Unternehmensprofil

| RBC Überprüfungszusammenfassung | |

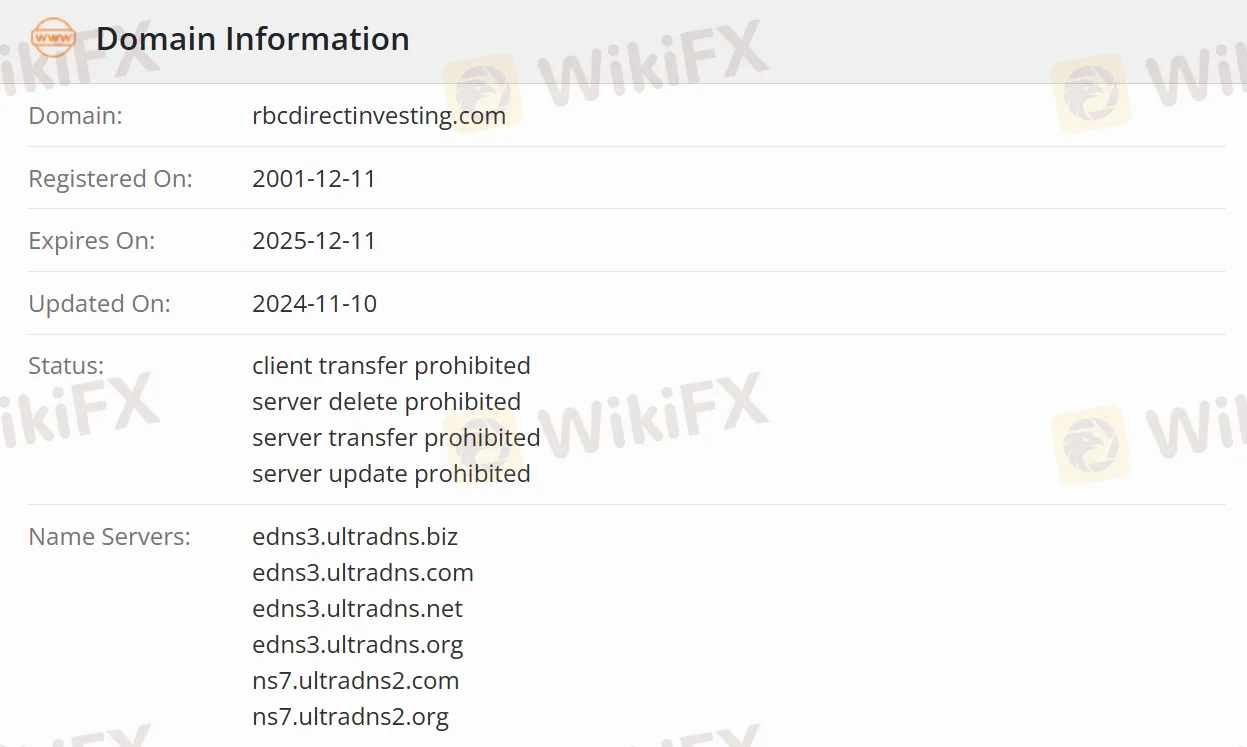

| Registriert am | 2001-12-11 |

| Registriertes Land/Region | Kanada |

| Regulierung | Reguliert |

| Investitionsprodukte | Aktien, Optionen, Neuemissionen/IPOs, ETFs, Investmentfonds, GICs, Anleihen, Gold und Silber |

| Handelsplattform | Online-Investmentplattform, RBC Mobile App (Mobile) |

| Kundensupport | Kostenlose Rufnummer: 1-800-769-2560 |

| Ausland: 1-416-977-1255 | |

| Kantonesisch und Mandarin: 1-800-667-8668 oder 416-313-8611 | |

| Fax: 1 (888) 722-2388 | |

RBC Informationen

RBC Direct Investing ist eine selbstgesteuerte Investmentplattform unter der Royal Bank of Canada (RBC), streng reguliert. Es bietet verschiedene Anlagemöglichkeiten, darunter Aktien, Optionen, ETFs, Investmentfonds und Anleihen, die 18 globale Märkte wie Kanada und die Vereinigten Staaten abdecken. Mit drei Handelsmethoden – der Online-Plattform, der mobilen App und dem professionellen Handelsdashboard – richtet es sich an alle Arten von Anlegern, von Anfängern bis zu erfahrenen Händlern.

