Resumo da empresa

| Match Securities Resumo da Revisão | |

| Fundado | 2021 |

| País/Região Registrado | Maurício |

| Regulação | Sem Regulação |

| Instrumentos de Mercado | FX, CFDs, ETFs, Futuros, Metais e Índices |

| Conta Demonstração | ❌ |

| Alavancagem | / |

| Spread | / |

| Plataformas de Negociação | ML Trader, Meta Trader 5 (MT5) e IRESS Pro Trader |

| Depósito Mínimo | / |

| Suporte ao Cliente | Chat ao vivo 24/5 |

| Telefone: +230 454 3200 | |

| Email: support@matchsecurities.com | |

| Endereço: 4º andar, Iconebene, Rue de LInstitut, Ebene, Maurício, 80817 | |

Fundada em 2021, Match Securities é uma empresa de corretagem não regulamentada com base em Maurício. Ela oferece FX, CFDs, ETFs, Futuros, Metais e Índices por meio de plataformas de negociação como ML Trader, Meta Trader 5 (MT5) e IRESS Pro Trader.

Prós e Contras

| Prós | Contras |

| Várias opções de negociação | Status não regulamentado |

| Vários canais de suporte ao cliente | Informações limitadas sobre contas |

| Plataforma MT5 fornecida | Informações limitadas sobre taxas de negociação |

| Sem conta de demonstração | |

| Complexidade para iniciantes |

Match Securities é Legítimo?

