Perfil de la compañía

| RBC Resumen de la revisión | |

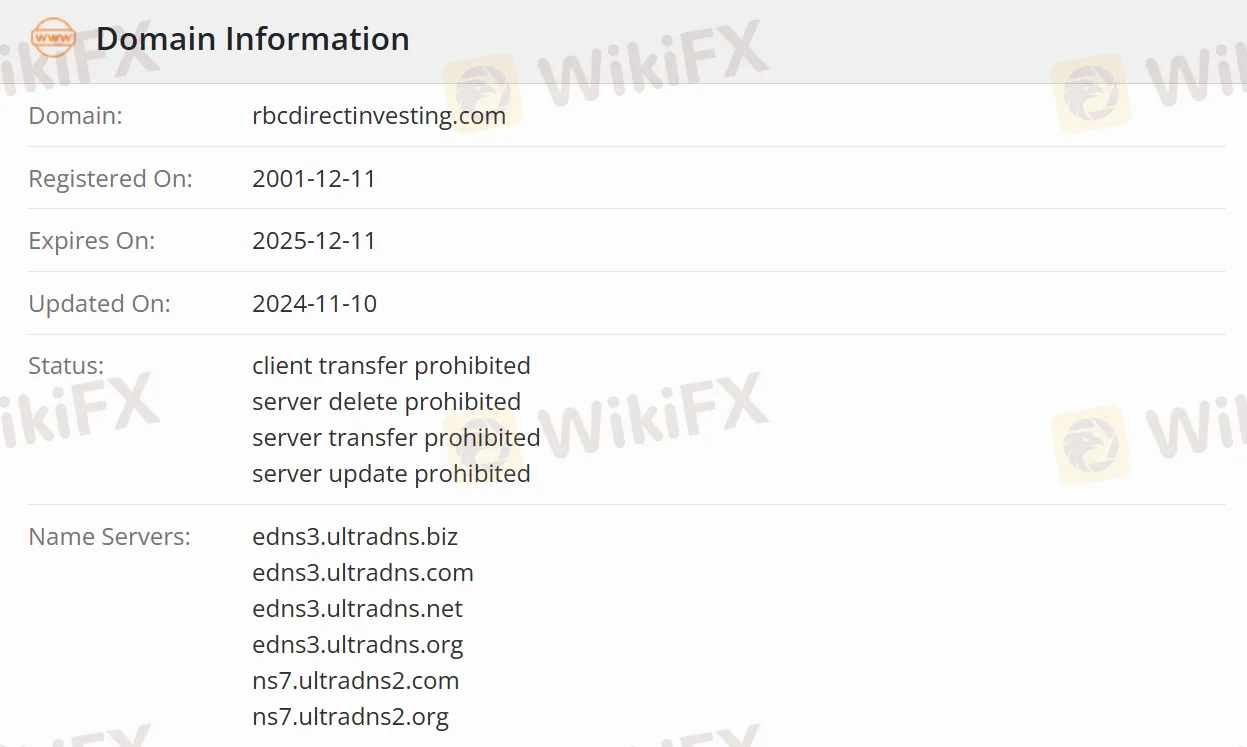

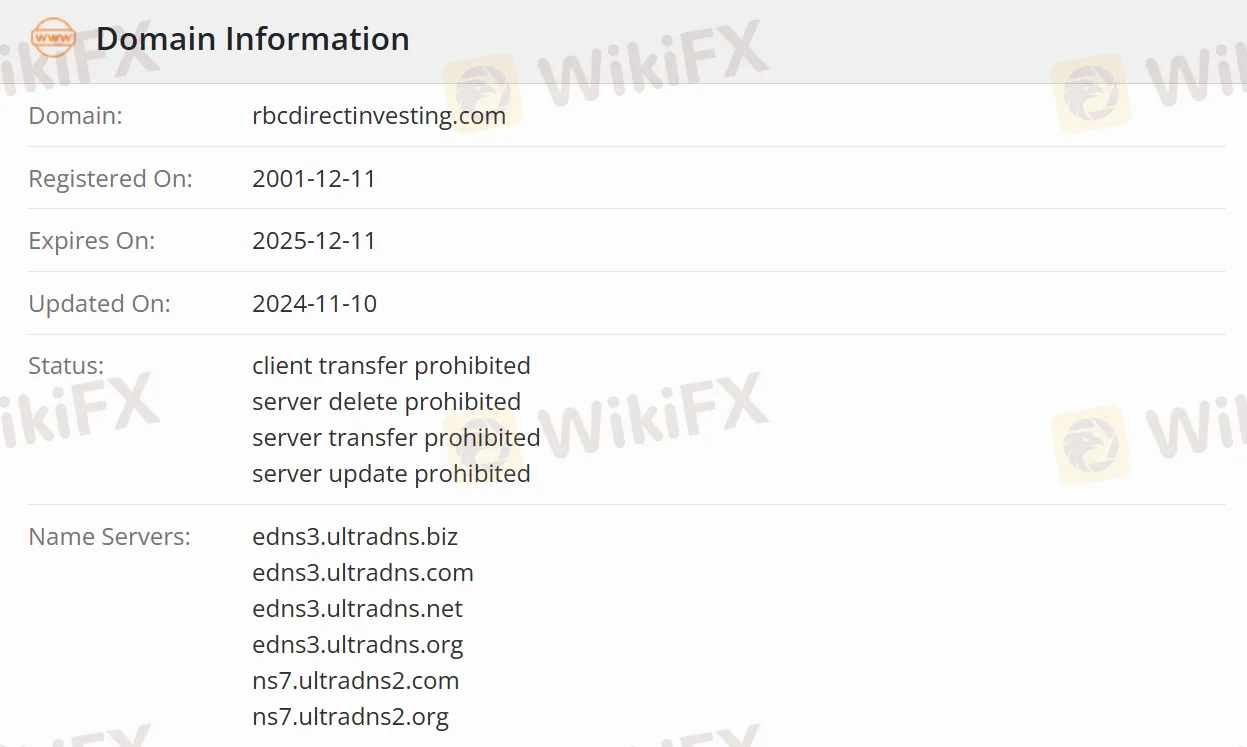

| Registrado en | 2001-12-11 |

| País/Región de registro | Canadá |

