公司簡介

| RBC 評論摘要 | |

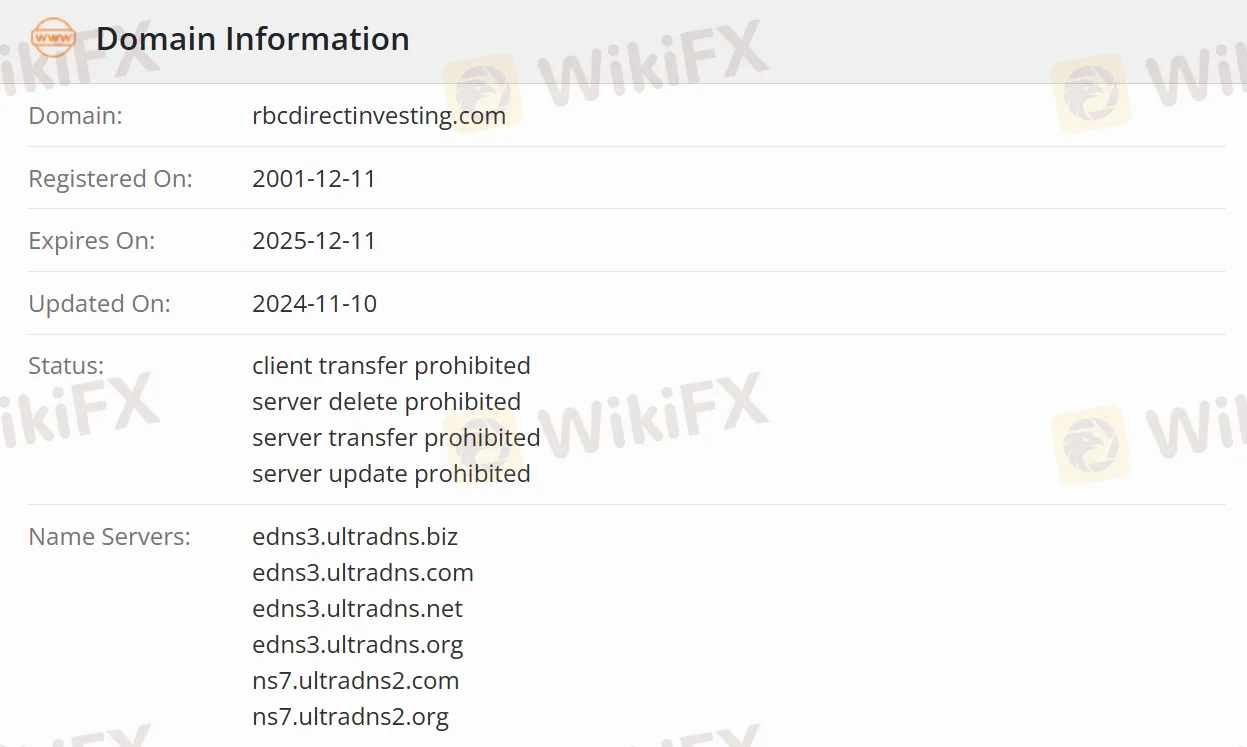

| 註冊日期 | 2001-12-11 |

| 註冊國家/地區 | 加拿大 |

| 監管 | 受監管 |

| 投資產品 | 股票、期權、新股/首次公開發行、ETF、共同基金、GIC、債券、黃金和白銀 |

| 交易平台 | 線上投資平台、RBC 手機應用程式(手機) |

| 客戶支援 | 免費電話:1-800-769-2560 |

| 海外:1-416-977-1255 | |

| 粵語和普通話:1-800-667-8668 或 416-313-8611 | |

| 傳真:1 (888) 722-2388 | |

RBC 資訊

RBC 直接投資是加拿大皇家銀行(RBC)旗下的自主投資平台,嚴格受監管。提供包括股票、期權、ETF、共同基金和債券在內的各種投資服務,涵蓋加拿大和美國等18個全球市場。支援三種交易方式——線上平台、手機應用程式和專業交易儀表板——迎合各類投資者,從初學者到老手交易者。

優缺點

| 優點 | 缺點 |

| 受監管 | 帳戶資訊不明確 |

| 低佣金結構(每筆交易低至$6.95) | 維持費門檻 |

| 清晰的費用資訊 | 價差高達1.6%(美元-加幣) |

| 靈活的交易平台 |

RBC 是否合法?

