Profil perusahaan

| Match Securities Ringkasan Ulasan | |

| Didirikan | 2021 |

| Negara/Daerah Terdaftar | Mauritius |

| Regulasi | Tidak Diatur |

| Instrumen Pasar | FX, CFD, ETF, Futures, Logam, dan Indeks |

| Akun Demo | ❌ |

| Leverage | / |

| Spread | / |

| Platform Perdagangan | ML Trader, Meta Trader 5 (MT5), dan IRESS Pro Trader |

| Deposit Minimum | / |

| Dukungan Pelanggan | Chat langsung 24/5 |

| Telepon: +230 454 3200 | |

| Email: support@matchsecurities.com | |

| Alamat: Lantai 4, Iconebene, Rue de LInstitut, Ebene, Mauritius, 80817 | |

Didirikan pada tahun 2021, Match Securities adalah perusahaan pialang yang tidak diatur yang berbasis di Mauritius. Mereka menyediakan FX, CFD, ETF, Futures, Logam, dan Indeks melalui platform perdagangan seperti ML Trader, Meta Trader 5 (MT5), dan IRESS Pro Trader.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Berbagai pilihan perdagangan | Status tidak diatur |

| Banyak saluran dukungan pelanggan | Informasi terbatas tentang akun |

| Platform MT5 disediakan | Informasi terbatas tentang biaya perdagangan |

| Tidak ada akun demo | |

| Kompleksitas bagi pemula |

Match Securities Apakah Legit?