| Regulación | Regulado |

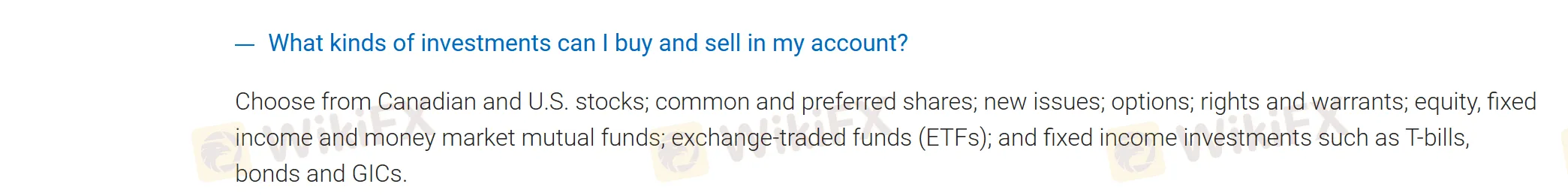

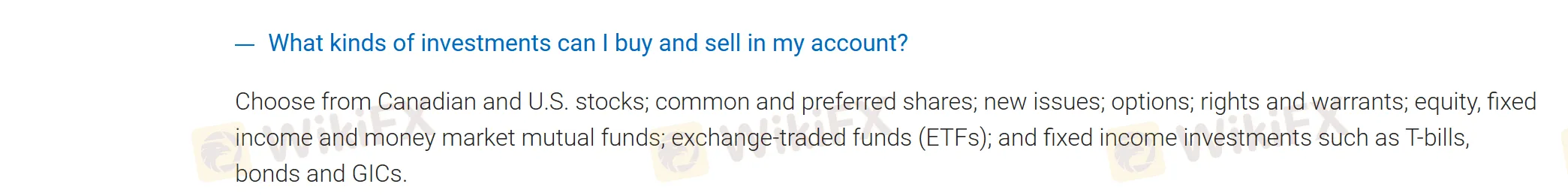

| Productos de inversión | Acciones, Opciones, Nuevas emisiones/OPI, ETF, Fondos mutuos, CDT, Bonos, Oro y Plata |

