Buod ng kumpanya

| Shikoku Buod ng Pagsusuri | |

| Itinatag | 2002 |

| Nakarehistrong Bansa/Rehiyon | Hapon |

| Regulasyon | Regulated by FSA (Japan) |

| Mga Instrumento sa Merkado | Investment Trusts, Stocks, Bonds, Forex, Commodities |

| Demo Account | / |

| EUR/USD Spread | mula 10 - 75 sen |

| Platform ng Paggagalaw | Web Trader |

| Suporta sa Customer | Tel: 089-921-5200 |

| Address: Ehime Prefecture Matsuyama City Sanbancho 5-10-1 | |

Impormasyon ng Shikoku

Ang Shikoku ay isang broker na nakabase sa Hapon na itinatag noong 2002, na regulado ng FSA. Nag-aalok ito ng iba't ibang uri ng mga instrumento sa merkado, halimbawa: Investment Trusts, Stocks, Bonds, Forex, at Commodities.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Regulated by FSA | Limitadong mga channel ng pakikipag-ugnayan |

| Iba't ibang mga asset sa pag-trade | Walang suporta para sa MT4 at MT5 cTrader |

| Mahabang oras ng operasyon | Walang available na demo accounts |

| Iba't ibang bayarin na kinokolekta |

Tunay ba ang Shikoku?

Ang Shikoku ay regulatedng Financial Services Agency (FSA), sa ilalim ng Shikoku, na may lisensyang 四国財務局長(金商)第21号.

| Status ng Regulasyon | Regulated By | Lisensyadong Institusyon | Uri ng Lisensya | Numero ng Lisensya |

| Regulated | Financial Services Agency (FSA) | Shikoku | Lisensya sa Retail Forex | 四国財務局長(金商)第21号 |

Pagsusuri sa Larangan ng WikiFX

Ang koponan ng pagsasaliksik sa larangan ng WikiFX ay bumisita sa address ng Shikoku sa Hapon, at natagpuan namin ang kanilang opisina sa lugar, na nangangahulugang ang kumpanya ay may operasyon sa isang pisikal na opisina.

Ano ang Maaari Kong I-trade sa Shikoku?

