Buod ng kumpanya

| IMC Buod ng Pagsusuri | |

| Itinatag | 1989 |

| Rehistradong Bansa/Rehiyon | Olanda |

| Regulasyon | SFC |

| Mga Produkto at Serbisyo | Quant Research, Trading Technology, Institutional Trading, Crypto Solutions, ETF Market Making |

| Demo Account | / |

| Suporta sa Customer | New York: 100 Park Ave, Suite 3215, New York, NY 10017, United States |

| Hong Kong: +852 (3) 658 9888, contact.hongkong@imc.com, Unit 1702, 17/F, 100 Queen's Rd Central, Hong Kong | |

| Seoul: 40F, FKI Tower, 24 Yeoui-daero, Yeongdeungpo-gu, Seoul 07320, Korea | |

Mga Benepisyo at Kadahilanan

| Mga Benepisyo | Kadahilanan |

| Regulado ng SFC (Hong Kong) | Hindi nag-aalok ng retail trading o demo accounts |

| Mahigit sa 35 taon ng karanasan sa market-making at trading | Walang pampublikong plataporma ng trading tulad ng MT4/MT5 |

| Matatag na presensya sa higit sa 90 na mga palitan at iba't ibang uri ng asset | Limitadong impormasyon sa mga feature ng account |

Tunay ba ang IMC?

Ang IMC ay isang lisensiyadong kumpanya sa pananalapi ng Hong Kong Securities and Futures Commission (SFC). Mayroon itong bisa na lisensya sa futures trading (ANR402) mula Marso 12, 2007. Ang status na ito ay nagpapatunay ng pagsunod ng IMC sa regulasyon ng pananalapi sa Hong Kong.

Mga Produkto at Serbisyo

Ang mga serbisyong pinansiyal na may teknolohiya mula sa IMC ay kinabibilangan ng kwantitatibong analisis, mga komplikadong paraan ng trading, at bagong teknolohiya. Ang artificial intelligence, machine learning, at mataas na pagganap ng mga computer ay tumutulong sa kumpanya na makipagsabayan sa pandaigdigang mga merkado ng pananalapi.

| Produkto / Serbisyo | Mga Detalye |

| Quant Research | Lumilikha at nag-o-optimize ng mga estratehiya sa trading gamit ang AI at ML |

| Teknolohiya & Engineering | Nag-a-automate ng trading at nagtatayo ng mataas na pagganap na imprastruktura |

| Trading | Paggamit ng natatanging mga taktika sa trading na may 35 taon ng karanasan sa merkado |

Serbisyong Liquidity

Matapos ang 35 taon, IMC ay isang pinagkakatiwalaang tagapagbigay ng likwiditi na may matatag na presyo at malalim na pag-access sa merkado sa 90+ mga palitan. Ang kumpanya ay nagbibigay ng mabilis, murang mga quote at custom financial solutions sa equity, crypto, at ETF counterparties. Ang IMC ay mahusay sa automation-driven pricing, geographic at product coverage, at product reliability sa lahat ng mga merkado.

| Serbisyong Likwiditi | Mga Detalye |

| Institutional Sales | Diretso, off-screen trading kasama ang IMC para sa mga buy-side firm sa buong Europa, US, at Asia-Pacific |

| Options Wholesaling | Advanced connectivity sa lahat ng OCC venues para sa U.S. listed options trading |

| Crypto Solutions | Global access sa mga crypto products, kabilang ang spot, perps, futures, at options |

| ETF Market Making | Lead Market Maker sa higit sa 150 U.S.-listed ETFs, na sumusuporta sa likwiditi at efficiency |

FX6351424842

Hong Kong

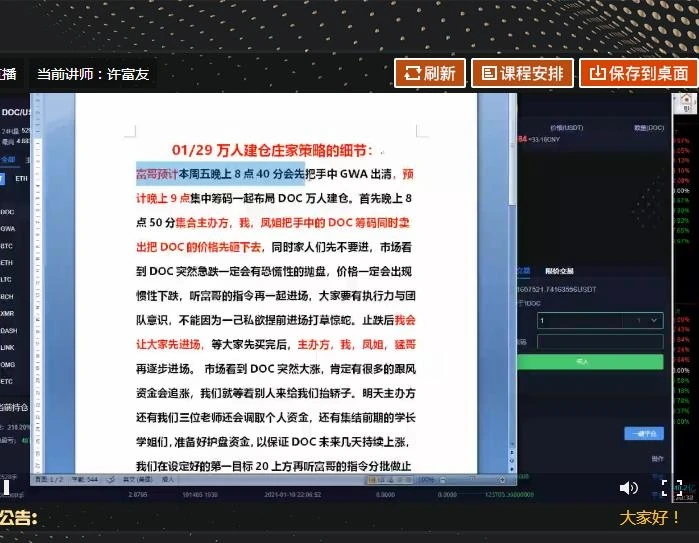

Pagkatapos ay biglang nagkamali ang platform at nag-aayos ito

Paglalahad

FX2287070820

Hong Kong

Ano ang dapat nating gawin kung isara mo ang iyong platform? Ikaw ay isang pandaraya

Paglalahad

jamloveok

Thailand

My website truemove company tell your subordinates why then i will call the police he sent link to my mobile phone how does it work truemove why this cheating behavior against AIS against happy from dtac not You see, dtac one-2-call they don't may parehong personalidad sa TrueMove h, kaya mas maganda ang ugali ng kanilang mga empleyado kaysa TrueMove h.

Positibo

FX1036488142

Ecuador

Sa ngayon sa tingin ko ang serbisyong ibinigay ng kumpanyang ito ay kasiya-siya para sa akin! Nag-aalok ito ng iba't ibang produkto sa pananalapi tulad ng futures. Ang fly in the ointment ay hindi available 24/7 ang customer support na inaalok nila, minsan kailangan kong maghintay ng mga oras o kahit isang araw o dalawa para sa isang tugon.

Positibo