加拿大投資監管機構監管RBC,其許可證號碼未公開,RBC嚴格遵守加拿大證券法規。

RBC 可以交易什麼?

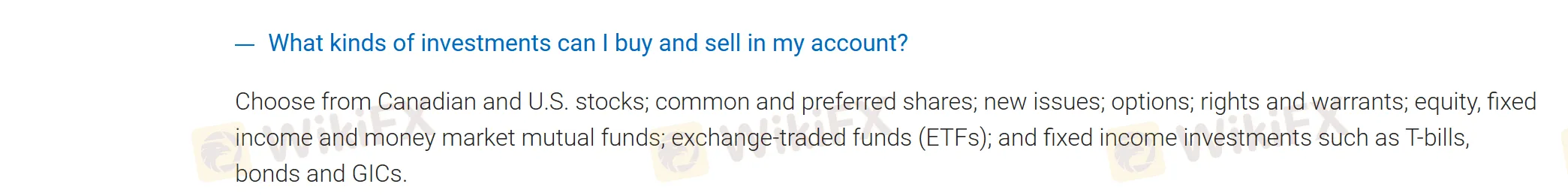

RBC 提供加拿大和美國股票,包括普通股和優先股,新發行股票,期權,權利和認股權證,股本,固定收益和貨幣市場共同基金,交易所交易基金(ETFs),以及國庫券,債券和保本投資證券(GICs)。

| 產品 | 可交易工具 | 支援 |

| 股權投資 | 股票 | ✔ |

| 期權 | ✔ | |

| 新發行股票/IPOs | ✔ | |

| 內置分散投資 | ETFs | ✔ |

| 共同基金 | ✔ | |

| 固定收益投資 | GICs | ✔ |

| 債券 | ✔ | |

| 貴金屬 | 金和銀 | ✔ |

帳戶類型

RBC 提供具有稅收優惠的註冊帳戶和非註冊帳戶。

註冊帳戶

TFSA(免稅儲蓄帳戶)

RRSP(註冊退休儲蓄計劃)

FHSA(首次購房儲蓄帳戶)

RESP(註冊教育儲蓄計劃)

RRIF(註冊退休收入基金)

