회사 소개

| RBC 리뷰 요약 | |

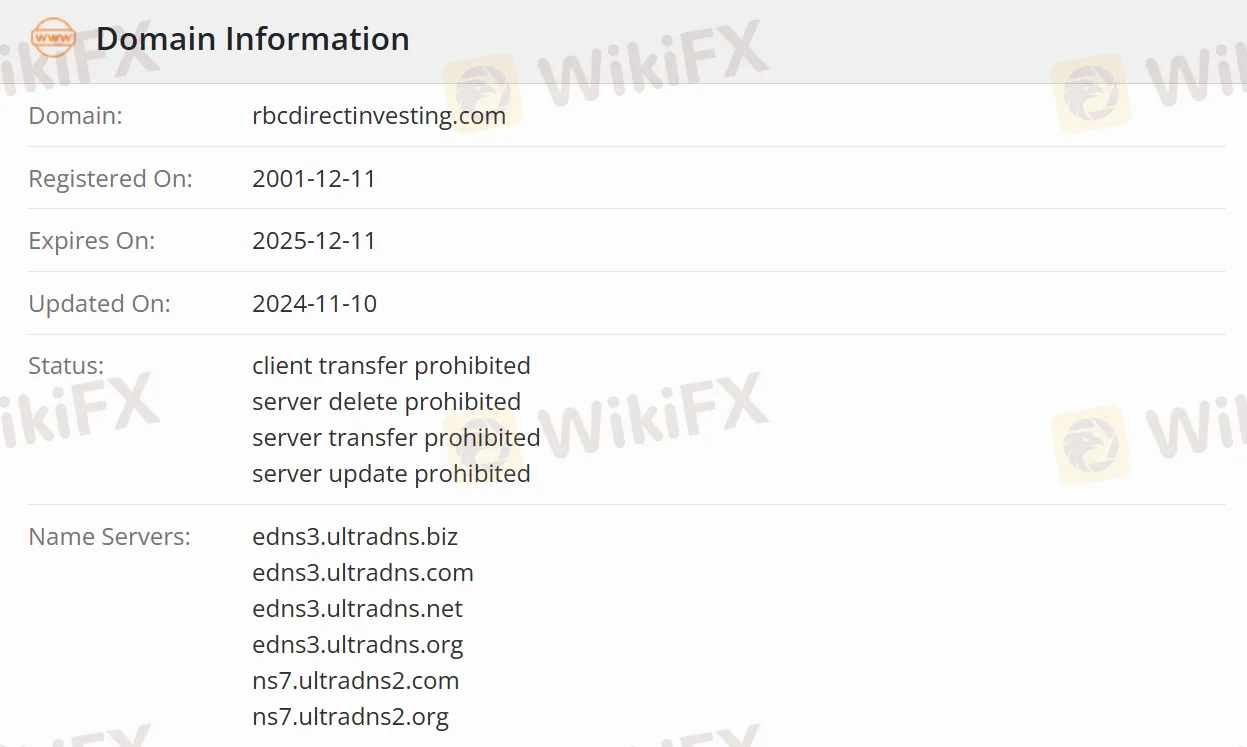

| 등록일 | 2001-12-11 |

| 등록 국가/지역 | 캐나다 |

| 규제 | 규제됨 |

| 투자 상품 | 주식, 옵션, 신규 상장/IPO, ETF, 펀드, GIC, 채권, 금, 은 |

| 거래 플랫폼 | 온라인 투자 플랫폼, RBC 모바일 앱 (모바일) |

| 고객 지원 | 무료 전화: 1-800-769-2560 |

| 해외: 1-416-977-1255 | |

| 광동어 및 만다린어: 1-800-667-8668 또는 416-313-8611 | |

| 팩스: 1 (888) 722-2388 | |

RBC 정보

RBC 다이렉트 투자는 로얄 뱅크 오브 캐나다 (RBC)의 자율 투자 플랫폼으로 엄격히 규제됩니다. 주식, 옵션, ETF, 펀드, 채권 등을 포함한 다양한 투자 서비스를 제공하며 캐나다와 미국을 포함한 18개의 글로벌 시장을 대상으로 합니다. 온라인 플랫폼, 모바일 앱 및 전문 거래 대시보드를 지원하여 초보자부터 숙련된 트레이더까지 모든 유형의 투자자를 대상으로 합니다.

