Buod ng kumpanya

| Match Securities Buod ng Pagsusuri | |

| Itinatag | 2021 |

| Rehistradong Bansa/Rehiyon | Mauritius |

| Regulasyon | Walang Regulasyon |

| Mga Instrumento sa Merkado | FX, CFDs, ETFs, Futures, Metals, at Indices |

| Demo Account | ❌ |

| Leverage | / |

| Spread | / |

| Mga Platform sa Pag-trade | ML Trader, Meta Trader 5 (MT5), at IRESS Pro Trader |

| Min Deposit | / |

| Suporta sa Customer | 24/5 live chat |

| Telepono: +230 454 3200 | |

| Email: support@matchsecurities.com | |

| Address: 4th Floor, Iconebene, Rue de LInstitut, Ebene, Mauritius, 80817 | |

Itinatag noong 2021, ang Match Securities ay isang di-regulado na kumpanya ng brokerage na nakabase sa Mauritius. Nagbibigay ito ng FX, CFDS, ETFS, Futures, Metals, at Indices sa pamamagitan ng mga platform sa pag-trade tulad ng ML Trader, Meta Trader 5 (MT5), at IRESS Pro Trader.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Iba't ibang mga pagpipilian sa pag-trade | Di-regulado na katayuan |

| Maraming mga channel ng suporta sa customer | Limitadong impormasyon sa mga account |

| Nagbibigay ng MT5 platform | Limitadong impormasyon sa mga bayarin sa pag-trade |

| Walang demo account | |

| Kasalukuyang kumplikado para sa mga nagsisimula |

Totoo ba ang Match Securities?

