Perfil de la compañía

| SHENGDA FUTURES Resumen de la reseña | |

| Establecido | 2010 |

| País/Región Registrada | China |

| Regulación | CFFEX |

| Instrumento de Mercado | Futuros |

| Cuenta Demo | ✅ |

| Plataforma de Trading | Shengda Futures CTP Express Client v2, Shengda Futures CTP Express Client v3, Shengda Futures CTP Infinite Easy Production System, Pyramid Decision Trading System (CTP), etc. |

| Soporte al Cliente | |

| Tel: 400-826-3131 | |

| Email: sdqh@sdfutures.com.cn | |

| Código Postal: 311201 | |

| Fax: 0571-28289393 | |

| Dirección: Room 2201, Unit 2, and Room 801, Unit 1, Guojin Center, No. 259, Pinglan Road, Ningwei Street, Xiaoshan District, Hangzhou, Zhejiang | |

Información de SHENGDA FUTURES

SHENGDA FUTURES es un proveedor de servicios regulado de corretaje y servicios financieros de primera categoría, fundado en China en 2010. Ofrece productos y servicios para oro, plata y platino, Futuros del Índice de Precios de Acciones (SPIF), Caucho Natural (RU), Fuel Oil (FU), Polietileno de Baja Densidad Lineal LLDPE (L), Cloruro de Polivinilo PVC (V), Coque (J), Ácido Tereftálico Purificado PTA (TA), Metanol (MA), etc.

Pros y Contras

| Pros | Contras |

| Cuentas demo | Se cobran diversas tarifas |

| Tiempo de operación prolongado | |

| Varios canales de contacto | |

| Bien regulado | |

| Múltiples plataformas de trading |

¿Es SHENGDA FUTURES Legítimo?

Sí. SHENGDA FUTURES está autorizado por la Bolsa de Futuros Financieros de China (CFFEX) para ofrecer servicios. Su número de licencia es 0256. CFFEX, establecido con la aprobación del Consejo de Estado de la República Popular China y la Comisión Reguladora de Valores de China (CSRC), es una bolsa incorporada especializada en brindar servicios de negociación y compensación para futuros financieros, opciones y otros derivados.

| País Regulado | Regulador | Estado Actual | Entidad Regulada | Tipo de Licencia | Número de Licencia |

| Bolsa de Futuros Financieros de China (CFFEX) | Regulado | 盛达期货有限公司 | Licencia de Futuros | 0256 |

¿Qué puedo negociar en SHENGDA FUTURES?