| Plataforma de trading | Plataforma de inversión en línea, Aplicación móvil de RBC (Móvil) |

| Soporte al cliente | Llamada gratuita: 1-800-769-2560 |

| Extranjero: 1-416-977-1255 | |

| Cantonés y Mandarín: 1-800-667-8668 o 416-313-8611 | |

| Fax: 1 (888) 722-2388 | |

Pros y contras

| Pros | Contras |

| Regulado | Información de cuenta no específica |

| Estructura de comisiones baja (tan baja como $6.95 por operación) | Umbral de tarifa de mantenimiento |

| Información clara sobre tarifas | Spread de hasta 1.6% (USD-CAD) |

| Plataformas de trading flexibles |

Productos Instrumentos Negociables Soportado Inversiones en renta variable Acciones ✔ Opciones ✔ Nuevas emisiones/IPOs ✔ Diversificación incorporada ETFs ✔ Fondos Mutuos ✔ Inversiones en renta fija GICs ✔ Bonos ✔ Metales Preciosos Oro y Plata ✔

Tipo de Cuenta

Tipo de Cuenta

RBC ofrece cuentas registradas con beneficios fiscales y cuentas no registradas.

Cuentas Registradas

TFSA (Cuenta de Ahorro Libre de Impuestos)

RRSP (Plan de Ahorro para la Jubilación Registrado)

FHSA (Cuenta de Ahorro para la Primera Vivienda)

RESP (Plan de Ahorro para la Educación Registrado)

RRIF (Fondo de Ingreso de Jubilación Registrado)

Cuentas no Registradas

Cuentas en efectivo, cuentas de margen y cuentas corporativas/fiduciarias para inversores institucionales (que admiten estructuras corporativas/asociativas).

