Unternehmensprofil

| Match Securities Überprüfungszusammenfassung | |

| Gegründet | 2021 |

| Registriertes Land/Region | Mauritius |

| Regulierung | Keine Regulierung |

| Handelsinstrumente | FX, CFDs, ETFs, Futures, Metalle und Indizes |

| Demokonto | ❌ |

| Hebelwirkung | / |

| Spread | / |

| Handelsplattformen | ML Trader, Meta Trader 5 (MT5) und IRESS Pro Trader |

| Mindesteinzahlung | / |

| Kundensupport | 24/5 Live-Chat |

| Telefon: +230 454 3200 | |

| E-Mail: support@matchsecurities.com | |

| Adresse: 4. Stock, Iconebene, Rue de LInstitut, Ebene, Mauritius, 80817 | |

Gegründet im Jahr 2021, ist Match Securities ein unreguliertes Brokerunternehmen mit Sitz in Mauritius. Es bietet FX, CFDs, ETFs, Futures, Metalle und Indizes über Handelsplattformen wie ML Trader, Meta Trader 5 (MT5) und IRESS Pro Trader an.

Vor- und Nachteile

| Vorteile | Nachteile |

| Verschiedene Handelsoptionen | Unregulierter Status |

| Mehrere Kundensupport-Kanäle | Begrenzte Informationen über Konten |

| Bereitstellung der MT5-Plattform | Begrenzte Informationen über Handelsgebühren |

| Kein Demokonto | |

| Komplexität für Anfänger |

Ist Match Securities seriös?