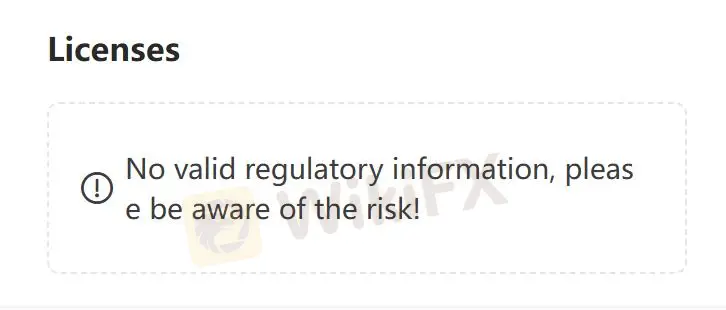

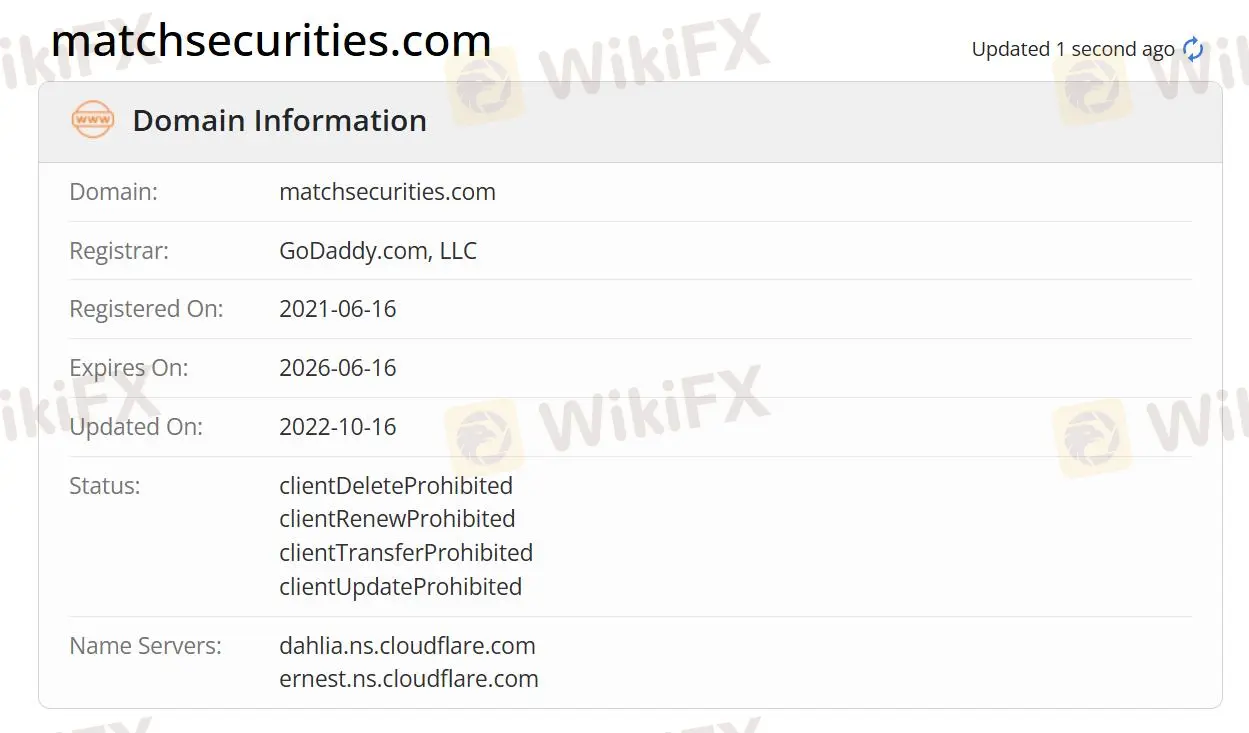

Atualmente, Match Securities não possui regulação válida. Seu domínio foi registrado em 16 de junho de 2021 e o status atual é "client Delete Prohibited, client Renew Prohibited, client Transfer Prohibited, client Update Prohibited". Por favor, preste muita atenção à segurança dos seus fundos se você escolher este corretor.

O que posso negociar na Match Securities?

Na Match Securities, você pode negociar com FX, CFDs, ETFs, Futuros, Metais e Índices.

Forex: Você pode acessar o mercado mais líquido do mundo. Você pode negociar mais de 200 pares de FX com baixas comissões e spreads competitivos. A empresa oferece plataformas de negociação poderosas, ferramentas superiores e suporte especializado 24/5.

Commodities: Investimentos em commodities mantêm valor a longo prazo. Match Securities oferece baixos custos de negociação, liquidez profunda e proteção contra inflação. Você pode negociar derivativos em energias como petróleo bruto e gás natural para execução rápida e melhor precificação.

CFD de Ações: Você pode negociar derivativos de ações de empresas líderes com baixos requisitos de margem. Você pode acessar CFDs de ações da Apple, Amazon, Facebook. Match Securities oferece alta liquidez, execução rápida, spreads baixos.

Índices: Você pode fazer operações longas ou curtas nos principais índices de ações. Você pode acessar USA500, Germany 30, UK100. É oferecido no MT4, MT5, ML Trader. Você pode negociar com spreads baixos e precificação líder.

Futuros: Eles podem negociar em plataformas premiadas. Eles podem acessar mais de 300 futuros de 16 bolsas. As vantagens incluem preços competitivos, ferramentas de negociação de pedidos e profundidade, suporte especializado 24/5 e gerentes de contas dedicados.

| Instrumentos Negociáveis | Suportado |

| Forex | ✔ |

| CFDs | ✔ |

| Metais | ✔ |

| Índices | ✔ |

| Futuros | ✔ |

| ETFs | ✔ |

| Ações | ❌ |

| Commodities | ❌ |

| Criptomoedas | ❌ |

Plataforma de Negociação

Match Securities oferece ML Trader, Meta Trader 5 (MT5) e IRESS Pro Trader.

ML Trader: Execução rápida e eficiente, integrando liquidez global extensa e profunda de bancos e instituições de primeira linha, oferecendo uma jornada de negociação de alta velocidade e alto desempenho.

Meta Trader 5 (MT5): Tecnologia de negociação multi-ativos padrão do setor para câmbio, ações e futuros. Rico em recursos e intuitivo, equipado com ferramentas para análise de preços, negociação algorítmica e cópia de negociação.

IRESS Pro Trader: Uma plataforma de negociação online baseada na web que integra streaming de dados de mercado dinâmico, multi-ativos e multi-canal com negociação sofisticada e gerenciamento de portfólio.