Buod ng kumpanya

| MITOBuod ng Pagsusuri | |

| Itinatag | 1997 |

| Nakarehistrong Bansa/Rehiyon | Hapon |

| Regulasyon | FSA |

| Mga Kasangkapan sa Merkado | Stock, Bond, ETF |

| Demo Account | ❌ |

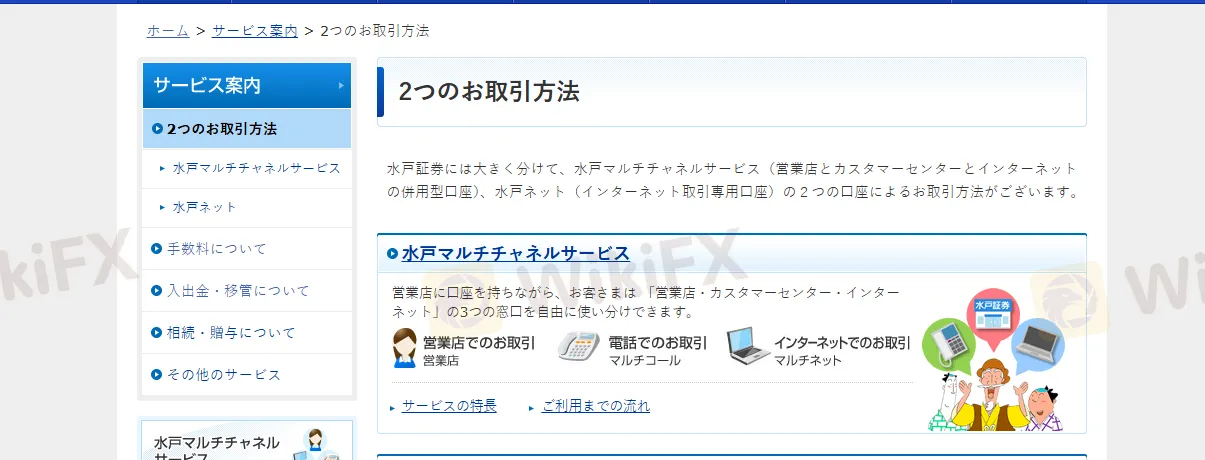

| Platform ng Paggawa ng Kalakalan | MITO Mga Serbisyong Multichannel, MITO Web |

| Suporta sa Customer | Tel: 0120-310-273 |

MITO, isang kumpanyang pang-serbisyong pinansiyal na nakabase sa Hapon na itinatag noong 1997, ay nag-ooperate sa ilalim ng regulasyon ng Financial Services Agency (FSA). Nag-aalok ang kumpanya ng malawak na hanay ng mga pagpipilian sa kalakalan, kabilang ang mga stocks, bonds, at ETFs. Sumasang-ayon sa iba't ibang mga kagustuhan ng mga mamumuhunan.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| regulated | Kakulangan sa mga kasangkapang pangkalakalan |

| Demo account hindi available | |

| MT4/MT5 hindi available |

Tunay ba ang MITO?

Oo. Ang MITO ay lisensyado ng FSA upang mag-alok ng mga serbisyo.

| Tagapamahala | Kasalukuyang Kalagayan | Regulated Entity | Uri ng Lisensya | Numero ng Lisensya |

| Financial Services Agency | Regulated | 水戸証券株式会社 | Lisensyang Pang-Retail Forex | 関東財務局長(金商)第181号 |

Ano ang Maaari Kong Kalakalan sa MITO?

MITO nagbibigay ng mga Stock, Bond, at ETF.

| Mga Tradable na Kasangkapan | Supported |

| Bonds | ✔ |

| Stocks | ✔ |

| ETFs | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

Platform ng Paggawa ng Kalakalan

| Platform ng Paggawa ng Kalakalan | Supported | Available Devices | Angkop para sa |

| ✔ | / | / | |

| ✔ | / | / | |

| MT5 | ❌ | / | Experienced trader |

| MT4 | ❌ | / | Beginners |

Deposito at Pag-Atas

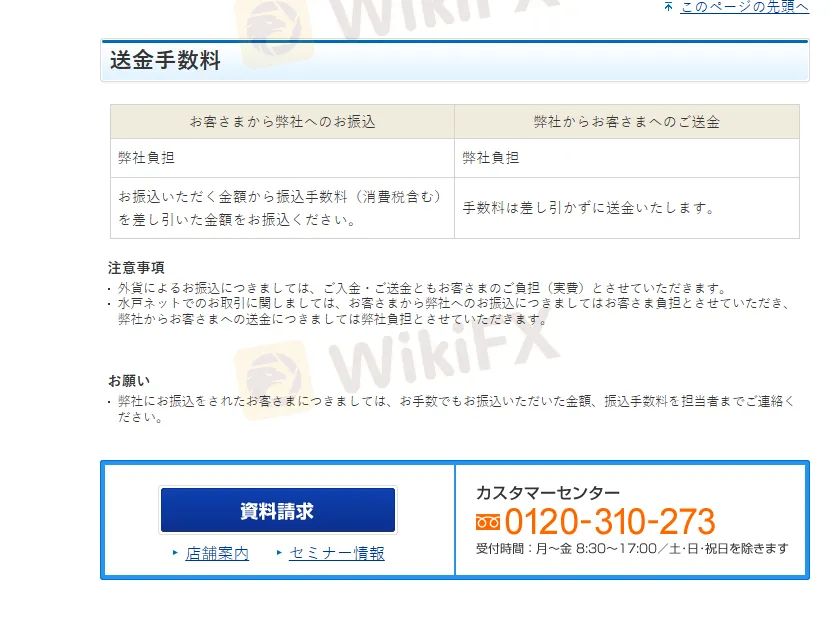

Para sa mga paglilipat ng dayuhan na pera, ang mga bayad sa deposito at pagpapadala ay inilalagak ng Customer (aktwal na bayad).

Para sa mga transaksyon sa pamamagitan ng Mito Net, lahat ng bayad sa paglilipat na binayaran ng customer sa MITO ay inilalagak ng MITO, at lahat ng bayad sa paglilipat na binayaran sa customer ay inilalagak ng MITO.