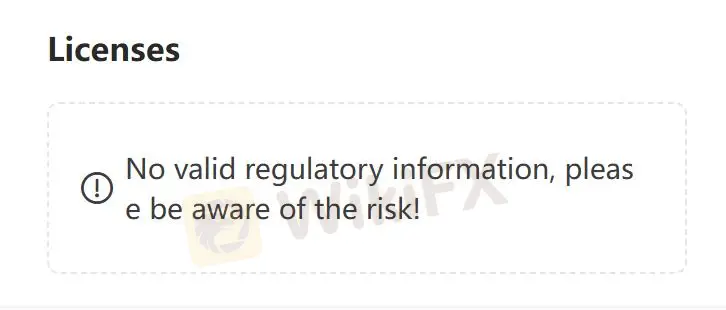

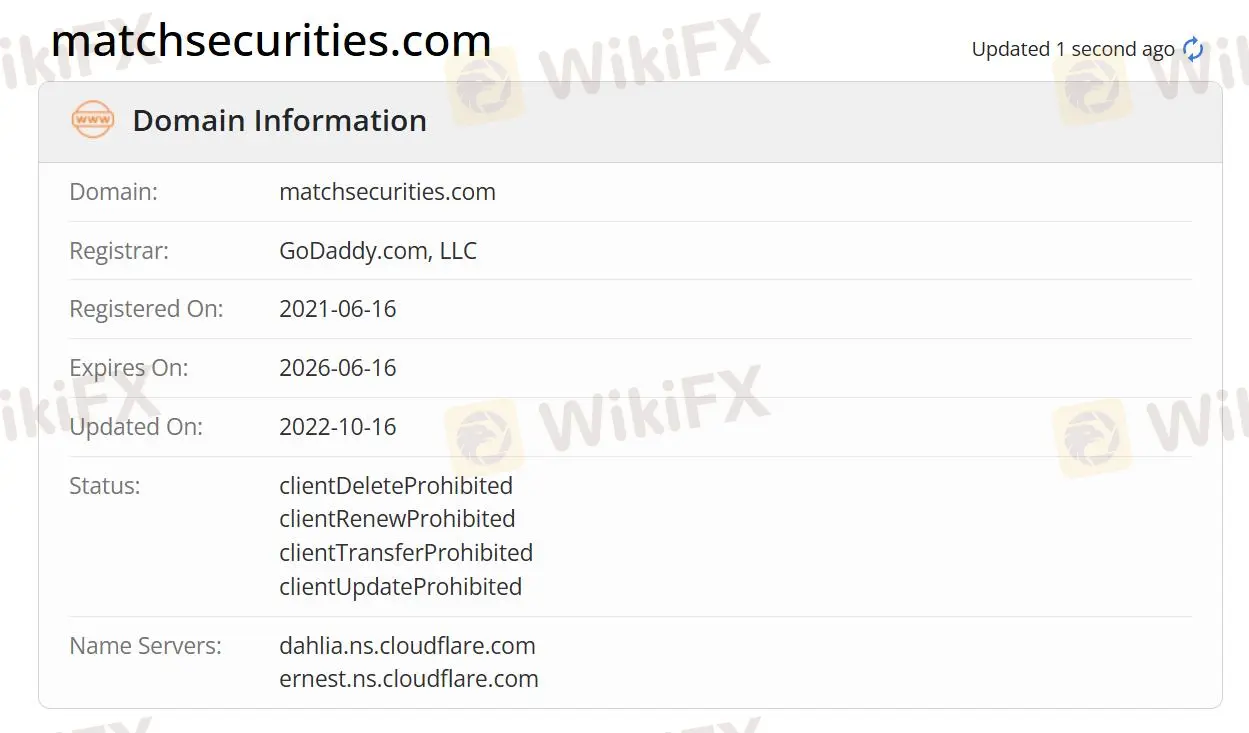

Derzeit fehlt Match Securities eine gültige Regulierung. Die Domain wurde am 16. Juni 2021 registriert und der aktuelle Status lautet "client Delete Prohibited, client Renew Prohibited, client Transfer Prohibited, client Update Prohibited". Bitte achten Sie besonders auf die Sicherheit Ihrer Gelder, wenn Sie sich für diesen Broker entscheiden.

Was kann ich auf Match Securities handeln?

Auf Match Securities können Sie mit FX, CFDs, ETFs, Futures, Metalle und Indizes handeln.

Forex: Sie können auf den weltweit liquidesten Markt zugreifen. Sie können mehr als 200 FX-Paare mit niedrigen Provisionen und wettbewerbsfähigen Spreads handeln. Das Unternehmen bietet leistungsstarke Handelsplattformen, erstklassige Tools und 24/5 Expertenunterstützung.

Waren: Rohstoffinvestitionen haben langfristigen Wert. Match Securities bietet geringe Handelskosten, hohe Liquidität und einen Schutz gegen Inflation. Sie können Derivate auf Energien wie Rohöl und Erdgas für schnelle Ausführung und beste Preise handeln.

Aktien-CFDs: Sie können Derivate auf Aktien von Top-Unternehmen mit geringen Margin-Anforderungen handeln. Sie können auf Aktien-CFDs von Apple, Amazon, Facebook zugreifen. Match Securities bietet hohe Liquidität, schnelle Ausführung und niedrige Spreads.

Indizes: Sie können Long oder Short auf wichtige Aktienindizes gehen. Sie können auf USA500, Germany 30, UK100 zugreifen. Es wird auf MT4, MT5, ML Trader angeboten. Sie können mit engen Spreads und führenden Preisen handeln.

Futures: Sie können auf preisgekrönten Plattformen handeln. Sie haben Zugriff auf über 300 Futures von 16 Börsen. Vorteile sind wettbewerbsfähige Preise, Aufträge und Tools für Tiefenhändler, 24/5 Expertenunterstützung und dedizierte Kontomanager.

| Handelbare Instrumente | Unterstützt |

| Forex | ✔ |

| CFDs | ✔ |

| Metalle | ✔ |

| Indizes | ✔ |

| Futures | ✔ |

| ETFs | ✔ |

| Aktien | ❌ |

| Waren | ❌ |

| Kryptowährungen | ❌ |

Handelsplattform

Match Securities bietet ML Trader, Meta Trader 5 (MT5) und IRESS Pro Trader.

ML Trader: Schnelle und effiziente Ausführung, Integration umfangreicher und fundierter globaler Liquidität von Tier-1-Banken und Institutionen, bietet eine schnelle und leistungsstarke Handelserfahrung.

Meta Trader 5 (MT5): Branchenübliche Multi-Asset-Handelstechnologie für Devisen, Aktien und Futures. Reich an Funktionen und intuitiv, ausgestattet mit Tools für Preisanalyse, algorithmischen Handel und Kopierhandel.

IRESS Pro Trader: Eine webbasierte Online-Handelsplattform, die dynamisches, multi-asset- und multi-channel Marktdaten-Streaming mit anspruchsvollem Handel und Portfolio-Management integriert.