| Instrumentos de Negociación | Soportado |

| Futuros | ✔ |

| Forex | ❌ |

| Índices | ❌ |

| Acciones | ❌ |

| Criptomonedas | ❌ |

| Bonos | ❌ |

| Opciones | ❌ |

| ETFs | ❌ |

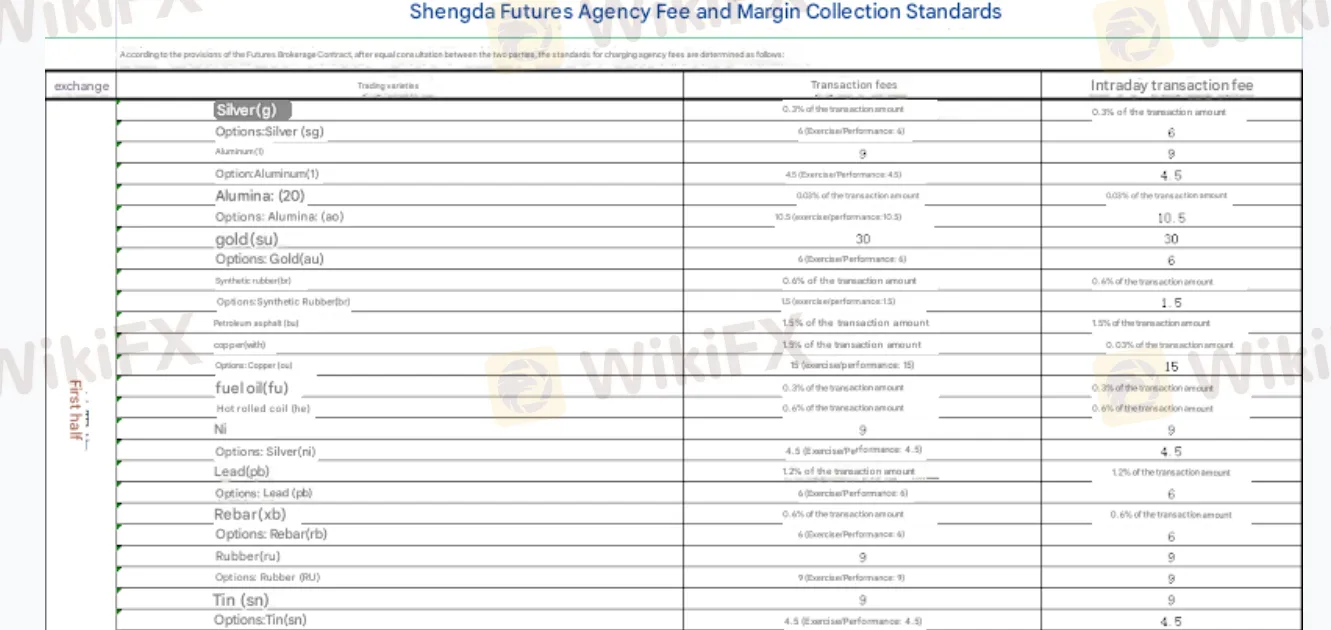

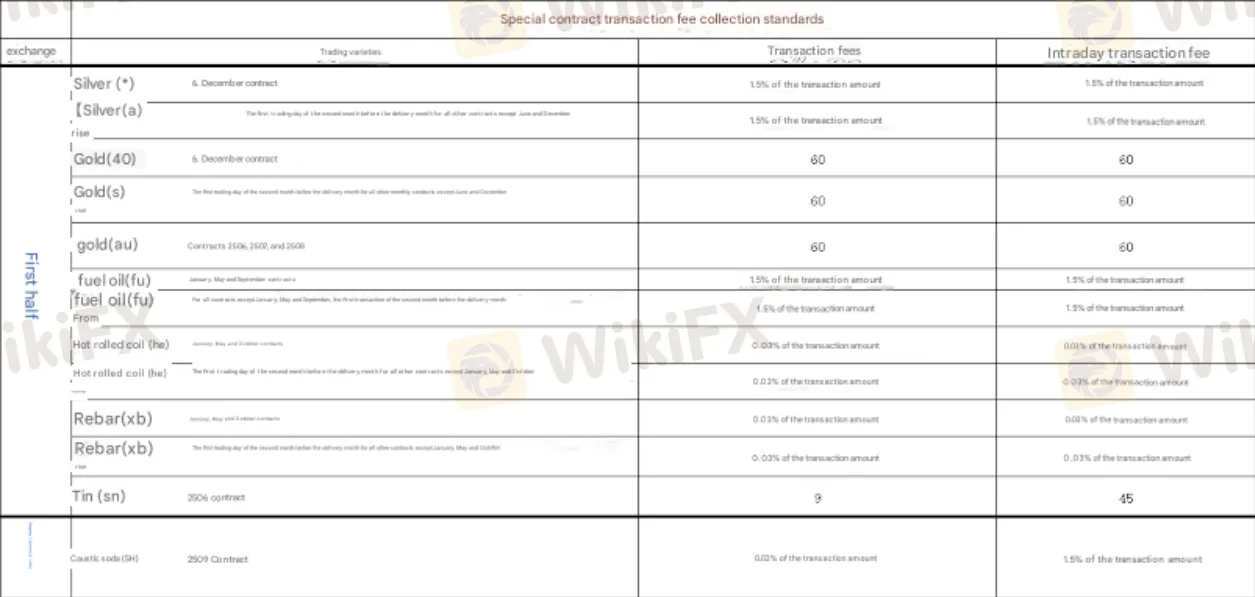

Tarifas de SHENGDA FUTURES

La comisión cobrada por diferentes sucursales para diferentes productos básicos y diferentes formas de contrato son diferentes, por favor visite el sitio web oficial para más detalles (la imagen está traducida por Google, no es muy clara, por favor visite el sitio web oficial para más detalles).