장단점

| 장점 | 단점 |

| 규제됨 | 구체적인 계정 정보 없음 |

| 수수료 구조가 낮음 (거래당 $6.95부터) | 유지 수수료 한도 |

| 명확한 수수료 정보 | 스프레드 최대 1.6% (USD-CAD) |

| 유연한 거래 플랫폼 |

RBC이 신뢰할 만한가요?

캐나다 투자 규제 기구가 RBC을 규제하며 라이센스 번호는 공개되지 않았으며 RBC은 캐나다 증권 규정을 엄격히 준수합니다.

RBC에서 무엇을 거래할 수 있나요?

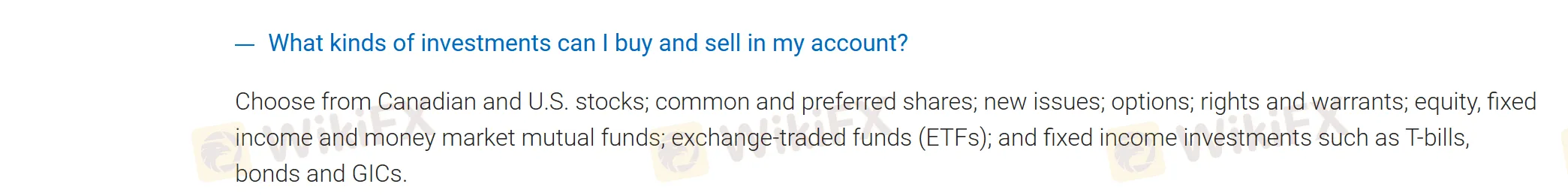

RBC은 캐나다와 미국의 주식을 제공하며 일반 및 우선주, 신규 발행 주식, 옵션, 권리 및 옵션, 자본금, 고정 소득 및 자금 시장 상품, 거래소 거래 펀드 (ETF), 국채, 채권 및 보증 투자 증서 (GIC)를 포함한 고정 소득 투자를 제공합니다.

| 제품 | 거래 가능한 상품 | 지원 |

| 자본금 투자 | 주식 | ✔ |

| 옵션 | ✔ | |

| 신규 발행/기업공개(IPOs) | ✔ | |

| 내장 다양화 | ETF | ✔ |

| 펀드 | ✔ | |

| 고정 소득 투자 | GIC | ✔ |

| 채권 | ✔ | |

| 귀금속 | 금 및 은 | ✔ |

계좌 유형

RBC은 세금 혜택이 있는 등록 계좌와 비등록 계좌를 제공합니다.

등록된 계좌

TFSA (비과세 저축 계좌)

RRSP (등록 연금 저축 계획)

FHSA (첫 주택 저축 계좌)

RESP (등록 교육 저축 계획)

RRIF (등록 연금 소득 기금)

비등록 계좌

기관 투자자를 위한 현금 계좌, 마진 계좌 및 기업/신뢰 계좌(기업/파트너십 구조 지원).

