公司简介

| Match Securities 评论摘要 | |

| 成立时间 | 2021 |

| 注册国家/地区 | 毛里求斯 |

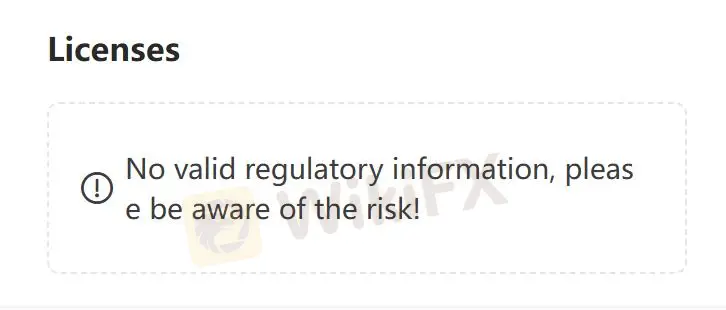

| 监管 | 无监管 |

| 市场工具 | 外汇、差价合约、交易所交易基金、期货、贵金属和指数 |

| 模拟账户 | ❌ |

| 杠杆 | / |

| 点差 | / |

| 交易平台 | ML Trader、Meta Trader 5 (MT5)和IRESS Pro Trader |

| 最低存款 | / |

| 客户支持 | 24/5在线聊天 |

| 电话:+230 454 3200 | |

| 电子邮件:support@matchsecurities.com | |

| 地址:毛里求斯Ebene LInstitut街Iconebene大厦4楼,邮编80817 | |

Match Securities成立于2021年,是一家位于毛里求斯的无监管经纪公司。它通过ML Trader、Meta Trader 5 (MT5)和IRESS Pro Trader等交易平台提供外汇、差价合约、交易所交易基金、期货、贵金属和指数。

优点和缺点

| 优点 | 缺点 |

| 多种交易选择 | 无监管状态 |

| 多个客户支持渠道 | 有关账户的信息有限 |

| 提供MT5平台 | 有关交易手续费的信息有限 |

| 无模拟账户 | |

| 对初学者来说较复杂 |

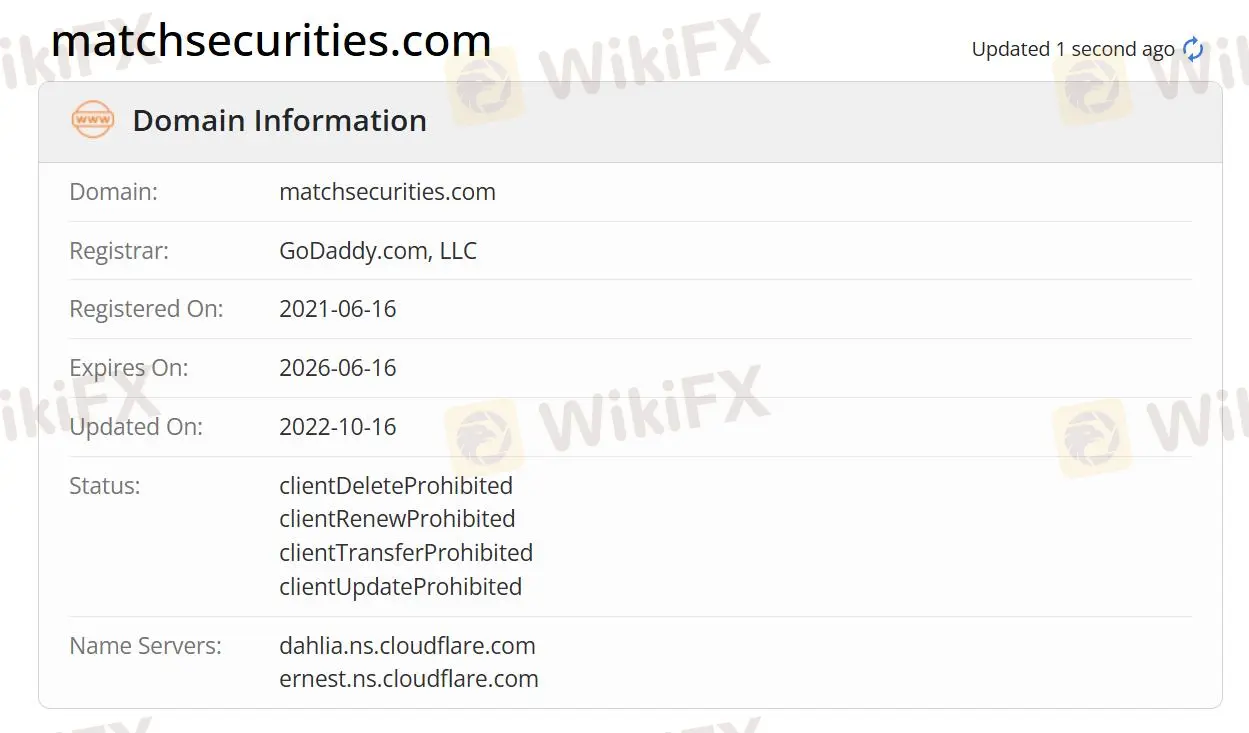

Match Securities 是否合法?

目前,Match Securities 缺乏有效的监管。其域名于2021年6月16日注册,当前状态为“客户禁止删除、客户禁止续订、客户禁止转移、客户禁止更新”。如果选择该经纪商,请高度关注您资金的安全。

Match Securities 可以交易什么?

在Match Securities上,您可以交易外汇、差价合约、交易所交易基金、期货、贵金属和指数。

外汇:他们可以进入全球最流动的市场。他们可以以低佣金和竞争性点差交易200多个外汇对。该公司提供强大的交易平台、优质工具和24/5专家支持。

大宗商品:大宗商品投资具有长期价值。Match Securities提供低交易成本、深度流动性和对冲通胀的保值功能。他们可以交易能源类商品的衍生品,如原油和天然气,以实现快速执行和最佳定价。

股票差价合约:他们可以以低保证金要求交易顶级公司的股票差价合约。他们可以在苹果、亚马逊、Facebook上交易股票差价合约。Match Securities提供强大的流动性、快速执行和低点差。

指数:他们可以做多或做空主要股票指数。他们可以访问USA500、德国30、UK100。该产品在MT4、MT5、ML Trader上提供。他们可以以紧密的点差和领先的定价进行交易。

期货:他们可以在屡获殊荣的平台上进行交易。他们可以从16个交易所中访问300多个期货。优势包括竞争定价、订单和深度交易工具、24/5专家支持和专属账户经理。

| 可交易工具 | 支持 |

| 外汇 | ✔ |

| 差价合约 | ✔ |

| 贵金属 | ✔ |

| 指数 | ✔ |

| 期货 | ✔ |

| 交易所交易基金 | ✔ |

| 股票 | ❌ |

| 大宗商品 | ❌ |

| 加密货币 | ❌ |

交易平台

Match Securities提供ML Trader、Meta Trader 5 (MT5)和IRESS Pro Trader。

ML Trader:快速高效的执行,整合来自一级银行和机构的广泛和深厚的全球流动性,提供高速和高性能的交易体验。

Meta Trader 5 (MT5):行业标准的多资产交易技术,适用于外汇交易所、股票和期货。功能丰富且直观,配备了价格分析、算法交易和复制交易工具。

IRESS Pro Trader:基于Web的在线交易平台,将动态、多资产、多渠道的市场数据流与复杂的交易和投资组合管理相结合。