非註冊帳戶

現金帳戶,保證金帳戶,以及為機構投資者提供的公司/信託帳戶(支援公司/合夥結構)。

RBC 費用

佣金

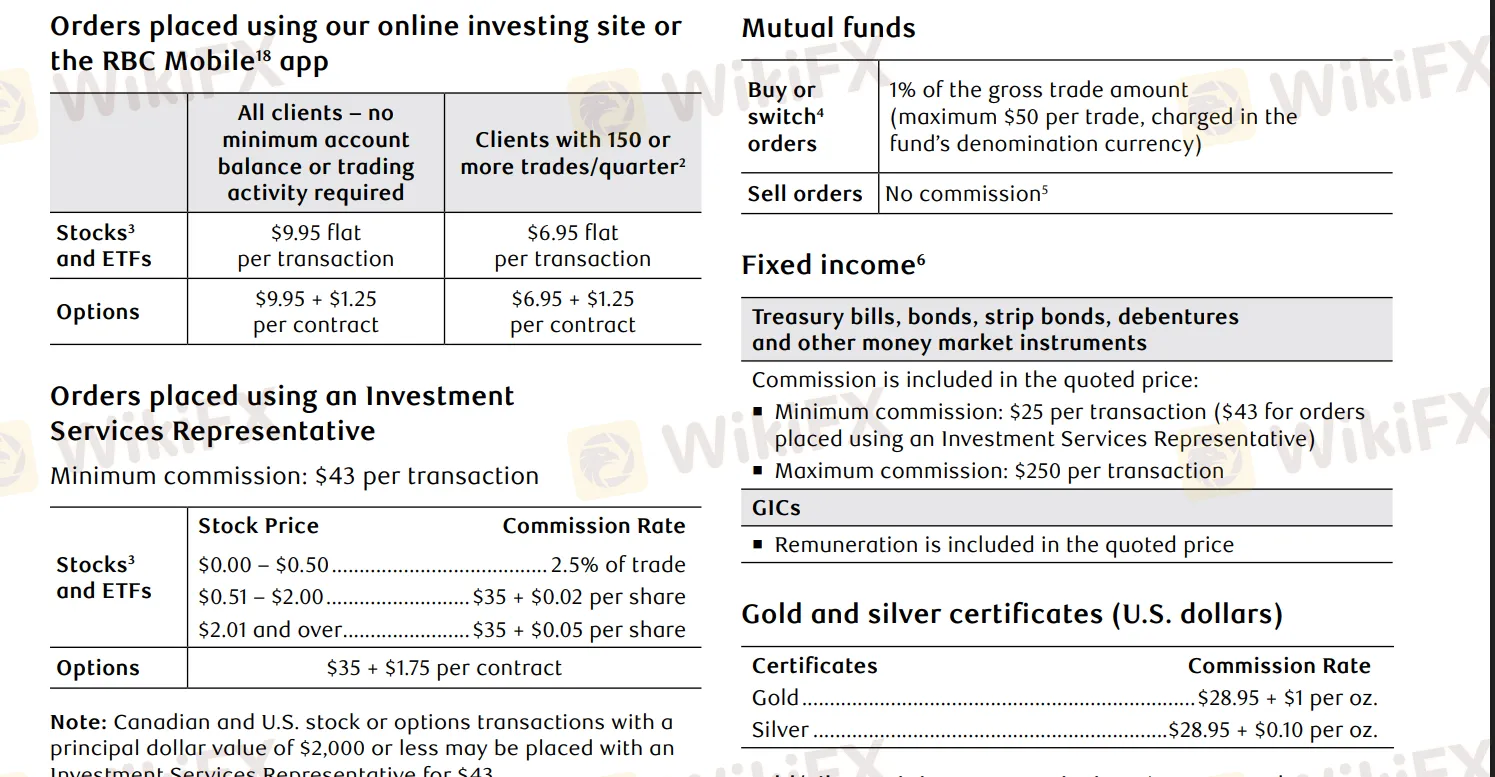

| 資產 | 佣金詳情 |

| 股票/ETF 交易 | 線上:每筆交易 $9.95(每季少於150筆交易),每筆交易 $6.95(每季150筆以上交易) |

| 期權交易 | 線上:每筆交易 $9.95 + 每份合約 $1.25(低頻率),每筆交易 $6.95 + 每份合約 $1.25(高頻率) |

| 共同基金購買 | 1% 佣金(最高 $50) |

| 金 | $28.95 + 每盎司 $1 |

| 銀 | $28.95 + 每盎司 $0.10 |

| 固定收益 | 每筆交易起步價格 $25 |

外匯差價率

| 交易金額(美元) | 差價(基本點) | 差價(%) |

| $0 至 $24,999 | 230 | 1.6% |

| $25,000 至 $99,999 | 145 | 1.0% |

| $100,000 至 $499,999 | 85 | 0.6% |

| $500,000 至 $999,999 | 50 | 0.4% |

| $1,000,000 至 $1,999,999 | 25 | 0.2% |

| $2,000,000.01 或以上 | 不超過10個基本點 | 0.1% |

如果資產少於$15,000,則需要支付每季$25的維護費(可豁免)。此外,在加拿大或美國境內的電匯費用為每筆$45。

交易平台

RBC 提供一個適合進行全面分析的線上投資平台,並提供模擬帳戶。此外,RBC 手機應用程式可方便進行移動交易,而專業級的交易儀表板工具則針對高頻交易者和機構投資者量身定制。

獎金

轉移資產≥ $15,000的交易者將獲得最高$200的賬戶轉移費用退款。