Présentation de l'entreprise

| Match Securities Résumé de l'examen | |

| Fondé | 2021 |

| Pays/Région enregistré(e) | Maurice |

| Réglementation | Pas de réglementation |

| Instruments de marché | FX, CFD, ETF, contrats à terme, métaux et indices |

| Compte de démonstration | ❌ |

| Effet de levier | / |

| Spread | / |

| Plateformes de trading | ML Trader, Meta Trader 5 (MT5) et IRESS Pro Trader |

| Dépôt minimum | / |

| Assistance clientèle | Chat en direct 24/5 |

| Téléphone : +230 454 3200 | |

| Email : support@matchsecurities.com | |

| Adresse : 4ème étage, Iconebene, Rue de LInstitut, Ebene, Maurice, 80817 | |

Fondée en 2021, Match Securities est une société de courtage non réglementée basée à Maurice. Elle propose des FX, CFD, ETF, contrats à terme, métaux et indices via des plateformes de trading telles que ML Trader, Meta Trader 5 (MT5) et IRESS Pro Trader.

Avantages et inconvénients

| Avantages | Inconvénients |

| Diverses options de trading | Statut non réglementé |

| Multiples canaux de support client | Informations limitées sur les comptes |

| Plateforme MT5 fournie | Informations limitées sur les frais de trading |

| Pas de compte de démonstration | |

| Complexité pour les débutants |

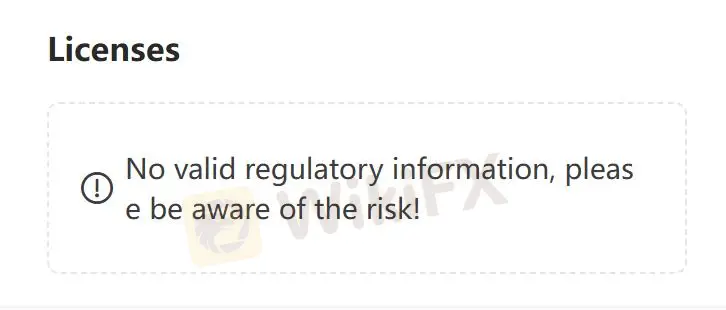

Match Securities est-il légitime ?