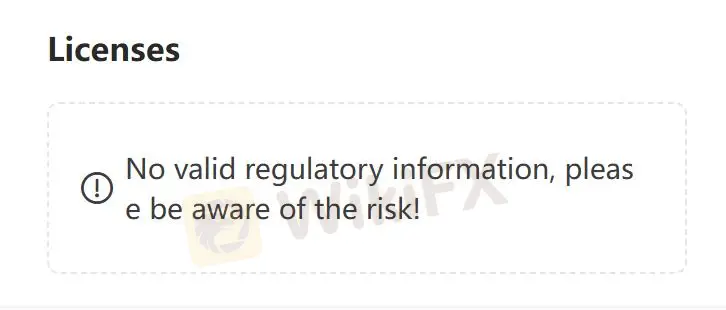

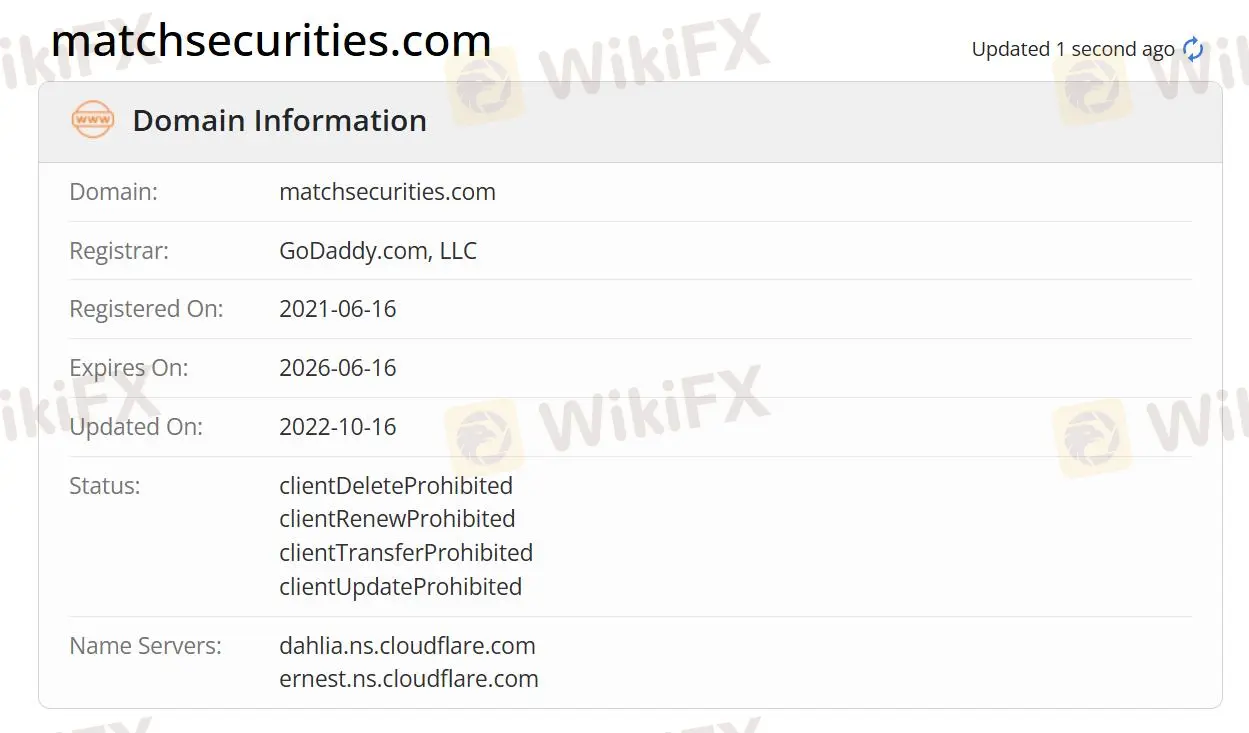

Sa kasalukuyan, ang Match Securities ay walang wastong regulasyon. Ang domain nito ay narehistro noong Hunyo 16, 2021, at ang kasalukuyang katayuan ay “client Delete Prohibited, client Renew Prohibited, client Transfer Prohibited, client Update Prohibited”. Mangyaring mag-ingat sa kaligtasan ng iyong mga pondo kung pipiliin mo ang broker na ito.

Ano ang Maaari Kong I-trade sa Match Securities?

Sa Match Securities, maaari kang mag-trade ng FX, CFDs, ETFs, Futures, Metals, at Indices.

Forex: Maaari nilang ma-access ang pinakaliquid na merkado sa mundo. Maaari silang mag-trade ng 200+ na mga pares ng FX na may mababang komisyon at competitive na spreads. Nag-aalok ang kumpanya ng mga malalakas na platform sa pag-trade, de-kalidad na mga tool, at 24/5 na eksperto na suporta.

Mga Kalakal: Ang mga pamumuhunan sa mga kalakal ay nagtatagal ng halaga sa pangmatagalang panahon. Nag-aalok ang Match Securities ng mababang mga gastos sa pag-trade, malalim na likwidasyon, at proteksyon laban sa pagtaas ng presyo. Maaari silang mag-trade ng mga derivatives sa mga enerhiya tulad ng langis at natural gas para sa mabilis na pagpapatupad at pinakamahusay na presyo.

Equities CFDs: Maaari silang mag-trade ng mga derivatives sa mga shares ng mga pangunahing kumpanya na may mababang mga kinakailangang margin. Maaari silang mag-access ng mga equities CFDs sa Apple, Amazon, Facebook. Nag-aalok ang Match Securities ng malakas na likwidasyon, mabilis na pagpapatupad, at mababang mga spreads.

Indices: Maaari silang mag-long o mag-short sa mga pangunahing stock index. Maaari silang mag-access ng USA500, Germany 30, UK100. Ito ay inaalok sa MT4, MT5, ML Trader. Maaari silang mag-trade na may mababang mga spreads at pangungunang presyo.

Futures: Puwede silang mag-trade sa mga award-winning na plataporma. Puwede nilang ma-access ang 300+ futures mula sa 16 na palitan. Ang mga benepisyo ay kasama ang competitive pricing, mga order at depth trader tools, 24/5 expert support at dedicated account managers.

| Mga Tradable na Instrumento | Supported |

| Forex | ✔ |

| CFDs | ✔ |

| Mga Metal | ✔ |

| Mga Indice | ✔ |

| Mga Futures | ✔ |

| Mga ETFs | ✔ |

| Mga Stocks | ❌ |

| Mga Komoditi | ❌ |

| Mga Cryptocurrency | ❌ |

Plataporma ng Pag-trade

Match Securities ay nag-aalok ng ML Trader, Meta Trader 5 (MT5), at IRESS Pro Trader.

ML Trader: Mabilis at epektibong pagpapatupad, nag-iintegrate ng malawak at malalim na global liquidity mula sa Tier 1 banks at institutions, nag-aalok ng mabilis at mataas na performance sa pag-trade.

Meta Trader 5 (MT5): Industriya-standard na multi-asset trading technology para sa foreign exchange, mga stocks, at futures. Mayaman sa mga tampok at madaling gamitin, may mga tool para sa price analysis, algorithmic trading, at copy trading.

IRESS Pro Trader: Isang web-based online trading platform na nag-iintegrate ng dynamic, multi-asset, multi-channel market data streaming kasama ang sophisticated trading at portfolio management.