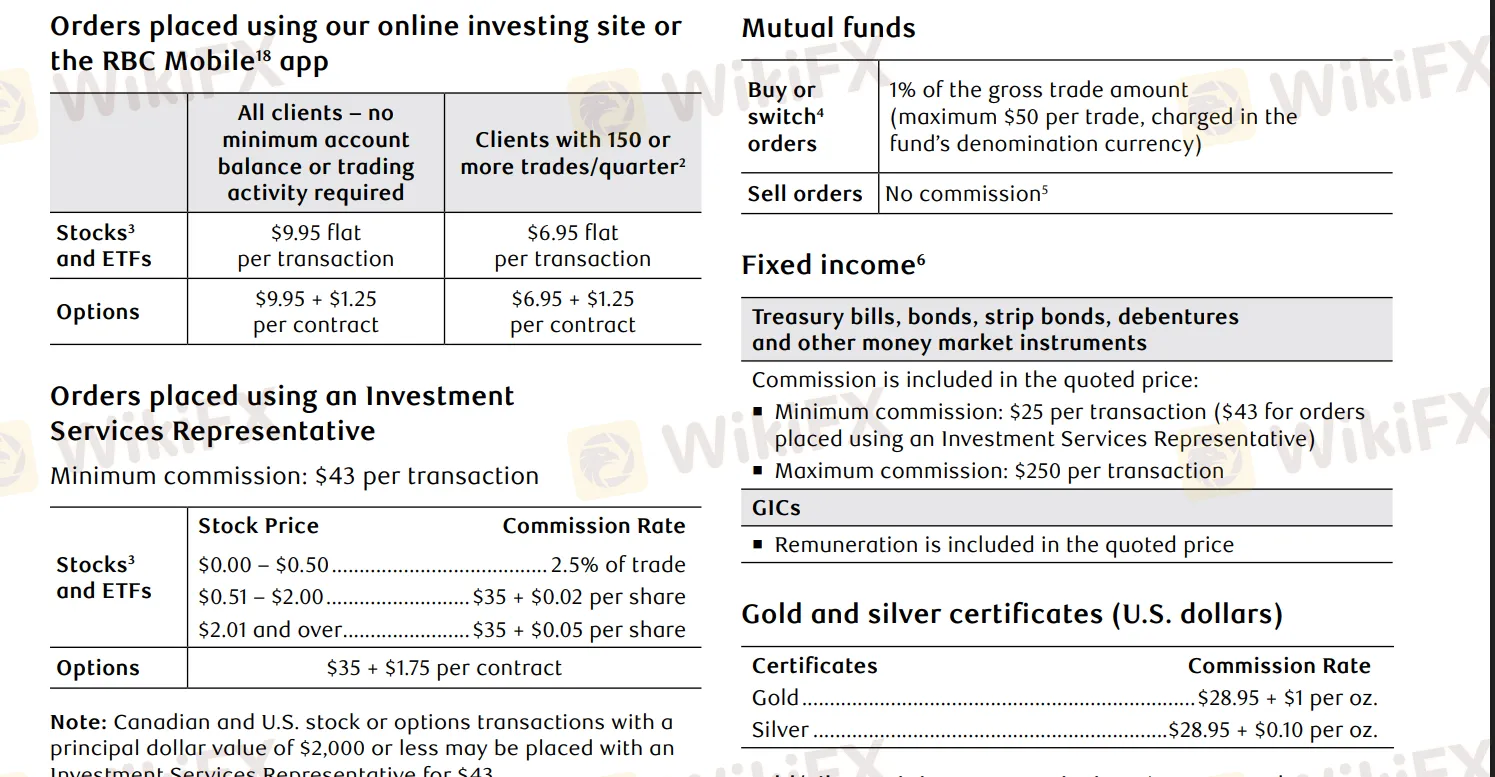

| Stock/ETF Trading | Online: $9.95 bawat trade (mas mababa sa 150 trades kada quarter), $6.95 bawat trade (150+ trades kada quarter) |

| Options Trading | Online: $9.95 bawat trade + $1.25 bawat kontrata (low frequency), $6.95 bawat trade + $1.25 bawat kontrata (high frequency) |