RBC 수수료

수수료

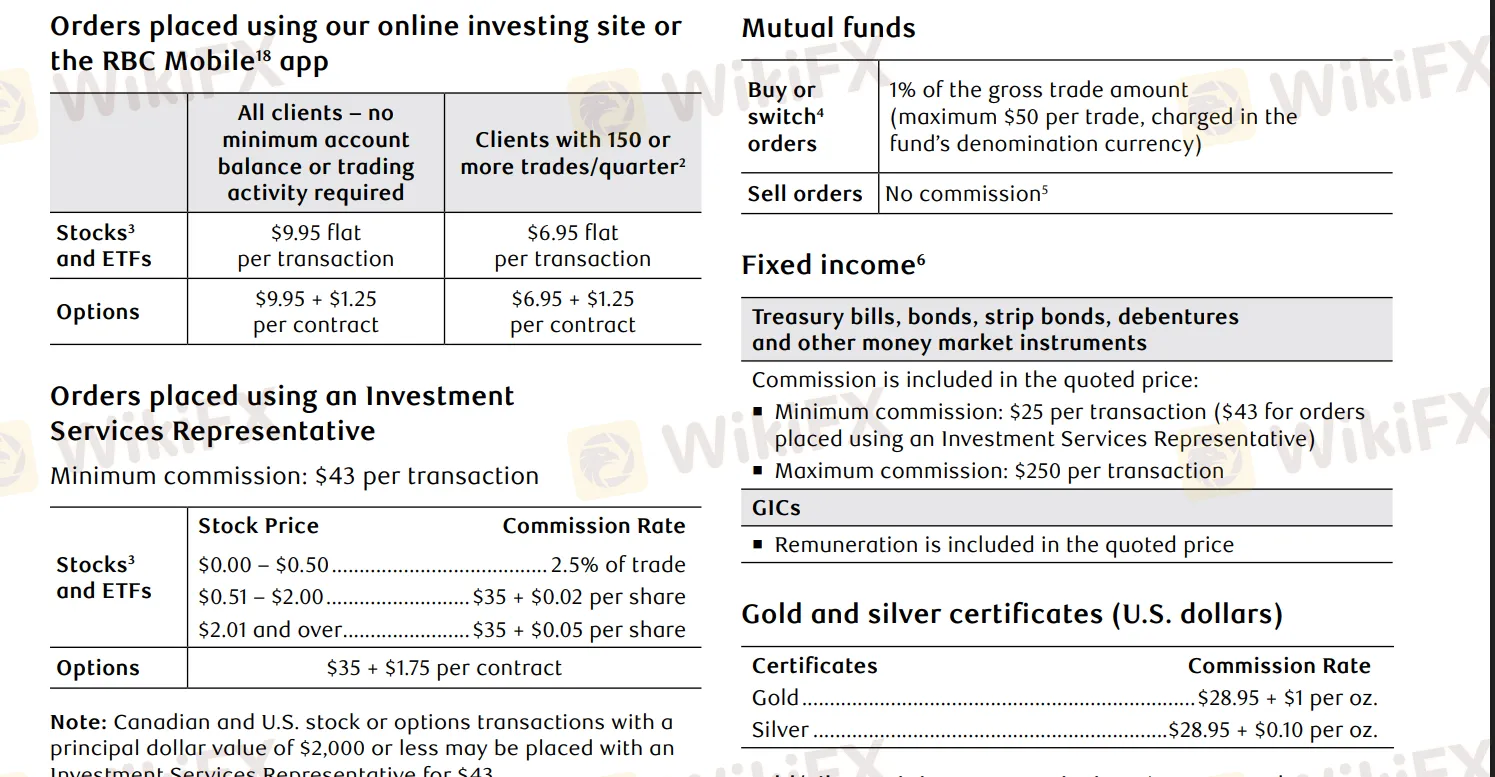

| 자산 | 수수료 상세 |

| 주식/ETF 거래 | 온라인: 1거래당 $9.95(분기별 거래 횟수 150회 미만), 1거래당 $6.95(분기별 거래 횟수 150회 이상) |

| 옵션 거래 | 온라인: 1거래당 $9.95 + 계약당 $1.25(저빈도), 1거래당 $6.95 + 계약당 $1.25(고빈도) |

| 펀드 구매 | 수수료 1%($50 상한) |

| 금 | $28.95 + 온스당 $1 |

| 은 | $28.95 + 온스당 $0.10 |

| 고정 소득 | 거래당 시작가 $25 |

외환 스프레드 요율

| 거래 금액 (USD) | 스프레드 (bps) | 스프레드 (%) |

| $0에서 $24,999 | 230 | 1.6% |

| $25,000에서 $99,999 | 145 | 1.0% |

| $100,000에서 $499,999 | 85 | 0.6% |

| $500,000에서 $999,999 | 50 | 0.4% |

| $1,000,000에서 $1,999,999 | 25 | 0.2% |

| $2,000,000.01 이상 | 10 bps 이하 | 0.1% |

자산이 $15,000 미만인 경우 분기별 유지 수수료로 $25가 필요합니다 (면제 가능). 또한, 캐나다 또는 미국 내에서의 와이어 이체는 거래 당 $45가 소요됩니다.

