Perfil de la compañía

| Match Securities Resumen de la reseña | |

| Fundado | 2021 |

| País/Región Registrado | Mauricio |

| Regulación | Sin regulación |

| Instrumentos de mercado | FX, CFDs, ETFs, Futuros, Metales e Índices |

| Cuenta demo | ❌ |

| Apalancamiento | / |

| Spread | / |

| Plataformas de trading | ML Trader, Meta Trader 5 (MT5) y IRESS Pro Trader |

| Depósito mínimo | / |

| Soporte al cliente | Chat en vivo 24/5 |

| Teléfono: +230 454 3200 | |

| Correo electrónico: support@matchsecurities.com | |

| Dirección: 4th Floor, Iconebene, Rue de LInstitut, Ebene, Mauritius, 80817 | |

Fundada en 2021, Match Securities es una empresa de corretaje no regulada con sede en Mauricio. Ofrece FX, CFDs, ETFs, Futuros, Metales e Índices a través de plataformas de trading como ML Trader, Meta Trader 5 (MT5) y IRESS Pro Trader.

Ventajas y desventajas

| Pros | Cons |

| Varias opciones de trading | Estado no regulado |

| Múltiples canales de soporte al cliente | Información limitada sobre las cuentas |

| Plataforma MT5 proporcionada | Información limitada sobre las comisiones de trading |