| Mga Pagbili ng Mutual Fund | 1% komisyon ($50 maximum) |

| Ginto | $28.95 + $1 bawat ounce |

| Pilak | $28.95 + $0.10 bawat ounce |

| Fixed Income | Simula sa $25 bawat transaksyon |

Mga Rate ng Pagkalat ng Palitan ng Dayuhan

| Halaga ng Transaksyon (USD) | Palitan (bps) | Palitan (%) |

| $0 hanggang $24,999 | 230 | 1.6% |

| $25,000 hanggang $99,999 | 145 | 1.0% |

| $100,000 hanggang $499,999 | 85 | 0.6% |

| $500,000 hanggang $999,999 | 50 | 0.4% |

| $1,000,000 hanggang $1,999,999 | 25 | 0.2% |

| $2,000,000.01 pataas | Hindi hihigit sa 10 bps | 0.1% |

Kung ang mga ari-arian ay mas mababa sa $15,000, kinakailangan ang isang quarterly maintenance fee na $25 (may waiver). Bukod dito, ang wire transfers sa loob ng Canada o ng U.S. ay nagkakahalaga ng $45 bawat transaksyon.

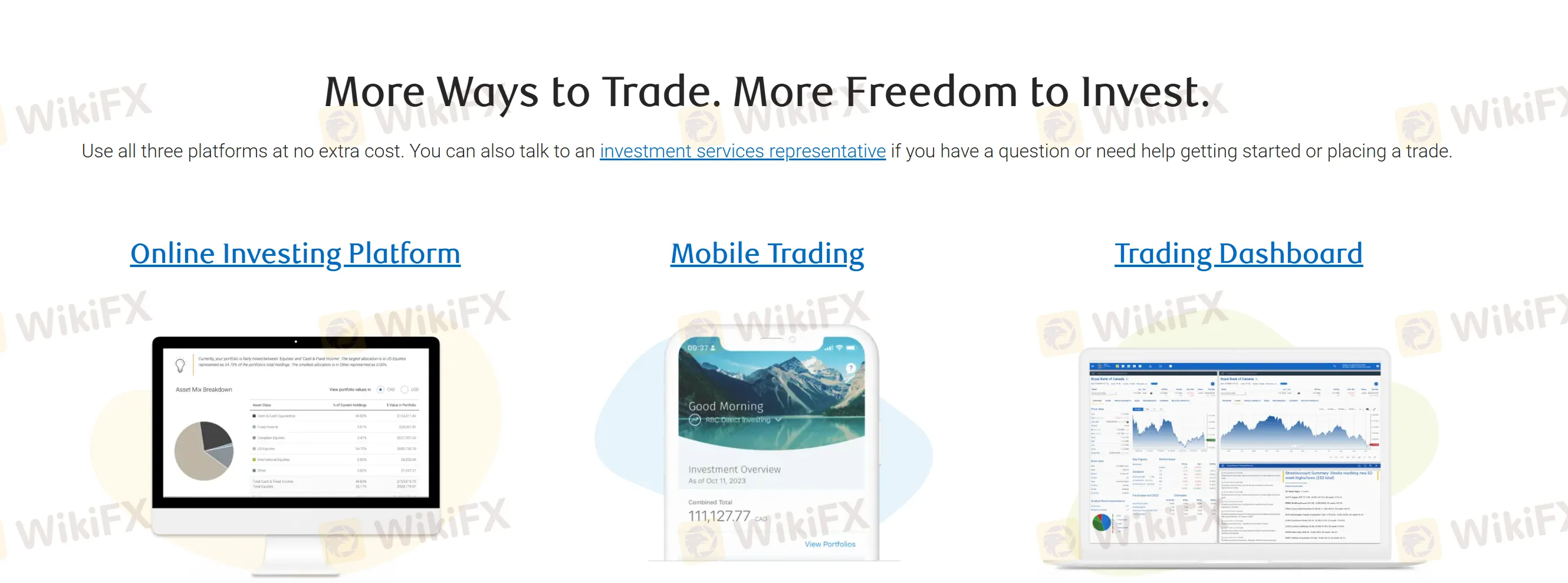

Platform ng Paghahalal

RBC ay nag-aalok ng isang online na plataporma ng pamumuhunan na angkop para sa komprehensibong pagsusuri, nagbibigay ng demo account. Bukod dito, ang RBC Mobile App ay nagbibigay ng kumportableng mobile trading, habang ang mga tool ng propesyonal na Trading Dashboard ay inaayos para sa mga high-frequency traders at institutional investors.

Bonus

Ang mga trader na naglilipat ng mga ari-arian na ≥ $15,000 ay maaaring ma-reimburse ng hanggang sa $200 para sa mga bayad ng paglipat ng account mula sa kanilang orihinal na brokerage.