Vor- und Nachteile

| Vorteile | Nachteile |

| Reguliert | Unspezifische Kontoinformationen |

| Niedrige Kommissionsstruktur (ab $6,95 pro Trade) | Wartungsgebühr-Schwelle |

| Klare Gebühreninformationen | Spread von bis zu 1,6% (USD-CAD) |

| Flexible Handelsplattformen |

Ist RBC legitim?

Die Canadian Investment Regulatory Organization reguliert RBC, wobei die Lizenznummer nicht veröffentlicht wird, und RBC hält sich strikt an kanadische Wertpapierregulierungen.

Was kann ich auf RBC handeln?

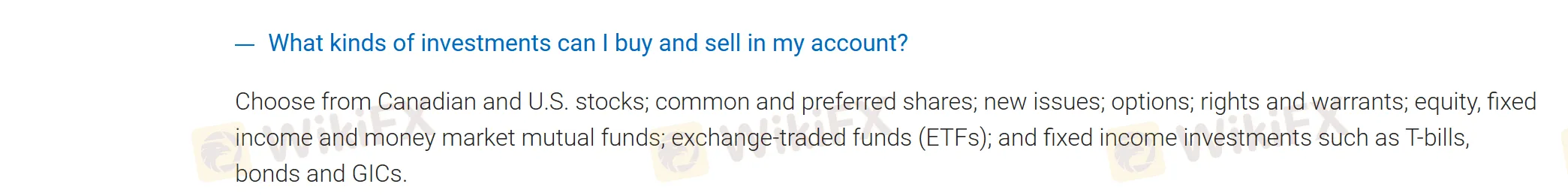

RBC bietet kanadische und US-amerikanische Aktien, einschließlich Stamm- und Vorzugsaktien, neu emittierte Aktien, Optionen, Rechte und Optionsscheine, Eigenkapital, Festverzinsliche Wertpapiere, Geldmarktfonds, börsengehandelte Fonds (ETFs) und Festverzinsliche Anlagen wie Schatzwechsel, Anleihen und garantierte Anlagezertifikate (GICs) an.

| Produkte | Handelbare Instrumente | Unterstützt |

| Eigenkapitalanlagen | Aktien | ✔ |

| Optionen | ✔ | |

| Neue Emissionen/IPOs | ✔ | |

| Integrierte Diversifikation | ETFs | ✔ |

| Investmentfonds | ✔ | |

| Festverzinsliche Anlagen | GICs | ✔ |

| Anleihen | ✔ | |

| Edelmetalle | Gold und Silber | ✔ |

Kontotyp

RBC bietet registrierte Konten mit Steuervorteilen und nicht registrierte Konten an.

Registrierte Konten

TFSA (Steuerfreies Sparkonto)

RRSP (Registrierte Altersvorsorge)

FHSA (Erstmaliges Eigenheim-Sparkonto)

RESP (Registriertes Bildungssparkonto)

RRIF (Registrierte Altersrentenfonds)

Nicht registrierte Konten

Bargeldkonten, Marginkonten und Unternehmens-/Treuhandkonten für institutionelle Anleger (Unterstützung von Unternehmens-/Partnerschaftsstrukturen).