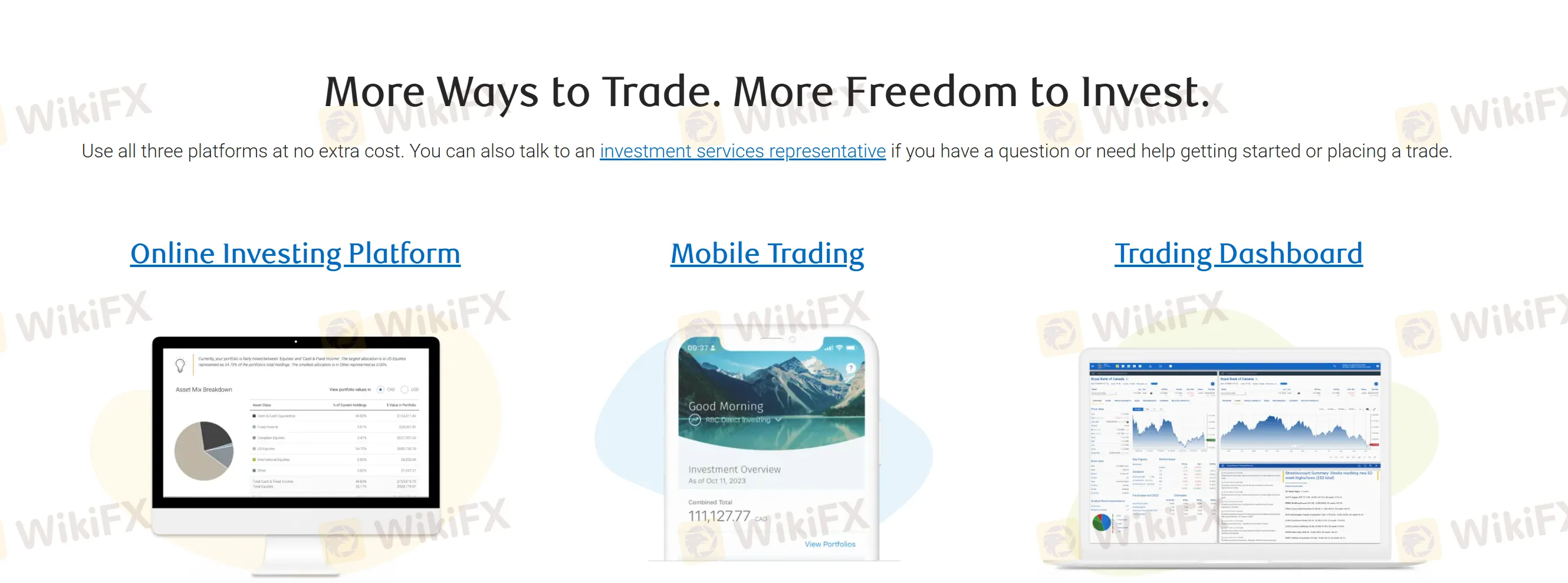

거래 플랫폼

RBC은 종합적인 분석에 적합한 온라인 투자 플랫폼을 제공하며 데모 계정을 제공합니다. 또한, RBC 모바일 앱을 통해 편리한 모바일 거래가 가능하며, 전문가급 거래 대시보드 도구는 고빈도 거래자와 기관 투자자를 위해 맞춤화되어 있습니다.

보너스

자산을 ≥ $15,000 이체하는 거래자는 원래 중개업체로부터의 계정 이체 수수료 최대 $200까지 환불 받을 수 있습니다.