Présentation de l'entreprise

| Hana BankRésumé de l'examen | |

| Fondé | 2013-02-08 |

| Pays/Région d'enregistrement | Corée du Sud |

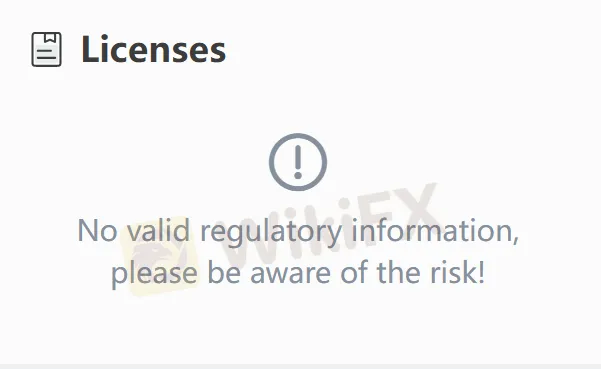

| Régulation | Non réglementé |

| Produits et Services | banque commerciale, banque d'investissement, gestion d'actifs et assurance |

| Support Client | 分行写 每种写一行 比如电话一行 邮箱一行等 可见别的兼职写的文章 |

Hana Bank Informations

KEB Hana Bank est l'une des principales institutions financières en Corée du Sud, appartenant au groupe financier Hana. Son activité couvre plusieurs domaines tels que la banque commerciale, la banque d'investissement, la gestion d'actifs et l'assurance. Basée à Séoul, en Corée du Sud, la banque dispose d'un réseau de services mondial, offrant un support multilingue (coréen, anglais, japonais, chinois, vietnamien, etc.), et lançant divers produits financiers et activités promotionnelles via son site web officiel et ses plateformes mobiles.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Support multilingue et services mondialisés | Non réglementé |

| Activités promotionnelles abondantes | Manque de transparence dans les informations essentielles sur l'activité |

| Interactivité et avantages pour les investisseurs | Détails d'activité ambigus |

| Divers produits de trading | Manque de support détaillé pour les utilisateurs internationaux |

Est-ce que Hana Bank est légitime ?

Hana Bank n'a pas affiché de licence réglementaire, ce qui l'empêche de prouver son statut réglementé. En tant que banque au sein d'un important groupe financier sud-coréen, Hana Bank affirme être une institution financière légitime régulée par les autorités financières sud-coréennes telles que le Service de Surveillance Financière (FSS) et possède des qualifications bancaires formelles.

Les investisseurs peuvent vérifier les informations de service via des canaux officiels (comme le site web officiel ou la hotline du service client 1599-6111) pour garantir la sécurité des transactions.

Que puis-je trader sur Hana Bank ?

Les activités promotionnelles sur le site web officiel de Hana Bank se concentrent principalement sur les dépôts, le change de devises, les tirages au sort et les jeux interactifs. Il ne liste pas explicitement les produits financiers négociables tels que le change, les actions et les contrats à terme.

Dépôt et Retrait

Hana Bank prend en charge les virements bancaires, les dépôts en espèces et les transferts de rente (comme les comptes IRP recevant des fonds d'autres institutions). Les retraits peuvent être effectués via des distributeurs automatiques, au guichet ou par virement. Pour les transferts d'argent internationaux, une hotline de service clientèle à l'étranger est fournie : 82-42-520-2500 (appuyez sur 8 pour l'extension).

Bonus

| Type d'activité | Nom/Heure de l'activité | Détails de la récompense |

| Incitation au dépôt | Dépôt de compte IRP | Gagnez des "하나머니" (points ou récompenses en espèces) |

| Tirage au sort | Journée HANA (1er, 11e, 21e de chaque mois) | Taux de gain de 100% avec des prix, y compris 1~11,111 하나머니, des bons de café et des bons d'essence |

| Remise d'échange | Échange de devises à l'aéroport d'Incheon | Coupon de 30% via l'application Smart Tax-Free |

| Récompense de jeu interactif | 리워드 팡팡! (Récompense Pang!) | Gagnez des récompenses en espèces en jouant |

| 물주기 꾹! (Activité d'arrosage) | Gagnez des récompenses en espèces en arrosant des plantes virtuelles |