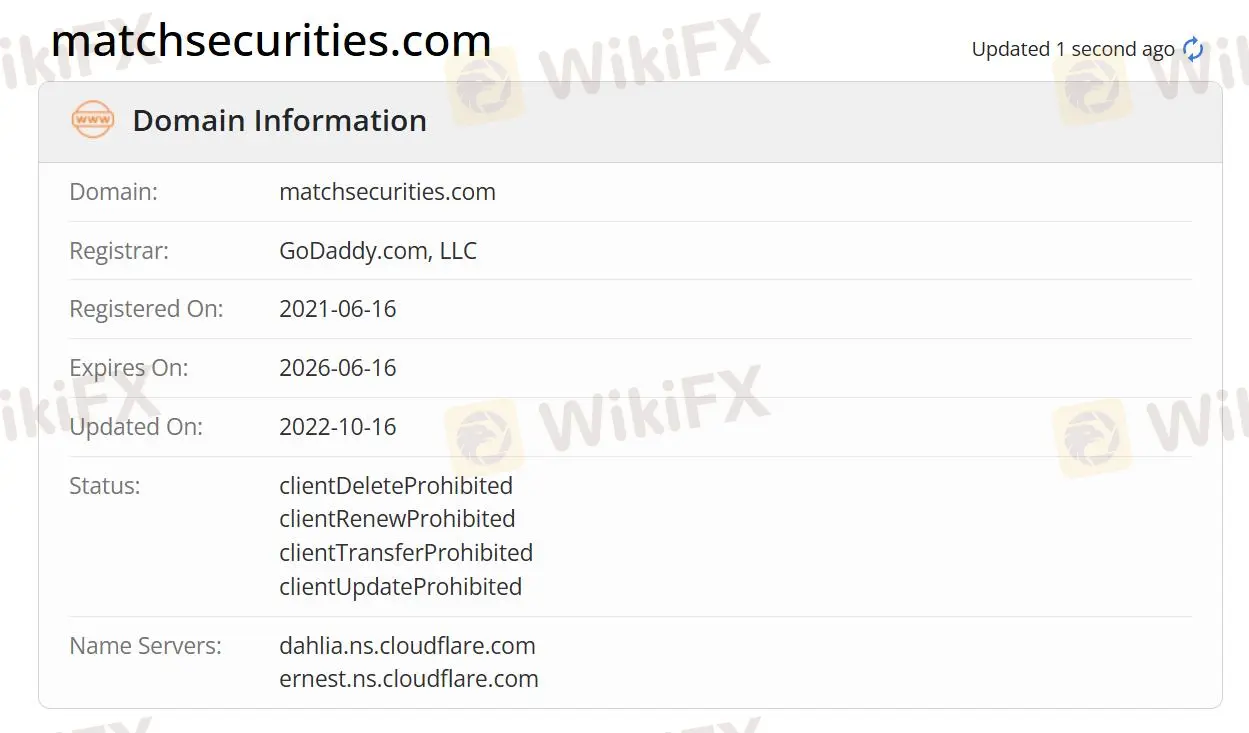

Actuellement, Match Securities ne dispose pas d'une réglementation valide. Son domaine a été enregistré le 16 juin 2021 et son statut actuel est "client Delete Prohibited, client Renew Prohibited, client Transfer Prohibited, client Update Prohibited". Veuillez accorder une attention particulière à la sécurité de vos fonds si vous choisissez ce courtier.

Que puis-je trader sur Match Securities ?

Sur Match Securities, vous pouvez trader avec des FX, CFD, ETF, contrats à terme, métaux et indices.

Forex : Vous pouvez accéder au marché le plus liquide au monde. Vous pouvez trader plus de 200 paires de devises avec des commissions réduites et des spreads compétitifs. La société propose des plateformes de trading puissantes, des outils de pointe et un support expert 24/5.

Matières premières : Les investissements dans les matières premières conservent leur valeur à long terme. Match Securities propose des coûts de trading réduits, une liquidité profonde et une protection contre l'inflation. Vous pouvez trader des dérivés sur les énergies telles que le pétrole brut et le gaz naturel pour une exécution rapide et les meilleurs prix.

CFD sur actions : Vous pouvez trader des dérivés sur les actions des grandes entreprises avec de faibles exigences de marge. Vous pouvez accéder aux CFD sur actions d'Apple, Amazon, Facebook. Match Securities offre une liquidité solide, une exécution rapide et des spreads réduits.

Indices : Vous pouvez prendre des positions longues ou courtes sur les principaux indices boursiers. Vous pouvez accéder à USA500, Germany 30, UK100. Il est proposé sur MT4, MT5, ML Trader. Vous pouvez trader avec des spreads serrés et des prix compétitifs.

Futures: Ils peuvent trader sur des plateformes primées. Ils peuvent accéder à plus de 300 contrats à terme provenant de 16 bourses. Les avantages comprennent des tarifs compétitifs, des outils de trading d'ordres et de profondeur, un support expert 24/5 et des gestionnaires de compte dédiés.

| Instruments négociables | Pris en charge |

| Forex | ✔ |

| CFDs | ✔ |

| Métaux | ✔ |

| Indices | ✔ |

| Futures | ✔ |

| ETFs | ✔ |

| Actions | ❌ |

| Matières premières | ❌ |

| Cryptomonnaies | ❌ |

Plateforme de trading

Match Securities propose ML Trader, Meta Trader 5 (MT5) et IRESS Pro Trader.

ML Trader: Exécution rapide et efficace, intégrant une liquidité mondiale étendue et profonde provenant de banques de premier rang et d'institutions, offrant un parcours de trading rapide et performant.

Meta Trader 5 (MT5): Technologie de trading multi-actifs de référence pour le forex, les actions et les contrats à terme. Riche en fonctionnalités et intuitive, équipée d'outils d'analyse des prix, de trading algorithmique et de copie de trades.

IRESS Pro Trader: Une plateforme de trading en ligne basée sur le web qui intègre des flux de données de marché dynamiques, multi-actifs et multi-canaux avec une gestion de trading et de portefeuille sophistiquée.