| Sin cuenta demo | |

| Complejidad para principiantes |

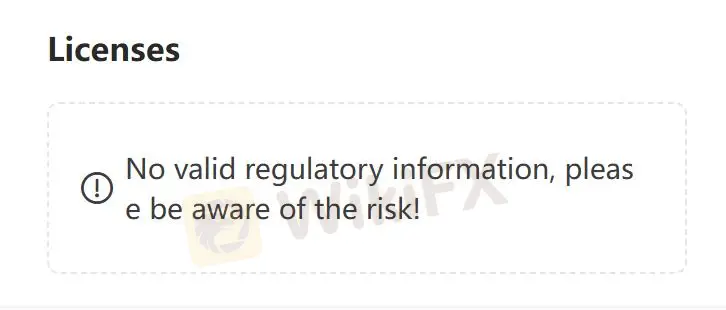

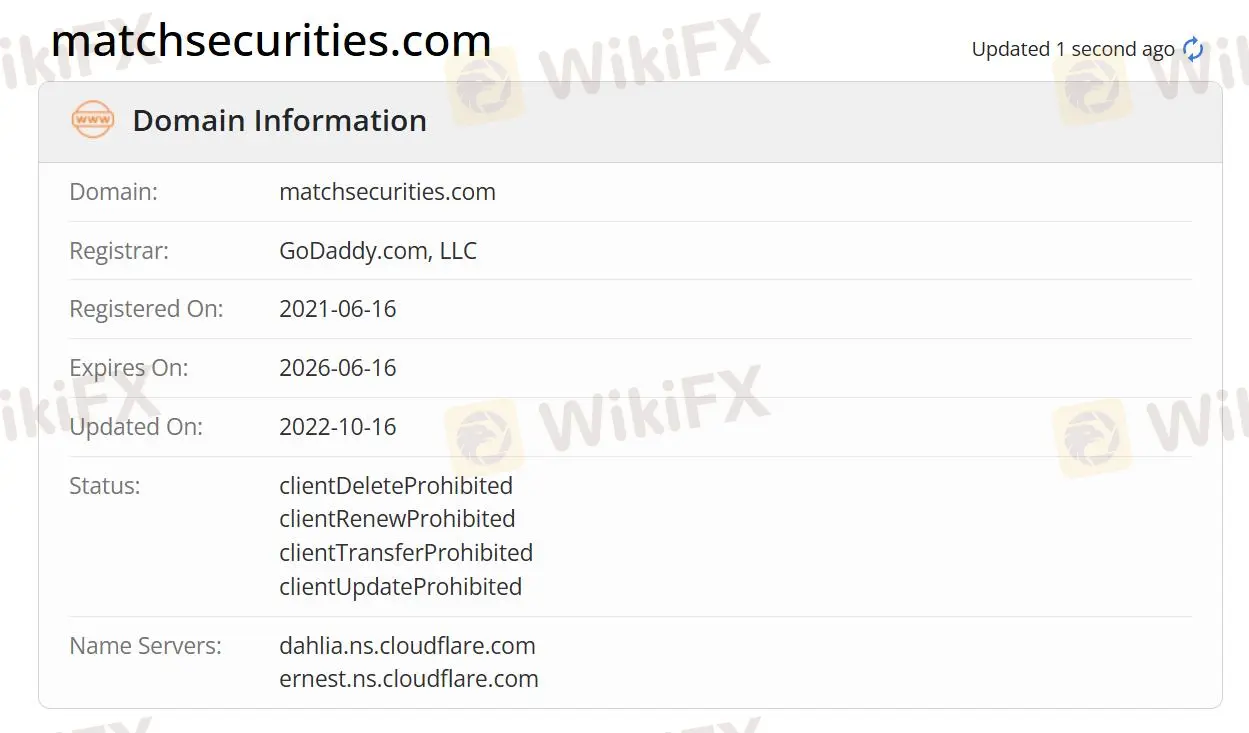

¿Es Match Securities legítimo?

En la actualidad, Match Securities carece de regulación válida. Su dominio fue registrado el 16 de junio de 2021 y el estado actual es "client Delete Prohibited, client Renew Prohibited, client Transfer Prohibited, client Update Prohibited". Por favor, preste mucha atención a la seguridad de sus fondos si elige este broker.

¿Qué puedo operar en Match Securities?

En Match Securities, puedes operar con FX, CFDs, ETFs, Futuros, Metales e Índices.

Forex: Puedes acceder al mercado más líquido del mundo. Puedes operar más de 200 pares de divisas con comisiones bajas y spreads competitivos. La empresa ofrece plataformas de trading potentes, herramientas superiores y soporte experto las 24/5.

Productos básicos: Las inversiones en productos básicos mantienen su valor a largo plazo. Match Securities ofrece bajos costos de trading, liquidez profunda y una cobertura contra la inflación. Puedes operar derivados de energías como petróleo crudo y gas natural para una ejecución rápida y los mejores precios.

CFD de acciones: Puedes operar derivados de acciones de las principales empresas con bajos requisitos de margen. Puedes acceder a CFD de acciones de Apple, Amazon, Facebook. Match Securities ofrece una liquidez sólida, ejecución rápida y spreads bajos.

Índices: Puedes abrir posiciones largas o cortas en los principales índices bursátiles. Puedes acceder a USA500, Germany 30, UK100. Se ofrece en MT4, MT5, ML Trader. Puedes operar con spreads ajustados y precios líderes.

Futuros: Pueden operar en plataformas galardonadas. Pueden acceder a más de 300 futuros de 16 bolsas. Las ventajas incluyen precios competitivos, órdenes y herramientas de profundidad para traders, soporte experto las 24 horas del día, los 5 días de la semana y gestores de cuentas dedicados.

| Instrumentos Negociables | Soportados |

| Forex | ✔ |

| CFDs | ✔ |

| Metales | ✔ |

| Índices | ✔ |

| Futuros | ✔ |

| ETFs | ✔ |

| Acciones | ❌ |

| Materias Primas | ❌ |

| Criptomonedas | ❌ |

Plataforma de Trading

Match Securities ofrece ML Trader, Meta Trader 5 (MT5) y IRESS Pro Trader.

ML Trader: Ejecución rápida y eficiente, integrando liquidez global extensa y profunda de bancos e instituciones de primer nivel, ofreciendo un viaje de trading de alta velocidad y alto rendimiento.

Meta Trader 5 (MT5): Tecnología de trading multiactivo estándar de la industria para divisas, acciones y futuros. Rico en funciones e intuitivo, equipado con herramientas para análisis de precios, trading algorítmico y copy trading.

IRESS Pro Trader: Una plataforma de trading en línea basada en web que integra transmisión dinámica de datos de mercado multiactivo y multicanal con trading sofisticado y gestión de cartera.