Perfil de la compañía

| Currency Solutions Resumen de la reseña | |

| Establecido | 2003 |

| País/Región Registrada | Reino Unido |

| Regulación | FCA: Procesamiento Directo (STP) (regulado), Licencia de Pago (excedida) |

| Servicios | Servicios de cambio de divisas (FX) y pagos internacionales |

| Cuenta Demo | ❌ |

| Apalancamiento | / |

| Spread | / |

| Plataforma de Trading | / |

| Depósito Mínimo | / |

| Soporte al Cliente | Teléfono: +44 2077400000 |

| X, Linkedin, Instagram | |

| Dirección: 4th Floor Hobbs Court, 2 Jacob Street, London, SE1 2BG | |

Fundada en el Reino Unido en 2003, Currency Solutions ofrece servicios de cambio de divisas (FX) y pagos internacionales, brindando acceso a más de 170 pares de divisas. La empresa está autorizada y regulada por la Autoridad de Conducta Financiera (FCA) para Procesamiento Directo (STP). Sin embargo, su Licencia de Pago (número 512130) ha sido excedida. Además, la información sobre plataformas de trading, spreads, apalancamiento y depósito mínimo no está fácilmente disponible, y actualmente no ofrecen cuentas demo.

Pros y Contras

| Pros | Contras |

| Regulado por la FCA | Licencia excedida |

| Información limitada sobre tarifas de trading | |

| Sin cuentas demo | |

| Falta de información sobre plataformas de trading |

¿Es Currency Solutions Legítimo?

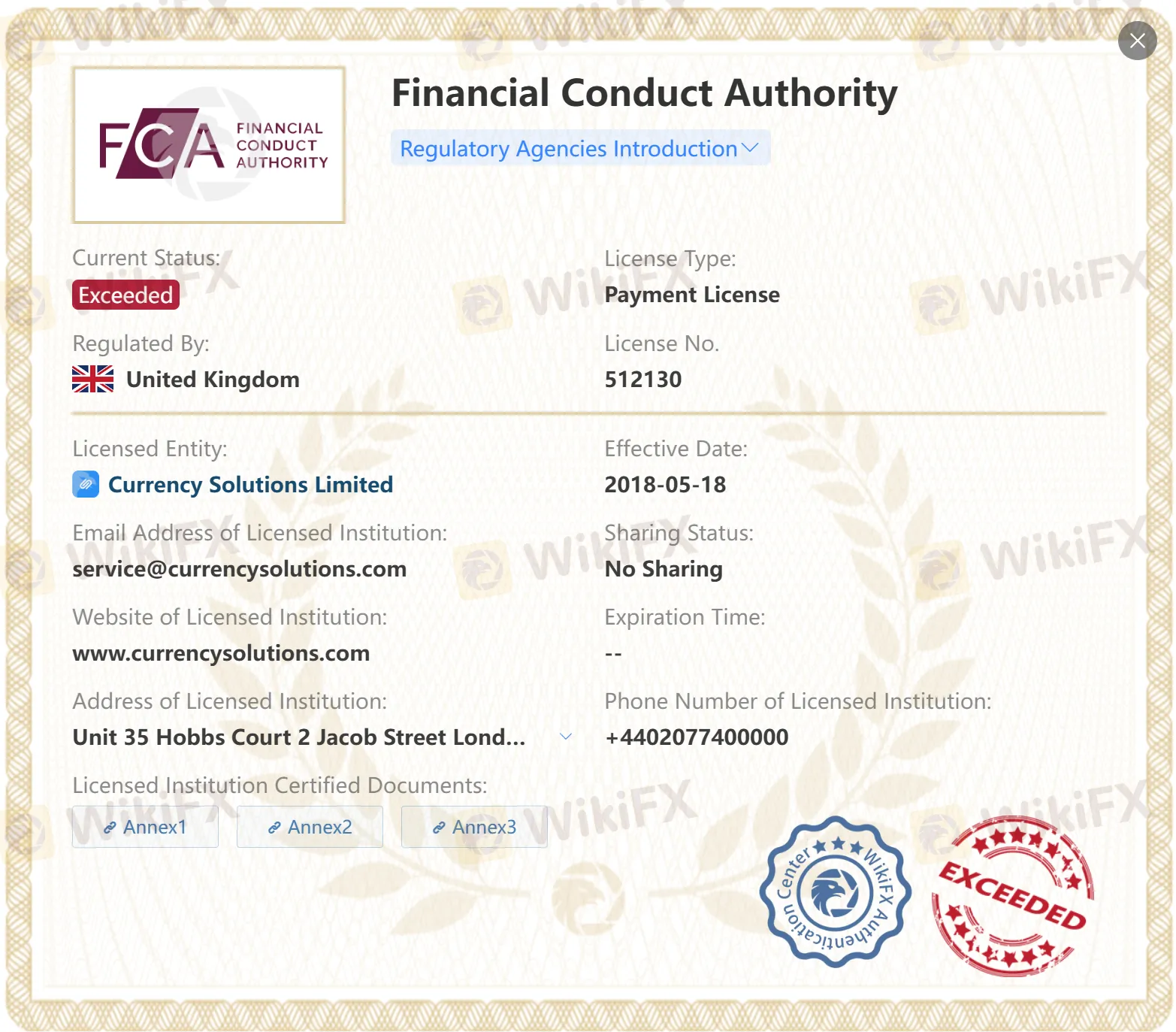

Currency Solutions actualmente posee dos licencias bajo la FCA. Una es una licencia de Procesamiento Directo (STP), que está regulada. La otra es una Licencia de Pago, que ha sido excedida.

| País Regulado | Autoridad Reguladora | Entidad Regulada | Estado Actual | Tipo de Licencia | Número de Licencia |

| Financial Conduct Authority (FCA) | Currency Solutions Limited | Regulada | Procesamiento Directo (STP) | 602082 |

| Financial Conduct Authority (FCA) | Currency Solutions Limited | Excedida | Licencia de Pago | 512130 |

Servicios

Currency Solutions ofrece más de 170 pares de divisas, servicios de intercambio de divisas (FX) y pagos internacionales.

Depósito y Retiro

Currency Solutions admite métodos de pago a través de tarjetas de débito Visa y Mastercard, así como transferencia bancaria.