| Mga Kasangkapan sa Paghahalal | Supported |

| Investment Trusts | ✔ |

| Stocks | ✔ |

| Bonds | ✔ |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

| ETFs | ❌ |

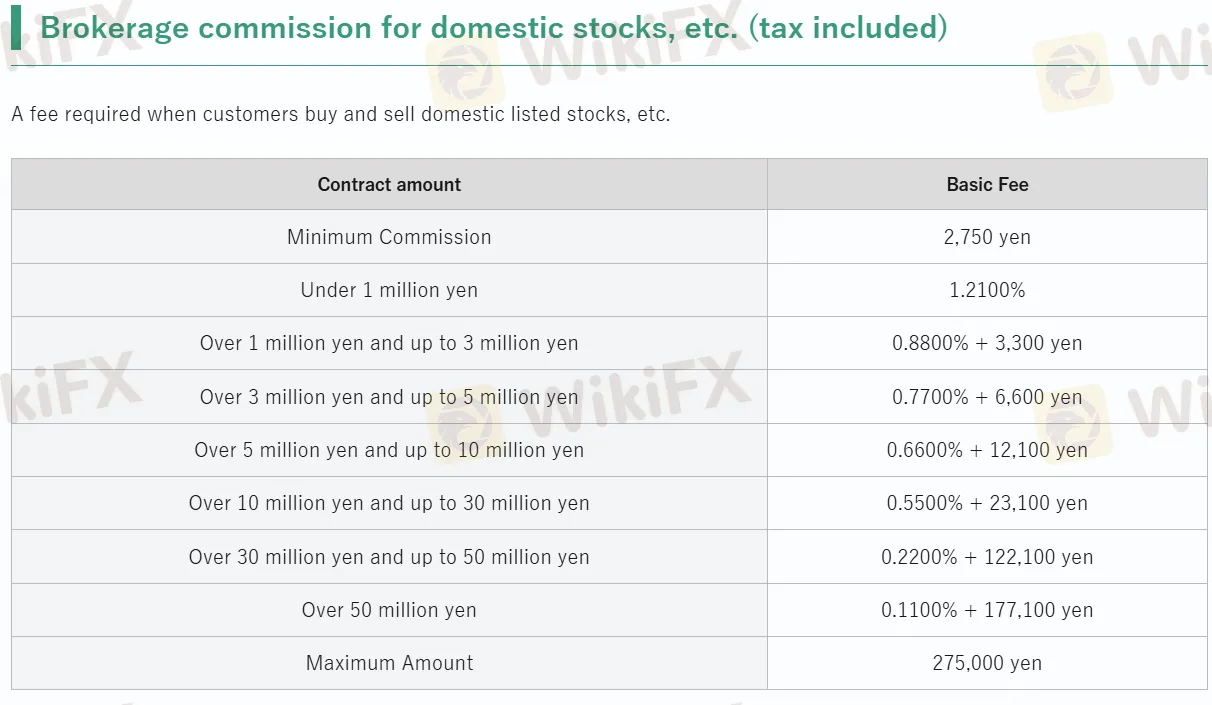

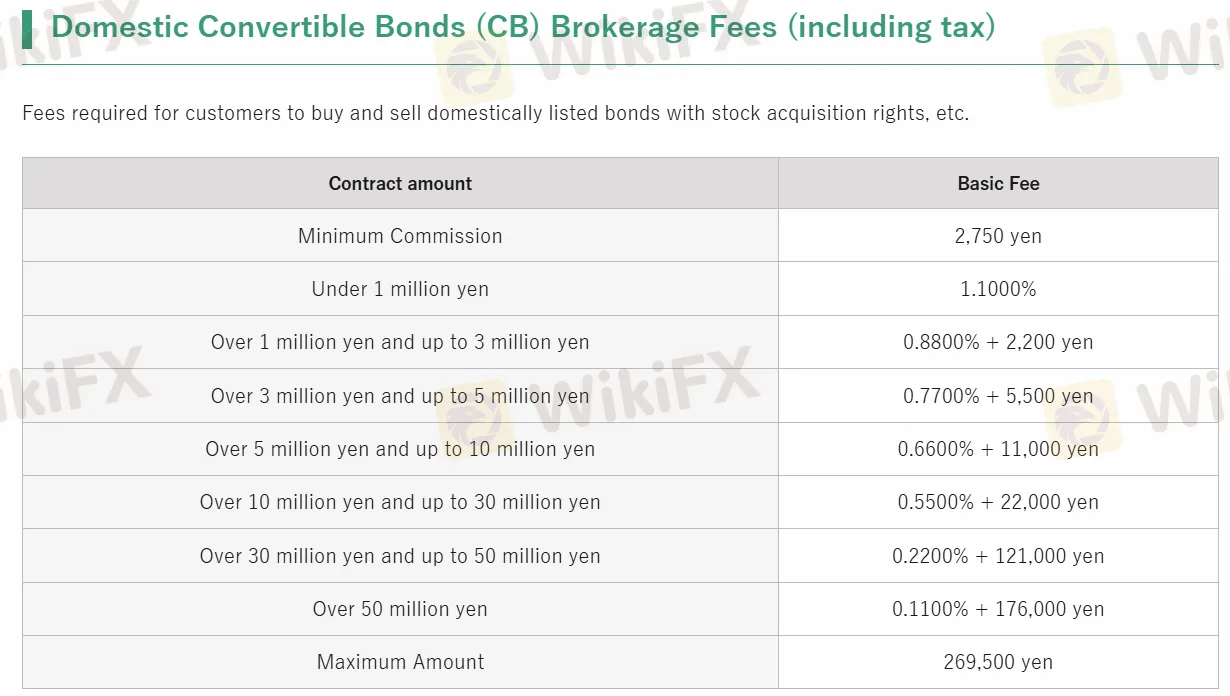

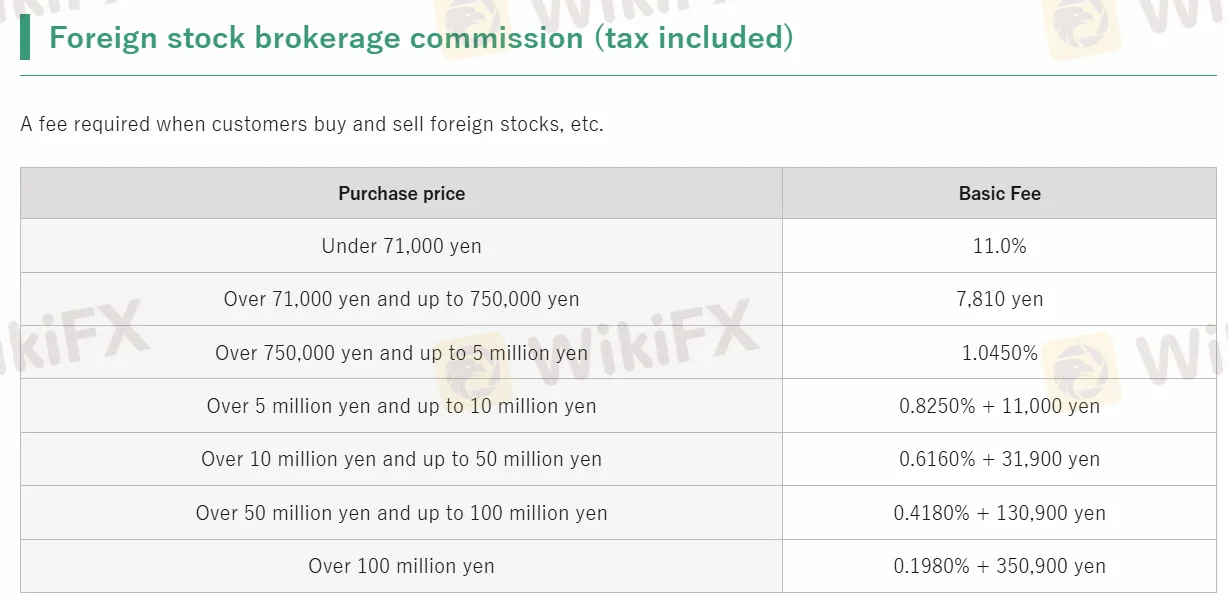

Mga Bayad sa Shikoku

| Uri ng Serbisyo | Basic Fee |

| Domestic Stocks Brokerage | JPY 2,750 - 275,000 |

| Domestic Covertible Bonds TradingBrokerage | JPY 2,750 - 269,500 |

| Foreign Stocks Brokerage | 0.1980% - 11% |

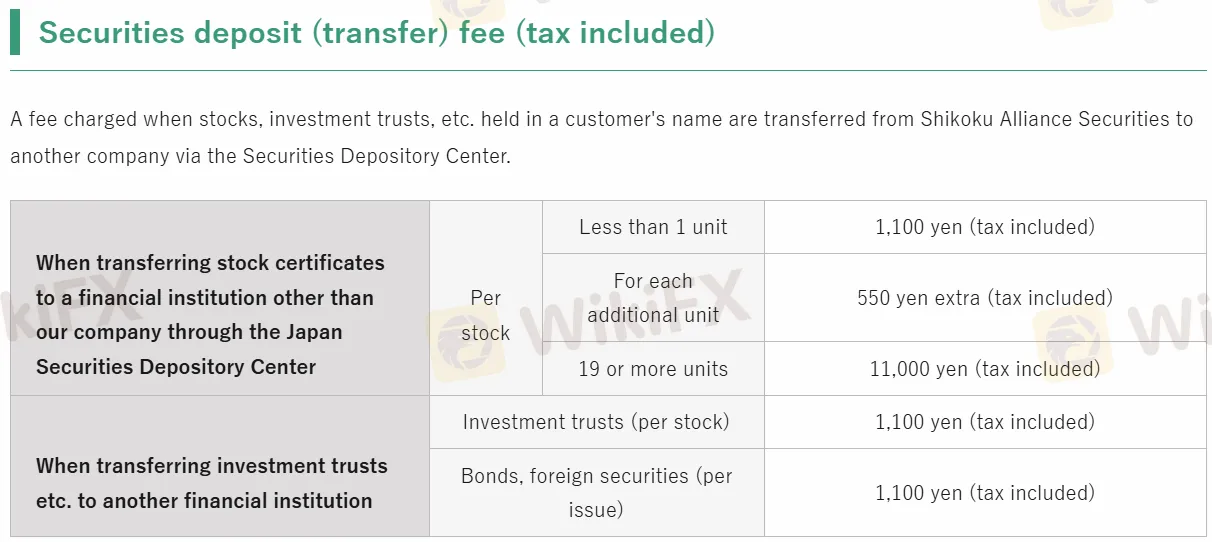