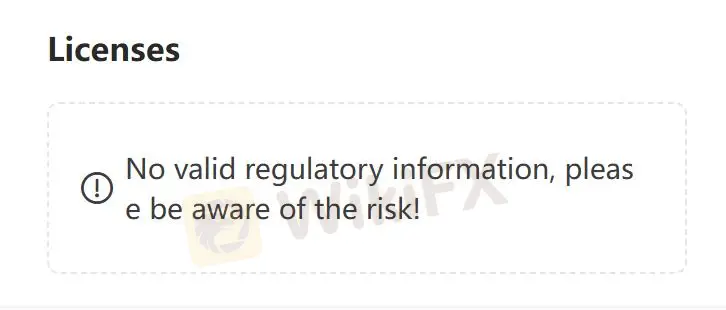

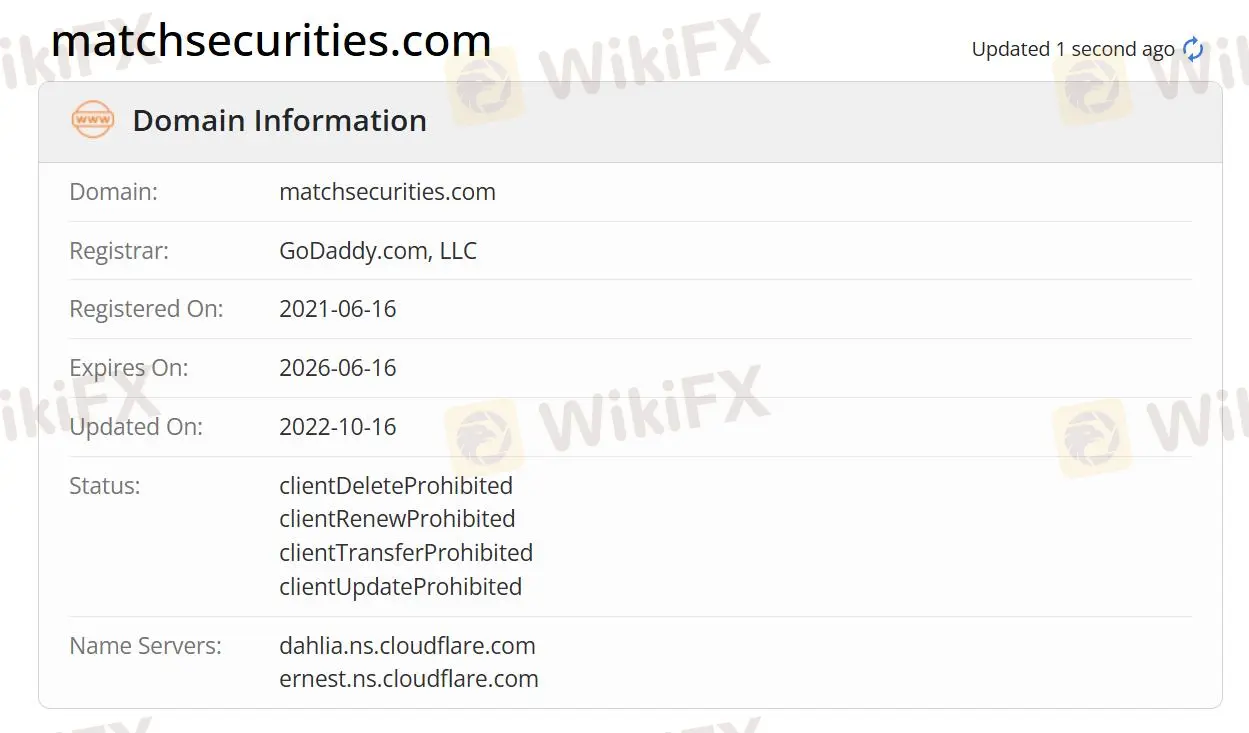

Saat ini, Match Securities tidak memiliki regulasi yang valid. Domainnya terdaftar pada 16 Juni 2021, dan status saat ini adalah "client Delete Prohibited, client Renew Prohibited, client Transfer Prohibited, client Update Prohibited". Harap perhatikan dengan baik keamanan dana Anda jika Anda memilih pialang ini.

Apa yang Bisa Saya Perdagangkan di Match Securities?

Di Match Securities, Anda dapat berdagang dengan FX, CFDs, ETFs, Futures, Logam, dan Indeks.

Forex: Mereka dapat mengakses pasar yang paling likuid di dunia. Mereka dapat berdagang 200+ pasangan FX dengan komisi rendah dan spread kompetitif. Perusahaan ini menawarkan platform perdagangan yang kuat, alat-alat unggulan, dan dukungan ahli 24/5.

Komoditas: Investasi komoditas memiliki nilai jangka panjang. Match Securities menawarkan biaya perdagangan rendah, likuiditas yang dalam, dan lindung nilai terhadap inflasi. Mereka dapat berdagang derivatif pada energi seperti minyak mentah dan gas alam untuk eksekusi cepat dan harga terbaik.

CFD Saham: Mereka dapat berdagang derivatif pada saham perusahaan-perusahaan top dengan persyaratan margin rendah. Mereka dapat mengakses CFD saham Apple, Amazon, Facebook. Match Securities menawarkan likuiditas yang kuat, eksekusi cepat, spread rendah.

Indeks: Mereka dapat melakukan posisi long atau short pada indeks saham utama. Mereka dapat mengakses USA500, Germany 30, UK100. Tersedia di MT4, MT5, ML Trader. Mereka dapat berdagang dengan spread yang ketat dan harga terkemuka.

Futures: Mereka dapat melakukan perdagangan di platform-platform yang telah memenangkan penghargaan. Mereka dapat mengakses lebih dari 300 futures dari 16 bursa. Keuntungan meliputi penetapan harga yang kompetitif, pesanan dan alat perdagangan kedalaman, dukungan ahli 24/5, dan manajer akun yang berdedikasi.

| Instrumen Perdagangan | Didukung |

| Forex | ✔ |

| CFDs | ✔ |

| Logam | ✔ |

| Indeks | ✔ |

| Futures | ✔ |

| ETF | ✔ |

| Saham | ❌ |

| Komoditas | ❌ |

| Kriptocurrency | ❌ |

Platform Perdagangan

Match Securities menawarkan ML Trader, Meta Trader 5 (MT5), dan IRESS Pro Trader.

ML Trader: Pelaksanaan yang cepat dan efisien, mengintegrasikan likuiditas global yang luas dan mendalam dari bank dan institusi Tier 1, menawarkan perjalanan perdagangan yang cepat dan berkualitas tinggi.

Meta Trader 5 (MT5): Teknologi perdagangan multi-aset standar industri untuk valuta asing, saham, dan futures. Kaya fitur dan intuitif, dilengkapi dengan alat untuk analisis harga, perdagangan algoritmik, dan perdagangan salin.

IRESS Pro Trader: Platform perdagangan online berbasis web yang mengintegrasikan streaming data pasar yang dinamis, multi-aset, dan multi-channel dengan perdagangan dan manajemen portofolio yang canggih.