RBC Gebühren

Provision

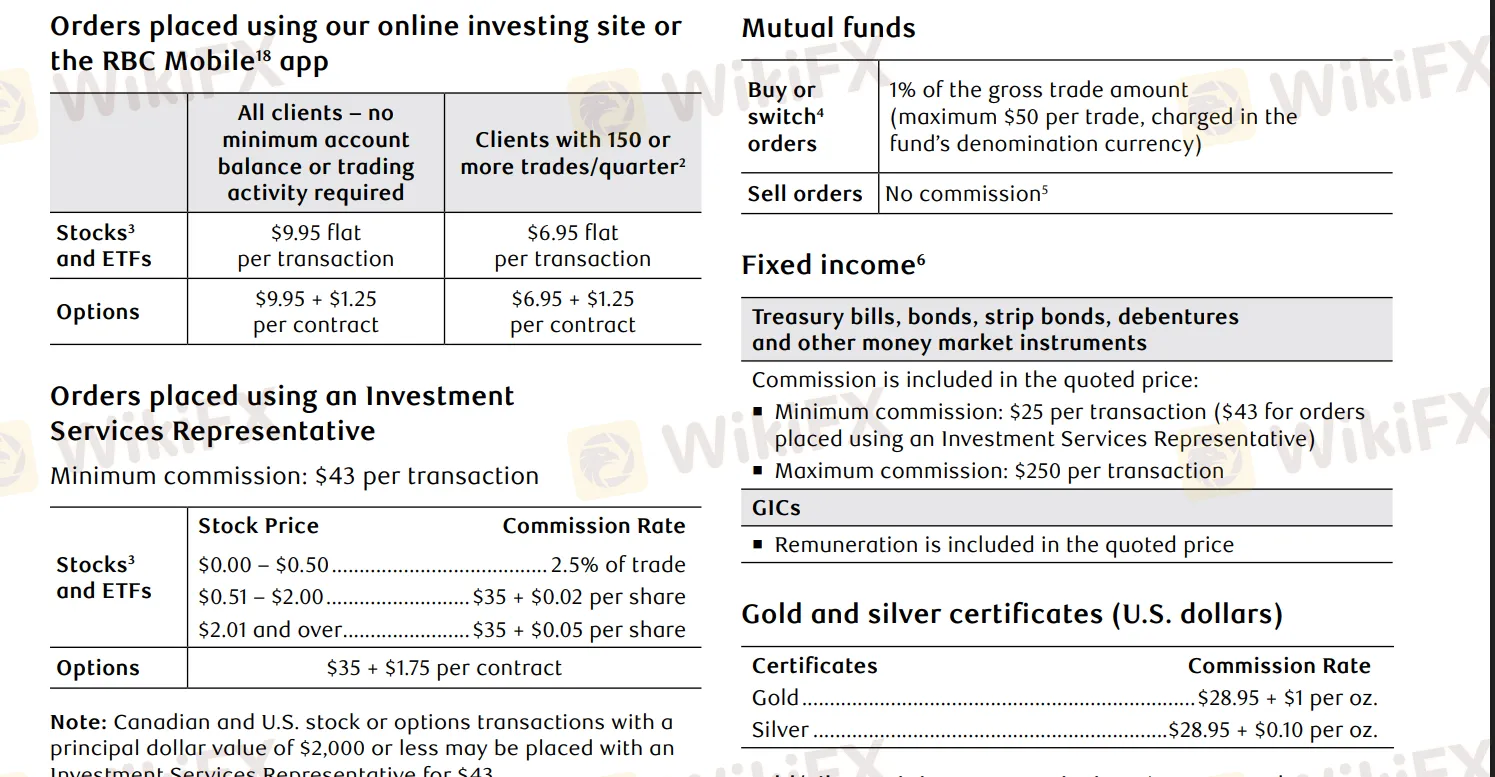

| Vermögenswerte | Provisionsdetails |

| Aktien/ETF-Handel | Online: $9,95 pro Trade (weniger als 150 Trades pro Quartal), $6,95 pro Trade (150+ Trades pro Quartal) |

| Optionsgeschäfte | Online: $9,95 pro Trade + $1,25 pro Vertrag (niedrige Frequenz), $6,95 pro Trade + $1,25 pro Vertrag (hohe Frequenz) |

| Kauf von Investmentfonds | 1% Provision ($50 Maximum) |

| Gold | $28,95 + $1 pro Unze |

| Silber | $28,95 + $0,10 pro Unze |

| Festverzinsliche Wertpapiere | Ab $25 pro Transaktion |

Devisenspreadsätze

| Transaktionsbetrag (USD) | Spread (bps) | Spread (%) |

| $0 bis $24,999 | 230 | 1,6% |

| $25,000 bis $99,999 | 145 | 1,0% |

| $100,000 bis $499,999 | 85 | 0,6% |

| $500,000 bis $999,999 | 50 | 0,4% |

| $1,000,000 bis $1,999,999 | 25 | 0,2% |

| $2,000,000,01 und mehr | Nicht mehr als 10 bps | 0,1% |

Wenn das Vermögen weniger als $15,000 beträgt, wird eine vierteljährliche Wartungsgebühr von $25 erhoben (Verzicht möglich). Darüber hinaus kosten Überweisungen innerhalb Kanadas oder der USA $45 pro Transaktion.

Handelsplattform

RBC bietet eine Online-Investmentplattform, die für umfassende Analysen geeignet ist und ein Demokonto bereitstellt. Darüber hinaus ermöglicht die RBC Mobile App bequemen mobilen Handel, während die professionellen Trading-Dashboard-Tools auf Hochfrequenzhändler und institutionelle Anleger zugeschnitten sind.

Bonus

Händler, die Vermögenswerte von ≥ $15,000 übertragen, erhalten bis zu $200 für die Überweisungsgebühren von ihrem ursprünglichen Brokerage erstattet.