| Securities Deposits | JPY 550 - 11,000 |

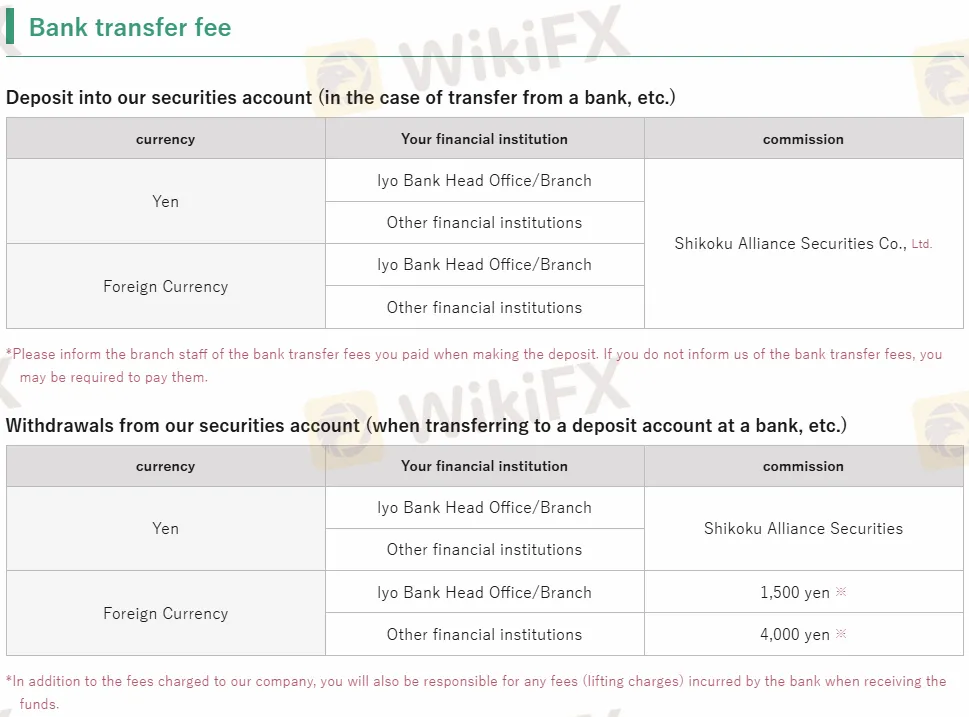

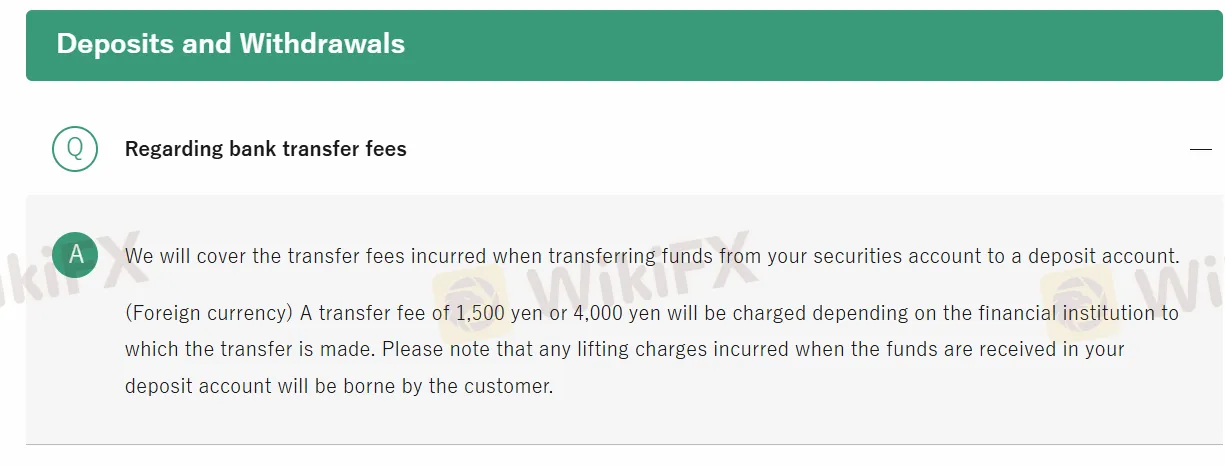

| Bank Transfer Fee | JPY 0 - 4,000 |

Plataforma ng Paghahalal

| Plataforma ng Paghahalal | Supported | Available Devices | Suitable for |

| Web Trader | ✔ | Web | / |

| MT4 | ❌ | / | Mga Baguhan |

| MT5 | ❌ | / | Mga Karanasan na mga mangangalakal |

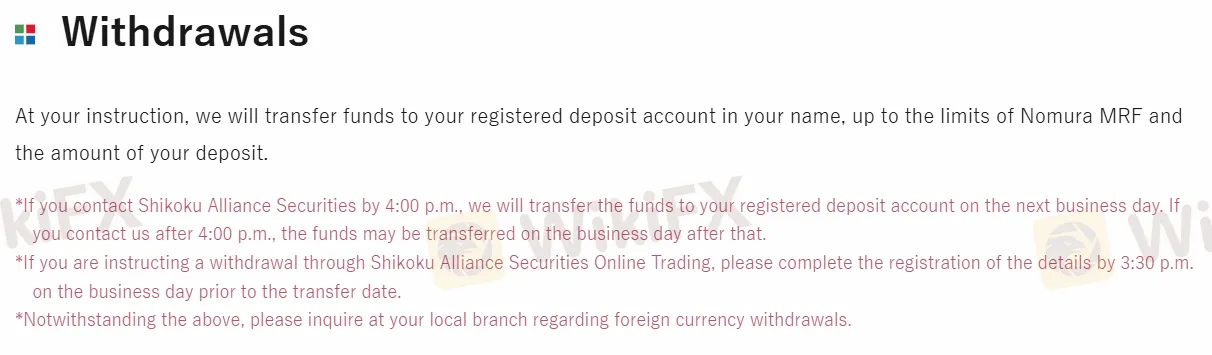

Deposito at Pag-Atas

| Minimum Amount | Bank Transfer Fee | Processing Time | |

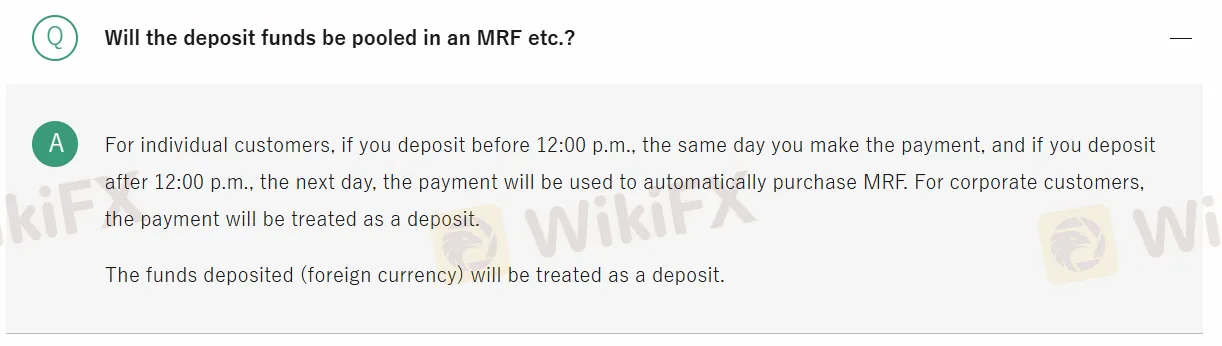

| Deposito | / | JPY 0 - 4,000 | Mas mababa sa 24 oras |