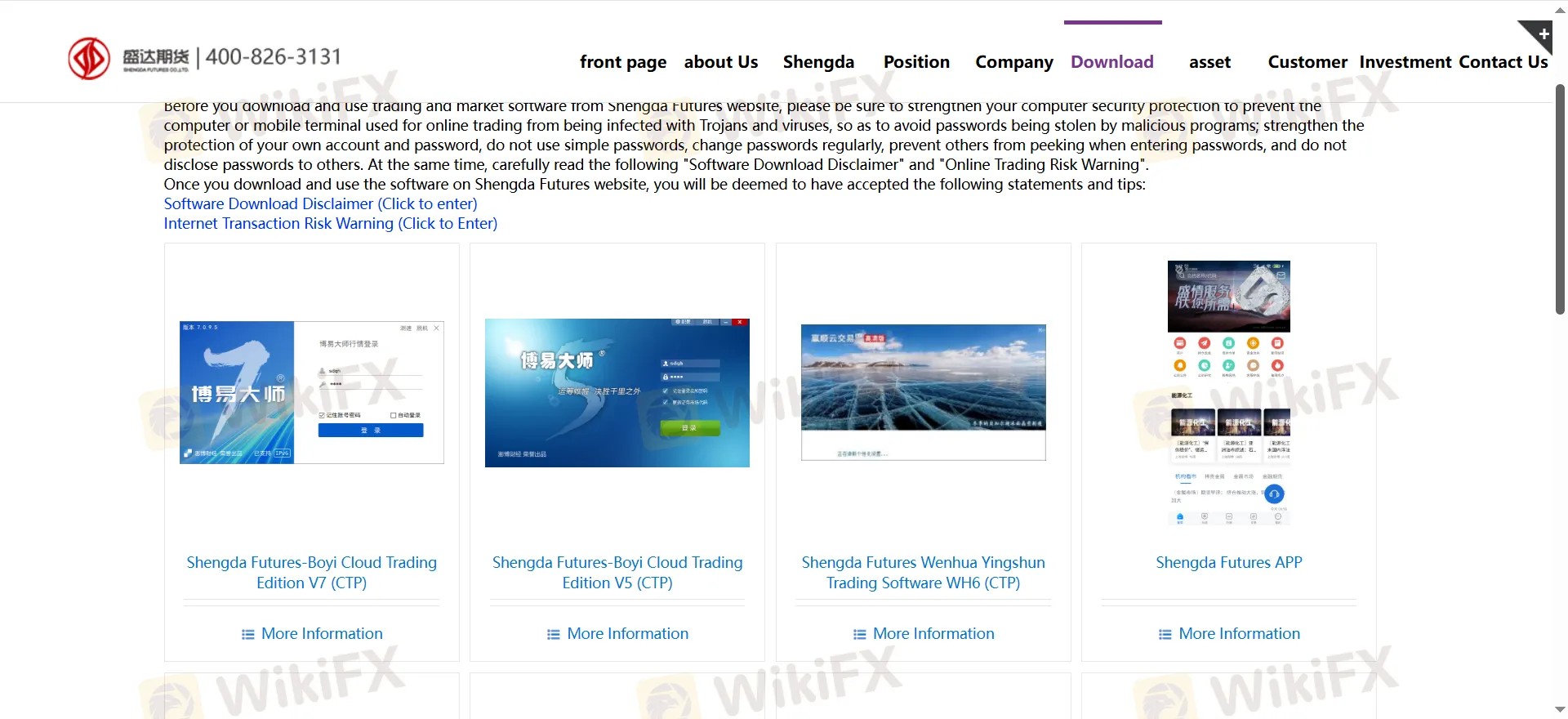

Plataforma de Trading

| Plataforma de Trading | Compatible | Dispositivos Disponibles |

| Shengda Futures CTP Express Client v2 | ✔ | PC, portátil, tablet |

| Shengda Futures CTP Express Client v3 | ✔ | PC, portátil, tablet |

| Shengda Futures CTP Infinite Easy Production System | ✔ | PC, portátil, tablet |

| Pyramid Decision Trading System (CTP) | ✔ | PC, portátil, tablet |

| Shengda Futures-Boyi Cloud Trading Edition V7 (CTP) | ✔ | PC, portátil, tablet |

| Shengda Futures-Boyi Cloud Trading Edition V5 (CTP) | ✔ | PC, portátil, tablet |

| Shengda Futures Wenhua Yingshun Trading Software WH6 (CTP) | ✔ | PC, portátil, tablet |

| Trading Pioneer Ultimate (CTP) | ✔ | PC, portátil, tablet |

| Shengda Futures Boyi Master 5CTP Demo Version | ✔ | PC, portátil, tablet |

| Shengda Futures CTP Option Simulation System | ✔ | PC, portátil, tablet |

| Shengda Futures CTP Infinite Options Simulation System | ✔ | PC, portátil, tablet |

| Shengda Futures APP | ✔ | Móvil |

Depósito y Retiro

SHENGDA FUTURES acepta pagos realizados a través de tarjetas de crédito, débito y transferencia bancaria.

Depósito: No hay restricciones en el número de depósitos, monto mínimo de depósito y monto máximo de depósito.

Retiro: Para requisitos de retiro como retiro único y límite total de retiro por día, número de retiros por día y fondos garantizados, por favor consulte el sitio web oficial del bróker.

Horario de depósito y retiro en ventanilla: Lunes a Viernes: 8:30-16:00.

Los fondos generalmente llegarán dentro de las 24 horas.