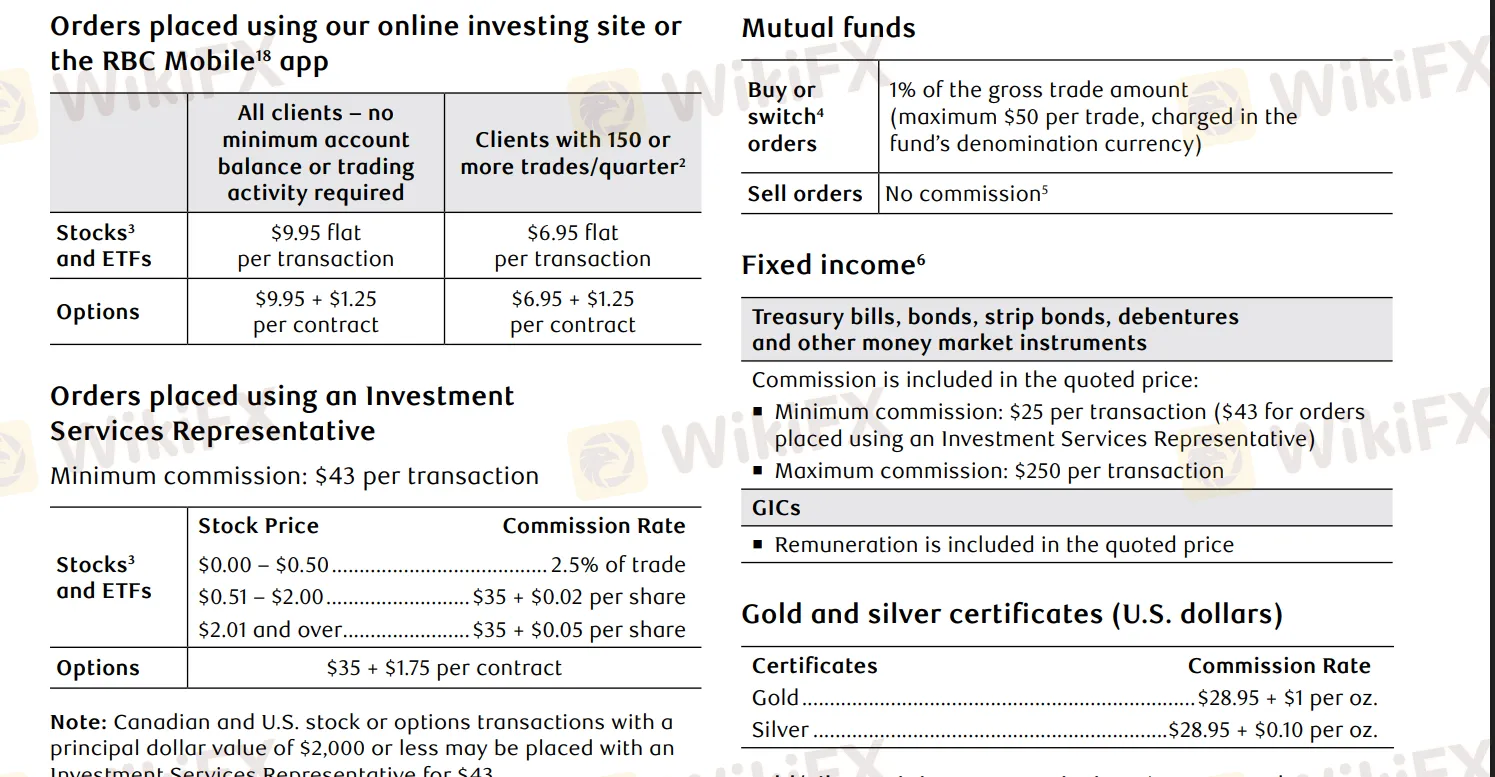

RBC Comisiones

comisión

| Activos | Detalles de Comisión |

| Operaciones de Acciones/ETFs | En línea: $9.95 por operación (menos de 150 operaciones por trimestre), $6.95 por operación (150+ operaciones por trimestre) |

| Operaciones de Opciones | En línea: $9.95 por operación + $1.25 por contrato (baja frecuencia), $6.95 por operación + $1.25 por contrato (alta frecuencia) |

| Compras de Fondos Mutuos | Comisión del 1% ($50 máximo) |

| Oro | $28.95 + $1 por onza |

| Plata | $28.95 + $0.10 por onza |

| Renta Fija | A partir de $25 por transacción |

Tasas de Spread de Divisas

| Monto de Transacción (USD) | Spread (bps) | Spread (%) |

| $0 a $24,999 | 230 | 1.6% |

| $25,000 a $99,999 | 145 | 1.0% |

| $100,000 a $499,999 | 85 | 0.6% |

| $500,000 a $999,999 | 50 | 0.4% |

| $1,000,000 a $1,999,999 | 25 | 0.2% |

| $2,000,000.01 o más | No más de 10 bps | 0.1% |

Si los activos son inferiores a $15,000, se requiere una tarifa de mantenimiento trimestral de $25 (exención disponible). Además, las transferencias bancarias dentro de Canadá o EE. UU. cuestan $45 por transacción.

Plataforma de Trading

RBC ofrece una plataforma de inversión en línea adecuada para un análisis integral, proporcionando una cuenta de demostración. Además, la aplicación móvil RBC permite un trading móvil conveniente, mientras que las herramientas del panel de trading de grado profesional están diseñadas para traders de alta frecuencia e inversores institucionales.

Bono

Los traders que transfieran activos de ≥ $15,000 serán reembolsados hasta $200 por las tarifas de transferencia de cuenta de su bróker original.