| Pag-Atas | / | / |

within

Colombia

Sa ngayon, sa tingin ko ang shikoku ay isang kwalipikadong kumpanya, kung kailangan mo ito, sa tingin ko ito ang iyong mapipili! Makatwiran ang iba't ibang kondisyon sa pangangalakal, at ang pinakamahalagang bagay ay hindi ito isang ilegal na kumpanya, hindi nito dayain ang iyong pera.

Positibo

文章

Hong Kong

Sanay na akong mag-invest ng trust sa Shikoku, maganda ang experience ko! Bagama't napakaraming bagong broker ang lumilitaw, sa anumang kaso, mas gusto kong piliin ang may karanasan.

Positibo

FX1015868943

Hong Kong

May nagsabi na ang Shikoku ay isang magandang platform para mamuhunan sa iba't ibang stock trading. Mayroon bang sinumang gustong sabihin sa akin kung ano ang sinisingil nito? Nagpadala ako ng isang katanungan, ngunit walang sumasagot sa akin...

Katamtamang mga komento

FX1022619685

Hong Kong

Ang disenyo ng website nito ay hindi ang gusto ko, at mahirap hanapin ang gusto mong pagtuunan ng pansin. May nakahanap na ba nito? Maaaring mas angkop ito para sa mga mamumuhunang Hapones. Para sa akin, hahanap ako ng ilang mga broker para maging komportable ako…

Katamtamang mga komento