Perfil de la compañía

| VANTAGEResumen de la reseña | |

| Fundado | 1991 |

| País/Región registrado | Egipto |

| Regulación | No regulado |

| Instrumentos de mercado | Acciones en diversas industrias y valores |

| Cuenta demo | / |

| Plataforma de trading | Web, Mist WS y aplicación móvil |

| Depósito mínimo | 0 |

| Soporte al cliente | Tel: +20 22560 4072, +20 22560 4073 |

| Whatsapp: 01025000896 | |

| Dirección: Calle No. 28; Edificio No. 170; cuarto piso, piso No. 9; Edificio del Quinto Distrito, Quinto Asentamiento, Nueva Cairo | |

VANTAGE fue fundado por Vantage Securities Brokerage en 1991 en Egipto. Ofrece trading en diversas carteras de acciones y valores. Los traders pueden operar a través de la web, Mist WS y aplicaciones móviles. Aunque no tiene requisitos de depósito mínimo, no está regulado.

Ventajas y desventajas

| Pros | Cons |

| Experiencia | Sin regulación |

| Estructura de tarifas clara | Tarifa de transferencia para algunos bancos |

| Múltiples plataformas de trading | |

| Sin depósito mínimo |

¿Es VANTAGE legítimo?

No, VANTAGE no está regulado por ninguna autoridad financiera. Los traders deben tener cuidado al operar.

¿Qué puedo operar en VANTAGE?

| Instrumentos negociables | Soportados |

| Acciones | ✔ |

| Valores | ✔ |

| Forex | ❌ |

| Materias primas | ❌ |

| Índices | ❌ |

| Acciones | ❌ |

| Criptomonedas | ❌ |

Comisión

No hay comisión por abrir una cuenta en VANTAGE.

Otros cargos

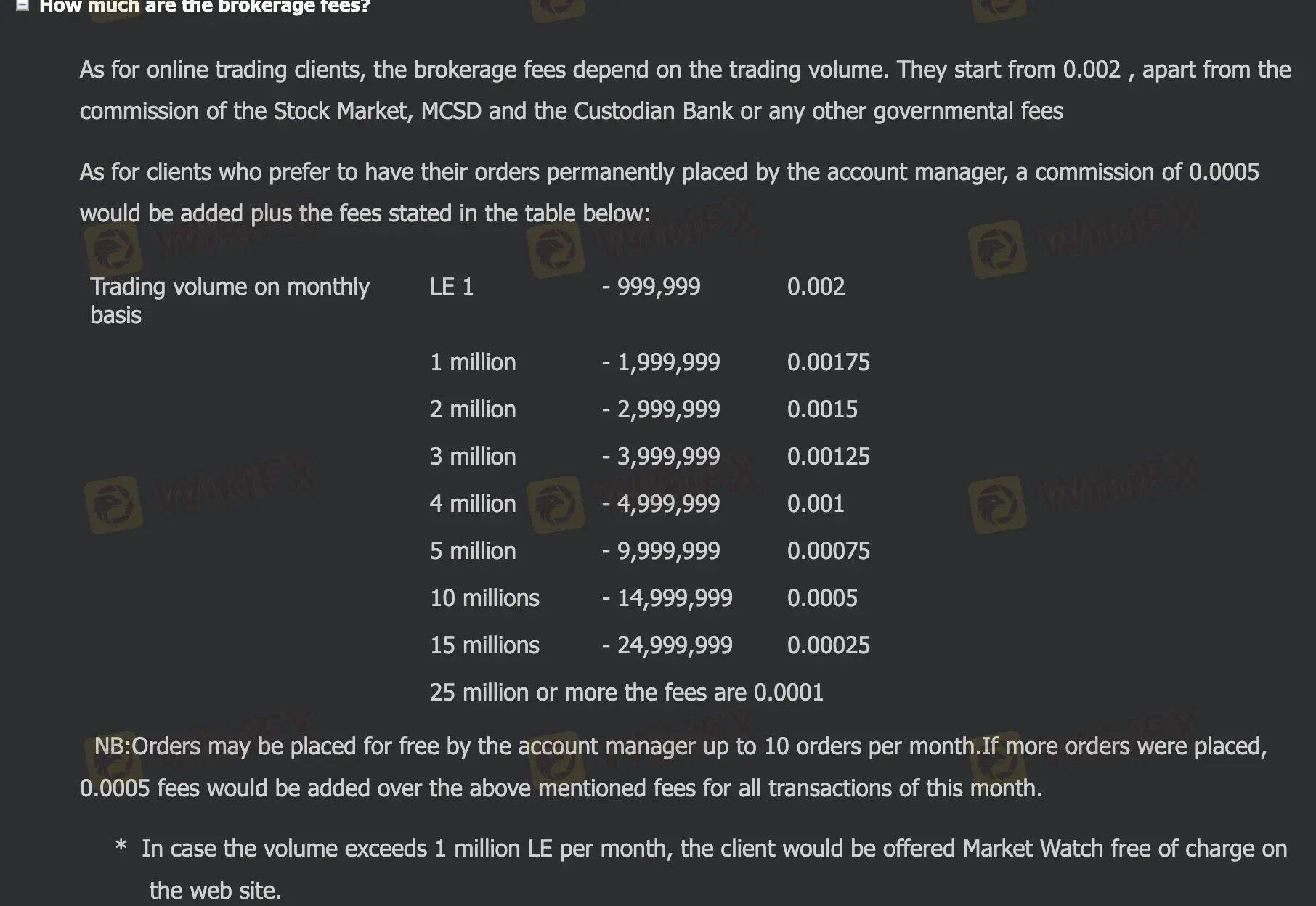

Las comisiones de corretaje de VANTAGE dependen del volumen de trading. Comienza desde 0.002, además de la comisión del Mercado de Valores, MCSD y el Banco Custodio u otras tarifas gubernamentales.

Los traders que deseen tener sus órdenes de forma permanente tendrán una comisión de 0.0005 que se sumará a las tarifas indicadas en la tabla a continuación. Además, los traders pueden realizar 10 órdenes gratuitas, si realizan más, se agregarán tarifas de 0.0005 a las tarifas mencionadas anteriormente para todas las transacciones de este mes.

| Volumen de Trading en Base Mensual | Tarifas |

| LE 1-999999 | 0.002 |

| 1 millón-1999999 | 0.00175 |

| 2 millones- 2999999 | 0.0015 |

| 3 millones- 3999999 | 0.00125 |

| 4 millones- 4999999 | 0.001 |

| 5 millones- 9999999 | 0.00075 |

| 10 millones- 14999999 | 0.0005 |

| 15 millones- 24999999 | 0.00025 |

| 25 millones o más tarifas | 0.0001 |

Plataforma de Trading

| Plataforma de Trading | Soportada | Dispositivos Disponibles | Adecuada para |

| Web | ✔ | Web | Traders experimentados |

| Mist WS | ✔ | Web | Traders experimentados |

| Aplicación móvil | ✔ | Móvil | Traders experimentados |

Depósito y Retiro

Los traders pueden realizar depósitos a través de transferencia bancaria con efectivo.

Hay dos formas de retirar: transferencia bancaria y un cheque cerrado emitido a nombre del cliente.

No hay tarifas de transferencia en caso de transferir a los siguientes bancos: Arab African International Bank, CIB, Ahli United Bank, Banque Misr, NBK. Si se transfieren a otros bancos, se deducirán tarifas de transferencia de 0.001 con un mínimo de EGP 25 y hasta EGP 50, más tarifas SWIFT de EGP 20.