公司簡介

| Match Securities 綜述 | |

| 成立年份 | 2021 |

| 註冊國家/地區 | 毛里求斯 |

| 監管 | 無監管 |

| 市場工具 | 外匯、差價合約、交易所交易基金、期貨、貴金屬和指數 |

| 模擬帳戶 | ❌ |

| 槓桿 | / |

| 點差 | / |

| 交易平台 | ML Trader、Meta Trader 5 (MT5)和IRESS Pro Trader |

| 最低存款 | / |

| 客戶支援 | 24/5 在線聊天 |

| 電話:+230 454 3200 | |

| 電郵:support@matchsecurities.com | |

| 地址:毛里求斯Ebene LInstitut街Iconebene大廈4樓,郵編80817 | |

Match Securities成立於2021年,是一家位於毛里求斯的無監管經紀公司。它通過ML Trader、Meta Trader 5 (MT5)和IRESS Pro Trader等交易平台提供外匯、差價合約、交易所交易基金、期貨、貴金屬和指數。

優點和缺點

| 優點 | 缺點 |

| 多種交易選項 | 無監管狀態 |

| 多個客戶支援渠道 | 帳戶信息有限 |

| 提供MT5平台 | 交易費用信息有限 |

| 無模擬帳戶 | |

| 對初學者複雜 |

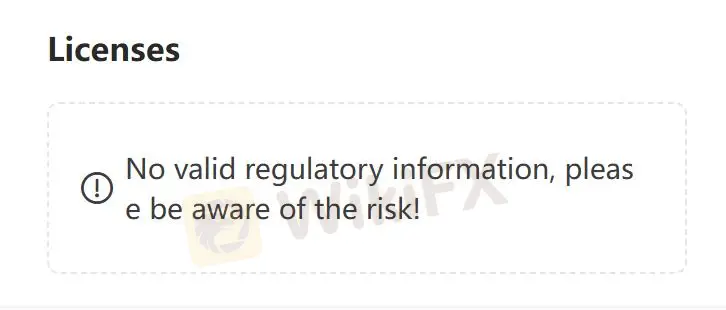

Match Securities 是否合法?

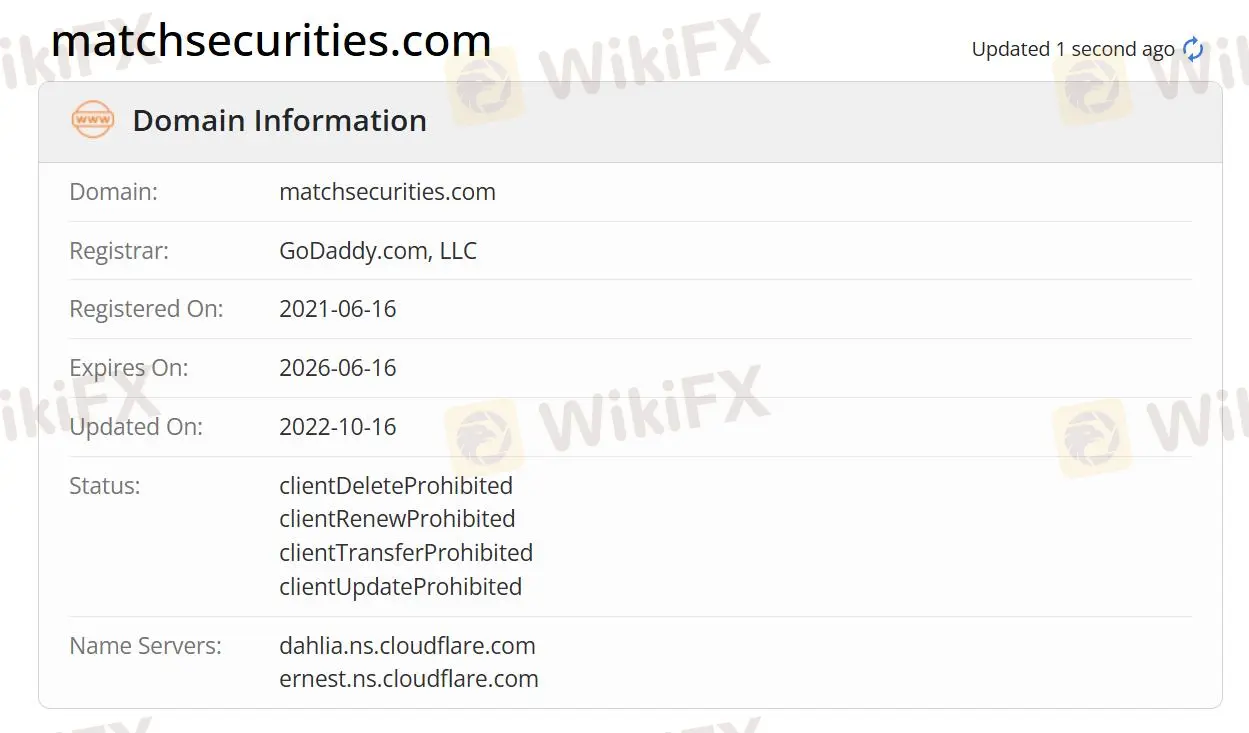

目前,Match Securities 缺乏有效的監管。其域名於2021年6月16日註冊,目前狀態為“客戶禁止刪除、客戶禁止續訂、客戶禁止轉移、客戶禁止更新”。如果您選擇此經紀商,請高度關注您資金的安全。

Match Securities 可以交易什麼?

在Match Securities上,您可以交易外匯、差價合約、交易所交易基金、期貨、貴金屬和指數。

外匯:他們可以進入全球最流動的市場。他們可以以低佣金和競爭性點差交易200多種外匯貨幣對。該公司提供強大的交易平台、優秀的工具和24/5專家支援。

商品:商品投資具有長期價值。Match Securities提供低交易成本、深度流動性和對抗通脹的對沖。他們可以交易能源類商品的衍生品,如原油和天然氣,以實現快速執行和最佳定價。

股票差價合約:他們可以以低保證金要求交易頂級公司的股票差價合約。他們可以在蘋果、亞馬遜、Facebook等股票差價合約上交易。Match Securities提供強大的流動性、快速執行和低點差。

指數:他們可以做多或做空主要股票指數。他們可以交易USA500、Germany 30、UK100等指數。它提供在MT4、MT5、ML Trader上交易,可以享受緊密的點差和領先的定價。

Futures: 他們可以在屢獲殊榮的平台上進行交易。他們可以從16個交易所訪問300多種期貨。優勢包括競爭定價、訂單和深度交易工具、24/5專家支持和專屬賬戶經理。

| 可交易工具 | 支持 |

| 外匯 | ✔ |

| 差價合約 | ✔ |

| 貴金屬 | ✔ |

| 指數 | ✔ |

| 期貨 | ✔ |

| 交易所交易基金 | ✔ |

| 股票 | ❌ |

| 大宗商品 | ❌ |

| 加密貨幣 | ❌ |

交易平台

Match Securities 提供 ML Trader、Meta Trader 5 (MT5) 和 IRESS Pro Trader。

ML Trader: 快速高效的執行,整合了來自一級銀行和機構的廣泛和深厚的全球流動性,提供高速和高性能的交易體驗。

Meta Trader 5 (MT5): 行業標準的多資產交易技術,適用於外匯、股票和期貨。功能豐富且直觀,配備了價格分析、算法交易和複製交易工具。

IRESS Pro Trader: 一個基於網絡的在線交易平台,將動態、多資產、多渠道的市場數據流與複雜的交易和投資組合管理相結合。